buzbuzzer

Sometimes, the most counterintuitive opportunities tend to make for the most attractive in the long haul. One company that has well exceeded my expectations over the past year or so has been Saul Centers (NYSE:BFS). Had you told me all of the economic uncertainty and volatility that we were going to face over a year ago, I would not have imagined that a REIT with a special concentration on the ownership of shopping centers would have significantly outperformed the broader market. Better last, that is exactly what has transpired with this particular prospect. Moving forward, the picture for the company does look rather solid. And in light of its improved financial performance recently and reasonable share price, I do think that the company probably offers some upside from here. So while I still do believe that there are better opportunities on the market today, I don’t think it’s unreasonable for me to increase my rating on this particular company from the ‘hold’ I had it at previously to a ‘buy’ to reflect my new view that the stock will likely continue to outperform the broader market moving forward.

Shopping for returns

Back in October of 2021, I wrote an article that took a rather neutral stance on Saul Centers. In that article, I mentioned how the company had staged something of a turnaround over the prior months, with revenue and profit figures rising nicely. But at that time, the company was still in the early stages of this turnaround, posting only a single quarter’s worth of favorable data. I cautioned then that a single quarter does not make a trend. And when you factor in how shares were priced, I felt as though it wasn’t cheap enough to be a favorable risk-to-reward prospect. At the end of the day, that led me to rate the company a ‘hold’ to reflect my view that it should generate returns that would more or less match the broader market moving forward. Since then though, the company has drastically outperformed. While the S&P 500 is down 11.1%, shares of Saul Centers have generated a loss for investors of only 0.9%.

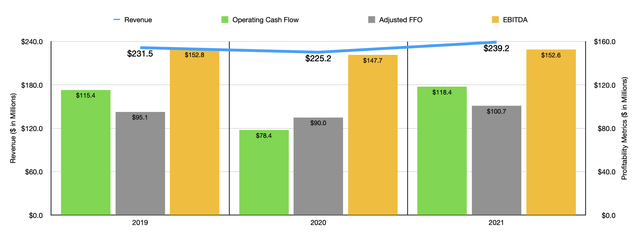

Author – SEC EDGAR Data

To understand exactly why this return disparity exists, I would recommend that we start with how the company ended its 2021 fiscal year. During that time, sales came in at $239.2 million. That’s a nice improvement over the $225.2 million the company generated only one year earlier. From 2020 to 2021, the company saw its occupancy rate for mixed-use properties drop from 88.4% to 82.3%. But these properties account for only a small portion of the company’s overall portfolio. At the same time, it benefited from the occupancy rate of its shopping centers growing from 93% to 93.4%. The company benefited in multiple ways during this time. For instance, revenue rose by 62.2% under its percentage rent operations thanks to increased sales reported by anchor and retail tenants at multiple shopping centers in its portfolio. But the biggest driver for the company involved an asset called The Waycroft, which was completed in April of 2020. That particular property added $9.8 million to the company’s top line. Although mixed-use property, The Waycroft was helpful in pushing the company’s residential portfolio occupancy rate from 85.5% at the end of 2020 to 97.1% by the end of 2021.

Profitability figures for the company also improved during this time. Operating cash flow, for instance, went from $78.4 million in 2020 to $118.4 million last year. Adjusted FFO, or funds from operations, rose from $90 million to $100.7 million, while EBITDA increased from $147.7 million to $152.6 million. At first glance, these profit figures may not seem all that impressive on a year-over-year basis. By considering the economic uncertainty we are dealing with and considering that this is a REIT, an asset notoriously known for slow but steady growth, these numbers should not be all that shocking.

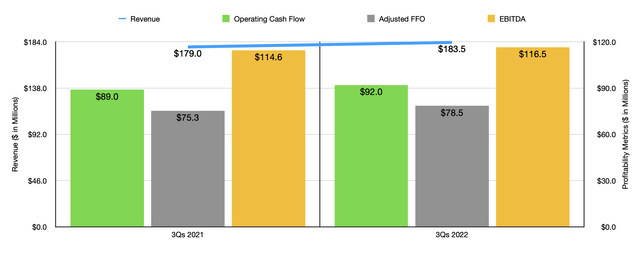

Author – SEC EDGAR Data

Growth for the company has continued into the 2022 fiscal year. For the first nine months of the year, revenue came in at $183.5 million. A rise in the shopping center occupancy rate for the company from 93.6% to 94.5% was very helpful for the enterprise, with some of this being offset by a decline in the residential portfolio from 97.8% to 97.2%. Fortunately for investors though, new and renewed leases brought in average monthly rent under the residential side of $3.49 per square foot. That was up from the $3.22 for expiring leases. Profitability for the company also improved during this time. Operating cash flow grew from $89 million last year to $92 million the same time this year. Adjusted FFO ticked up from $75.3 million to $78.5 million. And EBITDA rose from $114.6 million to $116.5 million.

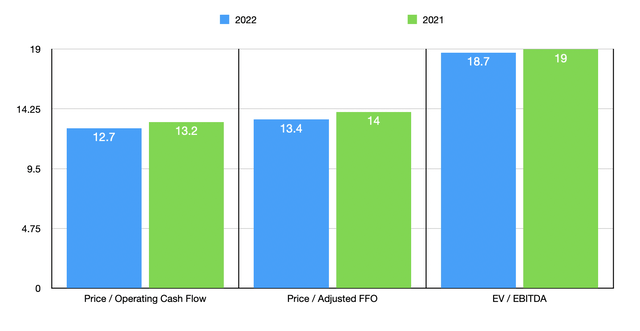

Author – SEC EDGAR Data

For 2022 as a whole, I simply annualized results experienced so far. This would give us operating cash flow of $122.4 million, adjusted FFO of $105 million, and EBITDA of $155.1 million. Based on these numbers, the company would be trading at a forward price to operating cash flow multiple of 12.7, a forward price to adjusted FFO multiple of 13.4, and a forward EV to EBITDA multiple of 18.7. As you can see in the chart above, this pricing is only slightly lower than what we would get if we utilized data from the 2021 fiscal year. Also as part of my analysis, I decided to compare the company to five similar businesses using the price to operating cash flow approach and the EV to EBITDA approach. On a price to operating cash flow basis, the range for the companies was from 8.3 to 18. In this case, two of the three were cheaper than our prospect. And when it comes to the EV to EBITDA approach, the range was from 11.9 to 26.7. In this scenario, three of the five companies were cheaper than our target.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Saul Centers | 12.7 | 18.7 |

| Acadia Realty Trust (AKR) | 10.5 | 26.7 |

| Getty Realty Corp. (GTY) | 16.2 | 14.3 |

| Alexander’s (ALX) | 8.3 | 11.9 |

| InvenTrust Properties Corp. (IVT) | 16.4 | 14.6 |

| NETSTREIT (NTST) | 18.0 | 24.3 |

Takeaway

By this point, I think it’s safe to say that Saul Centers has really staged a remarkable recovery from the pandemic. The company is steadily growing, with revenue and cash flow figures rising year over year. I wouldn’t exactly call the company a value prospect by any means. And in fact, it does look to be more or less fairly valued compared to similar firms. But for a steady cash generation machine that offers A chance of stability relative to what many other investment opportunities might, I do think it probably warrants a little bit of upside potential. And as a result, I’ve decided to revise my rating on the company from a solid ‘hold’ to a soft ‘buy’.

Be the first to comment