GaryPhoto

Discover Financial Services (NYSE:DFS) is a lending company that operates the popular Discover card network along with other assets. Discover is the United States’ third most popular credit card and fourth-largest payments network by purchase volume. The firm also operates a bank as part of its business and collects deposits from online savings accounts among other sources to fund its lending business.

The company had a tremendous 2021 as the American economy bounced back faster than expected. 2022 has been less kind, however, with shares down approximately 13% year-to-date. That decline, combined with fairly strong earnings, has made the stock look exceptionally cheap. But does that fact make DFS stock a buy today?

Discover Stock Is Cheap, But Consider This Context

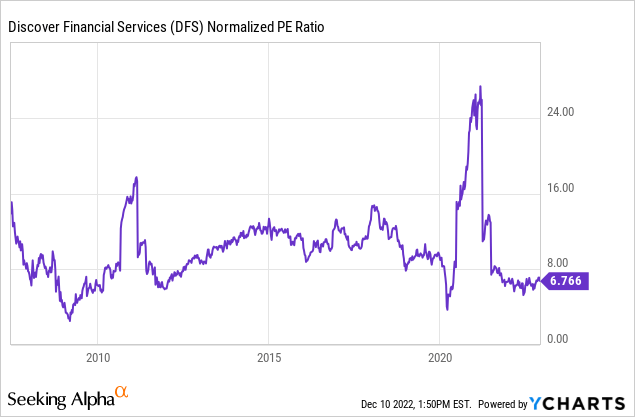

When taking a look at Discover stock, the first thing likely to jump off the page is the company’s startling P/E ratio. Shares are currently selling for less than both 7x trailing and 7x forward earnings.

This works out to 14% earnings yield. As long as the company maintains its current level of earnings and does something useful with the cash it generates, it should be able to generate mid-teens annualized total returns starting off such a favorable level of earnings.

You might think Discover’s low P/E ratio is something unusual and a result of the current economic disturbances. However, that would likely be a mistake. DFS stock has almost always traded below 15x earnings, and often at 10x or below:

Indeed, DFS stock was selling for just 9x earnings just prior to when the pandemic started. As a result, investors should be aware that the upside case here isn’t aiming for a 20x P/E multiple and the stock tripling in short-order.

At the end of the day, investors simply aren’t going to slap a high P/E multiple on a risky consumer lending business like this one. Even in good times, valuation tends to be fairly pessimistic since risk tends to be in the downside in this industry.

If things go well, the company earns a normal or slightly above average level of profits. If things go badly at the company in particular or the economy in general, the lender can rack up large losses quickly. This sort of negative skew tends to put a hard cap on a business’ valuation ratios.

I don’t want to take entirely away from the upside here. DFS stock should probably trade closer to 9-10x earnings in a more normal economy. Today, under 7x is still a significant discount and offers some potential for near-term capital gains. That said, look at this with a realistic lens; Discover is always going to be a lower P/E ratio sort of business.

What Discover Can Do With Its Earnings

In a low valuation stock like this one, investors rarely make money from major prolonged P/E multiple expansion. Rather, the returns come from management using the large profits wisely.

On that front, what has Discover done with its prodigious stream of cash flow generation in recent years?

The company pays a reasonable dividend; shares currently yield 2.3%. The company has, impressively, grown its annual dividend for 12 years in a row. And the five-year dividend growth rate is 12.1% annualized. That’s an admirable rate. Paired with a 2.3% starting dividend yield, and you start getting a sizable yield-on-cost fairly quickly.

Given that Discover is generating a 14% earnings yield at the moment, however, a 2.3% dividend yield doesn’t use up that much of the firm’s earnings. So where is the rest of the money going?

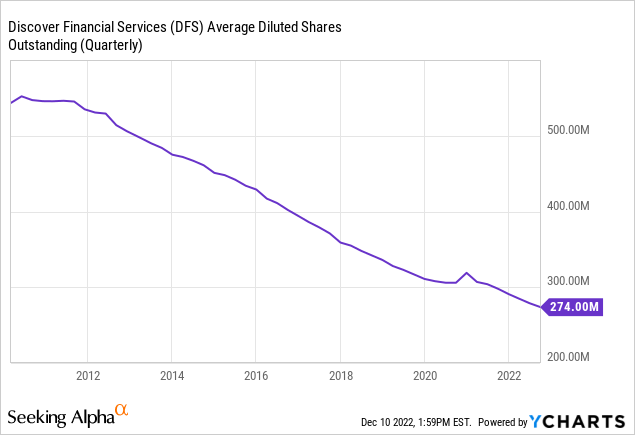

Share buybacks. And lots of them. Just look at this chart:

In 2010, Discover had approximately 550 million shares of stock outstanding. In just over a decade, it has slashed its outstanding stock by fully 50% to less than 275 million as of last quarter.

This is, simply put, one of the most impressive share buyback programs you’ll see at a large-cap American company. Apart from a couple quarters during the pandemic, Discover never wavered from the share buyback, keeping it running for the whole decade.

And it has been tremendously successful. Given the market’s continued skepticism of consumer lending businesses, Discover has been able to buy up mountains of its shares at 10x earnings or less. Things are even better now, with the share buyback now picking up stock for less than 7x earnings. This is how you supercharge returns.

In fact, this is the formula that the tobacco companies used to become some of the market’s top performers over the past 40 years. In their case, the constant threat of legal action caused investors to assign them unusually low P/E multiples. The companies paid out huge dividends and for investors that reinvested dividends at those rock bottom P/E multiples, they achieved gigantic total returns.

Discover appears to be following a similar course. The company has already retired half its outstanding stock at very low P/E multiples. Given the current economic uncertainty, Discover’s P/E ratio has fallen to an even lower level, making the share buyback even more powerful for the time being.

Intermediate-Term Outlook

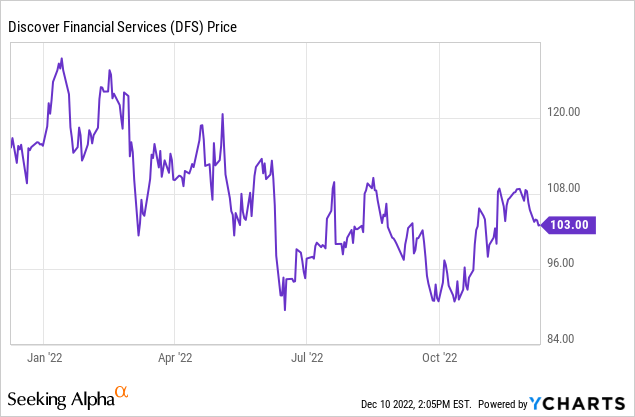

Discover stock hasn’t fared especially badly in 2022 given the overall bear market, but shares have been generally trending lower:

This isn’t too unexpected. After all, credit risk is certainly going up given the rash of worrying economic factors on the horizon.

On the other hand, the credit card companies arguably faced an opposite situation in 2020. In that period, there was so much government aid to the economy that consumers were flush with cash and thus had less reason to use their lines of credit.

Now that the economy has softened, credit demand has perked back up. To that point, as of September 2022, Discover held $83.6 billion of outstanding credit card loans, which was up a dramatic 19% versus the prior year. Throw in higher interest rates with those bigger balances and this notably increases the potential profit pool for Discover going forward.

That said, we should probably expect rising losses on loans in 2023 and 2024. However, it comes with the territory. If you’re buying a consumer lending company at less than 7x earnings, it’s a foregone conclusion that you are underwriting a significant possibility of meaningful lending losses. It’s not a question of avoiding lending losses altogether, but rather whether the risk/reward lines up favorably for investors.

DFS Stock Verdict

I view Discover as a hold at this point. And, indeed, that is what I am doing with my own money. I own a small position in DFS stock that I bought many years ago as part of my broadly diversified buy-and-hold portfolio.

For long-term holders, the current situation seems fine. Discover will enjoy another surge at some point in the future once we turn the corner on the current economic headwinds.

Right now, DFS stock might seem like an obvious pick at just 6.6x forward earnings. Shares scream bargain here. However, there’s probably no free lunch on Discover. Rather, the market is reasonably pricing in a level of uncertainty around the current rate hike cycle. It’s far from certain that the Federal Reserve will be able to achieve a so-called soft landing with its aggressive moves to tighten monetary policy.

And Discover, at the end of the day, is a credit company that makes some fairly risky loans. All that to say that it’s perfectly reasonable to have a high degree of uncertainty on DFS stock at the moment. However, once we see where the economy is 6-12 months from now, there’s a good chance that unless we get a hard landing, investors should come rushing back into economically vulnerable stocks such as the consumer lenders.

In the meantime, Discover’s supercharged buyback program can absolutely gobble up shares at the current discounted price. There is some risk here. The Fed could really put the economy into a hard place if it can’t manage the current pivot successfully.

Regardless, I expect DFS stock to rally significantly in late 2023 or perhaps 2024 once there are more signs of economic certainty. Expect another bumpy few quarters as investors digest a rapidly shifting economic landscape. Over time, however, Discover has a strong economic engine and is plowing its outsized cash flows straight into highly accretive share buybacks while also offering a fairly attractive dividend growth profile as well.

Be the first to comment