PHOTOEURO

General Overview

The calm before the storm. A jarring 2022 has seen risk capital implode, a SPAC unravelling, and a crypto Winter freezing of Internet money. We have had a war, an inflationary boom, an energy bust, and an intentional shuttering of the Chinese economy.

In fact, there has been little to crow about at all. Watching processionary downticks heaped in red on your trading platform has hardly been entertaining for any asset manager.

Ok, granted Robinhood made it fun with its little emojis, digital victory laps, and congratulatory icons. Perhaps those are less the trend when everybody, including Vlad, is losing money.

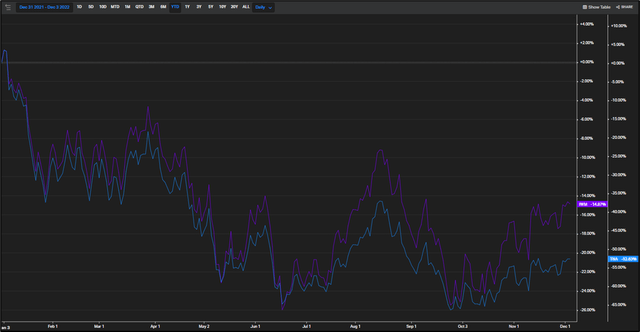

It’s been rough sailing for IWM (-14.87%), but even rougher sailing for its leveraged counterpart TNA (-52.63%) during 2022.

Maybe entertainment should be left to Sam Bankman-Fried, who continues to make cameo appearances at various media outlets in attempts to proclaim negligence. “We kind of lost track” confessed the mop-haired 30 something as he tried to recount burning billions. His contributions at FTX appear to have been “massive oversights” and even a lack of “rigorous thinking.”

If any lesson can be taken away from this cryptic debacle of fraud, misappropriation of assets and negligence, it’s one of prudence, responsibility, and risk management. These are exactly the traits you need to possess to actively manage leveraged ETFs like the Direxion Daily Small Cap Bull 3x Shares ETF (NYSEARCA:TNA).

My outlook continues to be clouded for risky assets as we move into 2023. Last week’s jobs report failed to show the intended decline, perhaps sending Fed officials sold on a 50-basis point December rise back to the drawing board. Who knows? In any case, the economic environment remains jittery for risky assets indexed in the Russell 2000.

Basic ETF info – Direxion Daily Small Cap Bull 3x Shares ETF.

Product Overview

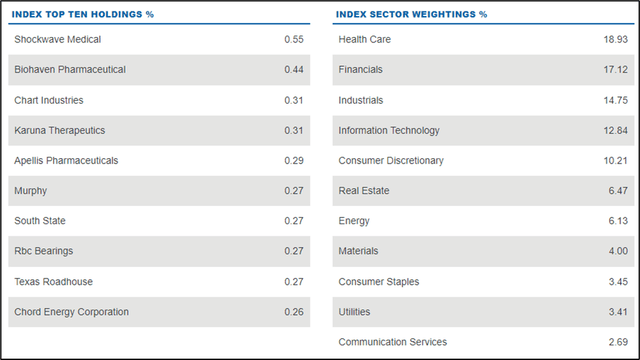

Direxion Daily Small Cap Bull 3x Shares ETF is a daily-reset long leverage package used to emulate the Russell 2000. The Russell 2000 is a small-cap stock market index made up of the 2000 smallest stocks in its big brother, the Russell 3000.

Developed by the Frank Russell company in the mid-eighties, the index has consistently been a barometer of U.S. economic sentiment. Smaller equities generally tend to show greater volatility, matched with a bigger upside when times are good. Problem is – times are not good.

This $1.183T small cap index has been embraced as the small-cap index of choice for benchmarking performance and creating portfolios of small-cap risky assets.

TNA holdings & Index Sector Weightings.

The Direxion Daily Small Cap Bull 3x Shares ETF can be used tactically to actively position into raging bull markets or potentially offset a basket of short positions without effectively having to sell them.

Its distant, and opposing, cousin is the Direxion Daily Small Cap Bear 3x Shares ETF (TZA), which I have covered here. Most of the innards of the product are not dissimilar – you have a healthy serving of derivatives used for leverage and all the usual suspects such as compounding and path dependency, making it inappropriate for a long-term holding.

Risks

This is for short-term hedging, tactical trading, and quick speculative trades. Real risks are present with anyone holding leveraged ETFs with real possibilities of portfolio implosion, and significant capital loss.

So don’t be a hero – besides, Alameda Research is no longer looking for interns anyway. Risk management is critical here, so for traders tactically resorting to using the ETF, it is worth familiarizing yourself with Direxion’s little video tutorial.

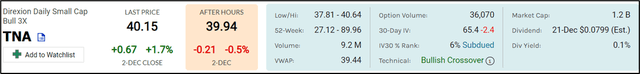

With this ETF dynamo, you get big magnified bullish returns allowing you to navigate the market upside. Liquidity provides easy entry and exits all for the price of 105 basis points. Assets under management total $1.12B and the fund’s age, over a decade, provides some assurances that correct risk management procedures have been used during its construction.

It is always a bit tricky to know what is in your drink, er…I mean ETF, particularly when dealing with synthetic leverage. Here, the cocktail is mainly made up of a holding in (IWM), the iShares Trust Russell 2000 ETF married with different types of index swaps, treasury swaps and other derivatives.

Direxion Daily manages derivative positions with counterparties such as Goldman Sachs and Dreyfus. So don’t worry – no Alameda Research on the term sheet. Weren’t they supposed to be buying Goldman anyway?

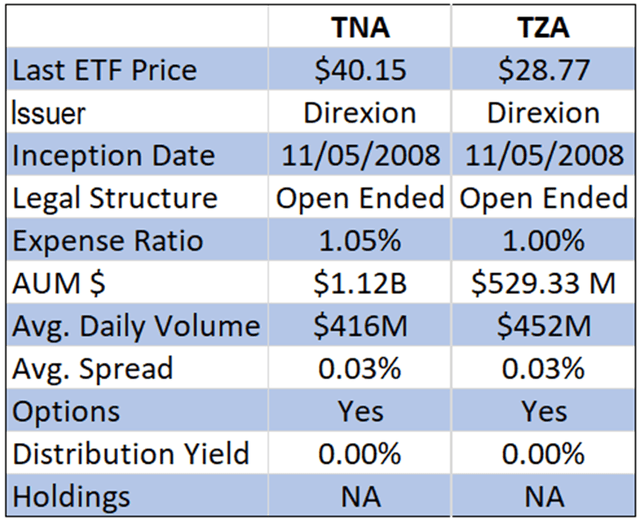

Spreadsheet developed by author with inputs from ETF.com

The leveraged bull TNA holds almost twice the AUM than its bearish counterpart. Note the huge average daily volume, indicating much shorter holding periods.

Key Takeaways

Direction Daily continues to be the reference in leveraged ETFs. Product range has grown, moving out into the more exotic leveraged types like the ones here.

They generally have higher administration costs, shorter holding periods, and are specifically used for tactical trading or hedging. One can only wonder what additional new products are being engineered presently to complete the customer offering.

Maybe a new mega-leveraged crypto ETF? Perhaps, as it is currently a Bahamian competitor which has the monopoly for that.

Be the first to comment