funky-data/iStock Unreleased via Getty Images

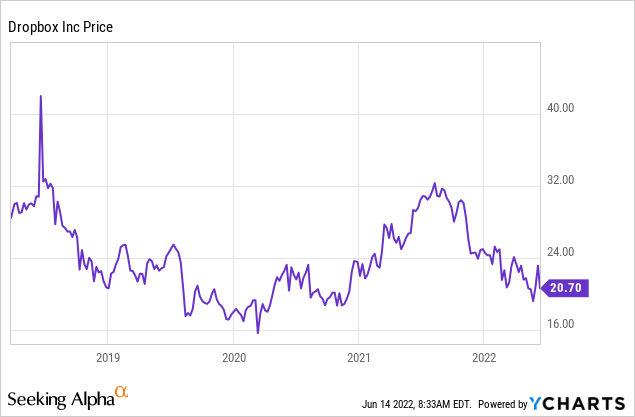

Dropbox, Inc. (NASDAQ:DBX) is a cheaply valued tech company. It produces a significant amount of free cash flow (“FCF”) and expects to increase the FCF at a decent rate. Slowing growth has made the share price go nowhere since its 2018 IPO at $21 per share. It has unraveled from a growth stock to a value stock.

About Dropbox

Dropbox offers cloud storage services in various forms. It’s primarily used as a free service by individuals and offers plans for more storage capacity and businesses. It’s expanding into electronic signing and document sharing. It also focuses on digital content creators with new capabilities and tests digital shops.

To quote Dropbox from their investor website,

Dropbox is a leading global collaboration platform that’s transforming the way people and teams work together. We’re on a mission to unleash the world’s creative energy by designing a more enlightened way of working.

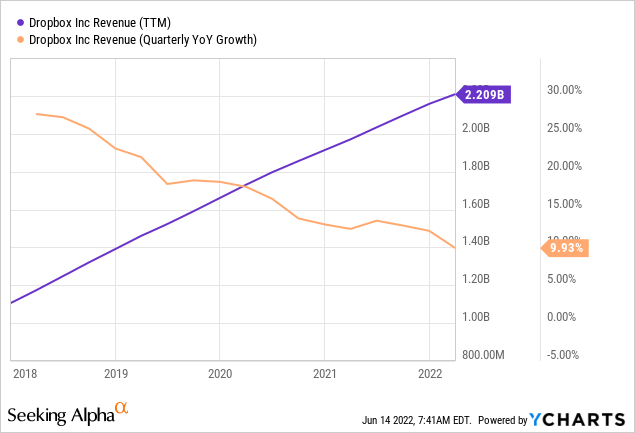

Slowing Growth

Dropbox’s top-line growth slowed significantly over the past couple of years. Its guidance of $2.32B to $2.33B in revenue for 2022 implies an expected growth rate of 7.5%—another slowdown after it experienced only a slight pandemic boost.

Dropbox looks at new ways to incite faster growth. Succeeding will be crucial for a revaluation of the shares.

Huge User Base

One remarkable aspect is the total user base of 700M+ registered users, of which only 17.09M are paying users. That’s a conversion rate of ~2.5%. Dropbox takes initiatives to monetize these free users. It introduced a lower-priced “Backup” plan and worked on the user experience.

It doesn’t show yet in the numbers. The conversion rate in 2018 was roughly the same, with 500M+ users and 12.3M paying users.

It’s a huge opportunity but hard to leverage with lots of competition from similar platforms like OneDrive from Microsoft (MSFT), Google Drive from Alphabet (GOOG, GOOGL), and Box (BOX).

New Features

DropBox Investor Presentation (Seeking Alpha)

Dropbox innovates its platform with targeted tools. It creates solutions for businesses and artists. The new solutions should reduce friction for freelancers to sell their content online. The focus on creative workflows seems promising, especially if Dropbox could integrate with more partners.

Acquisitions To Support Growth

DropBox made several acquisitions in the past couple of years. It acquired small and large companies:

- HelloSign provides easy-to-use signature and workflow applications. Dropbox acquired it in 2019.

- DocSend is a secure document sharing and analytics company. Dropbox acquired DocSend in March 2021.

- Command E is a universal search tool across numerous apps and cloud content. Dropbox acquired the company in the fall of 2021.

These acquisitions expand the functionalities of Dropbox. These companies had existing users, but they were immaterial compared to Dropbox’s user base. These could prove fruitful if they catch on.

For example, DocuSign (DOCU) is a direct competitor of HelloSign. DocuSign experienced much more substantial growth than Dropbox. The e-signature has a robust growth outlook as well.

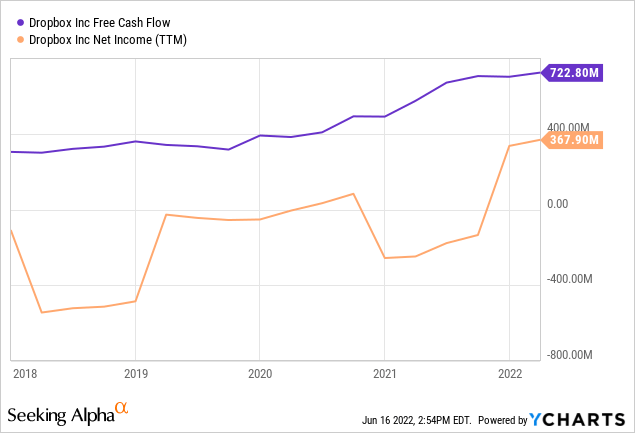

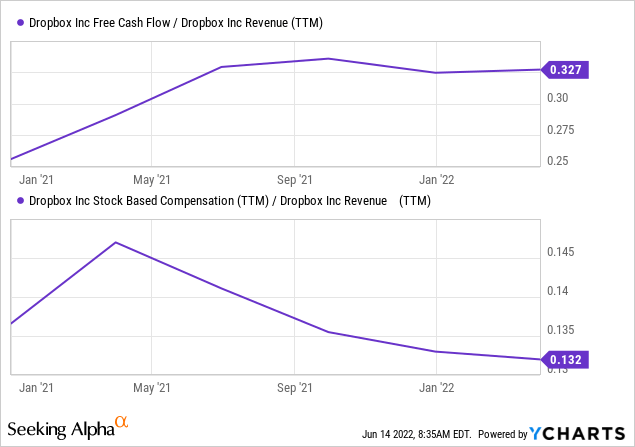

Robust Free Cash Flow Generation

Despite its slowing growth, Dropbox manages to squeeze significant amounts of free cash flow out of its revenue. It keeps its costs in check as the revenue grows. Dropbox aims at $1B FCF in 2024.

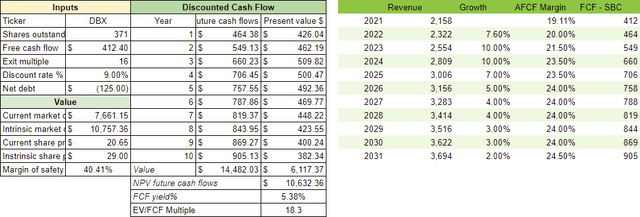

Dropbox does have significant SBC expenses as well. Correcting the SBC expense, it still produced $412M FCF in 2021.

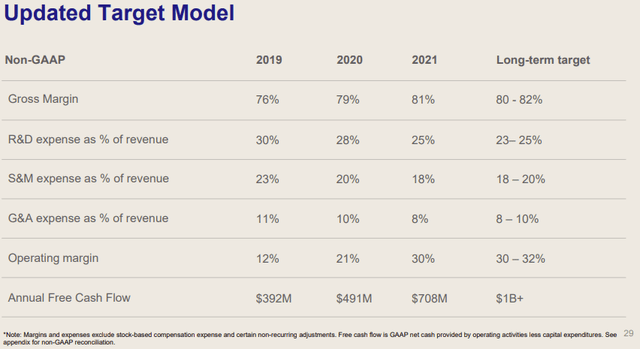

Target Model Shows Slight Margin Improvement

DropBox Investor Presentation (Seeking Alpha)

Dropbox shares a target model that shows only a slight further improvement in its margins. These margins are fine if the company can keep growing at a decent rate. The “long-term” target applies for 2024.

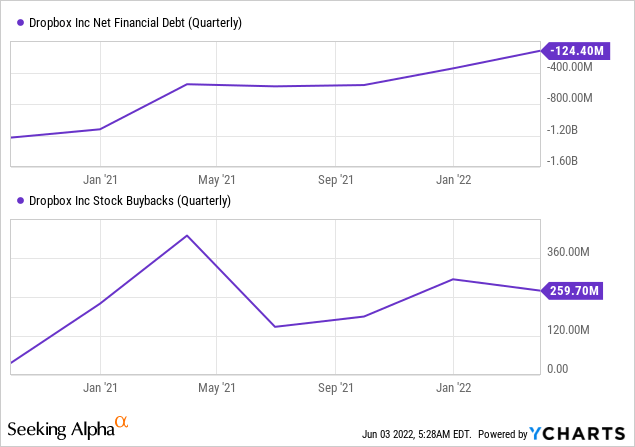

Shareholder Returns

Dropbox only uses share repurchases as a shareholder return. It states in the 10-K that it doesn’t expect to pay dividends in the foreseeable future. At the current share price, it makes sense to buy back stock instead. DBX should consider a dividend as it turns into a value stock and could attract new investors if it decides to pay a dividend.

It’s very active with its buybacks. It probably finished its $1B share repurchase program this quarter— only $84M was left on March 31.

DBX already has a new $1.2B program to continue its buybacks. The current rate of buybacks exceeds the free cash flow and eats into its cash position.

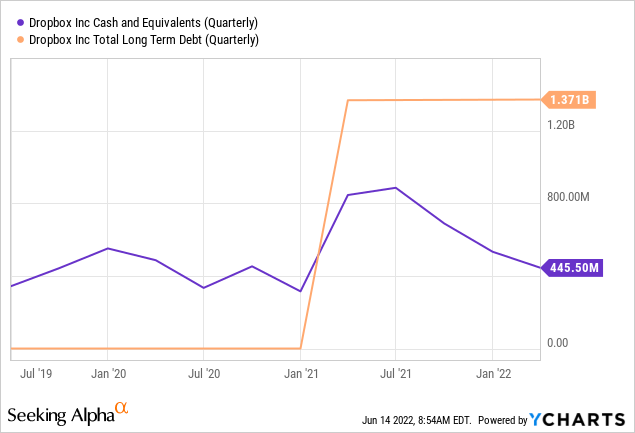

Balance Sheet

Dropbox has a strong balance sheet. It made only small acquisitions and hasn’t overly leveraged its operations.

The net cash position quickly fades due to buybacks, as shown above.

Dropbox issued convertible notes in February 2021 for the principal amount of $1.4B. The bonds are payable in 2026 and 2028. I expect Dropbox to refinance them with new notes as it uses cash for buybacks and acquisitions. Dropbox hedged these notes to prevent dilution.

Valuation

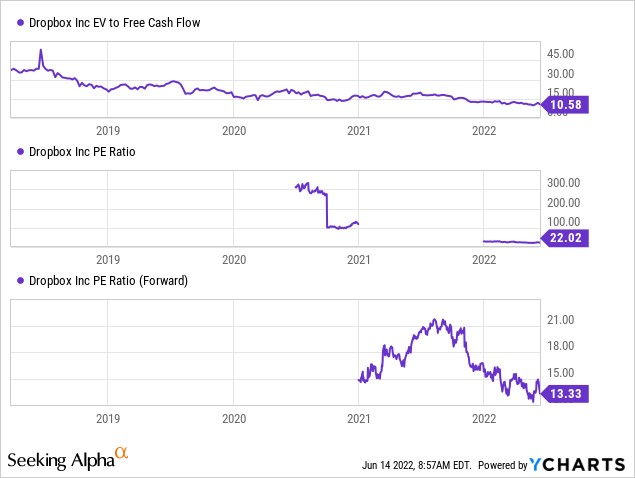

The multiples of Dropbox have dropped significantly. The company also produces positive net earnings since 2021, making the P/E ratio feasible. I expect it will continue its positive earnings in the future.

Dropbox’s valuation looks cheap at all levels, with a 10.5 EV/FCF, 22 P/E, and 13.3 FWD P/E. If I correct the FCF for its stock-based compensation (“SBC”), the 18.5 EV/FCF multiple is still reasonable but not cheap.

My Price Target: $29

I’ve made a prudent discounted cash flow (“DCF”) model that takes into account a couple of years with decent growth and then slowing down. I’ve adjusted FCF for SBC to account for the dilution from SBC. I expect more improvements to the adjusted FCF margin as SBC should grow slower than revenues.

Dropbox could grow much stronger if it finds a way to convert more users to a paid plan.

Risks

Dropbox should accelerate its revenue growth. Despite some small acquisitions, its growth has decelerated continuously since going public. Its new features seem promising, but they are unproven. Several large competitors emerged in the same space as Dropbox. Microsoft and Alphabet have much larger pockets and could out-compete them with their better-known services.

It does have considerable shareholder returns with its buybacks but can’t continue at this rate. It will soon have a net debt position on the balance sheet. Share repurchases will slow down, probably somewhere in 2023. I believe a dividend could attract new investors to the company. However, I don’t think it’s likely that Dropbox will announce a dividend soon.

Conclusion

I see two possible scenarios that make me optimistic about Dropbox.

It could succeed in monetizing its large user base. This should lead to reverse the trend in revenue growth. New features and targeted acquisitions should help leverage the user base into more paying accounts. The free cash flow would follow equally, enabling the company to continue its buyback spree. It should also see expanding multiples when the growth picks up.

The second scenario is an acquisition. For now, the possibility of getting acquired is only speculation. There are some attractive features for possible suiters like Adobe (ADBE), Salesforce (CRM), or Oracle (ORCL). DBX is already very profitable and trades at a low valuation. An acquirer could monetize its large user base.

Be the first to comment