Sean Pavone

Published on the Value Lab 14/7/22

Macau casino stocks are a rough place to have cash, now that lockdowns akin to the 2020 ones are being reinstituted as part of China’s zero-COVID effort. Market declines are pricing in about 250 days of lockdown in Macau for big player Las Vegas Sands (NYSE:LVS) which might be excessive. New cash proceeds from the Las Vegas sales help out the debt situation a bit, and Singapore looks to be recovering pretty well to about half of 2019 levels. While being less risky than Melco Resorts (MLCO), it’s still speculative and MLCO is more unreasonably penalised in our view, so we prefer them. Nonetheless, there is value in these casino stocks, but the timing makes them too risky, especially when the grail of convention revenue is being threatened by macro headwinds too.

Breakdown Of Las Vegas Sands

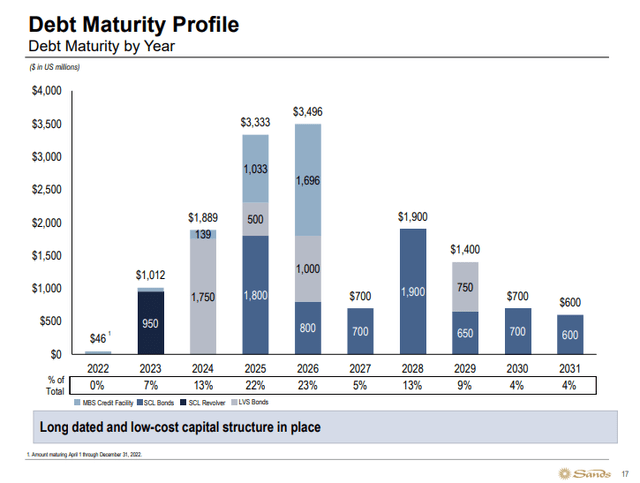

As of now, exposure between Macau and Singapore is about 2:3, which is not a bad ratio with Singapore coming back online these last couple of months. Singapore is seeing run-rate EBITDAs that are at about half of 2019 levels as part of the recovery, and have scope for longer-term recovery as people become less skittish about mobility. We think about $200 million in quarterly EBITDA is very feasible for this segment, while Macau should produce about $108 million in losses based on total closure run-rate figures. So, the company should produce positive EBITDA of about $100 million on a run-rate quarterly basis, which isn’t bad, especially with their debt load falling to about 25% D/E thanks to the Las Vegas sales, which is high but not extremely alarming given the maturities are focused in 2025.

Maturity Profile (Q1 2022 Pres)

LVS Stock Valuation

Macau on the other hand is going from bad to worse. Occupation rates are low at 35% as of the Q1 earnings call, and with the most recent wave of total Macau casino lockdowns, it is just going to average down for the year. LVS casinos in Macau should suffer from about $1.2 million in direct costs per day as a consequence of the closures, with a loss of about $6 million in revenue due to total closures, so the total lost value per day should be around $8 million. Based on the $2 billion in value shaved off from the company as of the announcements surrounding Macau, the priced in closure days for the Macau sands properties should be around 250 days, which is somewhat excessive given that China is putting its full effort into getting things under control.

Conclusions

Recent declines between Melco and LVS are similar, although since MLCO has about 33% more exposure to Macau than LVS does, they probably deserve to be penalised more as of the latest announcements, and value has definitely skewed towards LVS rather than MLCO. However, we like that MLCO is working on its Cyprus exposures, while LVS doesn’t really have anything up its sleeve except incremental investments into Macau and Singapore, which are draining on cash and might not be the best uses of funds despite reopening, with their assets already having been poised for reopening benefits. Osaka failed, and there isn’t anything else that’s concrete as of now for LVS. Also, because both are speculative investments, especially with China generally eyeing the industry on account of the capital outflows it causes, we continue to prefer MLCO which while being more aggressive is also more penalised in its discounts since early 2020. With 33% more Macau exposure, it has been penalised 50% more severely than LVS, a decline of 75% versus LVS’ 50%. This can be explained by MLCO’s higher debt load, with leverage ratios being twice as severe, but with the highly speculative nature of both, we prefer the more aggressive play in smaller allocations befitting of a highly risky position, which is regardless of COVID-19 due to the China exposures, and also because of the previously important convention revenue, which unlike regional casinos drives activity at casinos and is more highly connected to the macroeconomy. There is no strong value case for one over the other, although recent developments favour LVS more which is less exposed to Macau until Cyprus comes fully online for MLCO, and both are too risky for our tastes even though we do prefer MLCO as a speculative position and appreciate the Cyprus foray.

If you thought our angle on this company was interesting, you may want to check out our service, The Value Lab. We focus on long-only value strategies, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our group of buy-side and sell-side experienced analysts will have lots to talk about. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment