niphon

Planet Labs PBC (NYSE:NYSE:PL) recently reported better than expected Q2 FY23 results with both its revenues and EPS beating estimates. While the company reported revenues of $48.5 mn ( up 59% Y/Y), which beat consensus estimates by $6.02 mn, its adjusted loss per share of 7 cents beat consensus estimates by 4 cents. The company also increased its full year 2023 revenue guidance to between $182 mn and $190 mn range versus prior $177 mn and $187 mn range and adjusted EBITDA guidance to between negative $68 mn and negative $60 mn range from prior negative $70 mn and negative $60 mn range.

Planet Labs’ Revenue Drivers and Outlook

The company’s 59% Y/Y revenue growth last quarter was driven by increased usage from existing customers as well as the addition of new customers.

Most of the company’s business comes from recurring annual contracts. Over 90% of the company’s customers have annual or multiyear contracts and the weighted average contract length of the company is approximately two years. Many of the company’s contracts have usage components with quarterly or annual minimums. The company saw strong pace of usage last quarter which exceeded its prior expectations, particularly in some of its largest contracts as well as some of its newer contracts related to the situation in Ukraine. These higher usage suggests the strong value proposition which the company offers to its customers across both government as well as commercial markets

The company’s customers across its largest verticals – agriculture, defense and intelligence and civil government – are benefitting from its data to manage, monitor, and measure land and other critical resources. Whether it is NASA’ food security and agriculture program – NASA Harvest – using Planet Lab’s data to develop country-wide assessment of the health of grain in every field across Ukraine and its effect on global supplies; or Organic Valley- an organic food brand – measuring pasture health on dairy farms using Planet Labs’ data to support herd nutrition and contributing to sustainable agriculture practices like regenerative rotational grazing; the company’s offering is providing a significant value-add to customers across different end market. So, it’s not surprising that the existing customers are increasing their usage of the company’s data.

The meaningful growth in the customer usage is evident from the company’s net dollar retention rate of 125% last quarter. According to management, this increase in net dollar retention rate was primarily driven by higher than average renewal value of large government customers and the expansion of usage by its large agricultural customers. Management anticipates this metric to continue expanding over the years given the company’s significant investments in its product R&D as well as customer success teams.

In addition to usage growth, the company also posted good growth in customer count. The company’s end of the period customer count grew to 855 customers last quarter which represents a 17% year over year growth and reflects the growing demand of the company’s data. Earlier this year the company announced a ~$145.9 mn multiyear contract as a part of the National Reconnaissance Office’s Electro-Optical Commercial Layer (EOCL), which it quickly ramped up this quarter.

In Q2, the company also announced its contract with German Federal Agency for Cartography and Geodesy which will provide the employees of more than 400 German Federal institutions an access to Planet Lab’s data. This engagement follows an assessment by German central government that determined that Planet Labs’ data can help address the need of entire Federal Government. I expect Planet Labs to continue winning major contracts in the coming future as well given the strong value proposition its products offer to various end markets.

Looking forward, there is a good visibility for growth over the near to medium term as, at the end of Q2, the company’s remaining performance obligations (RPOs) were approximately $131 mn of which approximately 75% apply to the next 12 months and 95% to the next two years. These RPOs exclude $145.9 mn EOCL contract discussed above as well as other Federal contracts that include a termination for convenience clause (which is common in Planet Lab’s federal contracts). So, the company’s actual backlog is double of its reported RPOs. This gives me a confidence on the company’s growth path ahead.

Planet Labs’ Margins

Normally when we think about a company like Planet Labs which follows a subscription-based business model, the increment profit on additional revenues is very high. This was true for the company’s gross profits which increased to $25.196 mn in Q2 2023 versus $10.814 mn in Q2 2022. Planet Lab’s adjusted gross margin improved to 52% in Q2 FY23 from 36% in the same quarter prior year. However, this improvement in gross margin wasn’t reflected in adjusted operating income and adjusted net loss from operations widened to $21.460 mn in Q2 2023 from $19.030 mn. The company is heavily investing in its product development as well as sales and marketing. So, in Q2 2023, its adjusted R&D increased to $18.234 mn (vs. $11.14mn in Q2 2022) and adjusted Sales and marketing expense increased to $15.573 mn ( vs $9.951 mn in Q2 2022). This explains the increase in operating losses.

However, if one looks at Q2 2023 results closely, there is one interesting takeaway on the kind of flow through the company can see on incremental revenues. The company had guided for its Q2 2023 revenues in the range of $41 to $43 mn and adjusted EBITDA in the range of negative $18 mn to negative $16 mn. The company’s reported revenues of $48.5 mn in the quarter were $5.5 mn better than the upper end of its guidance and reported EBITDA of negative $10.5 mn was also better than the upper end of guidance by the same ~$5.5 mn amount. So, if we put aside the planned increases in sales, product development and other expenses, most of the company’s incremental revenues can find their way to its operating profit line. While it may still be a few years away, once the company’s sales and product development expenses reach normalized or target levels Planet Labs should show significant earnings growth which is typical of subscription-based models.

Is PL Stock a Buy?

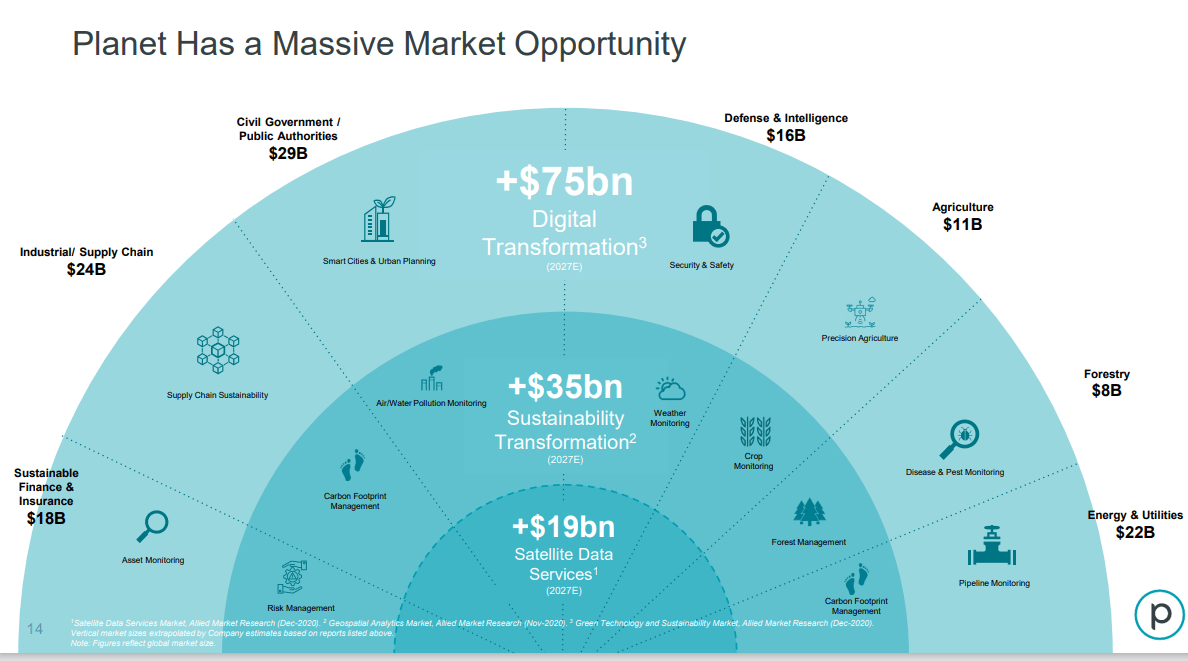

While Planet Lab is currently loss-making, the company has a massive market opportunity.

Planet Labs TAM (Planet Labs Investor Presentation)

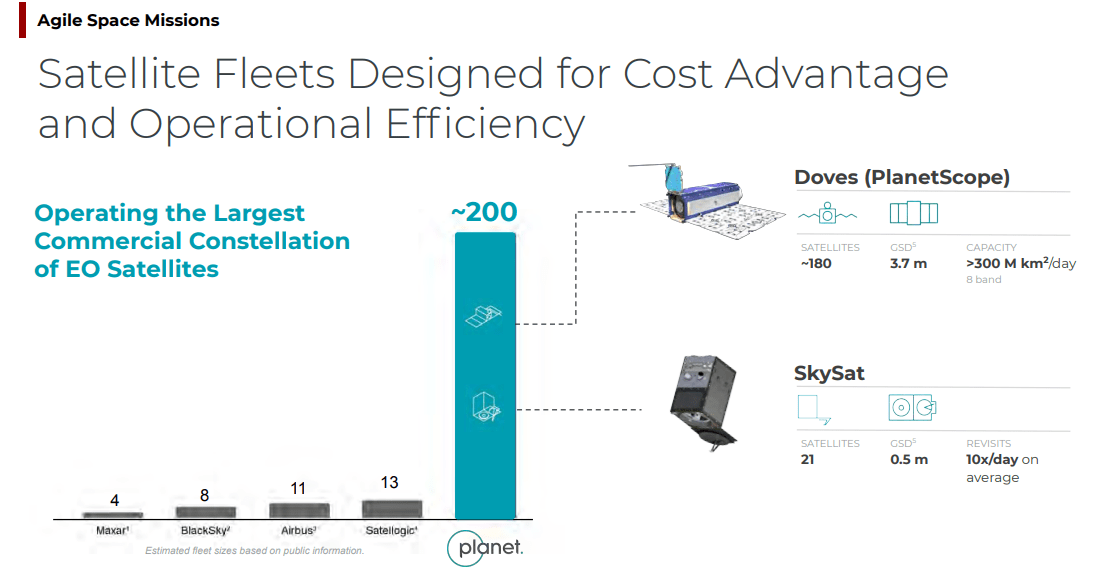

Also, in a business where scale matters, the company is also way ahead of its competitors in terms of size.

Planet Labs’ Scale Vs. Competitors (Planet Labs Investor Presentation)

The company’s offerings are helping its customers better manage their operations and create value. This is driving robust sales growth which, according to the sell-side estimates, is expected to continue in the future.

The company also has a solid balance sheet with ~$450 mn in net cash which provides it with a good leeway to continue investing in growth. The stock has corrected meaningfully since listing late last year, and the company’s Enterprise Value is close to $1 bn with its forward EV/Sales close to 5.5x. I believe long-term investors can consider buying the stock given the massive total addressable market, the company’s early mover advantage and leadership position, strong balance sheet, and excellent execution in terms of adding new customers, increasing usage of existing customers and improving gross margins.

Be the first to comment