SimonSkafar

Jabil (NYSE:JBL) announced Q4 and full-year 2022 earnings this morning (Tuesday, Sept. 27th), and – as expected – they were excellent and a strong beat on both the top- and bottom-lines. In particular, year-over-year results were driven by strong growth in the company’s Auto & Transportation operations: revenue grew 41% to $3.1 billion. Strong growth in the global EV market will likely be a powerful catalyst for Jabil for years to come. Meantime, and despite the macro-headwinds, JBL demonstrated revenue growth across seven out of its eight diversified sub-segments. Total revenue was up 14.3% yoy but due to margin growth and a declining share count as a result of the buyback program, earnings were up much more: 50.7%. Forward FY23 guidance is strong, yet Jabil shares trade with a forward P/E of only 7.5x. JBL is a BUY.

Investment Thesis

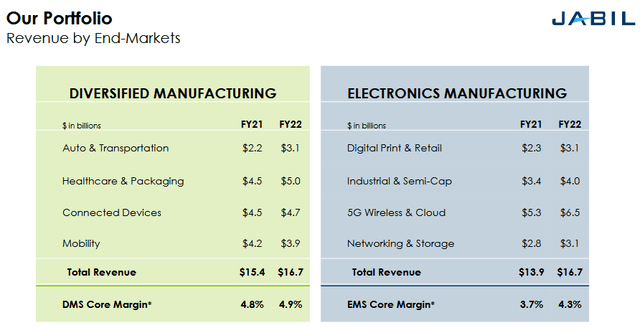

As shown in the graphic below, over the past few years, JBL has done a great job of nicely diversifying its revenue base away from being so dependent on Apple (AAPL) and its devices and now has operations across eight sub-segment categories:

Indeed, going forward, Jabil does not anticipate any single product – or any single product family – will contribute more than 5-6% to overall earnings in FY ‘23.

As is also clear in the graphic, the fastest growing sub-segment – within its relatively higher-margin Diversified Manufacturing Segment (“DMS”) as compared to the EMS Segment – was the Auto & Transportation business, which saw revenue grow 40.9% yoy in FY22.

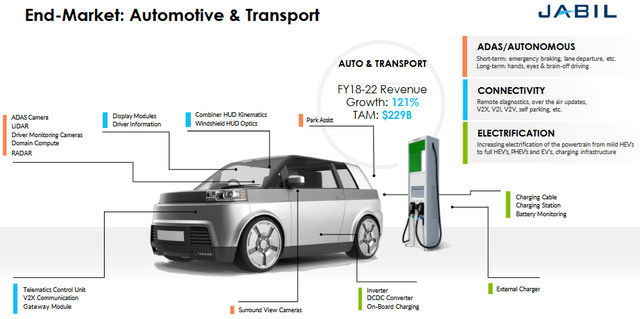

That’s because there is a plethora of various component opportunities within the EV and EV charging markets. These are shown in a slide taken from Jabil’s investor update presentation delivered after the Q4 results were discussed:

As Adam Berry, Jabil Head of Investor Relations, put it on the Q4 conference call:

In automotive, we are supporting a rapid shift in technology to electric vehicles as evidenced by our 121% revenue growth since fiscal ‘18. The growth has been driven by our best-in-class portfolio of customers in an addressable market that is growing by the day. In EV, our manufacturing processes support the industrialization and production of complex technology for electric vehicles, including battery management systems, inverters, converters, cables, off-board and onboard charging. And importantly, all of this increased complexity translates to increased content per vehicle for Jabil.

Later on the call, CFO Mike Dastoor said:

Jabil’s content per vehicle, which can be as high as $3,000 or more for a fully electric vehicle, continues to increase, which provides further confidence in future growth. It’s also worth pointing out that project lifecycles in this end market run as high as 7 or more years, providing a high level of stability and stickiness.

Note from the previous graphic that EVs represent a $229 billion TAM opportunity, and JBL is ideally positioned to capture its share. I say that because JBL has geographically diversified and global manufacturing footprint in Asia, North America, the EU, and Latin America with 260,000 employees across 100 locations in 30 countries. So no matter where the EV and/or components are needed to be manufactured, JBL is positioned well to satisfy that demand.

However, Jabil is obviously not dependent on just EVs for growth. The company has also been investing ~$1 billion annually in innovative manufacturing processes that benefit all its sub-sectors – such as rapid prototyping using additive manufacturing, advanced injection molding, robotics & AI, factory digitization & automation, and rigorous test procedures for regulatory compliance of its healthcare products.

In a previous Seeking Alpha article on EV and battery maker BYD (OTCPK:BYDDY)(OTCPK:BYDDF), I discussed how the Chinese government has been incentivizing EV adoption throughout the country with its “Three Year Blue-Sky Action Plan” (see BYD Continues Making Huge Progress In Electric Buses (and Passenger EVs Too). The EU has also adopted EV incentives and now the United States has joined the party in a big way with the Biden administration’s ability to pass Clean Energy Legislation (or the so-called “Inflation Reduction Act”) through Congress. This act allows up to $7,500 in tax credits for new EVs and $4,000 for used EVs. Those incentives, combined with the $7.5 billion for building out a national EV charging network that was contained in the bi-partisan Infrastructure Act, have – finally – gotten the U.S. serious about promoting EV adoption. These subsidies come just as many EV makers are set to roll out a plethora of new EVs to address a variety of markets – including trucks. As a result, Bloomberg is now reporting that 50%+ of new vehicle sales in the US are expected to be EVs by the year 2030.

The point here is that governments around the world – and now here in the U.S. – are heavily supporting policies to promote, subsidize, and accelerate the EV transition. And that is great news for JBL shareholders, because – in my opinion – global governments’ policy support for EVs makes the company’s Auto & Transportation sub-sector relatively recession-proof.

Earnings

As mentioned in the bullets, JBL delivered an excellent Q4 & FY2022 EPS report this morning. For the year:

- Total revenue of $33.5 billion was up 14.3% yoy.

- Earnings of $6.90/share were up 50.7% yoy.

- Adjusted free cash flow was $810 million (+26.6% yoy).

Of note was that core operating margin in Q4 was a very robust 5%.

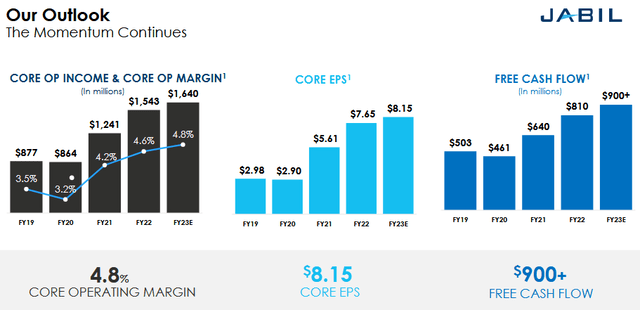

Going forward, the company expects to continue the strong momentum demonstrated in FY2022 during FY2023:

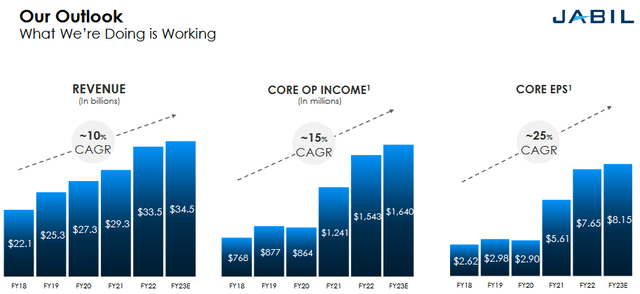

Note that core operating margin is expected to improve another 20 basis points in FY23. That will lead to an estimated $0.50/share increase in core EPS (+6.5%) while delivering an expected $900+ million in FCF (+11.1%). Note that the $900 million in FCF would equate to an estimated $6.41/share based on the average of 140.3 million fully diluted shares outstanding at the end of Q4. Based on the current share price of $57.31, that is a simple FCF yield of 11.2%. Combined that with JBL’s forward P/E ratio of only 7.5x, and Jabil clearly represents a value stock. Those arguing it could be a “value trap”, should take a look at the company’s excellent CAGR profile:

Share Buybacks

The strong growth in revenue, operating income, and FCF has enabled JBL to reduce its outstanding share count by 33% over the past 10 years. And as the share count is reduced and FCF increases, that reduction in outstanding shares should accelerate going forward. Indeed, the company announced a new $1 billion share buyback authorization (through 2024) along with the Q4 results. Jabil’s total market cap is only $7.74 billion, so at the stock’s current price, the $1 billion buyback equates to buying back ~13% of the total outstanding shares within the next two years.

On the earlier referenced Q4 conference call today, investors learned that in FY2022 the company repurchased 11.8 million shares for $696 million. That equates to an average of $58.98/share.

Risks

At $3.1 billion in FY22 revenue, Jabil’s Auto & Transportation business represents only 9.3% of total revenue and the primary investment risks to this thesis for JBL are:

- Declines in JBL’s other segments overwhelm EV-related growth.

- Serious lack of lithium and/or other key metals needed to supply the EV battery market could derail global EV growth.

- The global economy suffers a severe recession (or worse) that stresses consumers such that they cannot afford a new EV even with the tax credit.

Countering those arguments are that JBL is also expecting strong growth in several other sub-sectors in FY2023: these notably include the HealthCare & Packaging and 5G Wireless & Cloud segment, which have 5-year CAGRs of 17% and 19%, respectively.

And, of course, Jabil is not immune to all the macro-risks that have led to the 2022 bear market: high inflation, a higher interest rate outlook, Putin’s horrific war-of-choice in Ukraine that effectively broke the global energy & food supply chains (in my opinion, the real reason behind the massive inflation being seen around the world …), and covid-19-related shut-downs in China and related supply-chain disruptions, and the overall odds that a global recession is in the cards. Countering that narrative is the extremely low valuation of JBL shares based on forward earnings projections and the company’s strong free cash flow profile. Indeed, note that JBL has outperformed the S&P 500 by ~10% over the past year – likely on the back of its very strong FCF profile.

Jabil’s balance sheet is strong: it ended the year with total debt to core EBITDA levels of ~1.2x and cash balances of $1.5 billion.

Summary & Conclusion

The global EV transition has led to strong growth for Jabil’s Auto & Transportation business. In my opinion, this trend is likely to continue for years to come because it is supported by strong and global governmental policies designed to accelerate EV adoption and building out of the EV charging network. As a result, and due to JBL’s nicely diversified portfolio of growing businesses, JBL is going to continue to generate strong free cash flow and will continue to significantly reduce its outstanding share count. As a result, EPS growth will continue to outrun revenue growth, just as it did in FY22. JBL is a BUY and could easily trade up to $75/share over the next year – that’s up ~30% from here. And that would still be less than a 10x multiple on expected core operating EPS of $8.15/share.

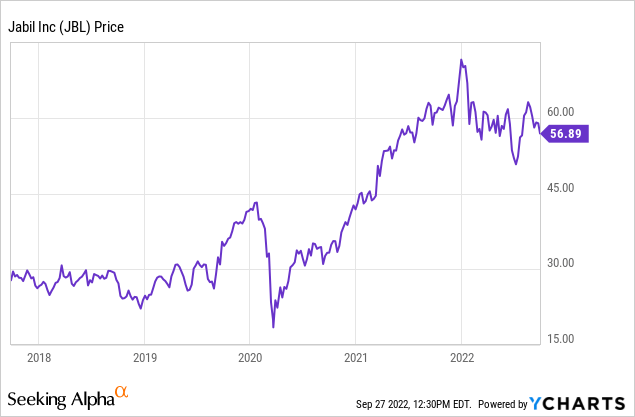

I’ll end with a 5-year chart of JBL and note that the stock is down ~20% from its high of $72 and change:

Be the first to comment