da-kuk

Investment Thesis

Many analysts now see the Fed hiking into the cyclical growth slowdown as the main risk for equity markets over the next couple of months. However, I believe the main problem for equities at the moment is EPS estimates which are over-optimistic, and downward revisions are already starting to happen across different sectors of the economy. This is particularly important for high dividend yield strategies that benefit from robust earnings in good times and tend to suffer during economic downturns. Since preserving capital is likely to become a key objective for a large number of companies, I think that dividends will take a secondary role in the coming months, which adds some risk for high dividend yield strategies such as the Global X SuperDividend U.S. ETF (NYSEARCA:DIV). I believe having a large cash allocation today is preferable over yield chasing since there will be other opportunities to accumulate DIV at a lower price over the next 18 months.

What Has Happened Since My Last Article

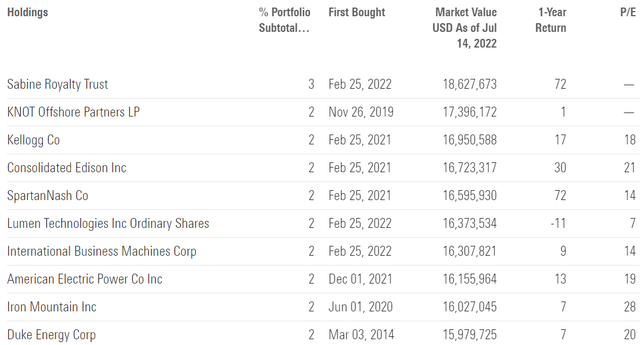

As a reminder, DIV invests in 50 of the highest dividend-yielding equity securities in the United States. This strategy seeks to provide monthly dividend distributions and the fund has made monthly distributions for 8 years running. You will find below a recent breakdown of the top 10 holdings, and you can read more about the strategy in my previous article.

I concluded my previous article with the following statement:

I would personally keep an eye on the dividend growth going forward to make sure the strategy keeps a stable dividend amount. I’m also concerned by the negative price performance over the years which resulted in mediocre returns and I don’t see any catalyst that could change this trend.

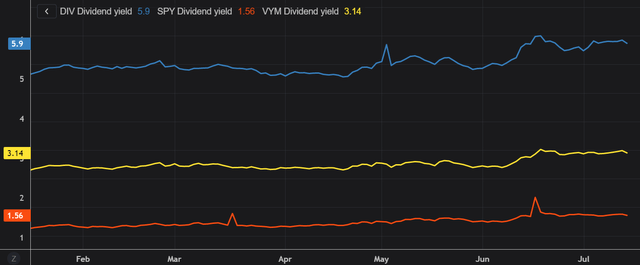

It’s good to see that the dividend remained relatively stable at around $0.1 per share per month. DIV continues to be one of the highest dividend-paying ETFs in the US with a yield approaching 6%. For comparison, that is nearly 4x higher than what you would get on an S&P 500 ETF and approximately twice as much compared to some of its competitors.

In terms of total returns, DIV performed better than the market, thanks in part to its lower valuation. I have compared below DIV’s price performance against the SPDR S&P 500 Trust ETF (SPY) and the Vanguard High Dividend Yield ETF (VYM) over the last 5 months to assess which one was a better investment. Since my previous article, DIV lost nearly 3% compared to a loss of ~7% and ~12% for VYM and SPY, respectively.

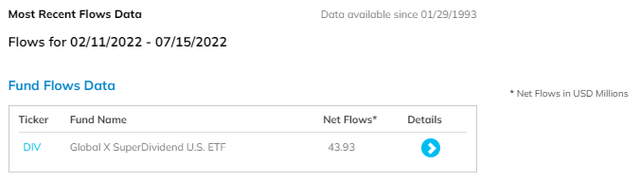

DIV registered $44 million in inflows since early February 2022, which represents nearly 6% of the fund’s latest assets under management. Investors are probably betting on a rally given the fund flows and are trying to capitalize on the higher dividend yield. However, engaging in yield chasing when the economy is slowing down is a dangerous strategy given the fact that dividends and buybacks are the first to take a hit when the economy turns south.

The Only Certainty is Uncertainty

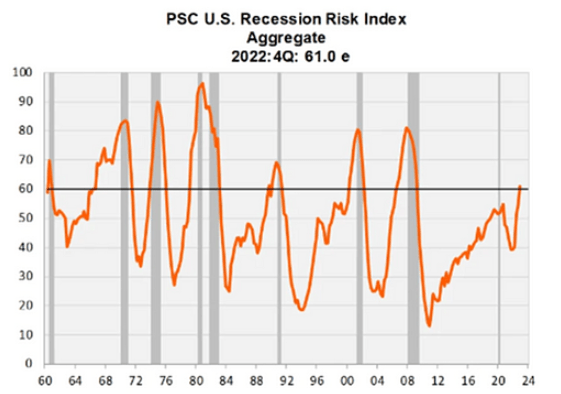

Recession odds have increased considerably over the last couple of months as illustrated by the PSC US Recession Risk Index, adding uncertainty to equity markets. This index generally doesn’t reach such levels without delivering one. Investors need to navigate this treacherous market and often rely on dividends to shield their returns during downturns. However, I believe this strategy can backfire if the economy deteriorates. In that context, preserving capital will become the main target for a large majority of companies.

Piper Sandler via @NancyRLazar1 and @mrblonde_macro

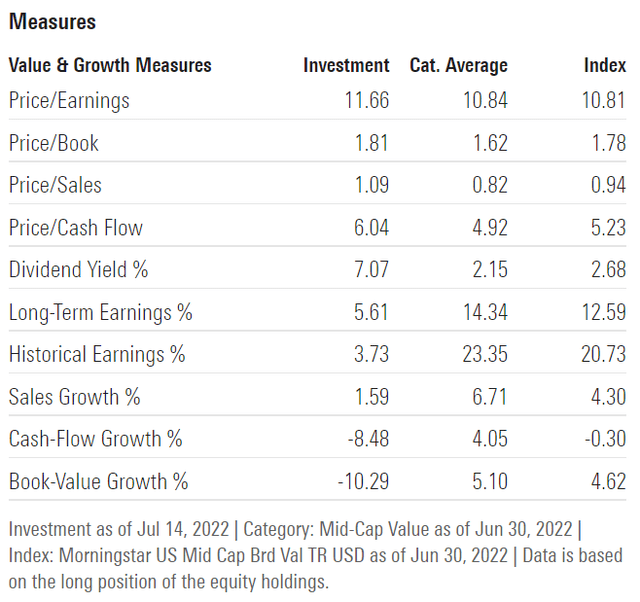

DIV continues to look extremely cheap from an absolute perspective. It’s trading at nearly 12x earnings and has a price-to-book ratio of less than 2. If we compare that to the S&P 500, DIV is trading at a ~25% discount to the market and offers a much higher dividend yield on top of that. That said, I believe there is a good reason why the market is not picking up on this opportunity. A large portion of the portfolio is invested in cyclical businesses that always look cheap before a recession.

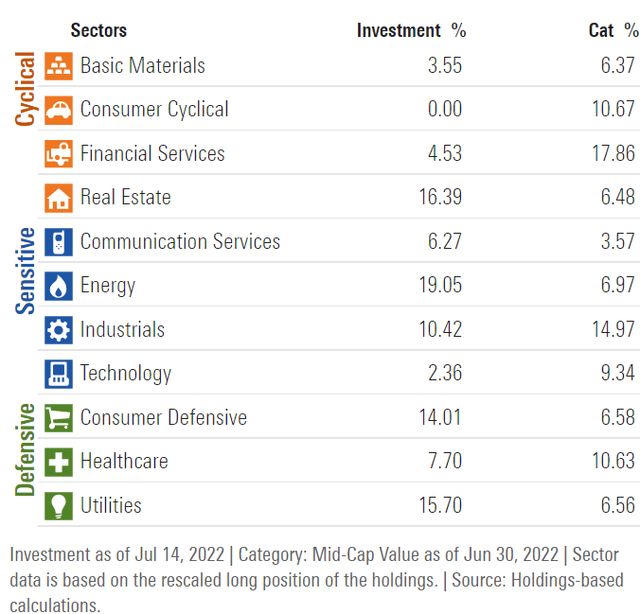

Over 62% of the portfolio is invested in cyclical/sensitive sectors such as Real Estate, Energy, and Industrials. In other words, the portfolio is very sensitive to changes in economic activity and therefore vulnerable to a recession.

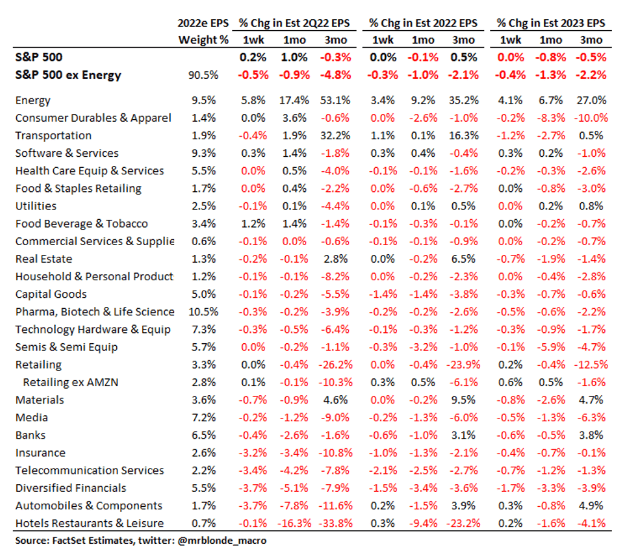

Analysts are starting to catch up with the economic reality, as EPS estimates for FY23 are falling across the board. And, with the exception of the energy sector, the cuts have been more severe. Of course, this doesn’t bode well for dividend-paying strategies which rely on strong corporate earnings to be able to finance dividends.

FactSet via @mrblonde_macro

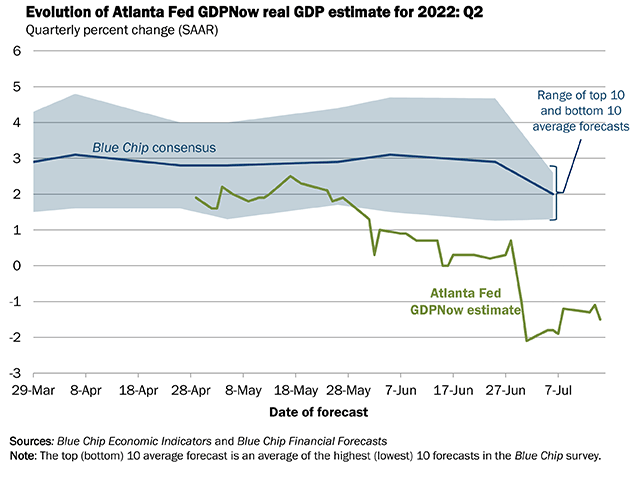

The recent GDPNow figures are confirming a deterioration in economic activity. GDP growth expectations for Q2 FY22 have been gradually lowered from ~2% to -1%. Owning stocks while the economy is weakening isn’t the most profitable trade in my opinion, regardless of the dividend yield. I believe a good allocation to cash is a better option at the moment since investors will probably have another opportunity to buy DIV at a lower price over the next 18 months.

Atlanta Fed

Key Takeaways

Many experts now consider the Fed’s hike into the cyclical GDP slowdown as the primary danger to equity markets in the coming months. However, I believe the major issue for stocks at the moment is overly high EPS expectations and the negative adjustments that will be taking place over the next 3-6 months. This is particularly important for high dividend yield strategies, which gain from strong earnings in good times but generally face significant pressure during economic downturns. Since I believe there will be more opportunities to accumulate DIV at a cheaper price over the following 18 months, I feel that having a substantial cash allocation today is the right move for the time being.

Be the first to comment