metamorworks/iStock via Getty Images

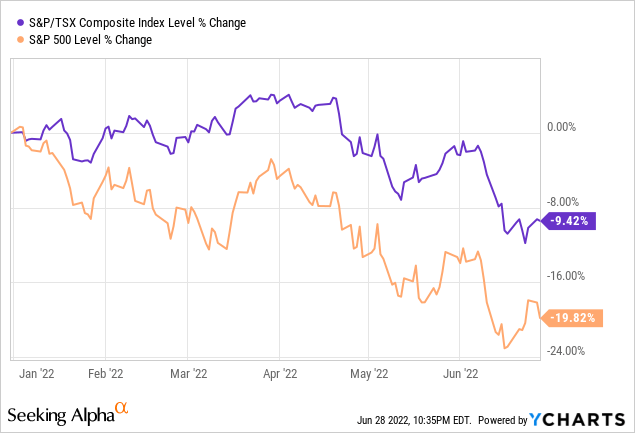

The past few months have seen the market in a state of free-fall. As inflation rages through the system, fears are stoked about the potential for an environment marked by stagflation and even a recession.

In times like this, it is crucial to have a stock watch list ready. Being ready to pull the trigger when the fickle market offers up a fat pitch is the easiest way to accumulate long term wealth.

Today I’ll be featuring two high quality companies with proven staying power, come what may.

Facts and figures will be presented in CAD, the currency both companies report earnings in.

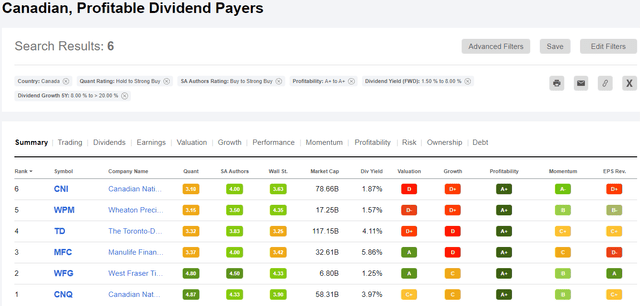

SA Stock Screener

In selecting my two companies, I started by using Seeking Alpha’s stock screener. I filtered down the companies based on the following criteria:

- Quant Rating: Hold to Strong Buy

- SA Authors Rating: Buy to Strong Buy

- Profitability: A+

- Dividend Yield: 1.5% to 8.0%

- Dividend Growth 5Y: +8.0%

- Country: Canada

This reduced the universe of companies from 2,685 down to just 6:

From here, I chose two companies that I know well and who have incredible track records of building sustainable growth.

Stock #1: Canadian National Railway (CNI)

Worried about supply chain problems and the eroding value of a dollar? How about adding one of the best companies out there when it comes to delivering the goods?

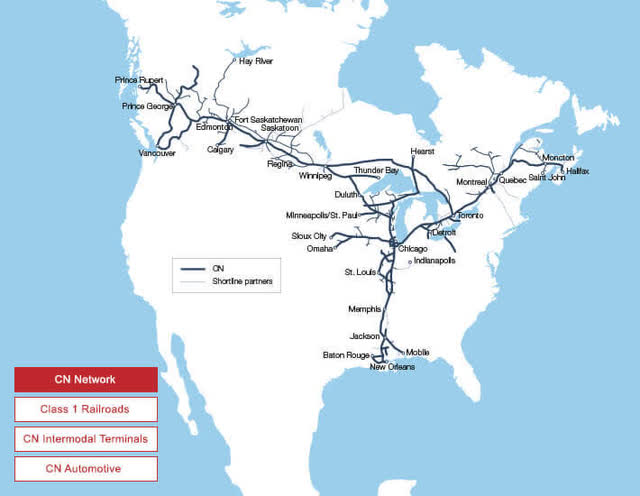

CNI is a Class I railroad that transports over C$250 billion worth of freight annually. It operates ~20,000 route-miles of track, connecting the Canadian East and West coasts and down to the Gulf of Mexico:

Source: CNI Website

One of the beautiful things about CNI’s business model is that it functions as a duopoly on its home soil in Canada. Given the financial and environmental benefits of moving goods by rail, this means that customers have few options, providing CNI with considerable pricing power. From a customer’s perspective, rail still remains the least expensive way to ship across country.

In an inflationary environment, this means the company is able to keep pace.

Let’s review two positive catalysts on the table for CNI in the coming months and years.

A New CEO and an Innovative Way to Railroad

In late February, CNI appointed Tracy Robinson as its President and CEO. She came directly from TC Energy where she was also leading the company, along with 27 years of experience at Canadian Pacific Railway (CP).

While a CEO-shakeup can often be a risky proposition, Robinson’s familiarity across the industry and experience with CNI’s direct competitor in Canada suggests she will come with operational know-how from the outset.

From the company’s Q1 2022 Earnings Call, Robinson outlined four key initiatives the company is focusing on:

- Operating as a scheduled railway with a “laser focus on velocity”.

- Curating their book of business to more effectively suit CNI’s network and strengths.

- Be more integrated between how the company operates and sells, along with how they invest and grow.

- Continue with long-term investments in the company’s network and capabilities to remain efficient and be able to grow.

Zeroing in on the first point, one of the ways CNI intends to improve its car miles per day is to extend beyond Precision Scheduled Railroading (‘PSR’). The company now identifies as the first Class I railroad to implement Digital Scheduled Railroading (‘DSR’):

Source: Q4 2021 Earnings Presentation

This move allows CNI to utilize the PSR concepts of precise scheduling and layer on the newest tech advancements. As the next evolution in railroading, DSR will permit the company to leverage big data and artificial intelligence to improve reliability, predictability, and safety on its rail networks.

In a move that places this great railway at the digital forefront of innovation, CNI entered into a seven-year strategic partnership with Google Cloud (GOOGL) (GOOG). This will modernize their IT infrastructure and provide access to the capabilities that only a top tech name like GOOGL is able to provide.

One basic and yet transformative example of using this new tech is with Automated Inspection Portals (‘AIP’). This allows ultra-high-definition cameras to capture a 360 degree view of trains as they move along tracks. AIP utilizes machine learning algorithms to inspect railcars without human intervention and then generate work-orders as needed for car repair. This simplifies the inspection process and does so far more efficiently than if these cars were needed to be pulled off the line for human processing.

CNI Valuation

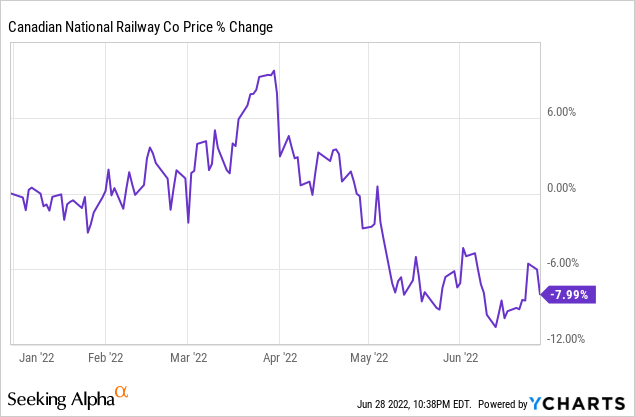

Despite its solid financial footing and growth prospects going forward, CNI has not been immune to the overall stock market malaise.

The company has dropped roughly 8% YTD:

CNI currently sits on a forward P/E of ~21.

At the time of writing, the company sports a ~2% dividend yield. While this isn’t much to start, the company’s most recent dividend raise was for a huge 19.11%. Going all the way back to 1995 when the company went public, they’ve boosted dividends annually by ~16%.

EPS growth expectations are in the 15–20% range, with free cash flow between C$3.7–4 billion. Coupled with the share buyback program of ~C$5 billion confirmed at the start of the year, CNI is poised to both grow its operations while rewarding shareholders.

My intention through July is to capitalize if the stock price shows any real signs of weakness. I’ll be looking to the earnings call in late July to see whether the company has continued executing on its priorities.

Stock #2: Toronto-Dominion Bank (TD)

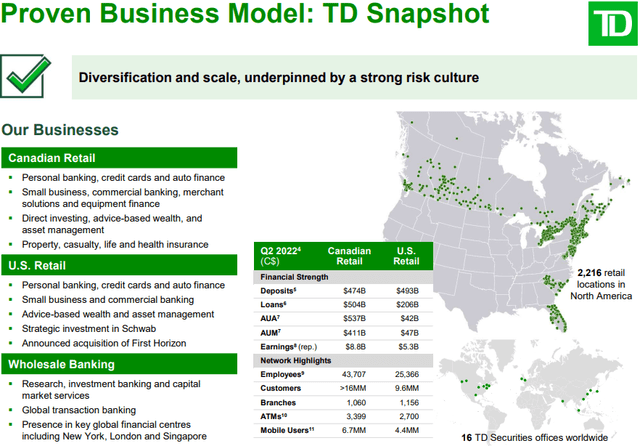

TD is the second largest bank in Canada, along with the sixth largest in North America by total assets. It has been the most successful of the Big Five Canadian banks in its foray onto US soil.

TD has three main lines of business:

- Canadian Retail

- US Retail

- Wholesale Banking

Across these services, TD offers the full suite of banking capabilities one might expect from an operation of its size. Where TD has worked to differentiate itself is on customer service. It gained customer favor through offering longer branch hours than competitors, soaking up market share in the process.

Handling an Inflationary Environment

Central banks around the world finally seem to be getting serious about taming the beast that is inflation. As interest rates rise, this can provide a boon to net interest margins for banks.

With the Federal Reserve recently boosting its benchmark by 0.75%—its single largest rate hike since 1994—all signs point to more moves in the period to come.

Despite its Canadian roots, TD is well-situated in the US market. In fact, it is well regarded for its branding as “America’s Most Convenient Bank”, where it holds an immense footprint along the East coast, all the way down through deposit-rich Florida:

Source: TD’s Q2 2022 Investor Presentation

While there is talk of a mild recession being in store for us in the near term, the need to tame rising prices should continue to provide a boon to TD’s earnings potential.

Adapting to a Digital Frontier

Banks have historically been known as stodgy and slow moving. Canadian banks in particular are recognized as conservatively managed.

TD is currently taking steps, however, which should position it well for the future ahead. The company announced in January that it will be hiring over 2,000 technology roles to bolster its strengths in several key tech segments:

- Artificial Intelligence

- Machine Learning

- Cloud

- Cybersecurity

- Automation Tools

- Engineering

These roles will be responsible for delivering on new methodologies, crafting UX design, and continuing to innovate with TD’s mobile experience.

This aligns with CEO Bharat Masrani’s remarks on the Q2 2022 Earnings Call where he highlighted TD’s “Next Evolution of Work” (‘NEW’) initiative. The overall goal and scope of NEW will be to revolutionize their operating model and tech capacity.

Masrani indicated that using these agile processes at scale has enabled TD to increase its speed-to-market with new initiatives to the extent that it can deliver new services and offers in a short period of weeks.

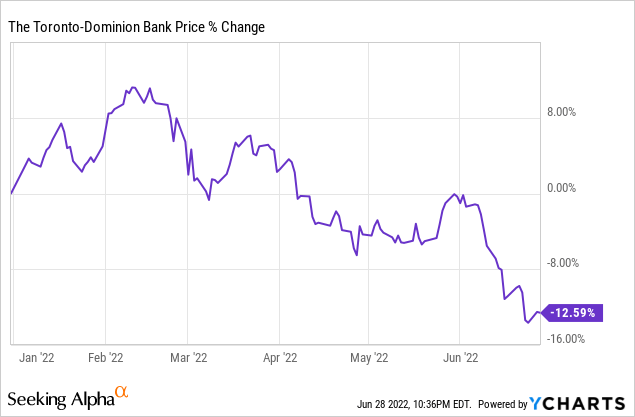

TD Valuation

TD has performed even worse than CNI above in the recent period. It has dropped ~12.5% YTD as the market has tanked:

Still, this should not be taken as a harbinger of what is to come, nor a reflection of TD’s actual business performance.

On the recent earnings call, the company commented on its financial strength, pointing to its solid 14.7% Common Equity Tier 1 ratio. TD also posted 8% YOY revenue growth. It currently sits on a forward P/E of ~10.

Coming out of the pandemic with its coffers topped up, TD provided shareholders with as 12.66% dividend boost at the start of the year. I should note, however, that this increase was slightly above the norm given it accounts for the period during the pandemic where the banks were instructed to keep their dividends steady between March 2020 and November 2021 by the OSFI.

All the same, boosts like this bode well for the future. TD currently hosts a solid dividend yield which is presently hovering around 4.2%.

Conclusion

Both CNI and TD bear the hallmarks of true blue chips. They have proven resilient through all market conditions and demonstrated an ability to continue rewarding shareholders.

Rising dividends are my favorite form of inflation protection. When you can get a cash flow that rises faster than general costs, you can sleep easily.

With CNI and TD, my emphasis today has been to demonstrate that while they are tried-and-true companies, they are also leveraging new technologies and processes to stay ahead of the game. I’ll be watching them closely in the month ahead.

Be the first to comment