Just_Super/iStock via Getty Images

Overview

In this series of articles, I am focusing on single Dividend Challenger stocks and determining whether they are solid long term buy options for investors based on a number of criteria related to performance, financial strength, valuation, dividend strength, etc. In the first article of this series, I reviewed the Dividend Challenger stock ACCO Brands (ACCO) and determined it to be a hold for current shareholders and should be avoided for other long term investors. That article can be found here.

Dividend Challengers are stocks that have increased their dividends every year for at least five consecutive years. This list is maintained with the Dividend Champions (25+ years) and Dividend Contenders (10+ years). More information on these lists can be found here.

For this article, I will be reviewing the stock performance, financials, recent news, valuation, and dividend strength of Ameren Corporation (NYSE:AEE).

Ameren is a public utility holding company operating in four business segments: Ameren Missouri, Ameren Illinois Electric Distribution, Ameren Illinois Natural Gas, and Ameren Transmission.

Dividend

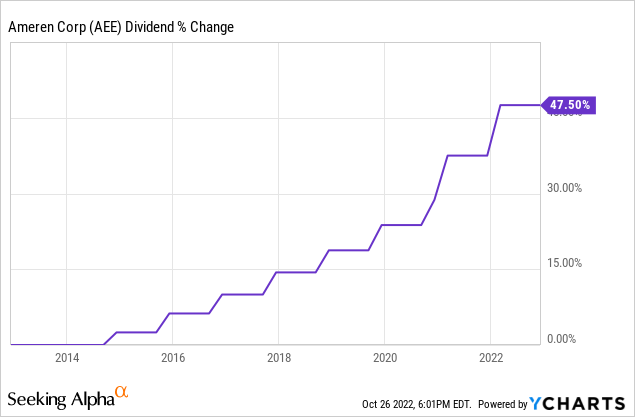

Ameren has been on the Dividend Challengers list for a while having 9 years of consecutive dividend growth. Looking at the chart below, you can see that the Ameren’s dividend growth has been steady and the rate of increase has improved recently.

Ameren’s dividend has risen from $0.40 quarterly dividends in 2014 to its current quarterly dividend of $0.59 per share.

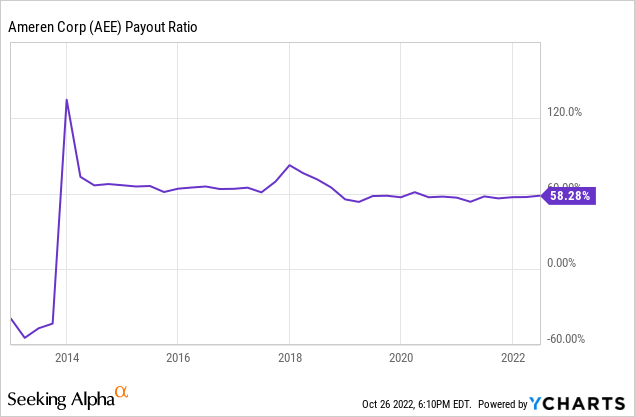

Looking at the chart below, you can see that Ameren’s payout ratio is a bit high, currently near 60%, but is in line with its historical average while it has continued its dividend growth.

This means it is likely that Ameren should be able to continue its dividend growth and shortly move from the Dividend Challengers list to the Dividend Contenders list.

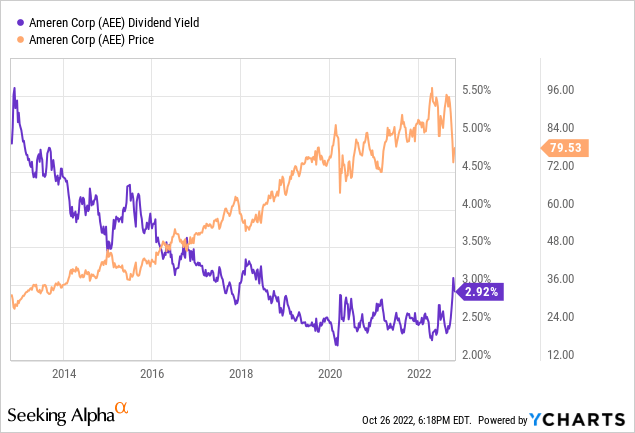

Ameren has a current dividend yield of 2.97%. And looking at the chart below you can see that this is below the average yield of its dividend over the past ten years but the decline in yield has correlated strongly with the price appreciation of Ameren during this time.

Financials

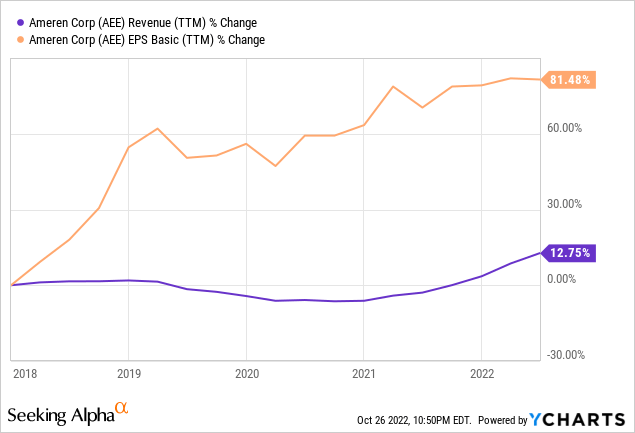

Ameren has seen ups and downs in terms of its revenue and earnings growth over the past several years but overall has seen positive growth in both areas. Looking at the chart below you can see that its earnings growth has outpaced its revenue growth over the past five years.

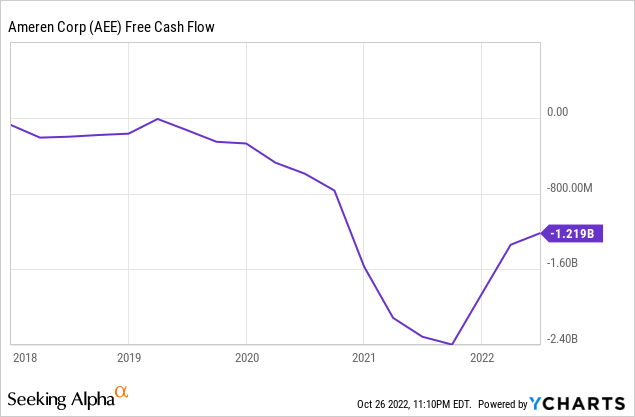

While Ameren’s earnings growth and future outlook appear impressive, its negative free cash flow is a bit concerning. With their capital expenditures, any misses in terms of revenue/earnings could apply pressure to its future dividend growth.

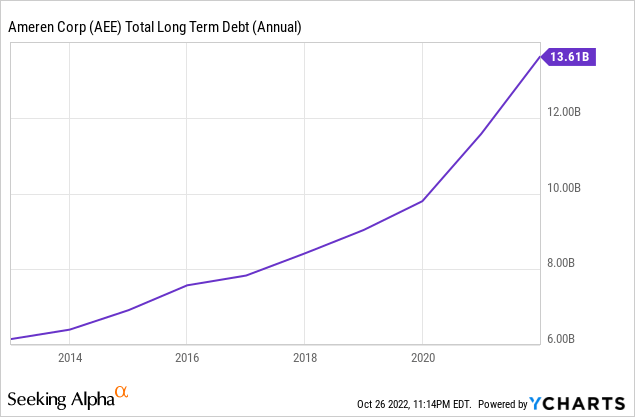

Another item that could eventually lead causes problems with Ameren’s dividend is its significant increase in debt over the past several years.

Valuation and Performance

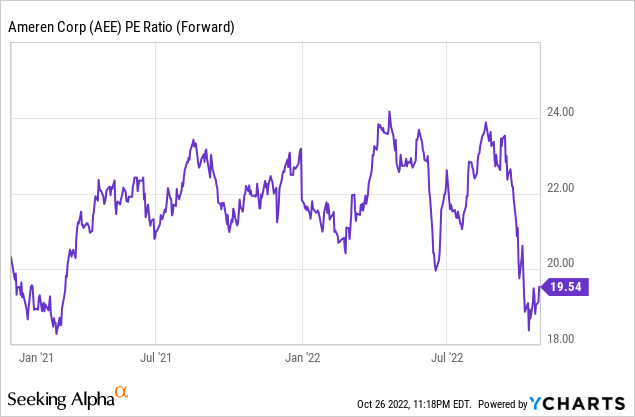

Ameren currently has a forward PE ratio of 19.54. Looking at the chart below, you can see that this is low compared to its recent historical average.

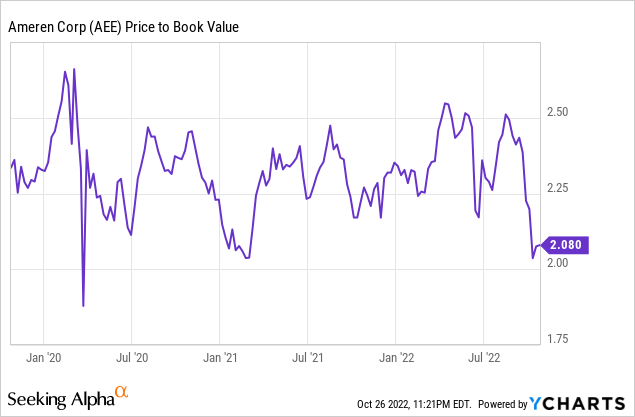

The same trend can be seen when looking at Ameren’s recent price to book value.

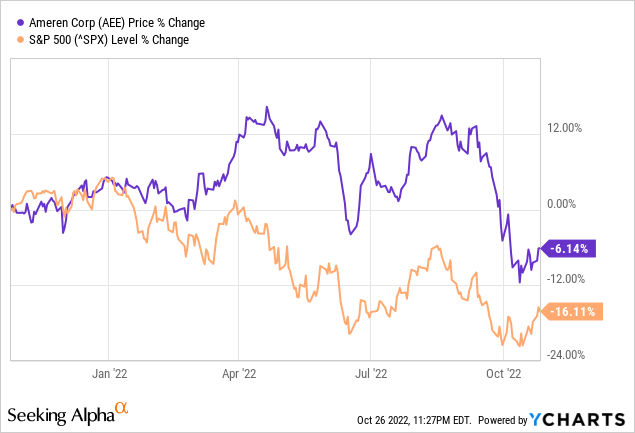

Part of the reason for Ameren’s lower valuation compared to its recent historical average is the drop in Ameren’s price over the past year.

While Ameren has seen a decline in price of over 6% this past year, you can see from the chart above that it has still performed better than the S&P 500 which is down just over 16% during the same time period.

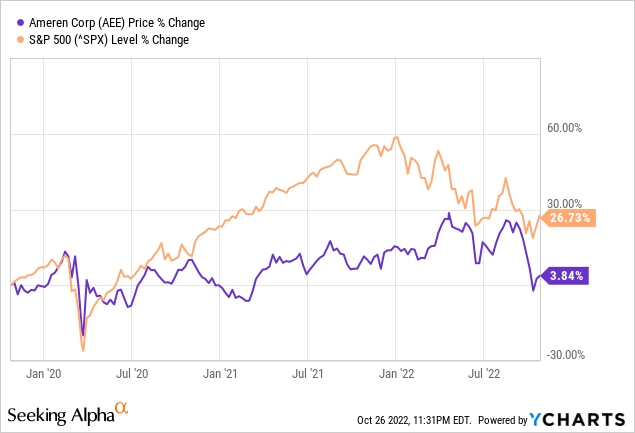

Ameren may have performed above the S&P over the past year, but that is not the case when looking at a longer-term period.

Peer Comparison

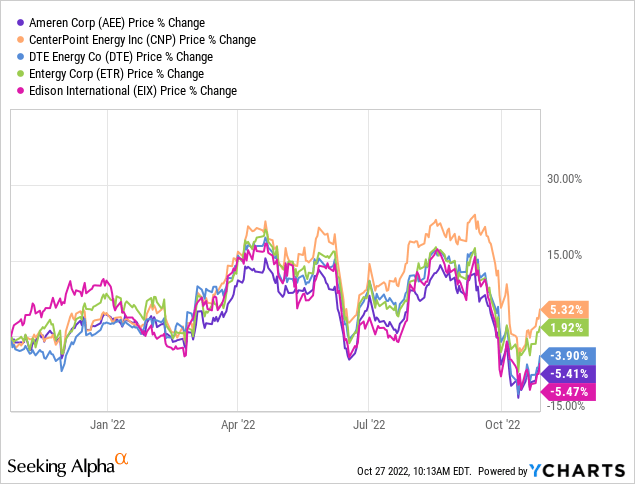

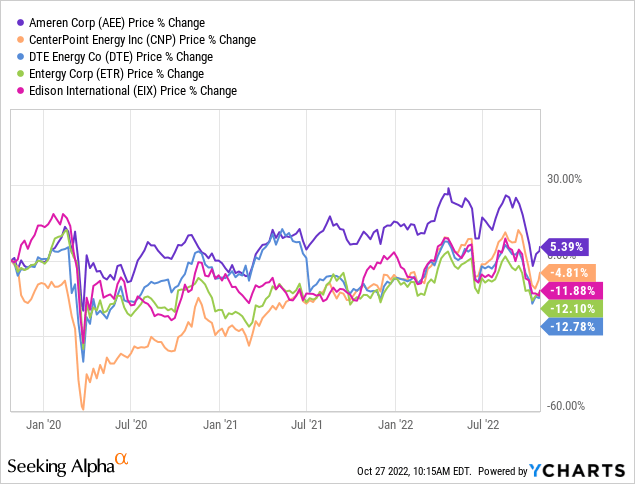

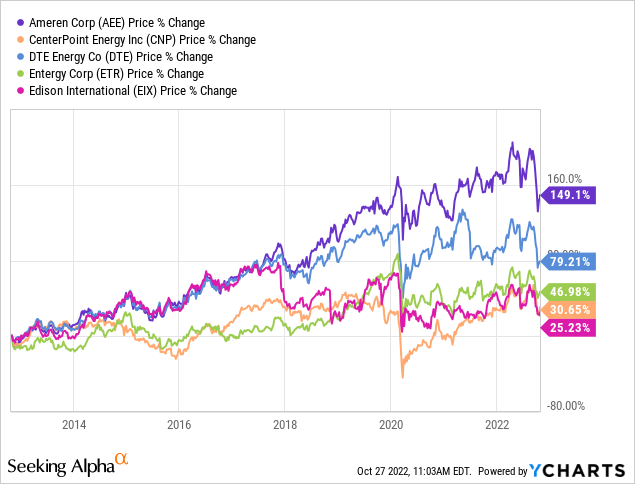

A few stocks in the same industry with similar market caps to Ameren include CenterPoint Energy (CNP), DTE Energy (DTE), Entergy Corporation (ETR), and Edison International (EIX).

In terms of stock price, you can see in the chart below that only Edison International has performed worse over the past year, with CenterPoint Energy and Entergy being the only two stocks with positive price appreciation during this time period.

However, when extending that date range out three years, you can see that Ameren has actually performed the best out of these five stocks and is the only one of the stocks to have a positive price return during this time.

Extending the time frame out to 5 years and 10 years, Ameren once again performs better than the other stocks during these time periods.

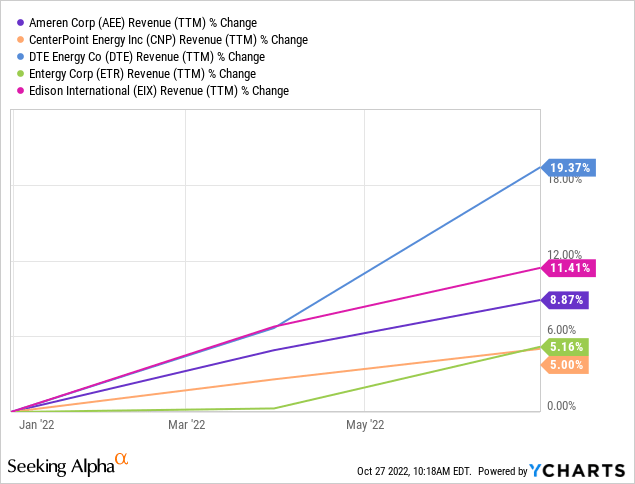

When looking at revenue growth, Ameren is right in the middle in over the course of the past year (the same is true for 3, 5, and 10 year revenue growth as well).

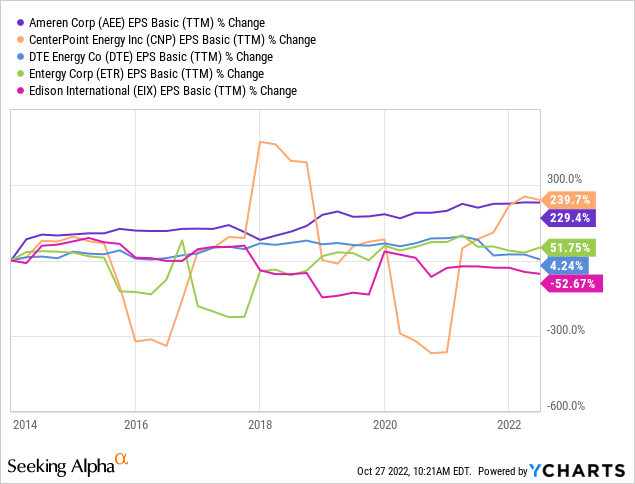

When looking at earnings, Ameren is 2nd in terms of long term growth over the past 10 years, but what I find impressive is that when you look at the lines for each of these stocks, you can see that Ameren’s earnings growth is the most consistent and is nearly a straight line over the past ten years compared to the other four stocks that have large ups and downs.

Recent News

In August, Ameren announced that it will delay retiring its Rush Island Missouri coal power plant until mid-2025. In the related court filing, Ameren asked for the ability to allow the plant to operate on a limited basis meaning that it will not have to invest in pollution controls as it prepares for the pending retirement.

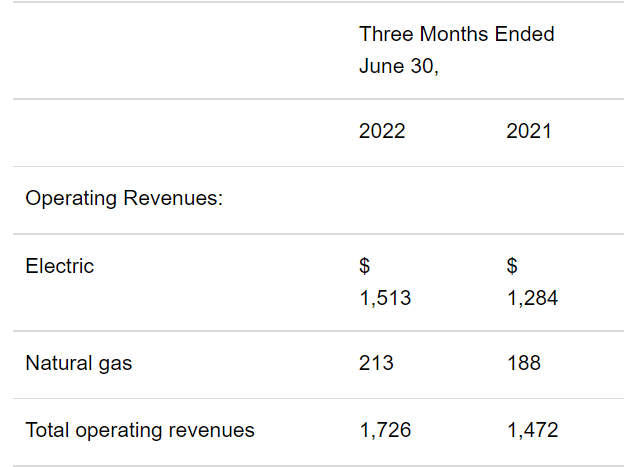

The company will report Q3 earnings next week. For Q2, Ameren missed its earnings estimates by $0.02 per share but beat its revenue estimate by 202.05M.

Looking at the image below, you can see that operating revenue increased in both its electric and natural gas segments.

Operating Revenue (Ameren)

Reviewing the Q2 earnings transcript, there are several factors that will affect the future performance of Ameren including:

- Ameren Missouri filed an electric rate review requesting a $316 million annual revenue increase to allow for modernization upgrades to the electric grid and investments in clean energy

- Illinois Electric requested an $84 million revenue increase to enhance the electric grid

- CCNs (Certificates of Convenience and Necessity) filed for two solar project acquisitions

- Tranche 1 – a set of projects to improve the reliability of energy transmission. Ameren is in position to compete for approximately $1.8 billion worth of these projects.

Based on these and other factors, Ameren issued its five-year growth plan that includes an expected 6% to 8% compound annual earnings growth rate between 2002 and 2026. The company expects to continue its dividend growth rate to be in line with its eps expectations maintaining a payout ratio between 55% to 70%.

Conclusion

I believe that Ameren remains a solid long-term buy option for long-term investors looking to add a utility stock to their portfolio. Recently, Ameren’s stock price hasn’t performed that well, but that can be said for most stocks in the Utilities sector this year. When looking at Ameren’s long-term price appreciation, it has performed well when compared to the other utility stocks mentioned above.

Ameren currently has a dividend that yields close to 3% and it should be able to continue growing its dividend at a similar rate it has done so over the past several years. At a forward PE ratio of 19.53x which is a little lower than its recent historical average, I don’t find it to be an overvalued stock at the moment. Operating in a highly regulated industry, this stock does have a number of associated risks with it but in relation to other stocks in the industry, I feel that it compares favorably and believe it will provide long-term investors with solid returns. As always, I suggest individual investors perform their own research before making any investment decisions.

Be the first to comment