Editor’s note: Seeking Alpha is proud to welcome MT Capital Research as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Justin Sullivan

Today I will be completing an in-depth analysis on Advanced Micro Devices (NASDAQ:AMD). Within, I will break down the multitude of opportunities the company has in front of it and provide a succinct overview of the company’s vast technology portfolio. Additionally, I will spend time discussing how the company is eating Intel’s (INTC) lunch, dig deeper into its financials, and discuss some positive and risk-based factors alike that I am considering with respect to the company.

Introduction

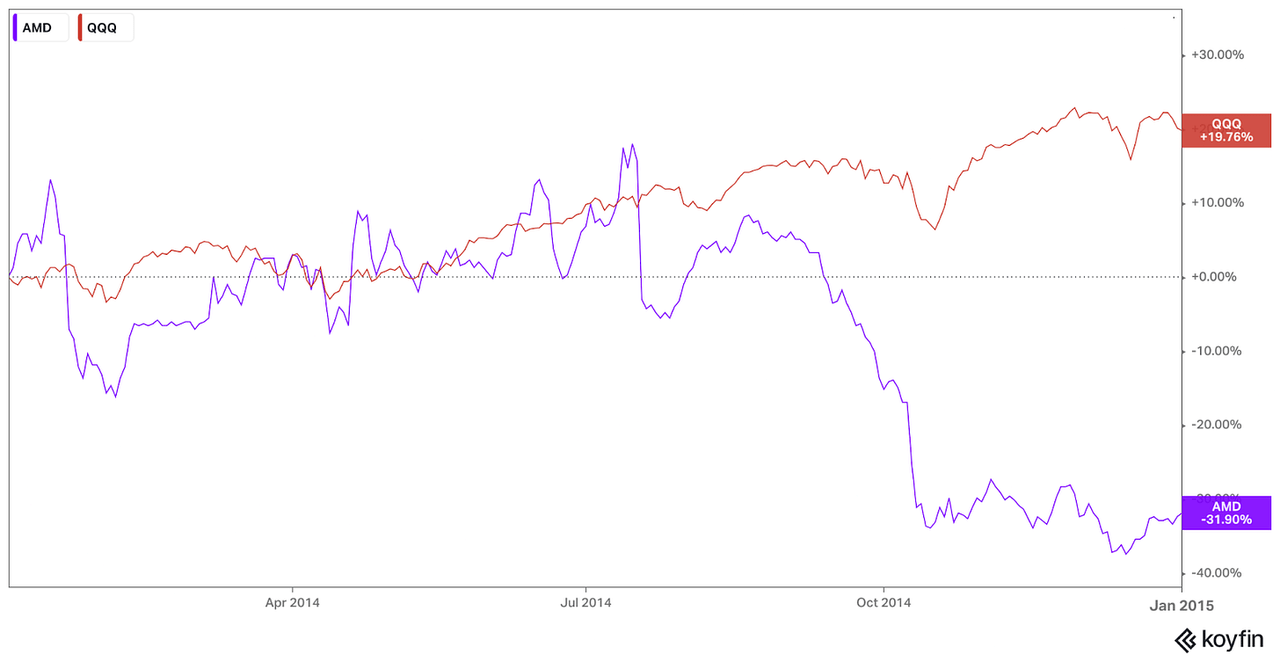

In 2014, AMD’s blood was in the metaphorical water. With sharks circling in as the company’s stock hit a new all-time low, AMD was struggling. Not only were they competing poorly with Nvidia (NVDA) on the GPU front, efforts that were made possible in the first place through their 2006 acquisition and incorporation of ATI, but they were also performing miserably in the CPU space against the then market leader, Intel. Markets were not oblivious to these happenings, with a downward spiral in the company’s equity on full display, and AMD underperforming the Nasdaq by approximately 50% by the end of the year:

AMD vs. QQQ Performance – 2014 (Koyfin)

Judging by AMD’s star-studded status at the moment, many investors are not familiar with just how close AMD came to failing not too long ago. These occurrences are pertinent to understand, seeing as they give one insight into the managing blunders that got them there in the first place. Prior to 2014, the company’s hardware was performing relatively well, with the Athlon and phenom architectures existing as strong competition to Intel’s hardware at the time. Unfortunately, this competitive positioning diminished with Intel’s launch of the Nehalem and Sandy Bridge architectures. As a result of their early success, AMD went back to the drawing board. Coming out of the workshop shortly thereafter, Q4’13 saw the company announce the bulldozer/fx-series CPUs, hardware that was focused on providing consumers with high clock speed and core counts, presenting itself as a threat to Intel’s aforementioned technology. Although intriguing on paper, this launch proved to be disastrous and almost sunk the company, with the chips leveraging the bulldozer architecture underperforming their intel counterparts in the technical sense of the word, while also falsely advertising their core capabilities to investors. AMD had claimed that these chips possessed eight cores, when in fact they did not. Rather than designing the chips to utilize simultaneous multi-threading, where each CPU core has two logical threads associated with it, the company used a clustered multi-thread design, which combines two cores into one effective CPU module. Put simply, this design choice meant that because two cores were combined into one module, they could no longer perform tasks independently, resulting in the fact that eight instructions were not able to be carried out simultaneously as claimed, a huge differing factor from the intel eight core hardware. As a result of the fact that subsequent AMD microarchitectures were based on these design choices, the company, in essence, lacked a competitive CPU for years, a phenomenon that resulted in Intel taking a comfortable lead, and fortunately for AMD, resting on their laurels.

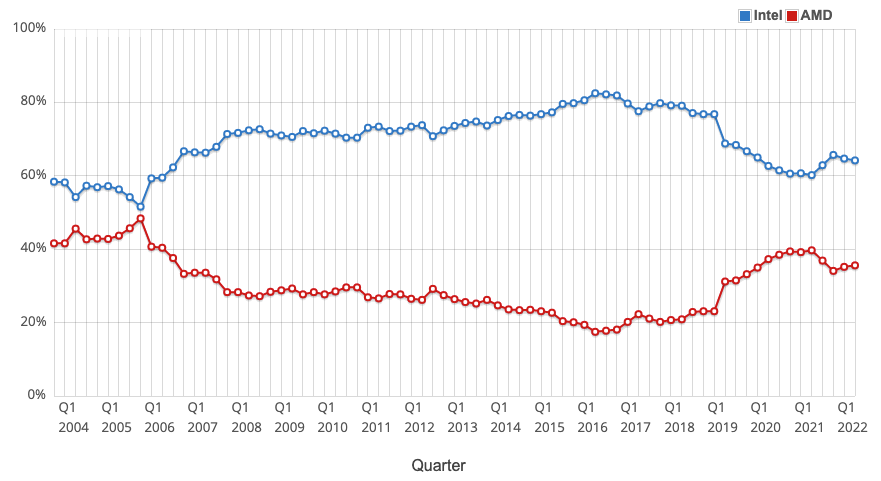

In late 2018, this all changed. A few years into Dr. Lisa Su’s role as top dog of AMD, the company started to get to work, putting their nose to the grindstone for the release of the zen chip microarchitecture, hardware they hoped would finally change their situation and a bet that was boom or bust since many analysts expected the company would go bankrupt by 2020. Despite a disastrous launch where users were unable to run RAM at its full clock speed, the Ryzen hardware was a success, bolstering a high performance/dollar, and offering consumers a series of budget offerings that were not previously available from other companies. As a result of intel’s complacency, and viewed in conjunction with AMD’s technical savviness, subsequent Ryzen 2 and Ryzen 3 architecture launches proved to be enormously successful, closing the gap between the company’s single and multi-thread performance differences, and the overall CPU market share as well.

Intel vs. AMD overall market share (TechPowerUp)

Heading into the next few years, AMD will need to continually evolve, cementing itself in a variety of business segments. Outside of the historical pretences I alluded to above, AMD is in fact a company with diverse offerings, operating in a variety of different avenues. Primarily, the company offers products and services within the Computing and Graphics, Enteprise, Embedded, and Semi-Custom end-markets. Products include but are not limited to x86 microprocessors, chipsets, discrete and integrated GPUs, data center and professional GPUs, development services, hosts of software offerings, server and embedded processors, semi-custom system on a chip products, game console tech and much more. In order to become one of the most valuable semiconductor companies in the world, the company will need to continue to excel with these existing products and release new ones at the forefront of some of the world’s largest technological trends, a proposition that I will spend time addressing within this deep-dive.

With these ramblings in mind, let’s spend some time quantifying, as best as we can, the opportunity that AMD has in front of it.

Opportunity

AMD’s opportunity was nicely outlined in the company’s most recent Financial Analyst Day, a four-hour showcase that I encourage all of you to watch if you’re interested in learning more about the company. Some of the biggest takeaways were contained within the early section of the presentation, particularly the outline of how much the company’s opportunity has changed from 2020, the date of the last analyst day, to 2022. In 2020, AMD estimated their TAM was approximately $79B, with $35B associated with the Data Center, $32B associated with PCs, and $12B associated with Gaming. Post-acquisition of Pensando and Xilinx, AMD now estimates their current opportunity to be approximately $135B, attributable to opportunities that measure $40B for PCs, $29B for Embedded, $50B for Data Center and $16B for Gaming. Lastly, AMD also provided a slide that outlines the enormous opportunity that AMD has in front of it, of which they aim to address over the course of the next five years. The contents of these projections will be what we address briefly for the remainder of this section.

AMD’s big opportunity (AMD)

Gaming and PCs

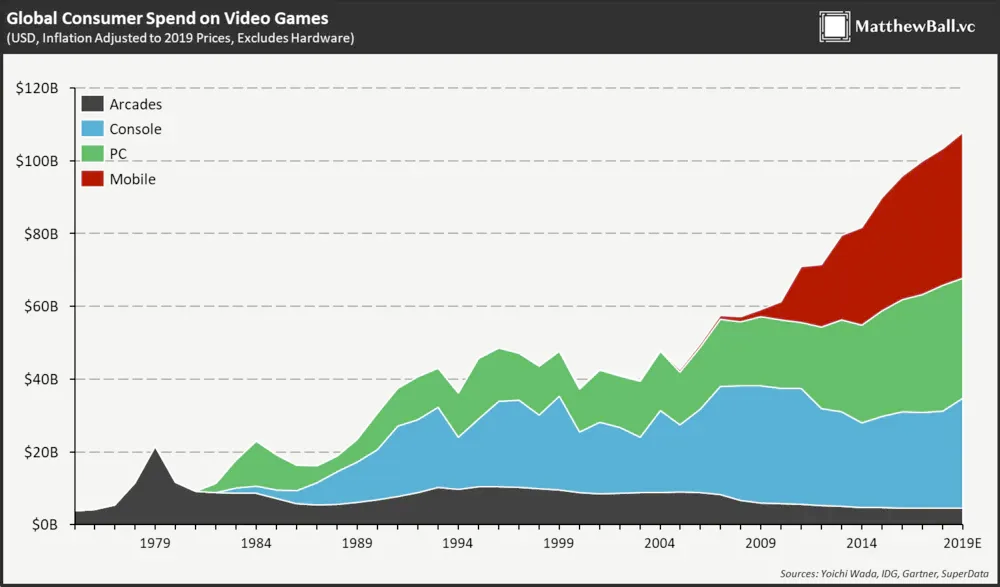

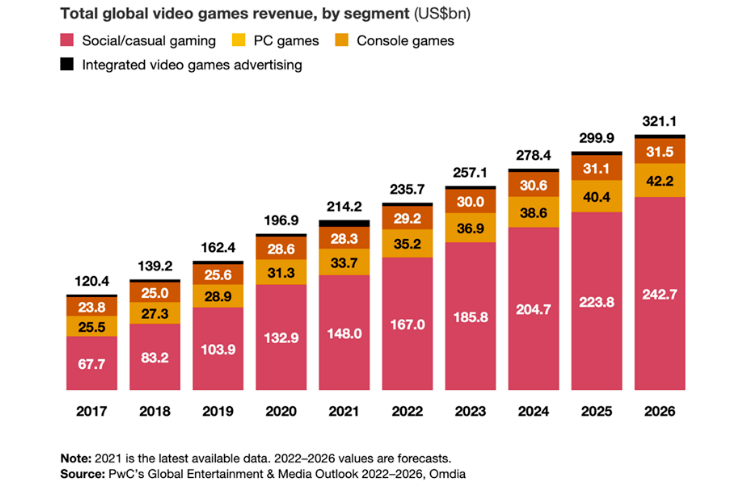

Staying surface level for a moment, AMD will continue to benefit from the growth of gaming as a whole. Readers have heard me harp on this before, however, it is worth touching upon again for a moment. Gaming as an entertainment source has grown more rapidly than any other counterpart, as outlined by the change in decades’ worth of expenditures outlined below:

The growth of the video game space (MatthewBall) Total Global Video Game Revenue Projections (PWC)

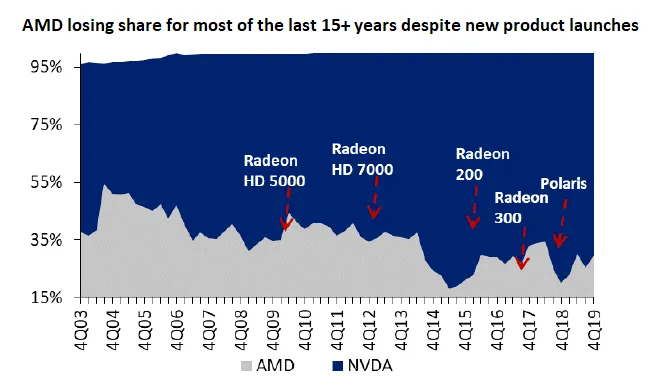

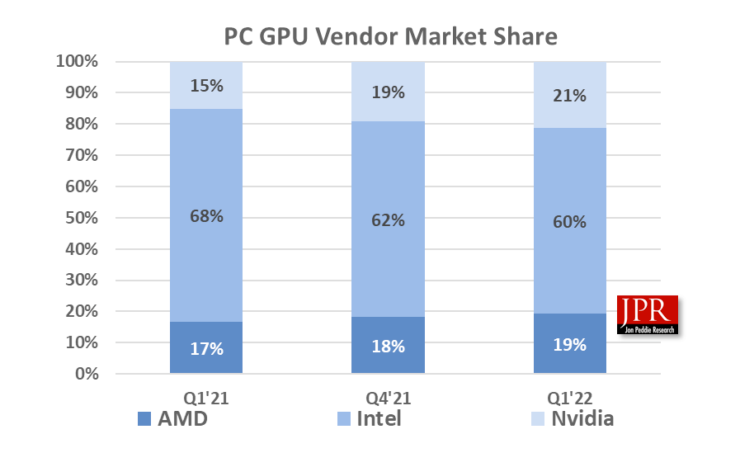

In the PC gaming space (most commonly where GPUs have been seen as the most prevalent application historically) and more generally applied to the entire GPU space as a whole, AMD quite clearly plays second fiddle to Nvidia, a phenomenon that has been true from 2003 up until today:

Historical AMD vs. NVDA GPU Market Share (Punch Card Investor-Substack) Recent AMD vs. NVDA GPU Market Share (Share Punch Card Investor-Substack)

Although the company still has a commendable market share in this space, where they truly shine is in the console gaming space. Currently, AMD powers the Playstation 5 and Xbox Series S/X consoles, and thus should be able to yield proportional benefits to the growth of associated expenditures.

On the PC side of things, AMD’s CPU business stands to benefit from continual improvements in the underlying hardware, as well as a strong footing in the high-end consumer and enterprise niches of the market. Though a large opportunity, the company’s projections may be ambitious, given the growth that the PC market has seen over the last decade. As an example, pandemic-induced headwinds resulted in total PC shipments for FY’21 being approximately 341M units, representing a 15% and 27% YoY and Yo2Y growth rate, respectively. Market share nuances aside, a $50B TAM insinuates that shipments will continue growing rapidly, a phenomenon I don’t believe holds up under a stress test, given macroeconomic factors in play at the moment, at least in the short term, especially given the pull-forward of years’ worth of tech expenditures that many consumers underwent during the pandemic. Arguably in this segment, and more broadly with CPUs as a whole investors are betting that AMD’s hardware tech will keep improving relative to competitors and Intel will be unable to outcompete the company as they have been able to in the past. Given Intel’s horrific mismanagement seen over the last few years, I don’t have a problem placing a few chips (no pun intended) on this bet.

Data Center

AMD’s data center-related offerings stand to benefit from some of the largest technological trends our world has ever seen, particularly with megatrends including but not limited to Cloud, AI, HPC, Data Analytics, and Video Streaming. All of these end-markets are important, however, I will spend time in this section quantifying the first three for simplicity’s sake, being I feel they are the most pertinent. Starting off with the cloud, this is arguably one the most important pieces of technology out there, with applications and use-cases touching almost every company and industry. Gartner anticipates that expenditures in this area are expected to reach nearly $600B in end-user spending by 2023, almost a 50% increase from the $411B in 2021. Using the hyperscalers as a proxy for cloud spend, i.e. AWS, Azure, and GCP, these segments bolstered phenomenal growth, increasing 33.3%, 40%, and 36%, respectively (all showing slight decelerations in YoY growth rates) within a tough macro and FX backdrop in their most recent earnings releases seen in the last few weeks. The point I am trying to convey here is although that growth rates may decelerate in the cloud, this is still a behemoth of an industry to be involved with going forwards, and a positive for AMD overall. We saw evidence of strong previous current and forecasted demand, but I will harp on that more later.

Moving over to AI, there is no doubt that these computing developments have the ability to reshape almost every industry known to man. Fortune Business anticipates that the market value of Global AI will reach nearly $270B by 2027 and PwC Global estimates that the contribution of AI to the global economy will reach approximately $16T by 2030. Although the accuracy of these projections is up for debate, it is clear that these developments are not lacking ambition or estimated scope. AMD’s technical competencies in this area are still up for debate, and I would argue largely in their infantile state. In comparison to NVDA, the company falls largely behind in its technology aimed at deploying and training AI models, the company has only recently incorporated Xilinx offerings that will likely need years of work in order to be competitive, and AMD’s own software and associated SDK geared at AI, in general, is again in its early stages. We will dig into these offerings more later, however, there is still some work that needs to be done on AMD’s part in order to capture this large opportunity.

Lastly, with HPC, this technology stands to empower engineers, data scientists, etc. to solve the largest and most complex problems in the shortest amount of time, all maximizing resources at a greater rate than traditional computing. As I’m sure most of you are aware, this is where AMD has some bragging rights. The company currently powers the world’s most powerful supercomputers, with EPYC CPUs and AMD Instinct Accelerators currently achieving number one spots on Top400, Green500, and HPL-AI performance lists. As an example, AMD tech is used within the ORNL Frontier system, the world’s fastest supercomputer, which broke the exascale barrier. Quite evidently, the company should be able to maintain a commendable presence and capture a host of value in this space going forwards. These are just three sub-niches of the data center and business segment and I think their associated descriptions sufficiently convey the magnitude of the opportunity as a whole.

Embedded, Automotive, Communications

Embedded systems play a role in almost every industry and sector today, ranging from ensuring the general functionality of home appliances to powering interactive kiosks and medical devices. With a $30B+ future opportunity, AMD Ryzen embedded processors stand to be intertwined with modern industries ranging from Aerospace to Networking. Moving along, both Automotive and Communications are evidently set to benefit from $30B+ megatrends of their own. Starting off with the latter, entertainment and connectivity are becoming important parts of in-vehicle experiences. Not only that, but hosts of engineers and some of the biggest tech companies in the world are devoting considerable efforts to semi or fully autonomous vehicles, one of the most difficult engineering problems known to man today. In short, as vehicles become more and more incorporated with high-end technological capabilities, AMD’s embedded hardware is likely to come into play here, similar to how Tesla’s (TSLA) Model S and Model X feature Ryzen Embedded APU and RDNA-2 GPUs, respectively. Lastly, with communications, with the advent and spread of 5G, as well as an expanding array of mobile edge computing use-cases, AMD EPYC systems are becoming increasingly pertinent in the communications sector.

I’ve barely scratched the surface here, but as you can see AMD stands at the forefront of some of the biggest happenings in the world. Now that we have a broad understanding of the sheer abundance of opportunities AMD has in front of it, let’s take a look at the technology that makes this all possible.

Technology

AMD’s products and services are expansive, to say the least. Entire deep dives could be devoted to each niche, however, for the sake of simplicity, I will devote time to briefly outline each, allowing you to research further on your own thereafter if you feel compelled to do so.

Processors

AMD offers customers and enterprises access to processors for servers, workstations, embedded and semi-custom, laptops, desktops, and Chromebook applications. Starting with servers, EPYC processors are the world’s highest performing x86 server processors, which can be incorporated with Cloud Computing, Database and Analytics, HCI and Virtualization, and High-Performance Computing applications. For workstations, AMD’s most up-to-date offerings are the thread ripper pro processors, which contain best-in-class core counts for multi-threaded workloads, and the threadripper series for creators, which allow for artists, engineers, architects, etc. to create expansive visual experiences much more efficiently than the nearest Intel Xeon W-3275 competitor, and Ryzen PRO Mobile Processors which power the likes of the Lenovo Thinkpad P14s, as examples, in order to offer access designers mobile-friendly solutions to their workloads. AMD directs embedded and semi-custom processors at a series of industries and use-cases through their EPYC Embedded, Ryzen Embedded, R-Series Embedded, G-Series Embedded, and Semi-Custom CPUs which power devices within the Aerospace, Automotive, Digital Casino Gaming, Networking and Communications, Medical Imaging, POS kiosks, and Console Gaming spaces, as examples. Lastly, the company powers a series of personal computers with their hardware. For laptops, these include the Ryzen Mobile Processors, Athlon Mobile Processors, and AMD-powered laptops for students and teachers. The Threadripper PRO, Ryzen PRO, Athlon PRO, Ryzen Threadripper, Ryzen and Ryzen with Radeon, and Athlon with Radeon Graphics processors power desktops on the mid-end consumer range of things, all the way to hardware operating within demanding business environments. Finally, AMD has Ryzen and Athlon processors geared at powering Chromebooks for enterprise, personal and educational end use-cases.

Graphics

AMD offers a series of graphics cards and associated drivers and software for a variety of end cases. Most notably these include the likes of AMD Radeon Pro graphics, focused on powering both mobile and desktop workstations, supporting raytracing, intensive workloads, etc., embedded GPUs, with the likes of the Radeon E9170 Series powering high-end casino gaming machines, medical imaging devices, aerospace applications, mobile signage, HMI, etc. AMD offers customers semi-custom graphics hardware, which most notably has been applied with Xbox and PlayStation consoles leveraging multi-core CPU and graphics technology within a single chip, and Nintendo consoles using custom AMD graphics tech to power their experiences. Lastly, AMD gears Radeon Graphics cards at both desktops and laptops to allow gamers to immerse themselves in the latest experiences.

Accelerators

Starting off with AMD Instinct, these professional GPUs are geared at the acceleration of the capabilities of deep learning, artificial neural networks, HPC, and GGPUs, supporting scale from single server solutions all the way up to the world’s largest supercomputers, thus allowing for scientists and outfits of all sizes to tackle some of the most pertinent problems. Powered off of a recent acquisition, AMD Pensando Infrastructure Accelerators are the industry’s only fully programmable software-in-silicon DPUs, essentially allowing for individuals and enterprises to execute a software stack that delivers cloud, compute, network, storage, and security services, all at a large scale. From the Xilinx acquisition, the company offers Alveo accelerator cards, of which provide optimized acceleration workloads for end-users working on financial computing, machine learning, computational storage, video streaming, etc. AMD offers the world’s only computational storage drive (CSD), which provides computing services and supports persistent data storage such as NAND flash or other non-volatile memory, which can help runtimes, libraries, APIs, and drivers be built into the data application systems, accelerating their capabilities by up to 10X. AMD’s SmartNIC Network Accelerators are geared towards cloud providers looking to boost performance and adaptability. These products help associated users navigate a vast array of complex applications and adapt acceleration and resources across multiple workloads. These network accelerators help to deliver scalable and low latency hardware acceleration while still giving users the ability to rapidly reconfigure workloads. Lastly, Telco Accelerator Cards are geared at 5G-specific applications. More specifically, these accelerator cards help to convert standard servers into virtual baseband units, abiding by the performance requirements of the O-RAN 5G deployments, allowing for the radio network to become more agile and scalable all while reducing the total costs of the overall deployment.

Software

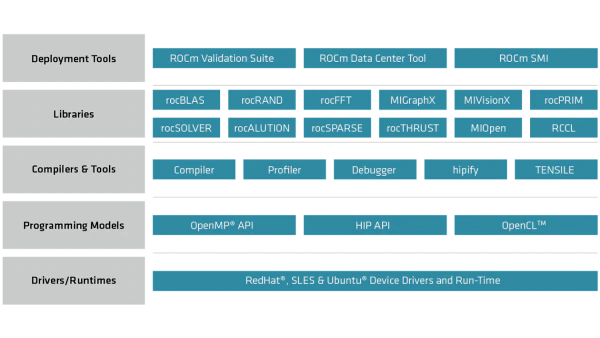

AMD’s software, particularly in the data center segment, will be crucial for the future trajectory of the company and should be something all investors focus on for the foreseeable future. Starting off with AMD ROCm, this is an open software platform that allows researchers to tap into the aforementioned AMD Instinct accelerators in order to drive their scientific discoveries. With this platform, individuals get access to open compute languages, a series of compile libraries, and tools that are designed to increase the rate at which code can be developed. A full overview of the capabilities contained within can be seen outlined below:

ROCm Capabilities (AMD)

AMD Infinity Hub contains a collection of advanced GPU software containers and deployment guides for HPC and AI/ML applications, which enable individuals to speed up deployment times and efficiencies. Although there was already software in the form of AMD’s GPUOpen, which allowed for individuals to develop around the functionality of Radeon GPUs, these offerings were primarily geared at gaming, whereas the Infinity Hub is HPC and AI-specific, making it easier for workloads to be deployed on both GPUs and accelerators. AMD PRO edition is the company’s all-encompassing name for its driver software, within, individuals can leverage drivers that help improve rendering speeds, video encoding, and overall performance across a series of intensive professional applications. Drivers assist with boosting raytracing, rendering, the ability to interact with 3D models, and system response time overall, all accessible through a user-friendly UI. AMD’s Radeon ProRender is essentially a rendering engine that allows for professionals to create realistic images and models. The software leverages a scalable ray tracing engine to harness both CPU and GPU performance in the most optimal manner possible, with stunning results.

Lastly, for those inclined, AMD offers the Ryzen Master and StoreMI software tools for individuals that would like to manage the overclocking capabilities of their hardware and improve load times, boot times, file management systems, and overall system responsiveness, respectively.

With this brief overview of all AMD offers in mind, let’s dig deeper into their most recent financials to gain a sense of how the business is performing overall.

Financials

Within this section, we will be delving into AMD’s financials, both on an annual basis, and for the company’s most recent Q2 FY’22 quarterly earnings release. All dollar values mentioned within are in millions of USD.

Income Statement

Revenue

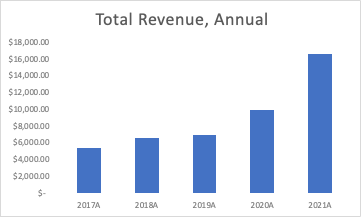

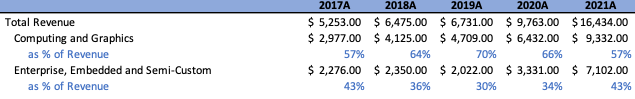

On an annual basis, AMD’s top line has grown astronomically over the course of the last few years. Coming in at approximately $16.4B for FY’21, representing a 68% increase YoY and 144% increase Yo2Y, this metric has grown at nearly a 33% CAGR from 2017 to 2021, driven by strong acceleration across all business segments, with particularly noticeable growth in data center revenue, which more than doubled YoY.

Change in Total Revenue, Annual (Author)

Delving deeper, we can take a look top-line split by segment, i.e. Computing and Graphics, and Enterprise, Embedded, and Semi-Custom, respectively. The distribution between these two revenue segments has fluctuated over the last few years, with the former representing 57% of the top-line, and the latter around 43%:

Author

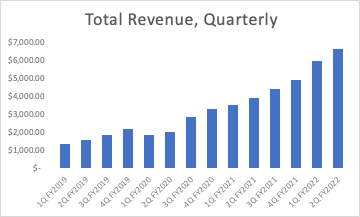

In my humble opinion, these segments do not provide proper insight into all of AMD’s inner workings, a phenomenon that I’m glad was addressed in the company’s recent reporting shift seen in Q2’22, something I will touch upon in a second. Q2’22 revenue was a record quarter for AMD on both top-line and profitability metrics, with the former coming in at approximately $5.9B, representing a 70% increase on a YoY and Yo2Y basis, respectively.

Change in Total Revenue, Quarterly (Author)

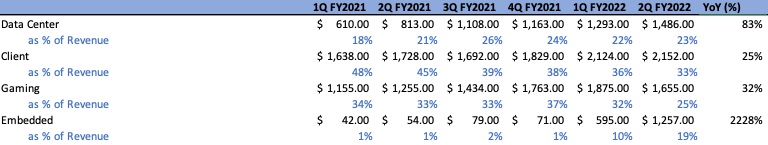

The company also started to segment its Revenue differently, a decision that was made in order to provide more transparency on segment performance and to better align reporting with long-term strategic initiatives. As such, investors gained insight into how Data Center, Client, Gaming, Embedded, and Other business segments have been performing from Q1’21 onwards, as outlined below:

Author

Starting off with Data Center, this business segment has been growing astronomically fast, coming in at $1.486B, representing 23% of Total Revenue and an 83% YoY increase. This increase was driven by strong EPYC processor demand, with cloud and enterprise customers remaining engaged despite the macro environment. The company deployed nearly 60 new instances across the top-cloud customer environments ranging from AWS to Azure and Google. This segment is likely to continue to be the shining star heading into the future. With the company expanding its data center solutions by way of the Pensando acquisition, i.e. adding a software stack and DPUs as complimentary offerings, the launch of Genoa, the company’s general-purpose server CPU, as well as the overall resiliency of the space as a whole, there is a lot to be excited about. Client Revenue came in at $2.152B, representing 33% of Total Revenue and a 25% YoY increase respectively. This segment is the one I believe is particularly susceptible to the macro environment. Although the company’s progress in this area has been commendable, a result of the Ryzen Pro Processors being well-received, as well as the fact that the 5nm Ryzen Pro desktop processors launch will likely garner some attention, weakening consumer demand amidst a recessionary environment rarely leaves any consumer-dependent business unscathed and I believe this will be no different. Looking over to Gaming, this is likely to be a similar story, we have seen the likes of Nvidia report a humongous deterioration of demand (partly due to crypto market dynamics) in this segment, and the emergence of the pandemic resulted in rampant over-earning. Regardless, Q2 saw this segment come in at $1.655B, a 32% YoY growth rate and 25% of the overall top-line. Lastly, Embedded came in at $1.26B, a large increase YoY and 19% of the overall top-line. These numbers were primarily driven by strong demand across multiple end-markets for both FPGA and adaptive computing products, particularly in core markets such as aerospace and defense, industrial vision, strong growth in the communications segment led by increased Tier 1 system vendor demand, and an increase in ORAN deployments, as well as an increase in automotive sales on the embedded CPU side of things. Looking forwards, AMD was quite adamant in their earnings call that they intend to drive figure growth through the capitalization of what they believe to be the largest opportunity in the world right now, AI. It is still up for debate how much the company will be able to achieve in this space, particularly since Nvidia is so well positioned, but if they are able to continually improve their hardware and software offerings therein, this picture may very well change going forwards.

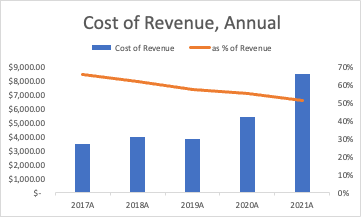

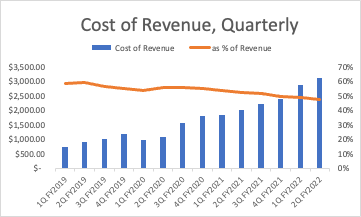

Cost of Revenue and Gross Profit

AMD’s Cost of Revenue (COR) came in at approximately $8.51B for FY’21, representing a 57% and 120% increase on a YoY and Yo2Y basis, and a 25% CAGR from FY’17 to this point, respectively. Over the last few years, the company has demonstrated quite clear cost controls, with COR as a % of Total Revenue decreasing commendably from 66% in FY’17 to 52% in FY’21.

Change in Cost of Revenue, Annual (Author)

On a quarterly basis, similar behavior is observable, with COR coming in at $3.115B for Q2, representing 48% of the top-line:

Change in Cost of Revenue, Quarterly (Author)

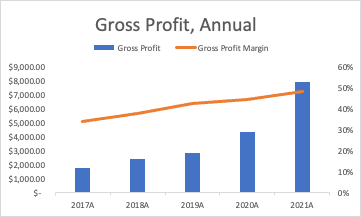

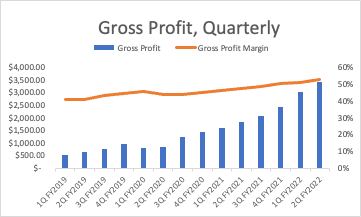

As a result of these COR controls, Gross Profit and associated margins have increased noticeably over the last few years and quarters, expanding to 48% in FY’21 in comparison to 34% in FY’17, and hitting 52% in Q2’22, a new record.

Change in Gross Profit, Annual (Author) Change in Gross Profit, Quarterly (Author)

Occurring in conjunction with cost controls is the fact that the data center and embedded business segments have become a larger part of AMD’s business, at more than 40% of Total Revenues for Q2. Within the conference call, the company mentioned that they aim to have this at 50% in the coming quarters/years, a phenomenon that will be positive given the high-margin nature of these segments.

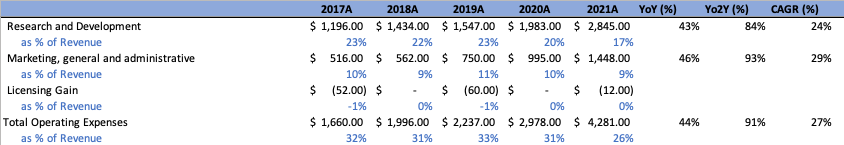

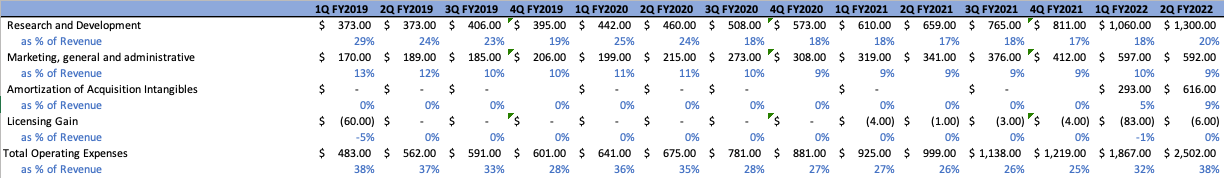

Operating Expenses

AMD’s Operating Total Operating Expenses came in at $4.28B for FY’21, representing a 44% and 91% increase YoY and Yo2Y respectively, again increasing at a lower rate in comparison to the top-line. Marketing and G&A have stayed consistent relative to Revenue and R&D has decreased slightly relatively speaking over the last few years. On a quarterly basis, the total OPEX of $2.5B represented a slight uptick on a relative basis, marking the company’s heightened investments in its product roadmap.

Author Author

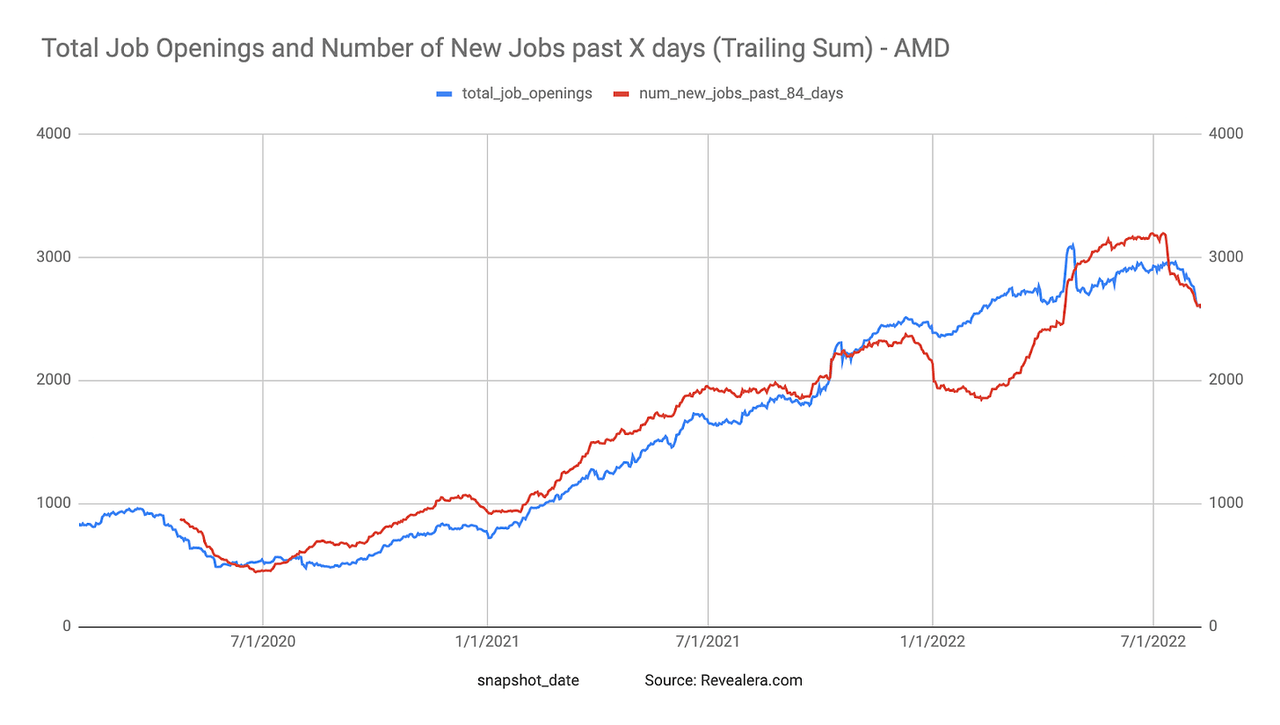

Going forwards, I would like to see the company continue to focus on R&D, efficiently allocating capital, ideally in the ~20% range of top-line, towards engineering talent and other resources in order to further cement themselves within their growing technological end-markets. Looking ahead, the company expects OPEX to stabilize at around 26% of revenue in Q3, a relative sequential decrease. This should result in a slight bottom line profitability bump, which took a hit this quarter as a result of AMD having to amortize intangible assets obtained within their most recent acquisition. Looking at hiring trends, total openings have decreased slightly lately but are still up relative to the beginning of the year, a net positive given how the rest of tech has been eviscerating current and prospective employees. The company was adamant about continuing to invest heavily in their business and showcased their new 5000 software engineer milestone (a positive given the amount of work that needs to be done on AMD’s software front), however, it doesn’t appear that noticeable OPEX increases as a result of heightened degrees of hiring will be observable in the coming quarter or two.

AMD Total Job Openings (Revealera)

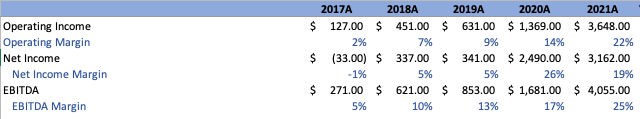

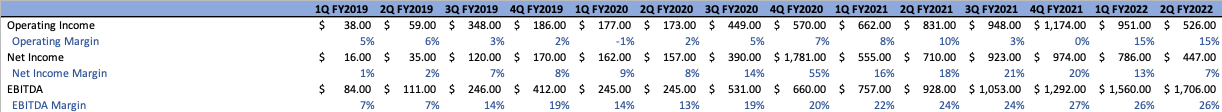

Margins and Profitability

Despite growing rapidly, under the helm of Dr. Lisa Su, AMD has really turned itself into a different animal, maintaining a high degree of profitability on an Operating, Net Income, and EBITDA Margin basis, as outlined for both FY’21 and Q2’22 below:

Author Author

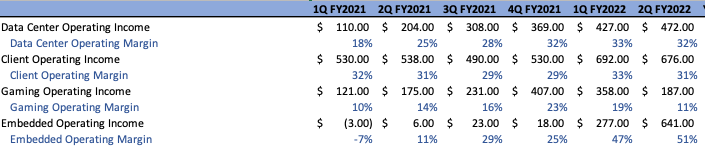

Delving deeper, this quarter also saw investors get a look into the operating margins of the company’s business segments:

Author

Looking at said segments, it is clear that having a long-term operational goal to have Data Center and Embedded Operating Incomes as more than 50% of the company’s top line will be a huge positive for the company’s profitability metrics, given their high margin nature. In addition, in the face of weakening consumer demand, the anticipated slowdown in gaming revenues is likely to have a small impact on the company’s profitability going forwards, given the low margin and thus low impact on the bottom line that this business segment has overall.

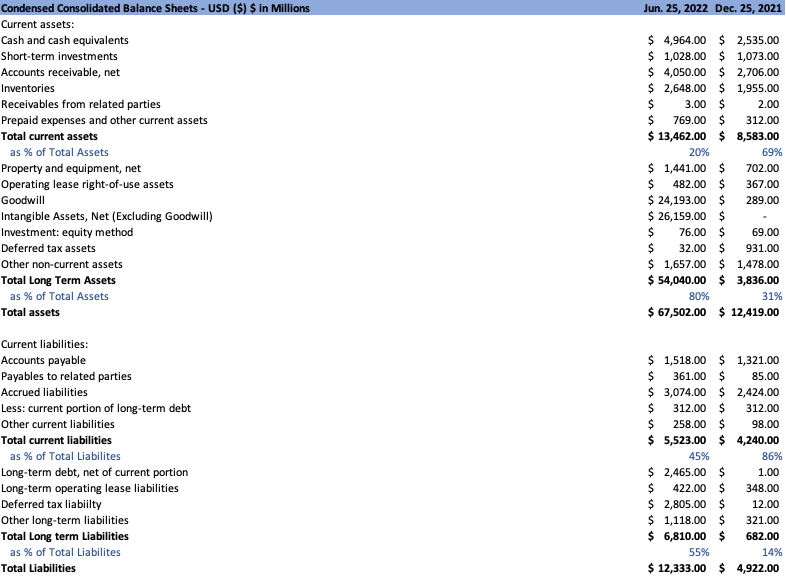

Balance Sheet

The structure of AMD’s balance sheet in Q2’22, in comparison to what was seen in Q4’21, can be seen outlined below:

Author

The majority of AMD’s assets are non-current. Current Assets are approximately $13.46B, coming in at 20% of total assets and mainly comprised of cash and equivalents, accounts receivable, inventories, short-term investments, and prepaid expenses in order of descending magnitude. Long Term assets are approximately 80% of Total Assets, coming in at $54B and comprised primarily of Intangible Assets and Goodwill. AMD’s assets are relatively liquid, comprised of 45% or $5.5B in current liabilities, mainly consisting of accrued liabilities and accounts payable. Long Term Assets are 55% of Total liabilities or &6.8B and are mainly composed of Deferred tax liabilities, other long-term assets, and long-term debt. The most notable change on the company’s balance sheet, to many, was the growth in the company’s debt, which went from essentially negligible amounts to a debt principal of $2.8B. This change occurred as a result of the Xilinx acquisition, which contributed around $1.5B, and the issuance of $1B worth of senior notes, issued on June 9th by AMD.

Of additional note is the degree to which the company has been executing buybacks. In May, the company approved the purchase of $4B in addition to the $8B already authorized. For Q2’22, the company purchased approximately $900M worth of stock, with $7.4B remaining in the plan, something that can be capitalized upon if markets tend to remain dislocated as a result of the poor macro environment going forwards.

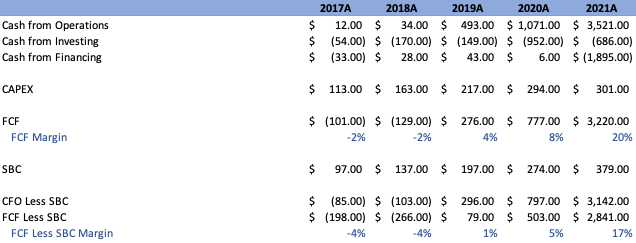

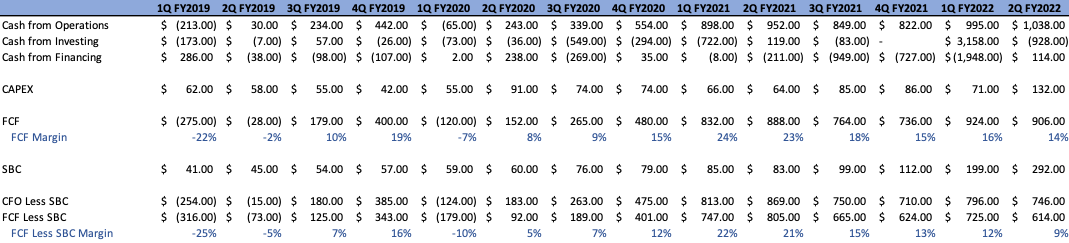

Cash Flow Statement

The structure of AMD’s cash flow statement, both on an annual basis and for the most recent quarter, Q2’22, can be seen outlined below:

Author Author

Honing in on Q2’22, CFO came in at approximately $2.033B, a 9% increase YoY from the $1.85B seen in Q2’21. CFI came in at an outflow of approximately $(928)B, attributable primarily to proceeds from short-term investments and cash received from the acquisition of Xilinx, offset by the purchase of PPE and investments, and the acquisition of Pensando. CFF came in as an inflow of approximately $114M, attributable to an inflow from the proceeds from debt issuance and offset by outflows attributable to stock repurchases. With FCF Margins of approximately 14%, coupled with the fact that the company is still safely FCF positive ex the contribution of SBC, I would say the company is in a good spot heading into the future.

With this look under the hood now complete, let’s delve into a discussion on what may be over the horizon for AMD’s future.

Discussion

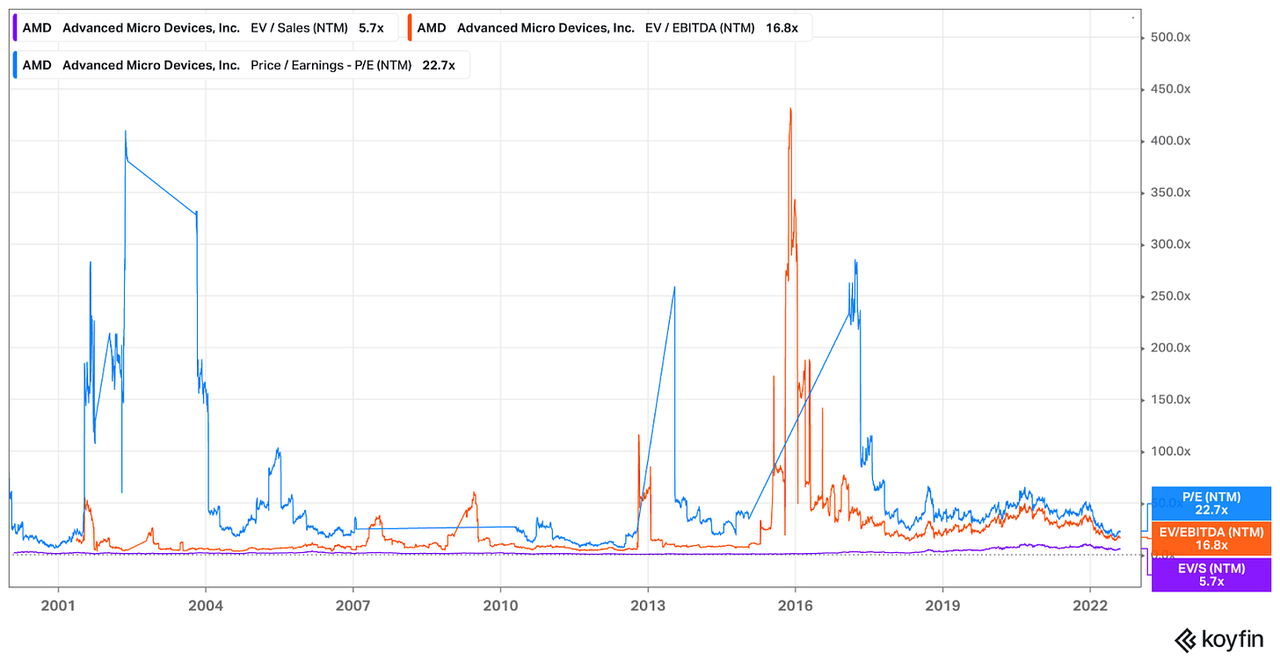

Before we discuss more broadly the prospects of the semiconductor space as a whole, it is worth briefly discussing AMD’s valuation and its long-term financial targets. Starting off with some high-level multiples, the company is on the low-end of these metrics when viewed historically, even with the recent resurgence we’ve seen in tech over the last few weeks. Despite this not being the declining interest rate environment seen over the course of the last few decades, the company is arguably in the best place they’ve ever been, taking share from competitors at the forefront of some very strong secular trends.

Forward Valuation Multiples (Koyfin)

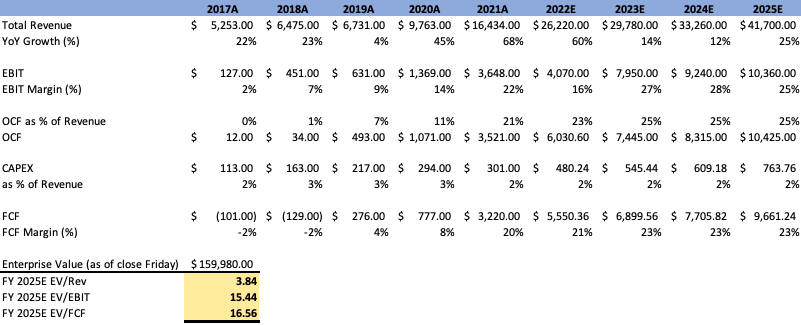

Completing some oversimplified napkin math, we can also zoom further out to get a relative sense of how expensive the company may be if they execute their forward-looking plan very well. Using consensus top-line values, the assumption that FY’25E revenues will be achieved at a 20% CAGR from the pro forma revenue values of AMD combined with Xilinx, consensus EBIT values with the assumption that they normalize around 25% in 2025, OCF and Capex remain at 2% and 25% of revenues, respectively and FCF margins normalize at 23%, we get the following FY’25E multiples:

Author

Again stressing that this is an imperfect exercise, I believe this illustrates that if things go right for the company, they are priced quite reasonably. Similar to Nvidia, the company benefits from the fact that they operate in some of the most promising industries on the planet, while also outsourcing the manufacturing of their products, a phenomenon that allows for their CAPEX to remain low, while still providing the upside of the space as a whole.

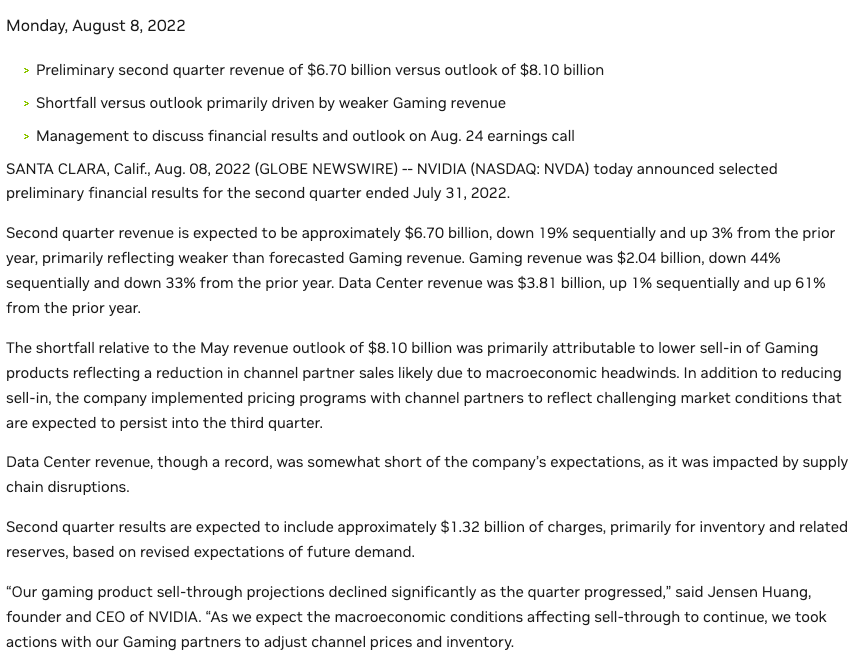

Sticking with the topic of guidance for a second, I believe that this quarter was quite illustrative of the fact that all semiconductor companies are not built the same. Although the company did guide below consensus Q3 revenue estimates, projecting $6.7B, plus or minus $200M, in comparison to the $6.84B that was expected, they did reaffirm FY’22 guidance, at $26.3B, plus or minus $300M, which came in slightly above the consensus estimate I used for 2022E above. This exists in stark contrast to some other semiconductor companies that reported over the last few weeks, of which both performed poorly for this quarter, and slashed estimates based on poor macro outlook going forwards. Nvidia was a prime example of this, with gaming revenue crushing their preliminary second-quarter revenue, and to the surprise of many, their data center revenue was weaker than expected:

Nvidia preliminary earnings highlights (Nvidia Investor Relations)

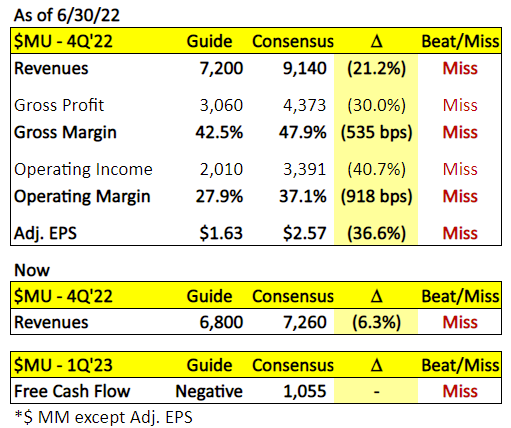

Additionally, we also saw the likes of Micron (MU) cut estimates for future quarters and miss earnings estimates for the most recent quarter, a result of customer inventories building up and waning demand for both chips used in PCs and smartphones:

MU Earnings (@consensusgurus, Twitter)

So in the midst of all this carnage, is AMD’s future outlook too optimistic heading into the remainder of the year? In my humble opinion, no. As gauged by the comments provided in the company’s most recent earnings call, the company has made the following assumptions regarding guidance:

-

AMD will continue to see strong demand in the data center, embedded, and console business segment (this may falter but Q3 is typically strong historically)

-

Strong cloud demand in North America. The forecast heading into next year is strong given the upcoming Genoa launch

-

AMD is being very conservative with its PC outlook, anticipating a mid-teens decline in demand that should put the overall market at around 290-300M units

-

The company has had an increase in server-side supply that should help them meet additional demand, picking up some of the slack in other business areas.

I believe all of these assumptions are reasonable, particularly with the overly conservative PC estimates, a segment that is likely to be at the forefront of continued demand destruction given the current environment. Therefore, I wouldn’t be surprised to see, at the very least, that AMD meets guidance targets with ease.

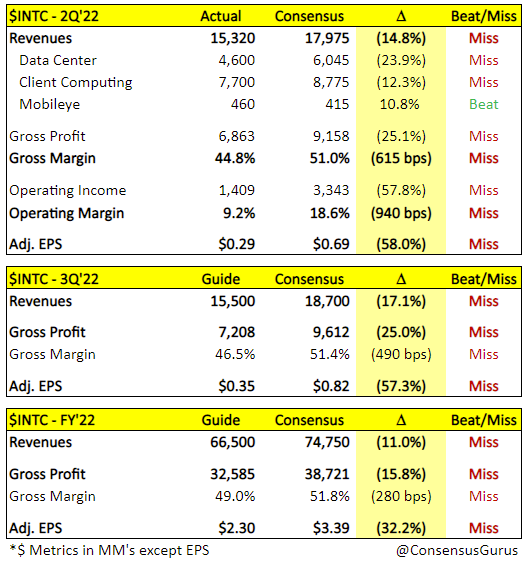

Lastly, it is worth touching upon the fact that AMD is continuing to eat Intel’s lunch, metaphorically speaking, a phenomenon that may continue to occur if Intel botches execution for the years to come. Let’s take the most recent quarter as an example, AMD reported strong results, but Intel did not. The company missed revenue estimates by a total of $2.6B and estimated that ongoing weakness will continue, causing FY’22 revenue estimates to be slashed by 11%, north of $7B.

Intel Earnings (@consensusgurus, Twitter)

This is all occurring in conjunction with a series of very CAPEX-intensive projects ($20B+ in costs to be exact) Intel has underway, i.e. the series of foundry build-outs they have on the go. Despite having the positive benefit of the CHIPS Act being passed, and receiving subsidies accordingly, these onshoring projects are likely to prove burdensome to Intel as a whole, and who knows what the payoff profile will be in years to come. In addition, AMD continues to gain share in the PC, Notebook/Mobile, Server, and Overall markets relative to Intel, as Mayhem pointed out in his latest Twitter thread:

Quite frankly, every one of Intel’s blunders is a positive for AMD, and with technological excellence continuing to be a focus in the years to come, I believe market share continues to go AMD’s way.

Conclusion

In a Nasdaq full of zombie companies, and many high-flyers wilting under the pressures of a weak macro environment, AMD presents itself as a shining light amidst the darkness. This company will be one I continue to monitor closely, and in my opinion, is likely to be a Harvard Business case study one day, one that highlights how managerial excellence can turn a highly distressed company around.

Disclaimer: The information and research contained herein is all my own opinion and should not be used as a substitute for proper due diligence. Please consult your financial advisor and evaluate your financial circumstances before making any investment.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment