Epiximages

Article Purpose

The purpose of this article is to initiate coverage of the TrueShares Low Volatility Equity Income ETF (NYSEARCA:NYSEARCA:DIVZ). DIVZ is an actively-managed portfolio of a concentrated group of low-volatility U.S. securities that pay above-average dividend yields. DIVZ launched in January 2021, so there isn’t much track record to assess. However, I’m impressed with its current selections and recent performance, and DIVZ stands a solid chance at standing out in a crowded field of low-volatility/high-dividend ETFs. I look forward to taking you through DIVZ’s strategy and fundamentals but will reserve judgment until it develops a longer track record.

DIVZ ETF Overview

Portfolio Manager Background

DIVZ is managed by Austin Graff, a CFA Charterholder and portfolio manager with over 15 years of experience at Goldman Sachs and PIMCO. An SEC filing listed Mr. Graff as co-portfolio manager of the PIMCO U.S. Dividend Fund effective October 2014 until its liquidation in August 2016. I don’t know the reasons for the liquidation, but I don’t assume it was performance related.

Mr. Graff’s outlook on investing appears to be shaped based on his time at PIMCO. He was listed as Vice President of the PIMCO Dividend Team in 2013, and the investment objectives of the U.S. Dividend Fund read similar to DIVZ’s goals, which include selecting 25-35 U.S. companies that:

- pay attractive dividends

- are expected to grow over time

- currently trade at favorable valuations

- provide capital appreciation opportunities

With DIVZ, Mr. Graff has added a low-volatility component, and the focus of approximately 30 stocks means it’s important to diversify across as many industries as possible. In a July “Ask Me Anything” webinar, Mr. Graff further described his investment approach. I encourage prospective investors to listen to the complete 30-minute discussion, but five takeaways for me were:

1. Graff takes a total portfolio approach, meaning it’s critical to consider how securities interact with each other. This approach aligns with Modern Portfolio Theory and doesn’t surprise me, given Graff’s credentials.

2. Graff’s bottom-up approach is informed by fundamental analysis and interviews with company management.

3. Graff prefers businesses with stable free cash flows to minimize the chances of a dividend cut. However, dividend cuts aren’t an automatic sell, and Graff used AT&T (T) as an example where he felt the management team remained strong and the dividend cut resulting from the spinoff was already priced in.

4. Graff doesn’t see inflation falling much before the end of the year and expects short-duration assets (e.g., dividend stocks) to outperform long-duration assets (e.g., growth stocks) for the foreseeable future.

5. Graff is bullish on the Energy sector, believing we’re in a secular trend that will favor unhedged oil and gas companies. However, he views Utilities as a hedge against these companies. Graff reasons that if clean energy becomes dominant, considerable investments in infrastructure are needed, and Utilities should be the primary benefactor.

In principle, I agree with much of this approach. However, I believe Graff is oversimplifying the energy and utility sector’s relationship. Over the last year, only five ETF categories (Energy, MLPs, Utilities, Consumer Staples, and High Dividend Yield) have had positive median returns. These sectors can rise together, and it stands to reason they can fall together, too. As I detailed in this article, the relationship between inflation, interest rates, and returns in the Utilities sector is much more complex.

Performance and Current Portfolio Composition

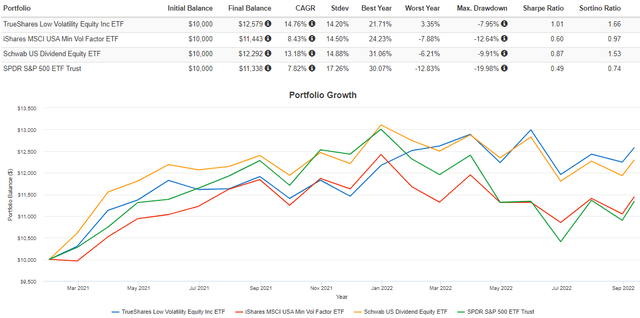

DIVZ has benefitted tremendously from favorable sector allocations since its January 2021 launch. Whether that’s skill, good fortune, or both remains to be seen. However, DIVZ’s 14.76% annualized returns were nearly twice as large as the SPDR S&P 500 ETF (SPY). It’s also soundly beating the iShares MSCI USA Min Vol Factor ETF (USMV) by 6.33% per year and the Schwab U.S. Dividend Equity ETF (SCHD) by 1.58% per year. Considering DIVZ has a 0.65% expense ratio, it indicates the strategy has merit.

Portfolio Visualizer

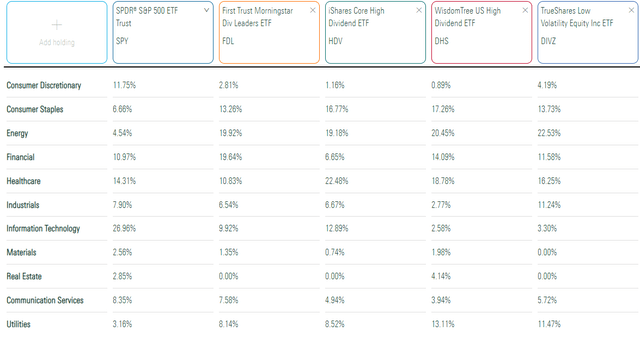

I track 90 U.S. low-volatility or dividend-focused ETFs in my U.S. Equity ETF Database, and DIVZ’s 1.34% one-year total return through August placed 16th best. Fourteen were in the High Dividend Category, led by FDL, HDV, and DHS. These ETFs also overweight Energy, as shown below.

Morningstar

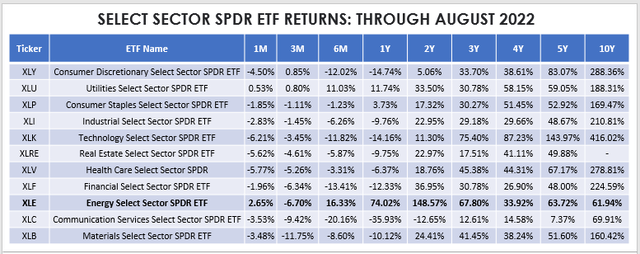

This emphasizes the importance of sector allocations, and Graff may be unwilling to wind down DIVZ’s Energy holdings if the Federal Reserve is too aggressive and causes a prolonged recession. The Energy Select Sector SPDR ETF (XLE) was the third-worst-performing sector in the S&P 500 Index over the last three months, so despite anyone’s thoughts about how markets should operate, there’s no guarantee they will.

The Sunday Investor

Fundamental Analysis

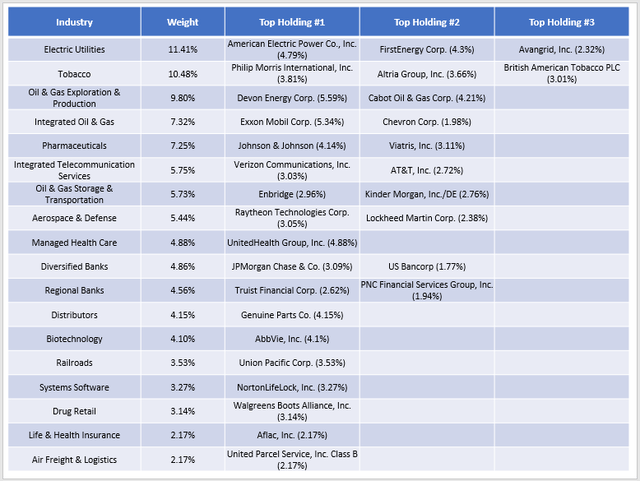

I mentioned earlier how important industry diversification is when managing a concentrated portfolio. Graff looks to have done a pretty good job, with DIVZ’s 30 holdings spread across 18 unique GICS industries. The top ten account for 72.92% of the ETF. This figure is 68.23% for the First Trust Morningstar Dividend Leaders Index ETF (FDL) and 58.43% for SCHD. Therefore, it’s still a highly-focused portfolio, but perhaps not as much as you might have assumed.

The Sunday Investor

DIVZ relies primarily on Electric Utilities stocks like American Electric Power (AEP) and FirstEnergy (FE) to balance out its riskier oil and gas plays like Devon Energy (DVN), the top holding in the fund. The least-risky Energy plays are Exxon Mobil (XOM) and Chevron (CVX), and there are several Health Care stocks like Johnson & Johnson (JNJ) and AbbVie (ABBV). Overall, I think it’s a pretty well-balanced portfolio.

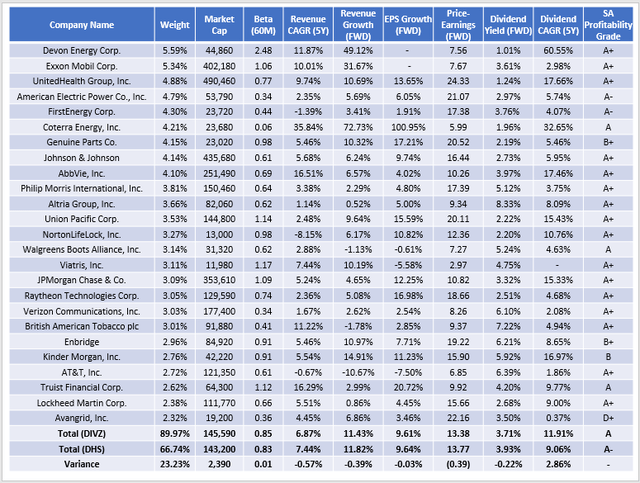

The following table closely examines the fundamentals of DIVZ’s top 25 holdings. For comparison purposes, I’ve calculated the same metrics for the WisdomTree U.S. High Dividend Fund (DHS). Recall how DHS has very similar sector exposures to DIVZ right now, with a competitive five-year beta and dividend yield.

The Sunday Investor

The similarities with DHS don’t end there. DIVZ’s weighted-average market capitalization is nearly identical to DHS at $145 billion. Current constituents have grown sales by around 7% over the last five years, and analysts project growth between 11-12% over the next twelve months. Earnings growth estimates are 9.61%, and DIVZ trades at 13.38x forward earnings, only 0.39 points behind DHS.

I have calculated DIVZ’s gross dividend yield to be 3.71%, but that’s probably a bit understated, given how some energy stocks like Devon Energy operate on a fixed-plus-variable dividend policy. Based on second-quarter performance, DVN’s board approved a $1.55 quarterly dividend payable on September 30, which puts its forward yield closer to 8.7%. Still, DIVZ’s yield lags DHS by about 0.22%, and distributions will likely be around 3% after accounting for fund expenses.

Finally, DIVZ has a stronger Seeking Alpha Profitability Grade (A vs. A-), consistent with Graff’s emphasis on quality. Of the 90 low-volatility and dividend-focused ETFs mentioned earlier, DIVZ ranks 14th on this metric, so I think DIVZ can support strong dividend yield and growth moving forward.

Investment Recommendation

DIVZ is an actively-managed 30-stock dividend ETF that should provide a 3% net dividend yield with below-average risk. DIVZ has been a recent top performer, but much of that success is due to its Energy holdings, which is a volatile and unpredictable sector. The portfolio manager, Austin Graff, doesn’t appear to be concerned about this and perhaps won’t be for a while, given the latest CPI report. While I agree with his approach to portfolio construction, I don’t believe Utilities is enough of a hedge against a decline in oil prices. I would rather see DIVZ’s Energy exposure reduced to 10%.

The good news is that DIVZ can do that quickly since it’s actively managed. In many ways, its fundamentals are similar to DHS, so investors may find comfort in knowing they aren’t beholden to time-based reconstitutions. The 0.65% expense ratio could be worth it, especially since it’s just 0.27% cheaper to own DHS. I’m hopeful, but I want to see more of a track record first before providing a recommendation. I plan to check back on this ETF and update its fundamentals regularly, and I look forward to your comments below.

Be the first to comment