May Lim/iStock via Getty Images

In this era of rising rates and 4%+ Treasury yields, one of the simplest ways to help insulate your portfolio against high inflation and a hawkish Fed is to increase your exposure to dividend growth stocks, which have a long history of outperforming the overall market and, unlike bonds, offer a rising income stream and high liquidity.

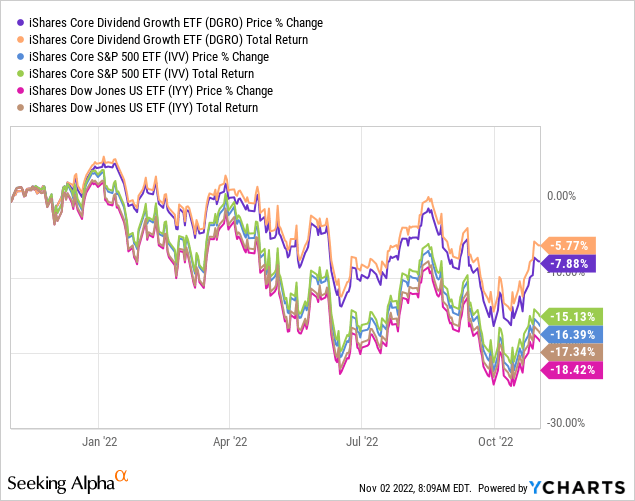

To wit, the iShares Core Dividend Growth ETF (NYSEARCA:DGRO), one of the largest such funds at $23.7 billion in assets, has significantly outperformed the S&P 500 (IVV) and the Dow (IYY) in both price change and total return over the past year as inflation has soared and the Fed has embarked on an aggressive campaign to reign it in.

Get To Know Your Index

Not all dividend growth funds are created equal, and investors should be aware that most exchange-traded funds (“ETFs”) track an underlying index that follows very specific rules. These rules will ultimately determine the ETF’s long-term performance more than the title of the fund might suggest. For example, a “dividend income” or even a “dividend growth” fund could theoretically own many high-yielding companies with low credit ratings and poor financials that put their dividends at risk, so it’s imperative to understand the indexes behind your ETFs.

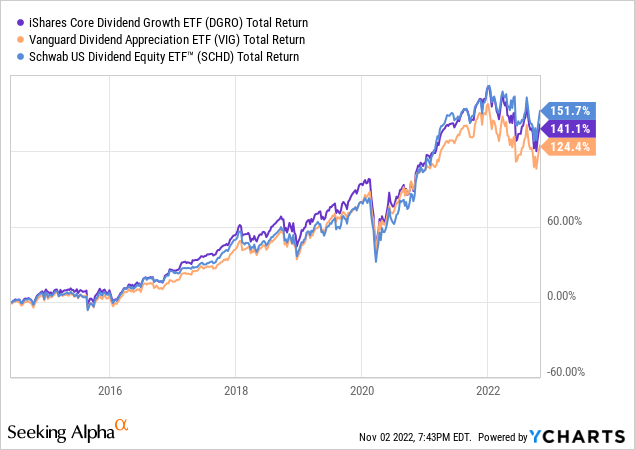

While older and larger dividend-focused ETFs from Vanguard (VIG) and Schwab (SCHD) track dividend indexes from S&P, BlackRock’s offering DGRO utilizes the Morningstar US Dividend Growth index. I’m a big fan of Morningstar’s rigorous approach to fundamental analysis, and it should come as no surprise that they’ve built a similarly rigorous and somewhat complex list of inclusion and weighting criteria for this index. Depending on your viewpoint and investing goals, each of these rules could be seen as a positive or a negative, so let’s take a closer look at them.

Rule #1: Diversification

With 417 holdings, Morningstar’s index is more diversified than its peers (VIG and SCHD hold 289 and 100 stocks, respectively), although I view anything above 100 stocks or so as highly diversified and wouldn’t expect any significant difference in performance between similar indexes with 200+ stocks and 400+ stocks based on diversification alone. Still, greater diversification can help to lower volatility and minimize the impact of any individual dividend cuts or freezes on the index’s overall yield.

My own back-testing has led me to believe that individual stocks have a more pronounced influence on portfolio performance at 50 or fewer positions, and while there are a number of potential benefits to holding fewer stocks along with additional risks, for most investors a diversified core ETF usually offers the best risk-adjusted way to anchor your portfolio. At 400+ holdings, one can truly view DGRO as an alternative to the S&P 500, with some additional screens to maximize quality and dividend safety while boosting the overall yield.

Rule #2: Dividend Growth Streak

Now to the most important part of a dividend growth fund: the dividends! While some dividend ETFs like VIG and SCHD limit their holdings to Dividend Contenders (10+ years of continuous dividend growth) or even Dividend Aristocrats (25+ years), DGRO has a relatively low minimum dividend growth threshold of 5 years, especially considering that they allow exceptions to the growth streak for companies that maintain their dividend without raising it in a given year as long as the company also reduces its share count via buybacks during that year. The 5-year threshold is an interesting choice. On the one hand it seems fairly risky, as 4-5 years of dividend growth isn’t enough of a history to trust that a company’s dividend will be sustainable for the long term. On the other hand, it allows DGRO to add younger, potentially faster-growing companies that have recently instituted a dividend before they qualify for inclusion in most other dividend growth ETFs. This may help to boost DGRO’s overall dividend growth rate, since dividend CAGRs tend to moderate over time, and is essentially a tradeoff between potential share price appreciation and dividend safety, which may favor growth investors who reinvest their dividends and don’t rely on them for current income.

The same could be said for the exception that allows share buybacks to be considered in total yield when the dividend is maintained at the same level for a second year. It’s not ideal for income investors, since share buybacks may or may not add value over longer periods depending on the stock price, but it does make sense to give companies extra time to raise their dividend if they’ve reduced their outstanding shares in the meantime.

Rule #3: Dividend Safety

DGRO’s index methodology excludes the top 10% highest-yielding companies from the broader U.S. stock market from consideration to reduce the risks that often come with the highest yields, such as elevated payout ratios, unsustainable debt levels, and hyper-cyclical businesses like mining, energy, and shipping. While this helps to reduce the likelihood of dividend cuts and enhances the overall financial quality of its holdings, it is again much lower than VIG’s threshold, which excludes the top 25% highest-yielding companies.

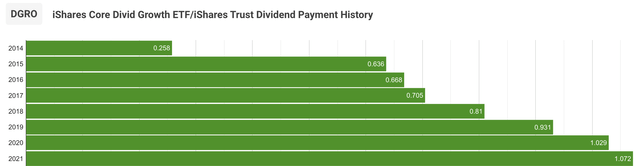

While in some ways this might be a disadvantage for DGRO, it also helps to give it a higher overall yield than some of its peers. Currently, DGRO yields 2.32% to VIG’s 1.94% and SCHD’s 3.35%. Similarly, DGRO’s 5-year dividend CAGR falls in the middle as well at 11.4% versus VIG’s 8.08% and SCHD’s 12.1%, but is still more than double the S&P’s 5-year dividend CAGR of 5.26%.

DGRO Dividend History (DividendInvestor.com)

Rule #4: Payout Ratio

The index’s second dividend safety criterion is payout ratio. DGRO requires its holdings to maintain a payout ratio of less than 75%, which I view as a fairly generous threshold designed to maintain a good balance of growth and yield in the index while ensuring that dividends are unlikely to be cut. Low-yield, high dividend-growth stocks such as Mastercard (MA), Pool Corp. (POOL), and Zoetis (ZTS) often have extremely safe dividends with payout ratios under 25%, but they aren’t very helpful for income investors. Likewise, high-yielding energy stocks and real estate investment trusts (“REITs”) often have payout ratios over 100% and carry additional risks such as financing via share dilution and dividend cuts during recessions.

A payout ratio range of 50-70% tends to be the “sweet spot” for the highest quality defensive stocks, and accepting payout ratios up to 75% allows for the inclusion of some high-quality utility and consumer stocks that might be excluded at a lower threshold, such as KO, OGS, WEC, AEP, WTRG, PG, and POR, which maintain payout ratios between 60-70%.

Rule #5: Weighting

Last but not least, DGRO’s index employs “dividend dollar weighting” — a complex formula that weights holdings by a combination of dividend yield and annual share count change rather than market cap — which in my view serves as an extra quality tilt by factoring stock buybacks and shareholder dilution.

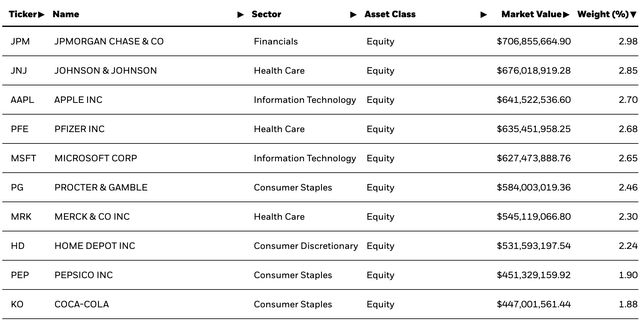

DGRO Top 10 Holdings as of 11/1/22 (iShares)

With any ETF or mutual fund, one of the first things I look at is the weightings of its top 10 holdings. Here is where DGRO stands out from its peers a bit, as it limits its holdings to a maximum weighting of 3% when it rebalances them each year, whereas VIG and SCHD have a higher 4% maximum. A one-percent different may not seem like much, but looking at the combined weighting of top 10 holdings in each ETF, we can see that it translates into a big difference in portfolio concentration.

| DGRO | VIG | SCHD | S&P 500 | |

| Top 10 Holdings | 25% | 30% | 41% | 28% |

By being less top-heavy, DGRO’s higher level of diversification can play more of a role in its performance. As we can see, it has an impressive record of outperforming both VIG and SCHD the majority of time since its inception, with the exception of the past year, when it has unsurprisingly been edged out by the higher-yielding SCHD.

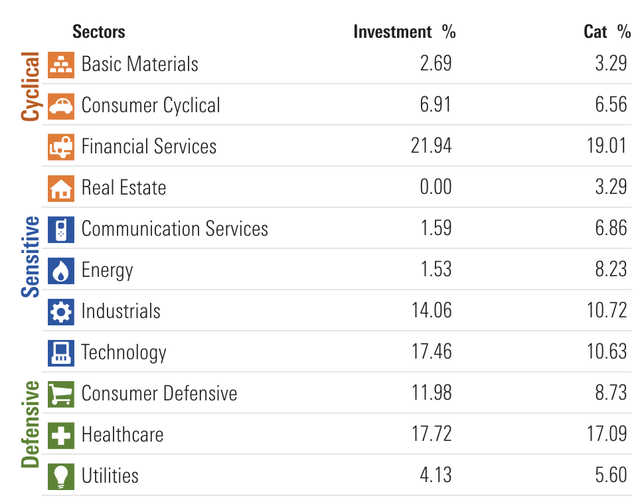

In terms of sector weightings, while significantly more defensive than the S&P 500, DGRO still has substantial exposure to rate- and recession-sensitive sectors like tech and financials, so I think caution is warranted here before jumping in.

DGRO sector exposure (Morningstar)

Conclusion

DGRO is a great core ETF for those looking to boost their portfolio’s yield and dividend growth rate without sacrificing the quality, safety, and diversification of S&P 500 ETFs. With a higher yield and double the dividend CAGR of the overall market, it is likely to offer additional insulation against rate hikes, and Morningstar’s unique index methodology should help to ensure a low risk of dividend cuts from its holdings.

I rate DGRO a hold at the moment due to uncertainty around upcoming inflation readings and the possibility of additional Fed rate hikes into a looming recession. However, I do recommend it as a core holding for all investor types, and I think long-term cost averaging into a solid dividend growth fund like this is a sound strategy in any environment.

Be the first to comment