Dilok Klaisataporn

Vertex Pharmaceuticals’ (NASDAQ:VRTX) commercial execution remains outstanding. The company beat Q3 revenue and EPS estimates and raised full-year revenue guidance. While potential competitors are still falling short of challenging Vertex’s cystic fibrosis franchise (I covered this in my previous article on Vertex), the company will soon hit a ceiling because the vast majority of cystic fibrosis patients will be on a Vertex product.

I believe the cystic fibrosis franchise is already more than fully valued at current levels and the rest of the pipeline and the company’s business development team will need to step up to create additional shareholder value from current levels. Exa-cel is a potentially important step in that direction, but I do not see the rest of the existing pipeline as meaningful contributors to Vertex’s topline growth anytime soon.

The cystic fibrosis franchise does not have a lot more room to grow

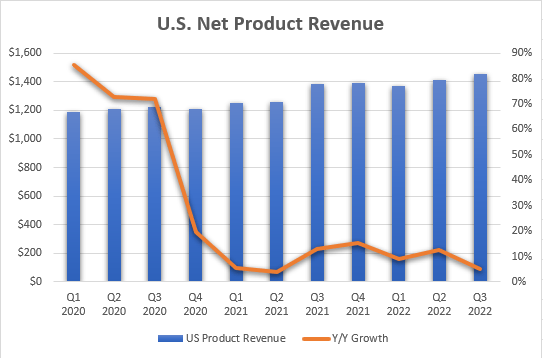

Total net product revenue grew 18% Y/Y to $2.33 billion in the third quarter, beating the analyst consensus by $100 million. As a result of strong year-to-date execution, management raised the full-year net product revenue guidance range from $8.6-$8.8 billion to $8.8-$8.9 billion, and this was above the $8.78 billion consensus at the time of the report.

The growth is now primarily driven by Trikafta’s uptake in international markets (where it is called Kaftrio). The Y/Y U.S. net revenue growth offers an advanced view of what will likely happen in international markets in five or six quarters – Vertex will run out of new cystic fibrosis patients. This sounds negative, but it’s actually a testament to the life-changing effect of the company’s drugs and the strong uptake of Trikafta/Kaftrio since launch.

Vertex Pharmaceuticals earnings reports

There is still some room for growth and I now expect peak net sales in the $11 billion to $11.5 billion range in 2024, an increase from my previous $10-$10.5 billion estimate range. I still expect to see double-digit revenue growth next year, followed by mid- to high-single-digit growth in 2024, and moderate growth after that.

This means Vertex is going to increasingly rely on its pipeline and business development activity to produce topline growth beyond 2024.

Exa-cel could become Vertex’s next important growth driver

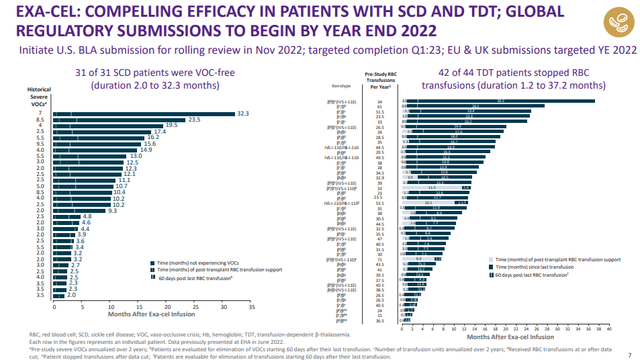

Exa-cel, formerly known as CTX001, is coming closer to market as Vertex plans to start global regulatory submissions before the end of the year. This is the company’s non-viral ex vivo CRISPR gene-editing therapy in development as a potential functional cure for transfusion-dependent beta-thalassemia (‘TDT’) and severe sickle cell disease (‘SCD’). Vertex in-licensed exa-cel from CRISPR Therapeutics (CRSP) and the data it is generating in the two diseases continue to impress:

- 31 of 31 SCD patients are VOC-free (Vaso-occlusive crisis) with a range of 2 to 33 months, and patients with longer follow-up are largely transfusion-free.

- 42 of 44 TDT patients are transfusion-free with a duration of 1.2 months to 37 months.

Vertex Pharmaceuticals investor presentation

The FDA granted exa-cel a rolling review, and it will be submitted this month and completed by the end of the first quarter of 2023. Given all the designations (Fast Track, Regenerative Medicine Advanced Therapy, rare pediatric disease, and orphan drug), it is likely that the application will be granted Priority Review and if that is the case, exa-cel could reach the market in the United States by the end of Q3 2023.

European and U.K. submissions remain on track for this quarter and time to market should be similar.

It is still hard to model the potential uptake of exa-cel in these populations, but I continue to see it as a $3 billion to $4.5 billion product, that I based on 3,000 to 4,500 patients treated a year and a price tag of $1 million per patient. Seeing other gene therapies priced as high as $3.5 million per patient, I believe my pricing estimate is now conservative, but the other assumption is still up for debate – how many patients will be treated by exa-cel every year? So, I am not changing my sales estimate range until I see at least a few quarters of sales.

Additional high-value assets are needed for more meaningful value creation from current levels

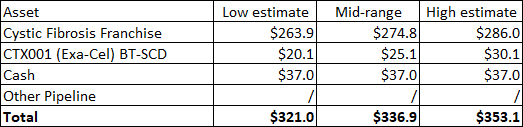

Exa-cel should be Vertex’s next important growth product and it could come at the right time, just as its cystic fibrosis franchise’s best years of growth will be in the rearview mirror. However, even if that is the case, I see Vertex as nearly fully valued at current levels based on the value of the cystic fibrosis franchise, exa-cel, and the growing cash balance.

author’s estimates

The rest of the company’s pipeline is not included in this valuation range, but all of the existing pipeline products combined would not contribute more than $15-$20 per share based on their phase of development, time to market, and adjusted for the probability of success. And I see no pipeline candidate other than exa-cel that is going to be large enough, or close enough to market to make a difference to the company’s valuation in the next three years.

But that is where Vertex’s business development team could step in. The cash balance has increased to nearly $10 billion and the company has plenty of financial firepower to expand its mid- and late-stage pipeline and also its product portfolio.

Conclusion

I continue to see Vertex as well-positioned to deliver long-term value, but going forward, the value creation will depend more on the rest of the pipeline and business development activity because it will soon become increasingly hard to grow cystic fibrosis franchise revenues. Exa-cel should be an important step in this direction, but the rest of the existing pipeline seems rather thin or far from generating revenues for Vertex, and the company may soon need to step up its business development activity to expand its pipeline and/or approved product portfolio.

Be the first to comment