grinvalds/iStock via Getty Images

Always forgive your enemies; nothing annoys them so much.”― Oscar Wilde

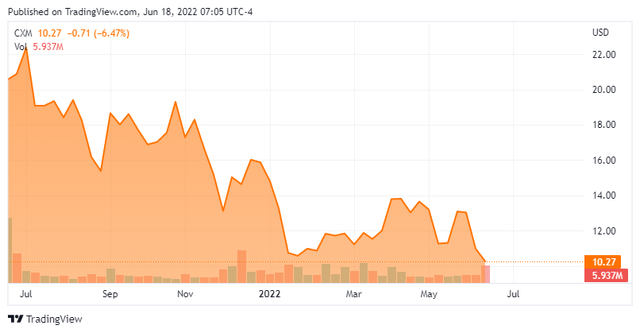

We are going to take our first look at Sprinklr, Inc. (NYSE:CXM) in this article. This mid-cap tech stock came public midway through 2021 during the midst of the pandemic. The stock has not held up to initial investor enthusiasm despite solid revenue growth and a balance sheet that is in good shape. The shares now find themselves deep in ‘Busted IPO‘ territory. Can the shares rebound? An analysis follows below.

Company Overview:

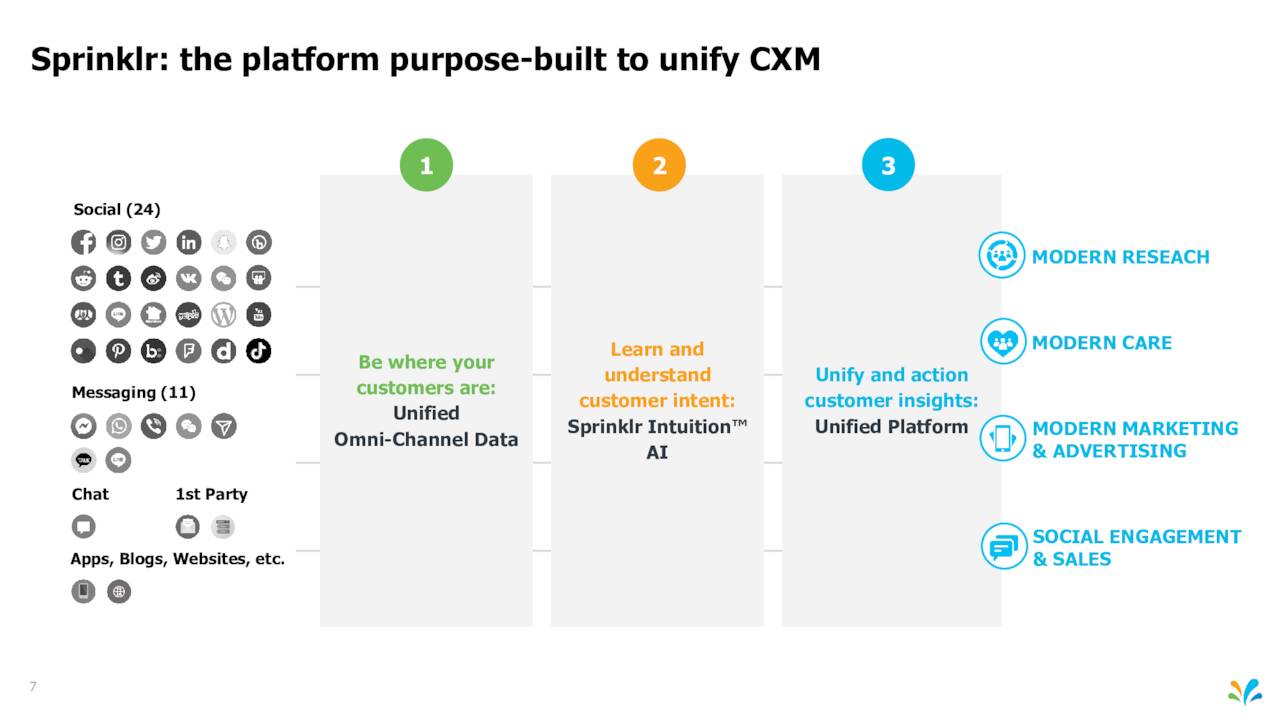

Sprinklr Inc. is located in New York City. The company provides a customer experience management (Unified-CXM) platform for modern enterprises. Its solution set is split into four broad categories: Modern Care, Modern Research, Social Engagement & Sales, Modern Marketing & Advertising. These platforms provide capabilities that enable AI technology that allows clients to gain valuable insights into their customers, as well to communicate with via various channels. Most of its revenues come via subscription services. The stock currently trades just over ten bucks a share and sports an approximately market capitalization of just south of $2.7 billion.

June Company Presentation

First Quarter Results:

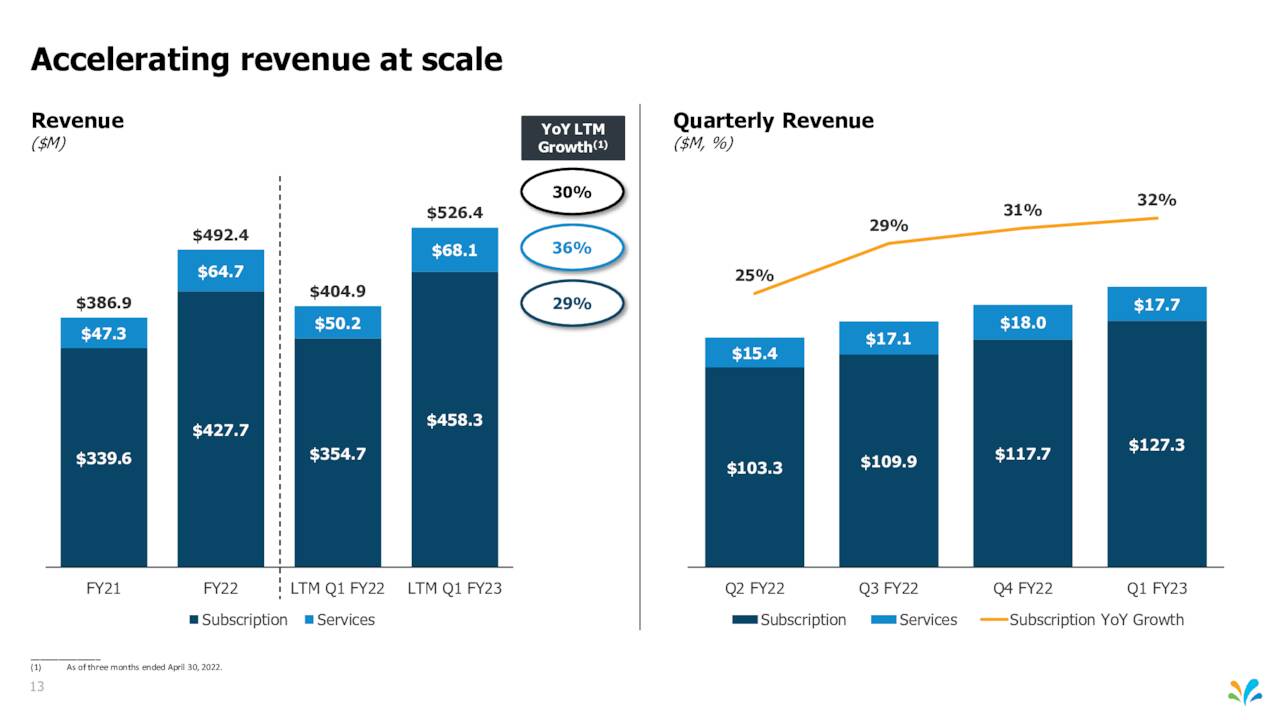

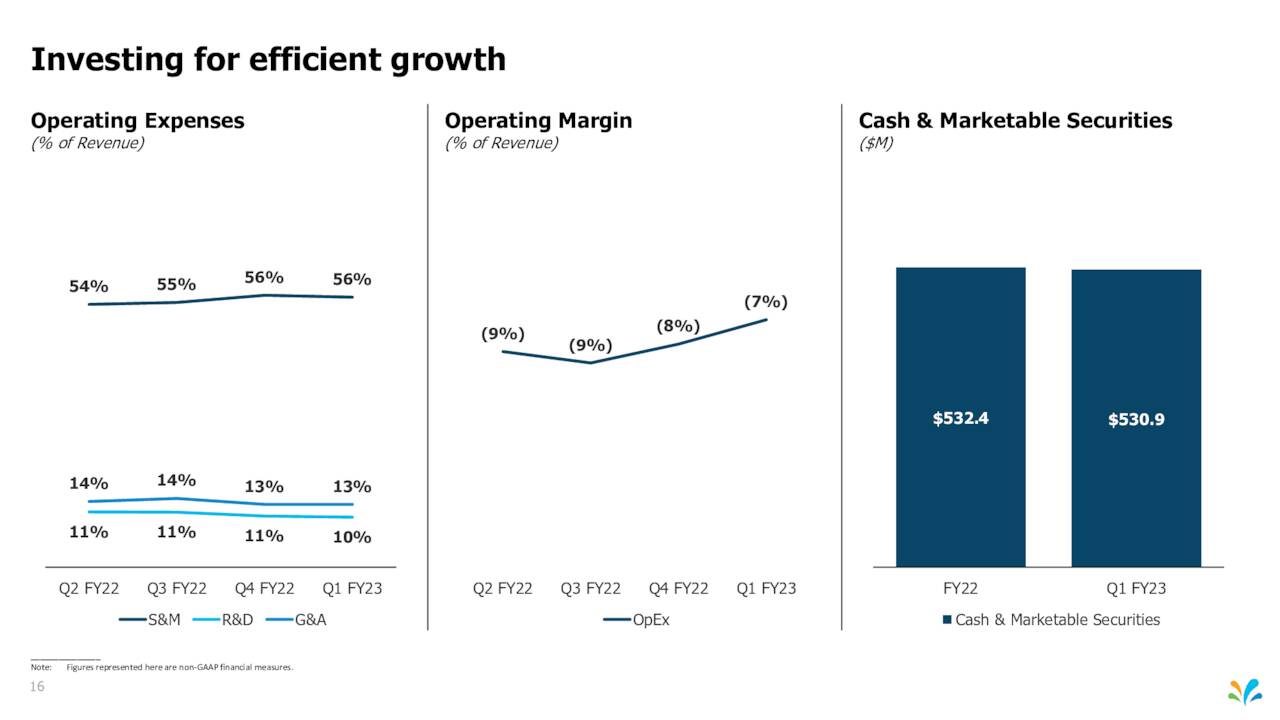

On June 14th, Sprinkler Inc. posted the first quarterly results of their 2023 fiscal year. The company had a non-GAAP loss of a nickel a share as revenues rose more than 30% over 1Q2022 to some $145 million. Both top and bottom line numbers slightly beat expectations.

June Company Presentation

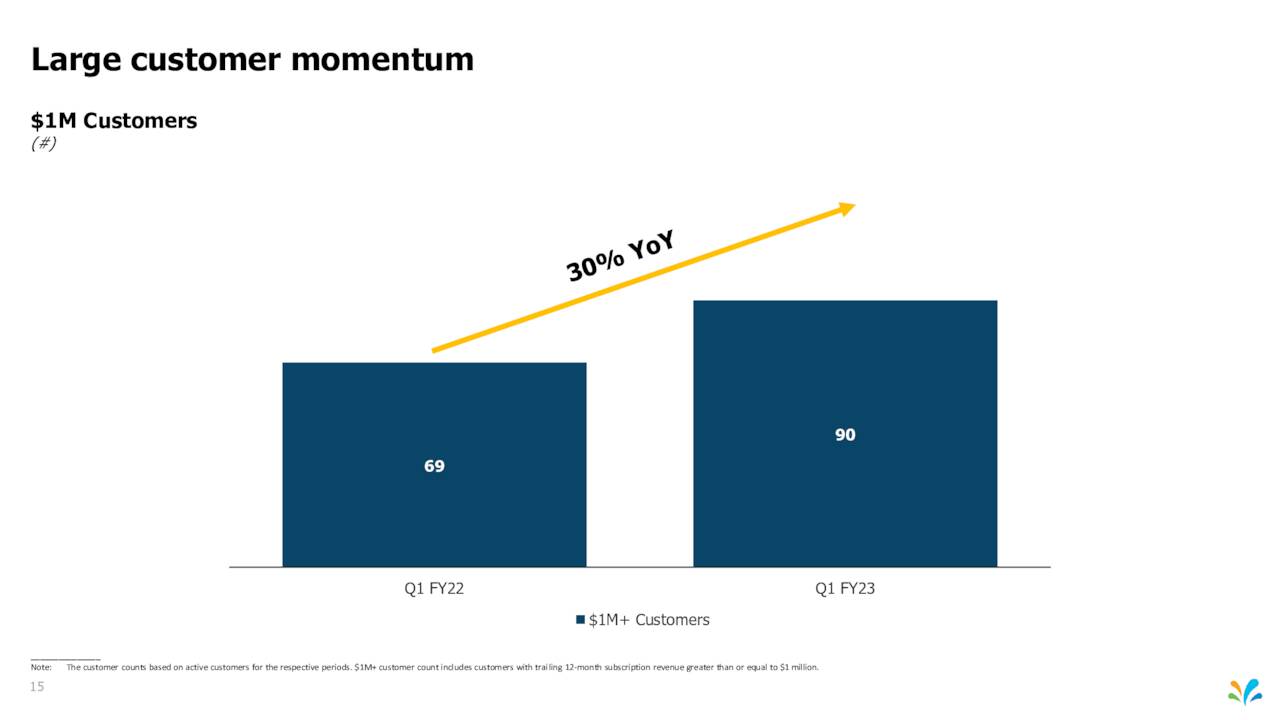

Subscription sales accounted for $127.3 million of overall sales and were up 32% from the same period a year ago. The company also increased its client count of customers who provided at least $1 million of annual revenues to 90, a 30% increase from 1Q2022.

June Company Presentation

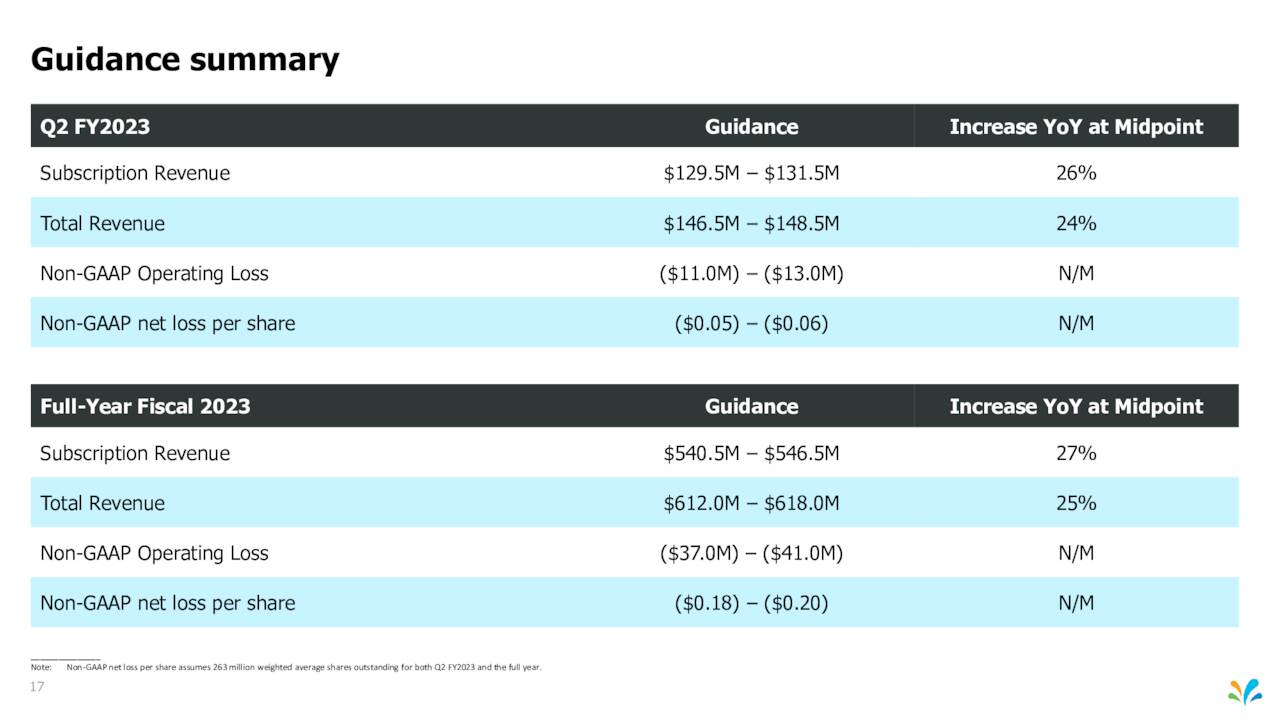

Leadership provided the following guidance for the 2023 fiscal year:

- Subscription revenue between $540.5 million and $546.5 million;

- Total revenue between $612 million and $618 million; and

- Non-GAAP net loss per share between $0.18 and $0.20, assuming 263 million weighted average shares outstanding.

June Company Presentation

Analyst Commentary & Balance Sheet:

Since 1Q2023 results posted, four analyst firms including JP Morgan and Stifel Nicolaus have reiterated Buy ratings. Two of these had slight downward price target revisions, one had a small upward price target revision. Price targets ranged from $15 to $16 a share. Both Citigroup and Morgan Stanley reissued their Hold ratings with identical $12 price targets.

Insiders are not backing up the truck to buy the dip in the stock yet. In fact, it appears the CEO sold most of his shares (over $15 million worth) in mid-April. Since then, several other insiders have sold just over $2 million shares in aggregate.

June Company Presentation

Just over three percent of the outstanding shares are currently held short. The company does have a pristine balance sheet. The company ended the first quarter with approximately $530 million worth of cash and marketable securities against some $80 million of long term debt. Leadership has guided to a Non-GAAP operating loss between $37 million and $41 million in FY2023, which the first quarter has posted.

Verdict:

The current analyst consensus sees Sprinklr losing some 20 cents a share in FY2023 as revenues rise some 25% to $615 million. They project roughly 20% sales growth in FY2024, where losses will nearly be cut in half.

The market has not been kind to profitless companies so far in 2022, regardless of their growth prospects. Given the amount of cash on the company’s balance sheet, shareholder do not have to worry about dilution. The stock sells for just over four times forward revenues, a bit under if you take the net cash on the balance sheet into the equation.

That is not unreasonable given Sprinklr’s growth prospects. However, given the current market sentiment on these types of names, tepid support from the analyst community, and continued insider selling; I am passing on any investment recommendation on this stock at the current time. This is a name we may revisit as the company gets closer to turning a profit, market sentiments shifts more into a ‘risk on‘ mode, and/or insiders start to purchase the shares in a significant way.

One of the keys to happiness is a bad memory.”― Rita Mae Brown

Be the first to comment