Brandon Bell/Getty Images News

While the new Trump media empire offered a lot of promise shortly after his Presidency, the deal with Digital World Acquisition (NASDAQ:DWAC) appears close to dead on arrival. The extended time period to get Truth Social launched and the Elon Musk buyout of Twitter (TWTR) are working in combination to reduce the momentum for a free speech outlet. My investment thesis is very Bearish on the SPAC trading far above the $10.20 deal price up at $28.40.

Took Too Long

The Trump Media & Technology Group, or TMTG, officially launched the Truth Social App on the App Store back at the end of February. The website wasn’t available on a web browser until May 18.

The problem here is that President Trump has been out of the White House since the inauguration of Joe Biden in February 2021. Trump was banned by Twitter and other social media platforms back around January 8, 2021.

Trump has had a very low profile for the last 17+ months with the lack of media coverage and social media access. The former President was a top 10 account on Twitter, so he definitely would garner a ton of followers and usage on any social media platform, but Trump no longer has a political position with which to attract anyone outside the hardcore supporters.

Source: TMTG SPAC presentation

TMTG promised the ability to create a media empire to compete for the digital audiences far beyond Twitter to include the 120 million people listening to podcasts and the large Netflix (NFLX) user base topping 200 million subscribers. After the launch of the web version, Forbes contributor John Brandon claims Truth Social is nothing more than a basic copy of Twitter:

Truth Social looks exactly like something a developer would make if they were asked to build an app that does only the Twitter basics and nothing more.

Most of the data continues to suggest the social app has ~500K daily active users (DAUs), but the data is mostly outdated numbers from April. According to Time, Truth Social only had 2.6 million lifetime downloads in the U.S. with Trump having 3.27 million users now.

The S-4 filing suggests Truth Social only has a 6-hour exclusive window for Trump posts. The former President is free to post on other websites eliminating the main reason to join the platform, if one just wants to see the posts of Trump:

President Trump is generally obligated to make any social media post on Truth Social and may not make the same post on another social media site for 6 hours. Thereafter, he is free to post on any site to which he has access…In addition, he may make a post from a personal account related to political messaging, political fundraising or get-out-the-vote efforts on any social media site at any time.

If Musk closes the acquisition to buy Twitter and makes the site a harbinger of free speech, Truth Social will be dead on arrival. The platform has over 242 million DAUs and most users wouldn’t need the limited user base of Trump’s media platform.

Even worse, Truth Social has the SEC all over their case regarding whether Digital World and TMTG negotiated terms before the SPAC officially went public. The company just finally submitted the S-4 with the agreement to merge with the Digital World SPAC over 8 months ago.

At this point, Trump just doesn’t have the reach or influence to move the needle unless the former President makes another run for the White House. Remember, Twitter had long claimed President Trump didn’t even move the needle the traffic on the social media platform while Monness Crespi Hardt estimated the former President was worth $2 billion to the social media platform. Considering the stock is actually worth more now without him banned than this estimate back in 2017 when Twitter was worth only $12 billion, one quickly gets the view of the limited value of Trump despite his popularity.

SPAC Priced For Perfection

The transaction valued TMTG at an EV of $875 million with the potential for an earnest of $825 million for a total value of $1.7 billion. The trust has $293 million in cash and a $1 billion PIPE lined up to provide TMTG with a cash balance of $1.25 billion (after expenses) to build the potential media empire.

The company filed the S-1 on May 27 and unlike other SPACs, TMTG hasn’t issues any financial projections. The Q1’22 numbers of Rumble (CFVI) highlight why financials wouldn’t be impressive and the limited data provided by TMTG suggest the company only spent a paltry $8 million on operating expenses in the quarter highlighting how far Truth Social is from being a media juggernaut.

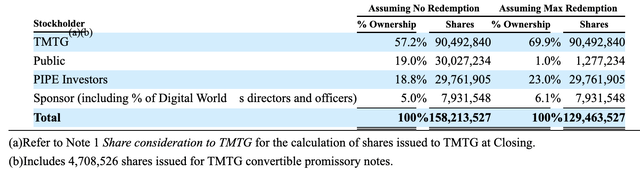

The big confusing aspect is the outstanding shares. Digital World hasn’t provided a good summary of the share balances and this basic table in the S-1 excludes any warrants, earnout shares worth up to $825 million and converts the PIPE shares at current prices.

Even if TMTG only goes public with 158 million shares outstanding, the stock has a market cap of $4.4 billion with an EV of $3.2 billion. Truth Social just launched and the company will take years to generate the hundreds of million in revenues warranting the current stock valuation. Not to mention, the business isn’t even guaranteed to succeed.

At lower stock prices, the $1 billion PIPE investors could end up being issued up to 100 million of shares at $10 each while the filing uses ~30 million shares for the PIPE investors. Either way, the share count is likely to differ once the deal is done due to potential redemptions of the public shares, exercise of warrants and adjustments for the PIPE investment.

Takeaway

The key investor takeaway is that Digital World is too expensive considering the business combination has failed to generate any meaningful user base. The stock market is too excited about the potential for a Trump media empire considering the former President isn’t in any position to influence policy anymore.

Investors should unload shares of Digital World up near $30.

Be the first to comment