oatawa

A bear market in 2022 has erased trillions of dollars of value, but it has also created opportunities for long-term dividend investors. Amplify CWP Enhanced Dividend Income ETF (NYSEARCA:DIVO) is among the opportunities that have the potential to outperform the broader market over time. It has a proven history of performing well in both bull and bear markets, a key characteristic investors look for when investing for the long term. Its portfolio concentration on dividend-paying value and growth stocks contributes to low volatility in the bear market and solid returns in bullish conditions.

A Proven History in Bull and Bear Market

As all three major stock indices are deep in bear market territory and investors are not sure when the market will hit the bottom due to the threat of an aggressive rate hike policy and the looming global recession in 2023, it’s important to take an approach that can help lower the downside risk and thrive when markets rebound. It would make sense to invest in dividend-focused ETFs that offer downside protection along with an ability to advance in bullish conditions. For long-term investing, however, choosing the right ETF is crucial since some dividend-focused ETFs do well in bear markets while others do well in bull markets. For instance, in my recent article, I recommended investors avoid SPYD since it offers greater protection in bear markets, but lacks the potential to thrive in bull markets.

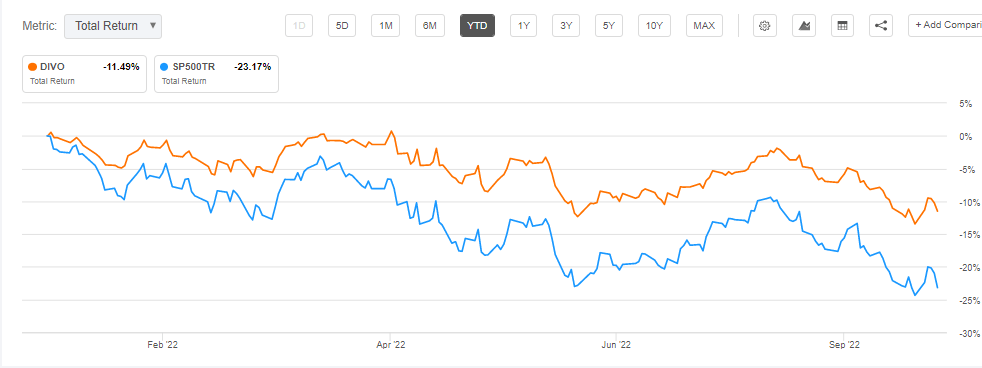

Seeking Alpha (Total Returns in 2022)

On the other hand, DIVO has outperformed the S&P 500 index so far in the bear market of 2022, losing almost 14% of its share price value as opposed to the broader market’s plunge of around 24%. Furthermore, DIVO’s dividend yield of over 5% helped trim total year-to-date losses to around 10% compared to negative returns of 23% from the S&P 500 index. Therefore, if the bear market extends into the following quarters, the ETF could offer downside protection.

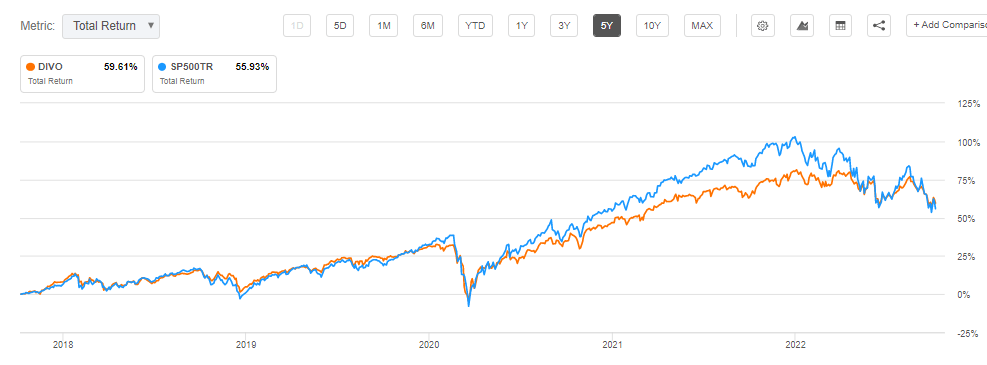

Seeking Alpha (Total Returns in 5 Years)

DIVO has also shown the potential to outperform the S&P 500 index in bullish markets. In a bull market of 2020 and 2021, DIVO’s total returns jumped by nearly 75%, compared to the broader market’s return of about 100%. A noteworthy point is DIVO’s total returns exceeded S&P 500’s when the index entered a bear market in 2022, which signifies DIVO’s potential to beat the S&P 500 index and offer lofty returns over the long term.

How Does DIVO Perform Well In Both Bear and Bull Markets?

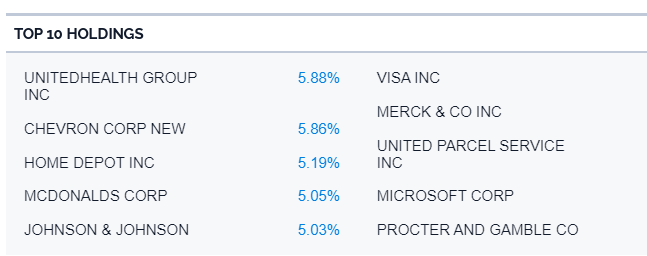

Amplifyetfs.com (DIVO’s Top 10 Stock Holdings)

DIVO’s performance is attributed to its portfolio concentration on 25 high-quality dividend-paying companies from both value and growth categories. The fund held three to four positions in healthcare, financials, energy, information technology, and consumer discretionary sectors. From the healthcare sector, DIVO owned positions in stocks such as UnitedHealth Group (UNH), Johnson & Johnson (JNJ), and Merck & Co (MRK), representing over 18% of its total portfolio. With a strong business model as well as the prospect of generating sustained growth in earnings and cash flows, these healthcare companies are among the most dependable large-cap dividend payers. UnitedHealth Group, for instance, has generated average dividend growth of 17% in the past five years while its share price has surged 160%.

Besides healthcare stocks, DIVO’s portfolio is dominated by large-cap dividend-paying technology stocks, which make up 17% of the total portfolio. At the end of September, DIVO owned stakes in Microsoft Technology (MSFT), Apple (AAPL), Cisco Systems (CSCO), Visa (V), and Qualcomm (QCOM). Due to their strong business models, large revenue bases, and healthy cash positions, these tech stocks generated significant gains in the bull markets of 2020 and 2021 and fell at a lower rate than their peers in the bear market of 2022. Moreover, after the price plunge, the valuations of these tech stocks fell significantly, putting them in a position for a sharp rebound once the market recovers.

The fund’s portfolio also includes energy stocks such as Chevron (CVX), Marathon Oil (MPC), Devon Energy (DVN), and Duke Energy (DUK), accounting for 13% of the entire portfolio. The fundamentals of energy stocks appear robust as a production cut of 2 million barrels a day from OPEC raised the oil price forecast to $90 to $100 per barrel for 2023. Similarly, the fund held a stake in three top dividend stocks from financial sectors: Goldman Sachs (GS), Aflac Inc (AFL), and JPMorgan Chase (JPM). These companies have earned an A plus or A grade on dividend safety based on the Seeking Alpha quant grading system. Additionally, the fund’s portfolio includes reliable industrial and consumer discretionary stocks such as Lockheed Martin (LMT), Deere & Co (DE), McDonald’s (MCD), and General Mills (GIS). Overall, the fund’s strategy of holding stakes in three to four high-quality and well-established dividend-paying companies from healthcare, technology, financials, energy, and industrial sectors helps it generate robust returns in the bull market and improves downside protection in bear markets.

Meanwhile, SPYD failed to perform well in the bull market due to its portfolio concentration on defensive sectors like utilities. The strategy of holding a small number of positions in high-growth sectors like technology contributes to underperformance in bull markets. In addition, its stock selection strategy of focusing on dividend yields instead of the quality of dividends also adds to inconsistency in returns. A focus on high yield has also significantly exposed SPYD’s portfolio to interest-rate-sensitive sectors like real estate and financials.

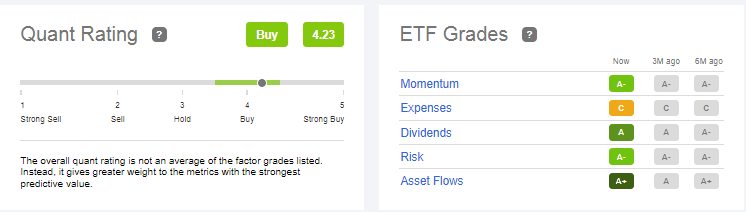

Quant Ratings

Seeking Alpha Quant Score

The Seeking Alpha quant system rated DIVO as a buy with a quant score of 4.23. It scored exceptionally well on factors such as momentum, dividends, and asset flow. A dividend score of A and a momentum score of negative A indicates the fund is set to generate healthy returns for investors in the long term. The negative A score on a risk factor also implies its ability to offer downside protection during periods of market decline. Top of all that, it has an A plus score for asset flows, which suggests higher inflow and investors’ strategy of taking advantage of a dip in its price. The fund is ranked first out of 11 ETFs within its sub-asset class and 113 out of 293 within its asset class.

In Conclusion

Divo’s characteristics, including healthy dividend growth, a dividend yield that exceeds 5%, prospects for solid price appreciation in a bull market, and a stock portfolio that consists primarily of high-quality growth and value stocks, make it a good option for long-term dividend investors. These characteristics also enable it to offer a cushion during high volatility periods. Additionally, active portfolio management reduces tail events and macroeconomic risks.

Be the first to comment