simpson33

Investment thesis

The streaming industry is facing major changes in the upcoming years. Until now, (partly due to the pandemic) the growth was unstoppable and investors valued subscriber growth more than earnings power. This trend has started to change in recent months because of Netflix’s subscriber losses, Disney’s content expense growth, and due to the decline in consumer confidence figures across the economy. This has shifted the focus on earnings power on streaming companies instead of subscriber growth.

This is the new trend in the streaming segment and we will see this trend unfolding even more in the upcoming years. Who is better positioned for the new trend and which company should investors buy in? Is The Walt Disney Company (NYSE:DIS) going to win big? Can Netflix, Inc. (NASDAQ:NFLX) maintain its leading position in the streaming segment?

Streaming trends

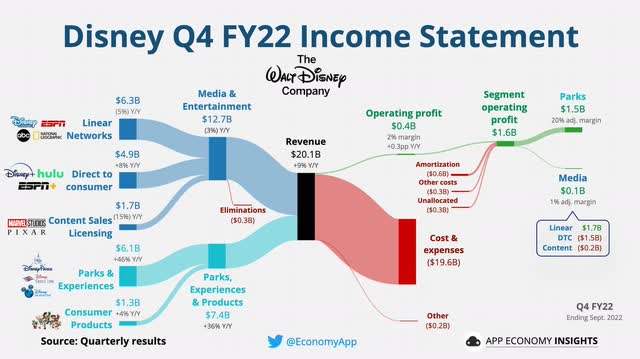

85% of U.S. households have streaming services subscriptions. In addition, each household has an average of 3 paid streaming services. Before 2022 the streaming industry was mainly focusing on subscriber growth and did not pay much attention to content expenses and overall profitability. The market and investors behaved the same way, one of the most important facts in every quarter was the subscription base growth and the number of new subscribers. This trend has started to change in the second half of 2022 and this new trend will stay with us for a long time. Just look at what happened to Disney after the company reported its Q4 subscriber growth numbers with rising expenses. The stock got hammered and later on the CEO was replaced. Since the second half of 2022, streaming platforms focus on growing the revenue and maximizing it from each subscriber rather than the excessive growth of subscriber figures. Most of the big players want to see the return on their streaming investments like Disney and those who are already profitable like Netflix want to produce as much cash as possible.

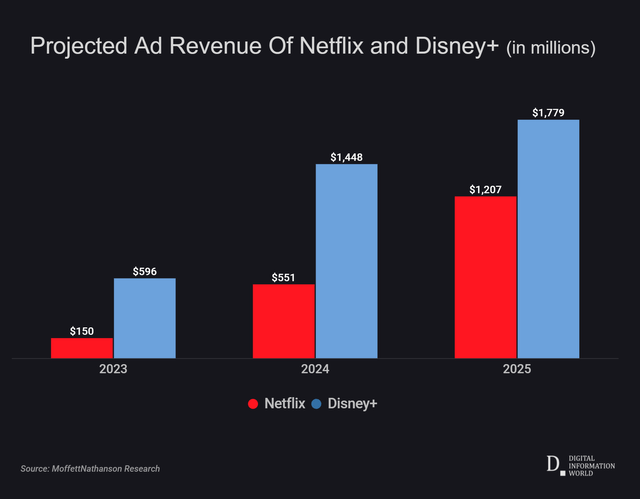

Both of them are focusing heavily on monetization and the ad-supported tiers. Originally, Netflix’s CEO said they will never show ads, then after disappointing quarterly results, this position was reconsidered, and then from the original plan to roll out an ad-supported tier in the first quarter of 2023 the new date was rushed to November 3, 2022. Disney’s ad-supported comes in December with a huge price increase in their current plans. This is due to the overall growth slowdown of the new subscribers and to increase the revenue.

Almost all of the streaming platforms spend a lot of resources on reboots, sequels, and big franchises from the 80s, 90s, and 2000s because people who grew up in the 1980s, 1990s, and early 2000s are spending the most time and money on streaming right now. This trend is likely to continue in the next 5-10 years until Generation Alpha (and late Generation Z kids) grows up, starts earning money, and starts to generate revenue for streaming platforms.

Live sports and events are also getting more and more popular and during the next 5 years, this market will experience significant growth. The global online live video sports streaming market is projected to grow at a CAGR value of 21.5% from 2022 to 2027. There are two major factors behind this extremely fast projected growth. One reason is the interest to watch live sports events are growing among people (as a consequence of the pandemic). The other reason is that the digital infrastructure is already in place, high-speed broadband is widely available and there is an upsurge in multi-platform and device-connected services.

The biggest risk factor is almost identical to all streaming services: consumer spending slowdown. If there is a major recession, streaming is among the first services that will be canceled by customers. They are not necessities and due to the easily accessible (and almost 3-click) canceling and then subscribing again later is much easier compared to cable. So in case of a deep recession customers might cancel for a couple of months and resubscribe later when things improve. However, this means not only subscription loss but revenue loss as well for the streaming service providers.

Highlights of Disney and Netflix

Disney has 235 million total streaming subscribers while Netflix has 223 million total subscribers. Streaming services account for 45% of ad views, overtaking TV everywhere. By 2027 the ad-supported video-on-demand (AVOD) revenue will likely surpass $69 billion. This is almost double the current 2022 spending of approximately $37 billion. To capitalize on this trend both of the streaming giants are moving in this direction.

Disney

Disney has started to focus on ads on its platforms and in August the company announced the ad-supported tier of Disney+. Investors were not given a lot of information about the specific details of it, only the launch date, 8th December. The same day when Disney will increase the prices for its streaming services by 38%. In terms of subscriber growth, if we take out the external macroeconomic factors, Disney is in a better position than Netflix purely based on the attractiveness of the content it produces. Due to its widely known brands such as Star Wars, Marvel, Toy Story, etc., they are in an excellent position to make content for every generation.

In the third quarter, the expenses rose for the Direct-to-Consumer segment due to higher marketing and content creation costs. From the next quarter, the management expects these losses to decline and by 2024 the streaming services should break even and then start to make consistent profits for Disney. This was the motivation behind the leadership change as well. So the next stage in the Direct-to-Consumer is to increase its earnings (with ads and subscription fee increases), rationalize expenses such as marketing and content creation costs, and deliver blockbuster shows that increase customer engagement on the platform. The biggest challenge Disney faces is that its content is under-earning and under-monetized. Bob Chapek (former CEO) emphasized in the earnings call that Disney is in a great position to “win the streaming war”:

“Building a streaming powerhouse has required significant investment. And now with its scale, incredible content pipeline, and global reach, Disney+ is well situated to leverage our position for long-term profitability and success.”

ESPN+ is a strong player in the live sports streaming space. They were able to extend the agreement until 2025 with one of the fastest-growing live sports events worldwide: Formula 1. In addition, Disney is thinking about somehow integrating sports betting on some of the live events into its platforms. I believe this is not going to come within the next few months and the management did not provide any updates since the third quarter but in the background, they are working on it:

…add some utility to sports betting and take away some friction for that for our guests. We have found that our sports fans that are under 30 absolutely require this type of utility in the overall portfolio of what ESPN offers. So we think it’s important. We’re working hard on it, and we hope to have something to announce in the future…

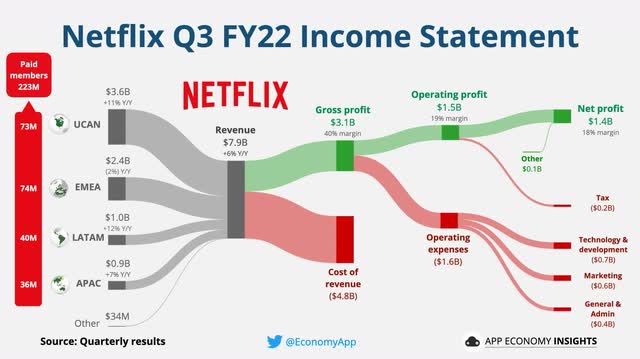

Netflix

Netflix is about to test out several new live broadcast shows in the upcoming months. The reason behind that is the further growth of the broadcast and streaming market share. One of the first live broadcasts is going to be the Chris Rock comedy special in early 2023. The management said they will focus on this segment in the future to capitalize on live broadcasts. I believe this is the consequence of Netflix dropping out of the bidding process for numerous live sports rights. Netflix might be able to win some live sports streaming rights but they are far behind Disney. Disney already has a very competitive advantage in the live sport streaming segment that Netflix either needs many years to be able to effectively compete with or drop the management’s intention to put major live sports events on Netflix.

Netflix is trying to take advantage of the merchandise sales of its most popular shows such as Stranger Things. In this segment, it is realistic to expect some extra revenue in the upcoming quarters and potentially $75 -100 million per quarter on average after 2-3 years, $300 – 400 million in a fiscal year. Disney recognizes approximately 6.5% of its revenue from product sales and merchandise. Calculating $300 – 400 million in additional merchandise sales revenue per year Netflix could increase its total revenue by approximately 3.5-4%. The reason why I calculated with only a fraction of Disney’s numbers is because of the brands Netflix owns and the fan base it has. Disney’s all-time favorite Star Wars will still be leading merchandise sales in the next few years despite Stranger Things’ or The Witcher’s success.

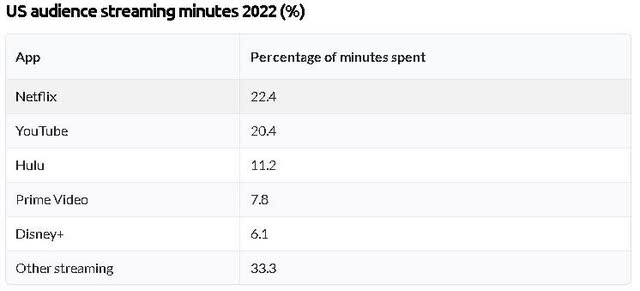

Netflix is in a good position to recognize substantial revenue growth from its ad-supported tier due to the platform having the longest watch hours among its competitors. Netflix remains the most popular streaming service in the US for total minutes watched so the platform will be able to generate great ad revenue if enough of its subscribers will use the ad-supported tier.

Disney is likely to win the ad spending competition in the next 2 years because it already has all the advertisers and infrastructure in place and the ad-supported tier has already been tested on HULU before applying it on Disney+.

I like how Netflix’s management reacted quickly to subscriber losses and revenue decline earlier this year. They are committed to tackling password sharing, starting in early 2023. However, I have some serious doubts that it will work and the subscriber base will grow due to this management action. I am pleased with the ad-supported tier introduction because the first time the management talked about it, the goal was to implement it in the first half of 2023, then about two months later the deadline was moved to the end of the first quarter of 2023. Then after another disappointing quarterly result, the management proactively decided to start the ad-supported tier before its rival Disney introduces it so the date was moved to early November 2022. On the other hand, if we look back to January 2020, to the company’s full-year 2019 earnings call, the CEO was very clear and determined that they will never show ads on the platform and they have no intention to change this in the future.

“We want to be the safe respite where you can explore, you can get stimulated, have fun and enjoy – and have none of the controversies around exploiting users with advertising” Reed Hastings – CEO.

Obviously, in the past 2 years, a lot of things have changed but it looks really bad when the CEO has a crystal clear statement about a topic, then suddenly the whole company changes position due to external shareholder pressure and in addition, giving up its values (if no ads policy was truly the company’s core value in the first place).

In my opinion, Netflix is in a good place to boost its revenue via ads and possibly attract new customers with its lower-priced ad-tier subscription. It can also minimize subscriber loss in case of a deeper recession where people decide not to pay $9.99/month or $15.49/month but the $6.99/month ad-supported package is acceptable for them. The wider spread of merchandise will add 3-4% revenue growth in the next years to its total revenue according to my calculations. The biggest risk Netflix faces is its already toped-up customer base, it cannot grow the subscriber base further in North America, and the platform’s satisfaction ratings are dropping among its subscribers. “HBO Max leads the industry in terms of customer satisfaction, with 94% of respondents saying they were “satisfied” or “very satisfied” with the service; Netflix, which ranked second overall in 2021, dropped to fourth place in 2022 (with 80%) behind Disney+ (88%) and Hulu (87%)”.

Valuation

If we are looking at the DCF model, Disney is fairly valued and Netflix is overvalued at its current price. However, this fair overvaluation is only true if we are taking into consideration the events and earnings power of 2023 but if we look further both stocks become undervalued. Let’s see why. Calculating with an EPS of 4.9 and a growth rate of 6% Disney is fairly valued at around $96-97 per share. However, in 2023 the streaming segment will not add any net income but by the end of 2024, the steaming segment (when it is going to be profitable) will grow the company’s net income and therefore its EPS. We do not know the exact numbers but what we know is that once the streaming segment becomes profitable it will continue to produce a significant net income for Disney. Analysts’ average price target for Disney is $121 which means a 20% upside from its current price.

Netflix is less undervalued than Disney if we are looking at the long-term growth, revenue, and net income estimates. Calculating with an EPS of 11.2 and a growth rate of 6% NFLX is overvalued and its fair price would be around $220-225 per share. If the EPS grows to $15-16 per share by the end of 2024 the fair value would be around $330. This indicates a 4% upside potential from its current stock price. Analysts’ average target price for Netflix is $293.

If investors look at the future earnings power of the two streaming giants Disney looks more attractive for long-term investors. Investors cannot forget that Disney has several different revenue sources, so the comparison is not exactly apple to apple because if we buy Disney, we are not only buying into its streaming segment but into the whole entertainment industry.

Investor takeaway

I believe Disney is in a better place to win the streaming war due to its ability to generate more cash when advertising starts on its platforms. The merchandise sales will likely stay ahead of Netflix for many years and Disney+ still has room to grow its subscriber base. I do not believe that there will be a deep recession in 2023 so I think both of the streaming giants will be able to generate subscriber growth. I also believe that the streaming war is becoming a revenue growth war and Disney has better capabilities to generate more revenue from its subscribers over the long term but I am curious about your thoughts. What do you think, who will win the streaming war?

Be the first to comment