Viorika/iStock via Getty Images

Real Estate Weekly Outlook

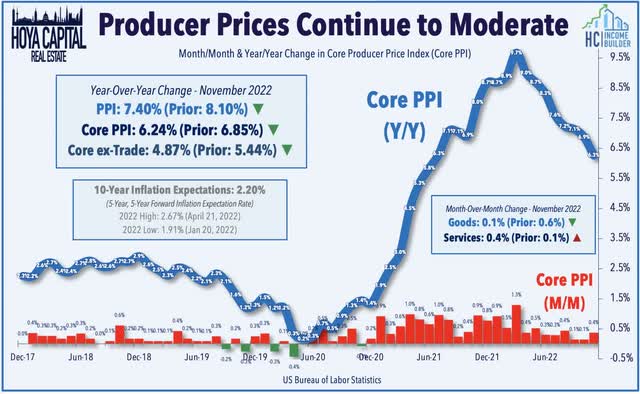

U.S. equity markets retreated this week as investors positioned for the upcoming FOMC meeting while a chorus of Wall Street analysts and executives expressed doubt on the likelihood of a “soft landing.” The closely-watched PPI report this week showed that wholesale prices rose slightly faster than expected in November – doing little to ease concern that inflation may not cool quickly enough to avoid a recession – representing a setback following a stretch of encouraging inflation reports over the last month which have pulled the Citi Inflation Surprise Index to the lowest levels since December 2020.

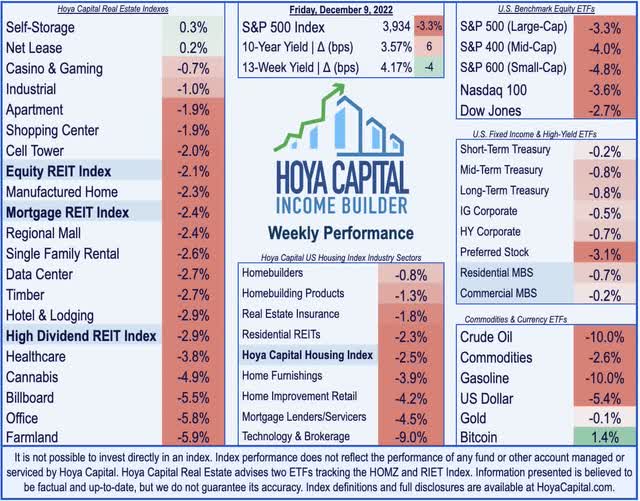

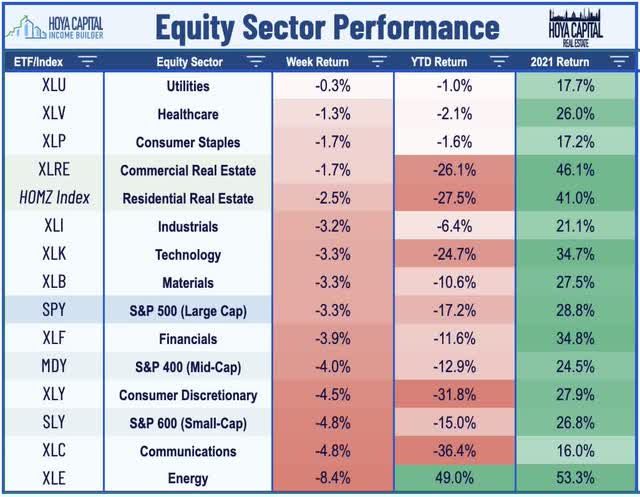

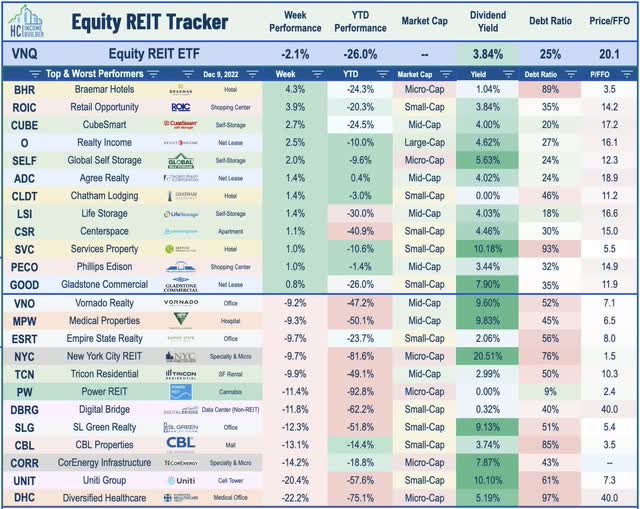

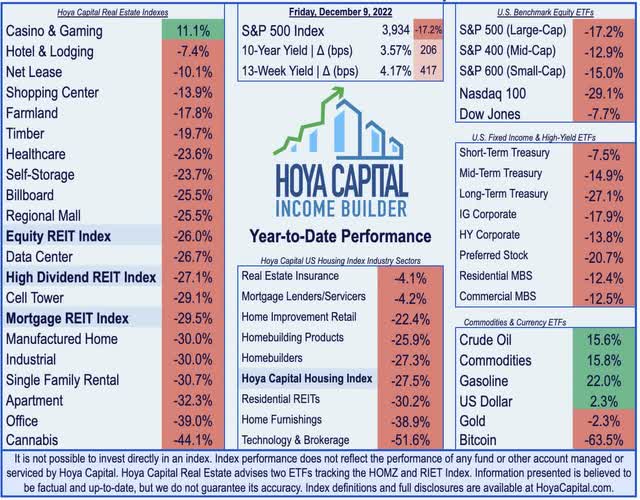

Posting its worst week since mid-September, the S&P 500 slid 3.3% on the week – slumping after a strong stretch of five-of-seven weekly gains – while the tech-heavy Nasdaq 100 dipped 3.6% to push its year-to-date declines back to nearly 30%. The Mid-Cap 400 and Small-Cap 600 posted steeper declines of 4.0% and 4.8%, respectively. Buoyed by a wave of a dozen REIT dividend hikes and decent homebuilder earnings reports, real estate equities were among the leaders on the week with the Equity REIT Index posting more modest losses of 2.1% while the Mortgage REIT Index declined 2.4%. Homebuilders and the broader Hoya Capital Housing Index were a bright-spot as the 30-Year Fixed Mortgage Rate fell for a fourth week to 6.33% – a full 75 basis points below its highs in early November of 7.08%.

After briefly dipping to three-month lows earlier in the week, the 10-Year Treasury Yield (US10Y) finished the week at 3.57% – up 6 basis points from the prior week. The 10-2 Yield Curve spread – viewed as a leading recession indicator – briefly inverted to its deepest levels since 1980 before narrowing later in the week. Deflationary forces – or perhaps simply recessionary forces – appear to be mounting as Crude Oil futures dipped another 10% on the week to erase their gains for the year – a dramatic reversal for the commodity that was higher by more than 60% on the year back in June. Gasoline futures also dipped by more than 10% as consumer gas prices also turned negative on a year-over-year basis and lower by over 35% from the peak in June. All eleven GICS equity sectors were lower on the week with Energy (XLE) stocks dipping by more than 8% while Utilities (XLU) stocks were an upside standout.

Real Estate Economic Data

Below, we recap the most important macroeconomic data points over this past week affecting the residential and commercial real estate marketplace.

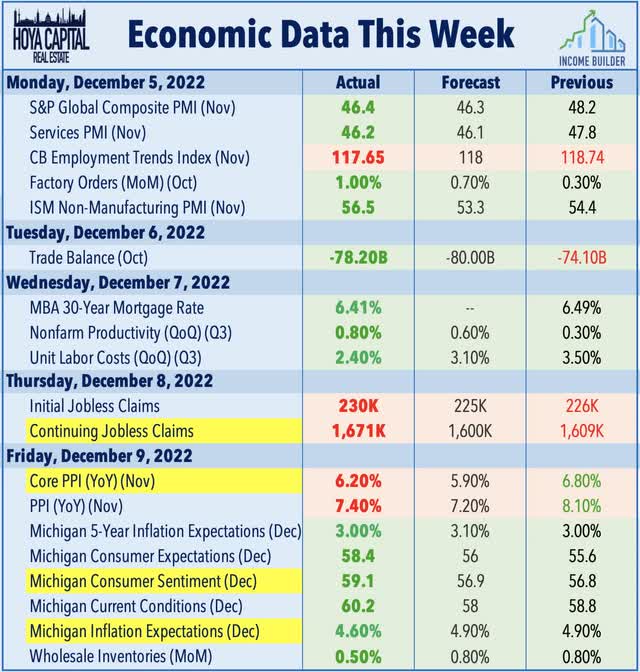

Ahead of the critical Fed rate decision in the week ahead, Producer Price Index data showed that wholesale prices rose slightly faster than expected in November – but continued the trend of moderation in the annual rate. Core PPI rose 0.4% from last month – above estimates of 0.2% – but the year-over-year growth rate cooled to 6.2% – the lowest annual increase since mid-2021. The “internals” of the report were more encouraging, however, as price inputs further up the supply chain – intermediate demand – were broadly lower in the month with the Intermediate Demand: Processed Goods Index declining for a fifth-straight month. Before the Fed meeting on Tuesday, we’ll see the Consumer Price Index for November which is expected to moderate to a 7.3% year-over-year rate while the Core CPI is expected to decelerate to 6.1%.

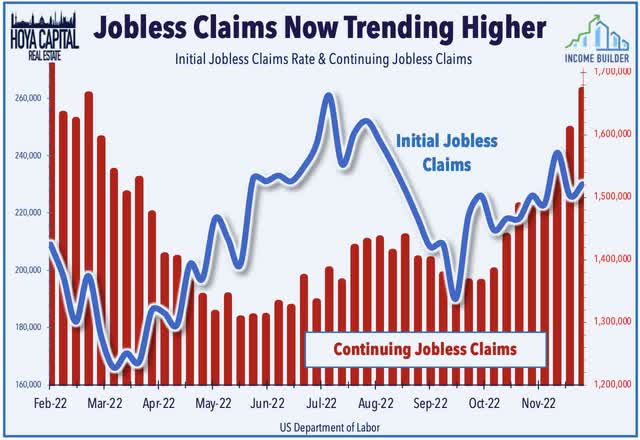

Following a decent nonfarm payrolls report last week, employment data this week showed that continuing jobless claims rose to the highest levels since early February at 1.7 million for the week ended Nov. 26 – the largest three-week increase since the depths of the pandemic in May 2020. Unadjusted initial claims jumped by nearly 90k last week driven by large increases in California and New York. We highlighted last week how the strong job gains observed in the BLS establishment survey have been at odds with most other employment metrics including the BLS’ household survey in the same report – which is used to calculate the unemployment and labor force participation figures – which showed net job losses of 138k in November – a second straight month of declines in the employment level.

Equity REIT Week In Review

Best & Worst Performance This Week Across the REIT Sector

‘Tis the Season for REIT Dividends. Despite the broader economic slowdown, REIT dividend increases continue to significantly outpace REIT dividend decreases consistent with our discussion in our State of the REIT Nation report last month which noted that REIT payout ratio ratios remain below the long-term historical averages, implying that REITs have significant ’embedded’ dividend growth that should be unlocked over the coming quarters. Highlights this week included American Tower (AMT) and W. P. Carey (WPC) – which each hiked their dividends for the fourth time this year – while lab space operator Alexandria Real Estate (ARE) hiked its payout for a second time. A pair of REITs also declared special dividends – timber REIT PotlatchDeltic (PCH), which hiked its dividend while announcing a $0.95/share special dividend, and Lamar Advertising (LAMR) which declared a special cash dividend of $0.30/share. In total, more than a dozen REITs hiked their dividend this week while three REITs reduced their payouts, bringing the full-year total to 120 REIT dividend hikes compared to 12 dividend decreases.

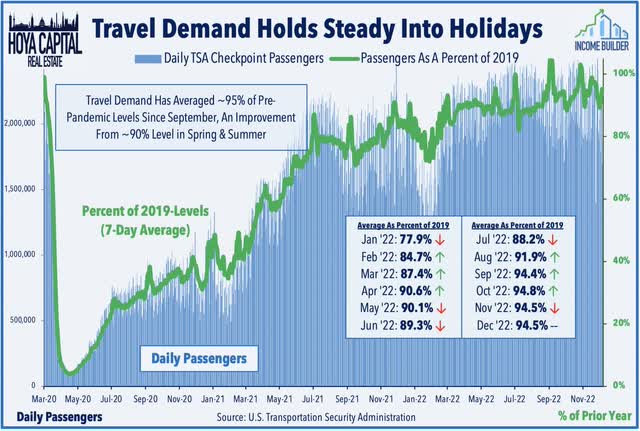

Hotels: Dividends are back – even for the most pandemic-impacted REIT sector. Braemar Hotels (BHR) rallied more than 4% on the week after it reinstated its quarterly dividend at $0.05/share – below its pre-pandemic rate of $0.16/share – while also announcing a $25M stock buyback program -representing about 10% of its market value. Chatham Lodging (CLDT) advanced 1.5% this week after reinstating its quarterly dividend at $0.07/share – slightly below its pre-pandemic rate of $0.11/share. Park Hotels (PK) slipped 2% despite reinstating its quarterly dividend at $0.25/share – below the $0.45/share paid before the pandemic. PK noted that $0.13/share of the dividend is attributable to gains from the sale of Park’s assets. Ryman Hospitality (RHP) was lower by about 1% despite hiking its quarterly dividend to $0.25/share – up from its prior rate of $0.10 still below its pre-pandemic rate of $0.95/share. Recent TSA Checkpoint data shows that travel demand remains relatively healthy into the holiday season with domestic throughput holding steady at 95% of pre-pandemic levels.

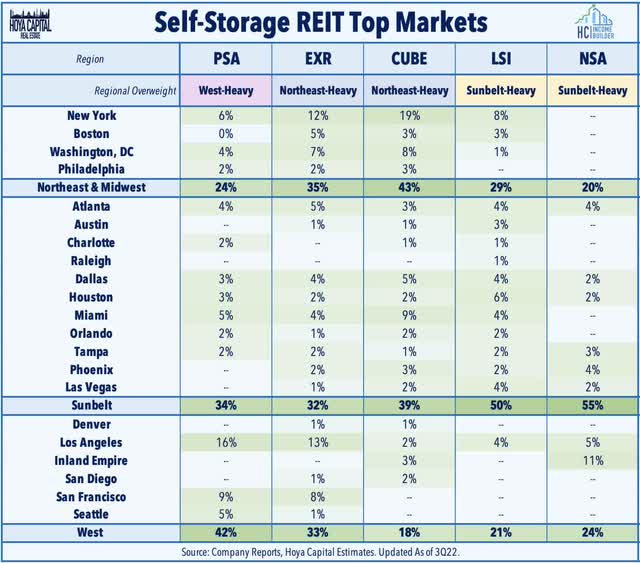

Storage: CubeSmart (CUBE) – which we own in the REIT Dividend Growth Portfolio – rallied nearly 3% after hiking its quarterly dividend by 14% to $0.49/share. CUBE was given an added boost by S&P’s announcement that it will be added to the S&P MidCap 400 prior to the open on Monday, December 19th. All five major storage REITs are now included in an S&P index with Public Storage (PSA) and Extra Space (EXR) included in the S&P 500 while Life Storage (LSI) and National Storage (NSA) are included in the S&P 400. Of note, there are 30 REITs included in the S&P 500 – representing less than 3% of the benchmark – but REITs are better represented in the Mid-Cap 400 with 10% of the total weight and the Small-Cap 600 with an 8% weighting.

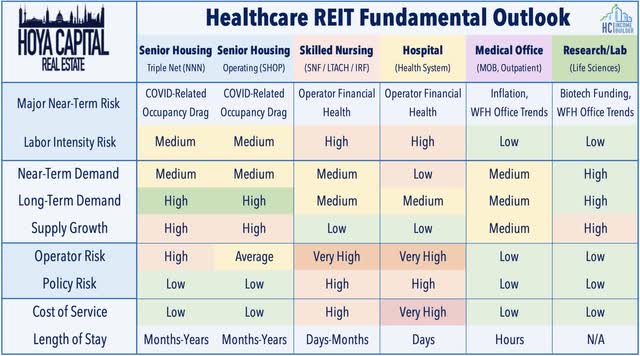

Healthcare: Diversified Healthcare (DHC) was on the wrong side of the index rebalancing, however, sliding another 20% this week after S&P announced that it will be removed from the S&P SmallCap 600. Welltower (WELL) – the largest healthcare REIT – was also under pressure this week after Hindenburg Research published a short report which raised questions over a new joint venture partner on a portfolio of skilled nursing facilities. Last month, WELL announced that it would move 147 skilled nursing assets managed by Promedica into a JV that will be 15% owned by private equity firm Integra Health. The short report focused on the limited operating history of Integra Health – a critique that received pushback from analysts including Raymond James, whose analyst noted “shows a clear misunderstanding” of the facts. ProMedica released a statement noting that the “opinion piece contains many inaccuracies — the most obvious of which is the fact that Integra is not the proposed operator in this transaction” consistent with the initial press release stating that Integra will “bring in select regional operators that will operate the facilities upon receiving regulatory approvals.”

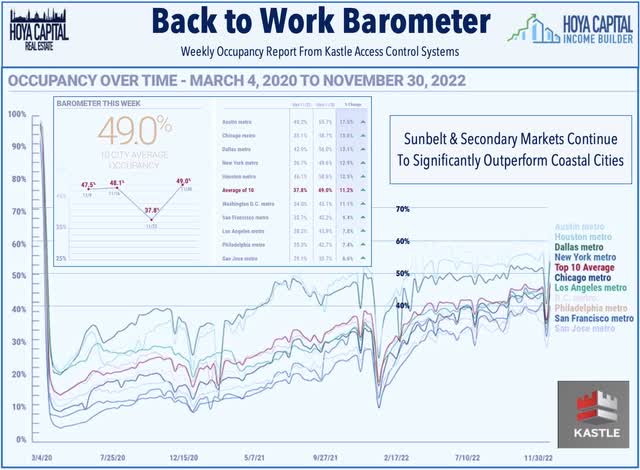

Office: While most property sectors continue to raise their distributions, office REITs have been heading the other direction. NYC-focused SL Green (SLG) slid 12% on the week after it trimmed its monthly dividend by 13% to “match our current projection of Funds Available for Distribution for 2023.” West Coast-focused Douglas Emmett (DEI) dipped more than 5% after trimming its quarterly dividend to $0.19/share – down from its prior rate of $0.28 – but concurrently announced a new $300M share buyback program representing about 10% of its market value. Several office REITs were active in the capital markets this week with Brandywine (BDN) pricing $350M of five-year notes at a 7.55% interest rate – notably higher than the 3.95% rate on the maturing note that it’s replacing. Elsewhere, Armada Hoffler (AHH) announced a new $100M five-year unsecured term loan with the option to increase the total capacity to $200 million at a fixed interest rate of 4.79%. Recent data from Kastle Systems shows that average office utilization rates remain below 50% of pre-pandemic levels with coastal urban markets continuing to lag.

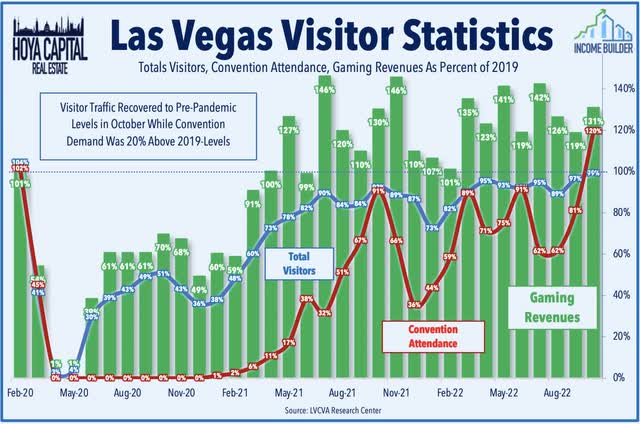

Casino: VICI Properties (VICI) was among the better performers this week after it announced that it will provide $52M in capital for an expansion project at Century Casino Caruthersville. Upon completion of the improvements, the annual rent under the master lease with Century will increase by approximately $4.2M. Last week, VICI announced that it reached a $5.5B deal to acquire the remaining 49.9% share in the MGM Grand Las Vegas and the Mandalay Bay Resort from Blackstone (BX), giving VICI full ownership of the properties. Blackstone will receive $1.27B in cash while VICI will assume the private equity firm’s share of roughly $3B in debt. The transaction – which has an implied cap rate of 5.6% – is expected to be immediately accretive to AFFO/share and will generate annual rent of $310M next year and escalate at a fixed 2.0% rate through 2035 and up to 3.0% thereafter. Recent data room the Las Vegas Conventional and Visitor Authority shows that total visitors to Vegas recovered to pre-pandemic levels last month while convention attendance was 20% above comparable 2019-levels for the first time.

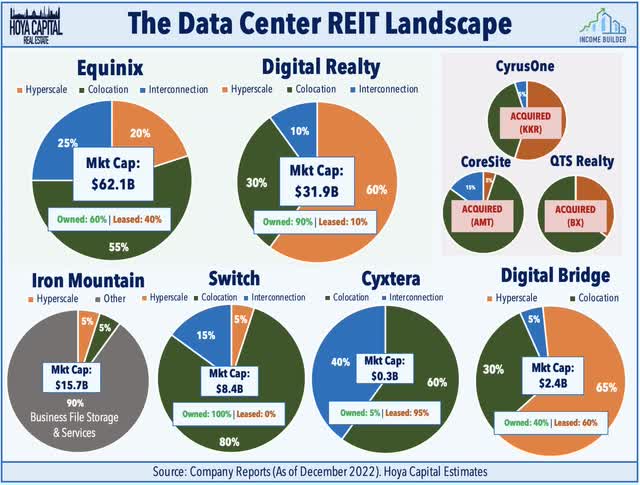

Data Center: Sticking with the M&A theme, DigitalBridge (DBRG) slid nearly 12% on the week after it announced that it completed its previously announced $11B acquisition of data center operator Switch (SWCH) for $34.25/share in cash. Switch had planned to convert to a REIT in 2023 prior to the DBRG acquisition. This week we published Data Center REITs: Patience Pays Off which discussed why Equinix (EQIX) and Digital Realty (DLR) are now positioned to be aggressors in the M&A space as other more-highly-levered private players seek an exit. Ironically, just as Data Center REITs became a trendy “short” idea centered on a thesis of weak pricing power and competition from hyperscalers, rental rate trends have meaningfully improved. Competition from the hyperscale giants– Amazon (AMZN), Microsoft (MSFT), and Google (GOOG) (GOOGL) – has been a well-established risk and with negotiating power tilting back towards landlords, there appears to be enough economic value to be shared between landlord and tenant alike.

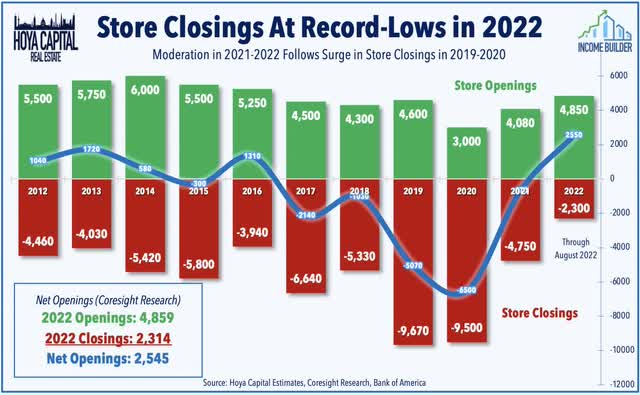

Mall: Small-cap Pennsylvania REIT (PEI) – which emerged from a brief bankruptcy last year – was among the better performers this week after it announced that it extended its credit facility by one year after meeting all of the requirements under its first and second lien credit facilities which now have a maturity date of December 10, 2023. PEI also noted that it has sold assets generating $110M in proceeds so far in 2022 and has applied asset sale proceeds and excess cash from operations to pay down debt by $148M through October 31, 2022. Last week in Mall REITs: The Bleeding Has Stopped we noted that following nearly three years of rental rate and occupancy declines, the supply-demand dynamic has recently favored retail landlords, rewarding mall REITs with some long-elusive pricing power.

Single-Family Rentals: Invitation Homes (INVH) was also active in the capital markets this week, announcing that it voluntarily prepaid the $560M balance of its IH 2018-1 securitization which was set to mature in March 2025 by drawing on a new term loan facility that matures in June 2029 which has a variable interest rate based on the term SOFR plus 124 basis points – currently a rate of approximately 4.90%. With the prepayment, INVH’s earliest debt maturity is now 2026 and 83% of the Company’s wholly-owned properties are now unencumbered while over 99% of its debt remains at fixed or swapped to fixed rates. This week we published Single Family Rental REITs: Save The Gloom & Doom which discussed our updated outlook for the SFR sector. Our newly-developed Own vs Rent Index highlights that while the monthly cost of owning and renting was nearly identical at the start of the year, owning a home now costs $700 more per month than renting the same home.

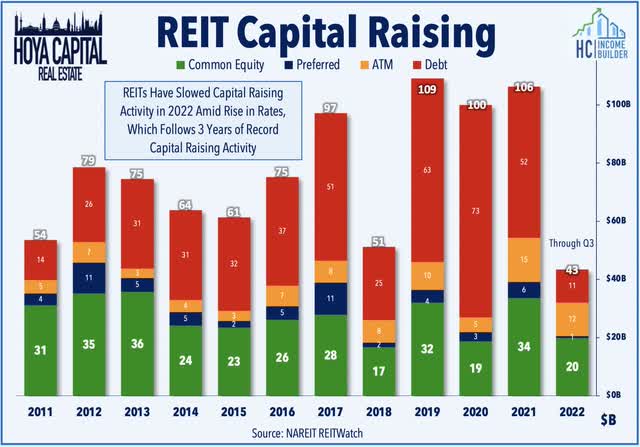

In addition to the REIT capital raising activity discussed above, AvalonBay (AVB) announced that it completed an underwritten public offering of $350M of 5.00% senior unsecured notes due 2033. Elsewhere in the apartment sector, Moody’s assigned Apartment Income (AIRC) a first-time “Baa2” issuer credit rating with a stable outlook. As noted in our updated State of the REIT Nation report, REITs have been able to lean more heavily into shorter-term credit facilities for funding needs rather than tapping longer-term bond markets, hoping to “wait out” the spike in interest rates this year. REITs entered this period of volatility with a “war chest” relative to their position in 2008 as REITs raised more capital from 2019-2021 than in any prior three-year period on record with most REITs able to lock in low-interest rates on long-term debt while still maintaining a relatively “equity-rich” capital stack.

Mortgage REIT Week In Review

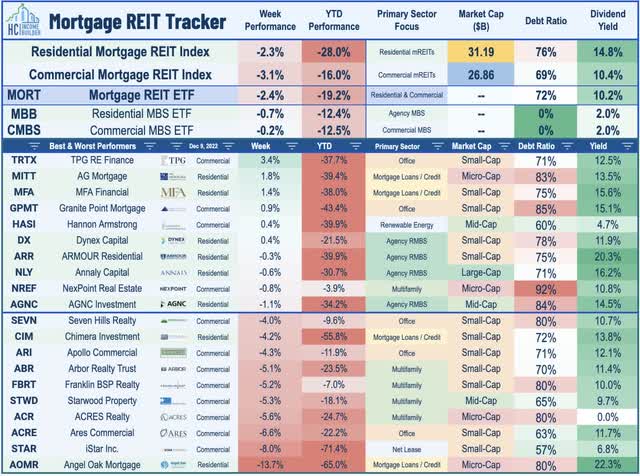

Mortgage REITs were also broadly lower this past week with the iShares Mortgage REIT Capped ETF (REM) finishing lower by 2.4%. PennyMac Mortgage (PMT) dipped 3% after confirming its prior indication that it would be reducing its dividend by 15% to $0.40/share which reflects its “objective to distribute its income that reflects the earnings per share we expect.” The other half-dozen REITs that declared dividends this week held their payouts steady including commercial mREIT Starwood Property (STWD) and residential mREITs Annaly Capital (NLY), AGNC Investment (AGNC), Redwood Trust (RWT), Ellington Financial (EFC), and Ellington Residential (EARN).

2022 Performance Check-Up

With just three weeks left of 2022, the Equity REIT Index is lower by 26.0% on a price return basis for the year – on pace for its second-worst year of performance behind the 37% declines in 2008 – while the Mortgage REIT Index is lower by 29.5%. This compares with the 17.2% decline on the S&P 500 and the 12.9% decline on the S&P Mid-Cap 400. Within the real estate sector, just one property sector is in positive territory on the year – Casino REITs – and six property sectors are lower by more than 30%. At 3.57%, the 10-Year Treasury Yield has surged 206 basis points since the start of the year, but is well below its 2022 highs of 4.30%. Despite the rebound this past week, the US bond market is still on pace for its worst year in history with a loss of 11.8% on the Bloomberg US Aggregate Bond Index, which is 4x larger than the previous worst year back in 1994 (-2.9%).

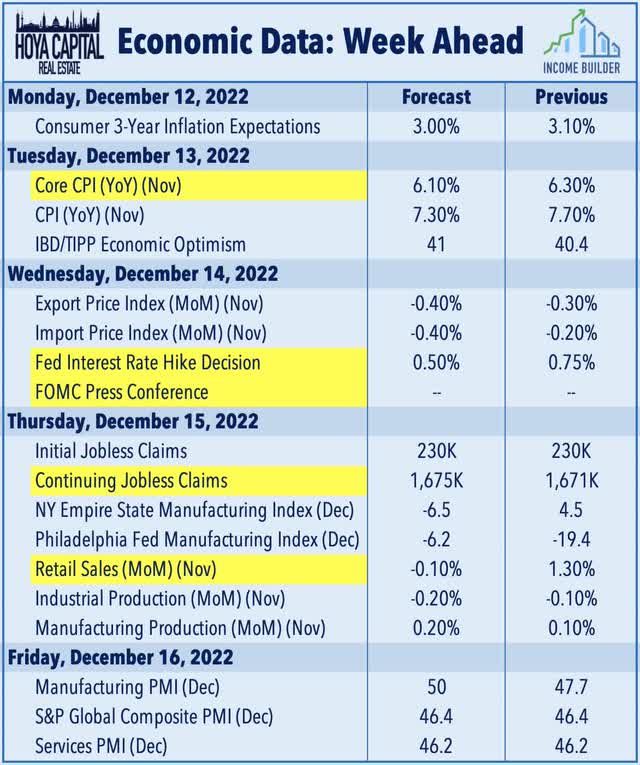

Economic Calendar In The Week Ahead

It’ll be another jam-packed week of economic data with the main event coming on Wednesday with the FOMC Interest Rate Decision in which the Fed is widely expected to raise rates by 50 basis points to bring the Fed Funds rate to a 4.50% upper-bound. Notably, market pricing indicates expectations of the terminal rate peaking at 5.25% next June. Before the Fed meeting on Tuesday, we’ll see the Consumer Price Index for November which investors – and the Fed – are hoping to show that the fastest pace of year-over-year increases is finally behind us. The headline CPI is expected to moderate to a 7.3% year-over-year rate while the Core CPI is expected to decelerate to 6.1%. Importantly, gasoline prices averaged $3.69 nationally in November – down about 3% from the prior month. On Thursday, we’ll also see Retail Sales data covering the early holiday shopping season which is expected to show a slight decline in seasonally-adjusted spending from the prior month.

For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Be the first to comment