Andreas Rentz/Getty Images News

Recap

We last wrote about Deutsche Telekom AG (OTCQX:DTEGY), or DT, discussing how the mobile service industry in Germany has been approaching saturation. There are three big players, namely DT, Vodafone (NASDAQ:VOD), and O2 owned by Telefonica (NYSE:TEF), having comparable mobile service revenue market share. The smartphone penetration rate in Germany has already been high, and many MNVOs, which generally offer cheaper plans in exchange for slower network speed, intensify the competition. As a result, we noted that the aggregate revenue growth of the three biggest operators fell short below 1%, on average, in the last few years.

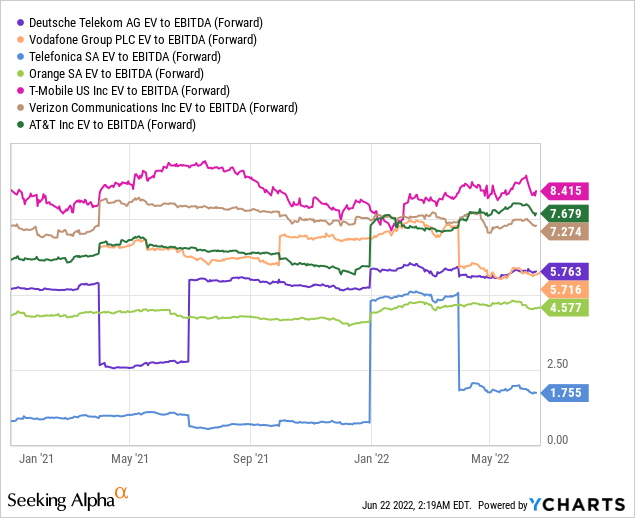

In addition, we argued that getting ahead in the 5G rollout in Germany might not provide a significant competitive advantage over competitors because of the lack of 5G availability and the low appetite for upgrading to the latest technology. Yet, we believe that DT’s broadband business will come to the rescue as the company is building fiber-optic connections. Lastly, the fact that DT is a cash-generating business with a lower EV/EBITDA multiple vs. some of its peers makes the share worth considering.

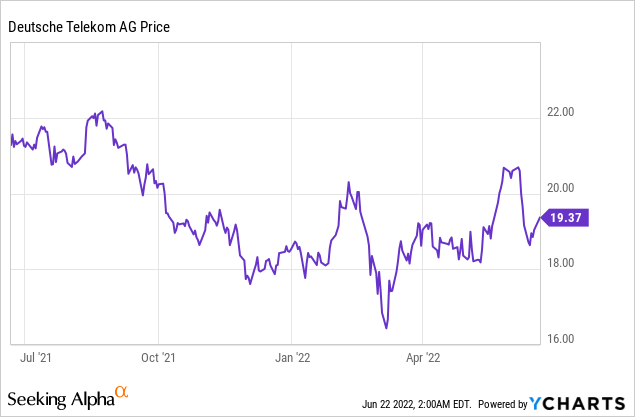

Since our article last February, the share price went up nearly 9%, outperforming the S&P500, which declined by almost 14% after the recent sell-off. Last month, the share went up to US$21 per share, as the management raised the full-year guidance: adjusted EBITDA AL to exceed €36.6 billion from €36.5 billion and FCF AL to be over €10 billion. This article will update the 1Q22 results, give our thoughts on how the competition will play out, and discuss our target price for the stock.

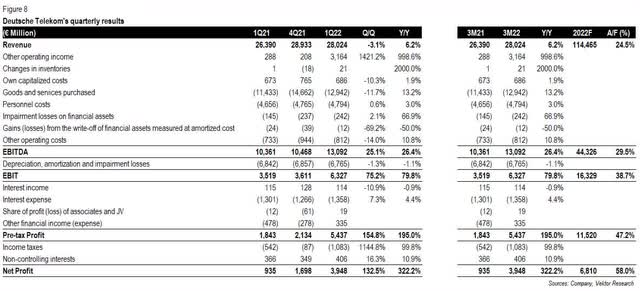

1Q22 Results: Solid Numbers Boosted By Gain From Deconsolidation

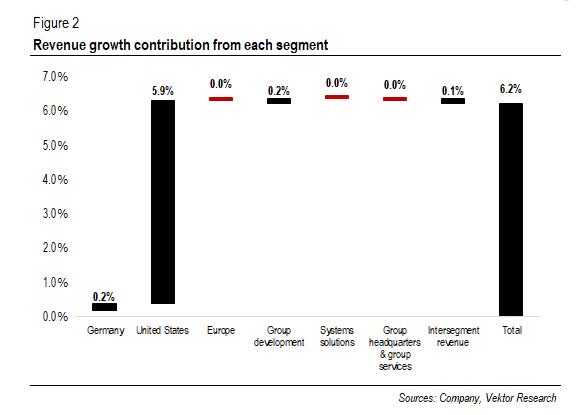

DT recorded revenue growth of 6.2% (Y/Y) in 1Q22, primarily supported by the T-Mobile US (NASDAQ:TMUS), which remains the growth engine for DT. In an article titled “TMUS Remains Ahead of the Curve” last month, we noted that T-Mobile’s 5G leadership would enable the company to gain market share in the industry. At the same time, its peers will try to retain their subscribers and encourage them to upgrade to premium plans.

Revenue growth contribution from each segment (Company, Vektor Research)

We see that T-Mobile will enjoy strong growth in the near term, but things will get more competitive once its peers have expanded their network coverage in the C-band spectrum. When asked about M&A possibilities, DT’s management did not give any clue but described increasing the stake in the U.S. as “the biggest return on M&A right now.” It aims to increase the stake to 50.1% from the current 48.4%.

Excluding the United States, the business is in “a strong EBITDA momentum.” For example, in Germany, DT’s revenue only grew 1% (Y/Y) in the quarter, but the EBITDA AL grew 3.6% (Y/Y). On the other hand, the European segment declined 0.1% (Y/Y), impacted by the sale of its 54% stake in the company’s Romanian fixed-line business back in 2021. Yet the company reported a 3.2% (Y/Y) adjusted EBITDA AL growth.

Revenue from group development rose 5.5% (Y/Y). However, please note that DT will no longer consolidate T-Mobile Netherlands in the future after selling 75% of its ownership in the business to private equity funds managed by Apax Partners LLP and Warburg Pincus LLC. The €5.1 billion deal was closed on March 31st.

Lastly, net profit jumped to €3.9 billion from €935 million mainly because of the gain from the sale of 50% of GlasfaserPlus to IFM Global Infrastructure Fund and T-Mobile Netherland deconsolidation totaling €2.6 billion.

Competitors Eyeing the German Broadband Market, Still Expect DT to Gain a Sizeable Market Share

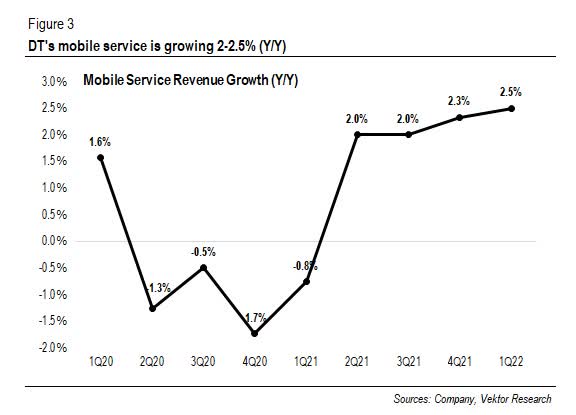

In the German market, mobile service revenue grew 2.5% (Y/Y) in 1Q22, which the management depicted as a “really strong mobile performance.” The company expects the impact from Lebara MVNO to fully materialize in the 3Q22 after the MVNO agreed to a deal that will bring in Telefonica Germany as a new wholesale partner.

DT’s mobile service is growing 2-2.5% (Y/Y) (Company, Vektor Research)

When asked whether it was “an acceptable situation” for DT only to be tracking the market growth despite heavy investments, the management acknowledged that some instances, such as Magenta, should have performed better. Yet, it also said that an increase of 2-2.5% “is healthy in the context of the vast majority of markets” and that the market growth “plays a much bigger role” in return on capital employed (ROCE) in a market with nearly equal market share among the incumbents.

In other words, this is in line with what we said in the previous article: the high penetration rate indicates that the market is now closer to saturation, and MVNOs have intensified the competition. And the 5G adoption might be slow given the low appetite to upgrade to the latest technology. To fight against inflation, the company is open to “taking out promotional pricing” in Germany but at the expense of an elevated churn rate.

Furthermore, the retail fixed revenue’s organic growth stood at 0.4% (Y/Y). Besides the one-off public income, the reason for the tepid growth is that the new TKG (Telekommunikationsgesetz) law removed the one-year automatic extension and gave customers a choice to terminate within a one-month cancellation period. As a result, the management estimates that the company lost about 30 to 40 thousand consumer net adds in mobile and between 25 and 30 thousand broadband lines this quarter.

Nevertheless, the management insisted that the newly-passed law did not materially impact the company since “no real change” was seen in the “gross add or churn momentum.” However, the mobile churn increased to 1.2% from 0.8% in 1Q21. So, the churn rate was “pulled forward,” churn that would have materialized next year. Second, the law will remove overlapping contracts. But, as we move forward to the subsequent quarters, the effect will “wash itself out of the system,” the management believes.

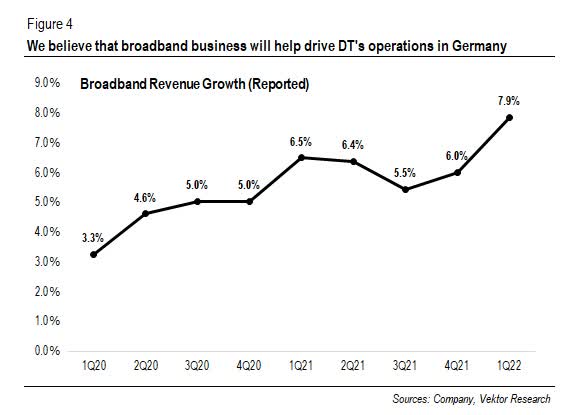

On the other hand, the broadband business posted organic growth of 5% (Y/Y) in 1Q22. The management said that the company is on track to add two million homes passed this year, which would make the total figure 5.4 million homes on fiber. According to the company, as the broadband penetration rate is now in the 80% range, it is safe to say that the growth driver will shift from volume to ARPU in the next three to four years, with the former possibly growing at ~2% and the latter above 2%–resulting in more than 4% growth. About 35% of DT’s customer base was on more than 100 Mbps (~12 MB per second), up by eight percentage points from the previous year.

Broadband revenue growth (reported) (Company, Vektor Research)

To accelerate the FTTH expansion, DT is still open to “a few JV conversations,” despite the already-established partnership with Glasfaser Nordwest and GlasfaserPlus. When asked whether alternative networks–or altnets–put pressure on DT, Srini Gopalan said that such pressure remains “reasonably limited and well within the scope of our current thinking on plans.” Nevertheless, he noted that altnets were “more fragmented” than initially thought and that “it’s a bit hard to call where that environment is going right now.”

While altnets are likely to provide competition to the incumbents, building fiber broadband is not an easy feat. For instance, an interesting article from telecoms.com pictured the competitive landscape in the UK, where altnets have hard times competing with the incumbents.

Instead, Vodafone, another big player, sees the German market as a lucrative opportunity, given its “significant structural growth opportunity for Vodafone,” as cited in the Fierce Telecom. Besides promoting fixed-mobile convergence, Vodafone plans to upgrade its hybrid fiber cable network and is pursuing “other fiber build opportunities,” reportedly preparing for a €10 billion investment in German fiber JV. Furthermore, Telefonica Germany formed a 50-50 joint venture with Allianz in 2020. And Liberty Global also joined the crowd by starting a joint venture with the private equity firm InfraVia Capital Partners to target FTTH deployments in underserved areas.

However, please note that the market still has ample room for growth. Despite the competition, we still think that DT’s ambition to build over 10 million homes by 2024, around 30% of the FTTH Council Europe target by 2026, will allow the company to capture a sizeable share in the nascent market. In addition, GlasfaserPlus aims to cover four million premises in rural areas by 2028, showing the intent to provide coverage in underserved locations. Overall, we estimate Germany’s revenue growth to reach 1% (Y/Y) in 2022F.

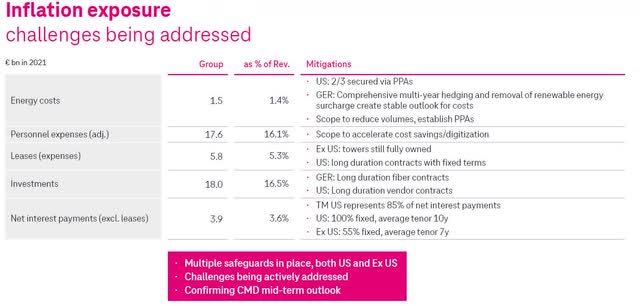

When asked about measures to deal with inflation, DT’s management said long-term contracts mainly protect Germany and the United States. Yet, it was not the case with the European segment because DT could not enter the multi-year hedges in many countries, said CFO Christian Illek. But he also mentioned the opportunities to “pass on some price to consumers,” thus resulting in “a higher momentum on net margin increase.”

Exposures and measures against inflation (Company)

Although the company believes that the consumer behavior in the European segment is unlikely to change when faced with price increases, we estimate revenue in Europe to be down 1.5% (Y/Y) and a margin decline this year.

Valuation

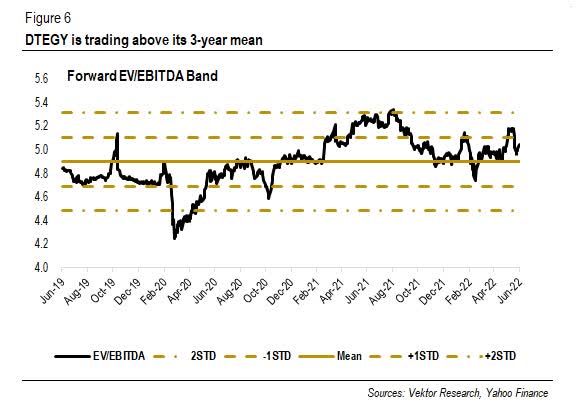

Deutsche Telekom is trading slightly above its 3-year mean. Figure 6 suggests that the market was willing to pay at the 3-year +1STD after the management raised full-year guidance last month. Even the multiple remains at the +0.5STD following the recent sell-off. Figure 7 shows that Deutsche Telekom’s EV/EBITDA is lower than some of its peers. But is the share a buy?

DTEGY 3-year forward EV/EBITDA band (Vektor Research, Yahoo Finance)

During pre-COVID days, DTEGY hovered between US$16 per share and US$18 per share. But it was not until early last year that the price breached the US$20 per share mark. We think investors are willing to pay more for the stock because T-Mobile’s acquisition of Sprint has given the company a competitive advantage, allowing T-Mobile to maintain above-average revenue growth (you can see the comparison here). In reality, T-Mobile US raised the full-year guidance for synergies from US$5 billion-US$5.3 billion to US$5.2 billion-US$5.4 billion. As such, postpaid net adds are expected to reach 5.3-5.8 million from 5-5.5 million. A strong T-Mobile performance justifies a multiple expansion, in our view.

With an estimated 2023F EBITDA of €43 billion, we arrive at a 12-month target price of US$20 per share (forward EV/EBITDA of 5.1x, 3-year +1STD), implying a 3.3% potential upside from the current share price, or 12% since our first article on DTEGY. Accordingly, we reiterate our HOLD call.

But what can go wrong? First, fewer customers are willing to upsell their broadband services. Second, higher-than-expected inflation would further drive costs, forcing the company to pass these expenses to customers. As a result, higher prices will result in an elevated churn rate.

In conclusion, we think Deutsche Telekom might be suitable for those who are looking for defensive stocks with stable dividends (3.65% yield, source: Seeking Alpha) and additional international exposure. Nonetheless, we can still expect some growth from the company thanks to the strong performance in the United States. If you have any thoughts, please comment below.

Be the first to comment