Getty Images

Investment Thesis

Deutsche Telekom (OTCQX:DTEGY) might be one of the most solid, least volatile companies in the world. The Telecommunications giant is at the same time actively expanding its business by buying shares of T-Mobile US (TMUS). This gives it a lot more growth prospects in the future, as it broadens its exposure and diversifies the business. The Telecommunications sector is well known for its inflation-proof business model, and this might be exactly what investors need in these uncertain economic times. In these times of extreme inflation, interest rate hikes, and recession threats, all you want is a company whose cash flows are safe and growing.

Deutsche Telekom is one of the largest positions in my portfolio, because of the points mentioned above. I believe Deutsche Telekom is a strong buy on strong business fundamentals, with good cash flows, strong growth potential, a recession-proof business model, strong dividend yield, and a cheap valuation. In this article, I will take you through the business fundamentals and show you why I am so enthusiastic about this company.

(Please be aware that Deutsche Telekom reports in Euro)

Deutsche Telekom

Deutsche Telekom is one of the leading telecommunications companies. The company had 248 million mobile subscription customers, 26 million fixed-network lines, and 22 million broadband lines. The company is present in over 50 countries and employs 216,500 employees throughout the world. Deutsche Telekom generated revenue of €108,8 billion in FY21. This is what Deutsche Telekom adds to this on their website:

Today, we are developing from a classic telephone company into a service company of a completely new type: the software company that sells telecommunications services. Because only a Telekom that is digitalized in all areas can continue the successful path of the past years. With our presence in Europe and the USA, we are ideally positioned for this. We want to become the leading digital telco. The core business, i.e. the operation and sale of networks and connections, will remain the basis.

As stated above, the company also has exposure in the US. This is through partial ownership of T-Mobile US. Fierce Wireless reported on the 11th of August that Deutsche Telekom now owns 48.4% of T-Mobile US shares. Chief Executive Timotheus Hoettgas said that Deutsche Telekom expects to have a majority ownership (50%+) way before its earlier target of 2024. This investment is crucial for Deutsche Telekom since T-Mobile US has been the main growth driver and possibly will be over the coming years. Earlier this year, Deutsche Telekom paid $2.4 billion to SoftBank Group to increase its stake.

Performance

Deutsche Telekom reported very strong results last August. Revenue grew by 5.9% to €28.2 billion and adjusted EBITDA grew by 5.0% to €9.9 billion. Free cash flow was €2.8 billion and adjusted net profit grew by 15.7% to €2.4 billion.

Looking at these results we can see the company managed to grow strong and steady. Cash flows were excellent and there was no slowdown to find in these numbers, despite the economic turmoil. Guidance for FY22 was raised for the second time this year, something we love to see. The company now expects adj. EBITDA to come in at 37 billion and free cash flow of €10 billion. This performance was supported by strong results in Germany and record consumer growth at T-Mobile US. The growth course in Europe continued as expected. The company invested €5 billion in Capex, excluding expenses for mobile spectrum, during the second quarter. This was an increase of 16.3% compared to the same quarter last year.

If we look at the performance per region, we can see that Germany delivered strong financials. Revenue grew by 2.7% YoY to €6.1 billion and adj. EBITDA recorded even stronger growth of 3.1% to €2.4 billion. This corresponds to a 40% margin and earnings growth for a whopping 23 quarters in a row. With Germany being one of its biggest markets, growth in this region is crucial for company performance.

In the US postpaid net additions were at a record of 1.7 million new subscribers. This was a record Q2, and more than competitors Verizon and AT&T combined. The total customer base increased to a total of 110 million, an increase of 5.2 million YoY. Total revenue at T-Mobile US decreased by 1.1% during the last quarter, to $19.8 billion (please note, T-Mobile US reports in dollars). Adj. EBITDA did decline by 2.4% to $6.7 billion. T-Mobile US also increased its guidance to $22.7 billion, from $22.4 billion. For the number of postpaid subscriptions, the company now expects a 6%-6.3% increase YoY. That is about 600,000 more than were expected at the end of the first quarter.

For Europe, the growth course continues. Adj. EBITDA grew 4.5% YoY, all organically, making it 18 consecutive quarters of growth in a row. Revenue recorded organic growth of 4.2% YoY. 243,000 mobile contract net additions were recorded in the second quarter. Broadband net additions were at the same level as in the previous quarter at 70,000.

This shows Deutsche Telekom performed great over all regions. The consecutive growth quarters for its European and German regions show the incredible performance of the company and the steadiness of its business. The financials of this company are incredibly consistent and resistant.

Finally, I want to look at the outlook for FY22. Deutsche Telekom expects sales to come in flat compared to last year. EBITDA is expected to grow from €36.5 billion last year to €36.6 billion this year. Free cash flow is expected to come in at €10 billion, which is a decent increase from last year’s €8.4 billion. This is what the company wants to do to achieve these results:

Germany: Telekom Deutschland will maintain its clear market leadership. We accelerate the roll-out of our networks: by 2024, we will reach around 10 million households with FTTH and increase our 5G coverage to over 97 percent. This will enable us to accelerate growth in the residential and business customer segments. By systematically exploiting the opportunities offered by digitization, we will reduce costs and improve our earnings and return on equity.

USA: T-Mobile US is integrating the acquired wireless company Sprint and is rapidly rolling out its nationwide 5G network.

Europe: The positive trend of recent years in the traditional communications markets of our Europe operating segment will continue in the next years. Growth is being driven by a further increase in demand for mobile data and broadband and pay TV lines.

Just as I did in my previous articles, I always like to take a look at the growth of the company’s financials over the last 5 years. These are the numbers for 2Q17:

- Revenue of €18.9 billion

- Adj. EBITDA of €5.9 billion

These results show us revenue grew with an 8% CAGR over the last 5 years. For adj. EBITDA this was a 10.76% CAGR. For a business like Deutsche Telekom, this is really strong growth. Growth is way stronger than American peers Verizon (VZ) and AT&T (T).

Returns

Now that we know how the financials of this company evolved and grew over the last quarter and last few years, it is interesting to see if the stock price did the same.

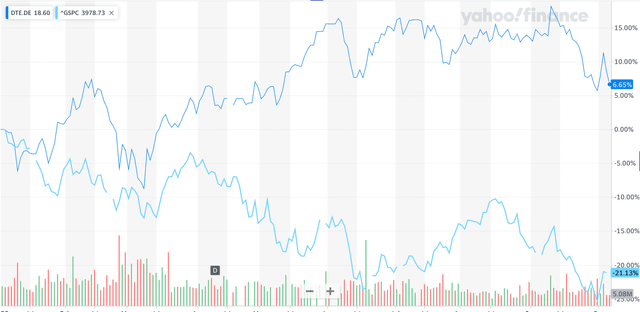

Deutsche Telekom stock performance (Yahoo Finance)

In the graph above we can see that Deutsche Telekom put down a decent performance so far this year. Deutsche Telekom stock is 6.65% higher and way outperforms the S&P500 by a fair margin. This is a really strong performance from the stock, but also at the same time you expect it to perform this way. It is seen as a safe harbor in a high inflation environment, because of its recession and inflation-proof business model. But how did the stock perform compared to its peers?

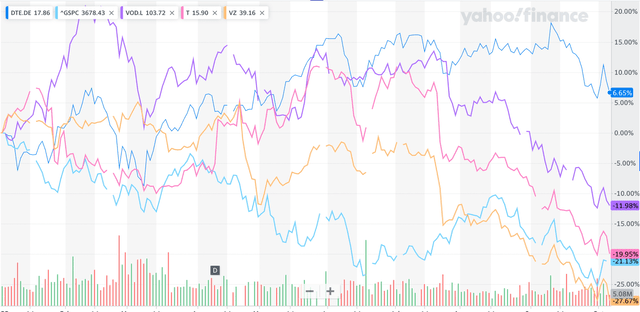

Deutsche Telekom performance vs peers (Yahoo Finance)

If we compare the performance to its peers, we can see Deutsche Telekom way outperformed any of its peers. Verizon put down a horrible performance with a loss of over 27%. Deutsche Telekom is the only one putting down a positive performance. In this graph, I compared them to Vodafone (VOD), AT&T, and Verizon. Finally, let’s see if the stock performance of Deutsche Telekom shows us the same improvement as its financials showed us earlier.

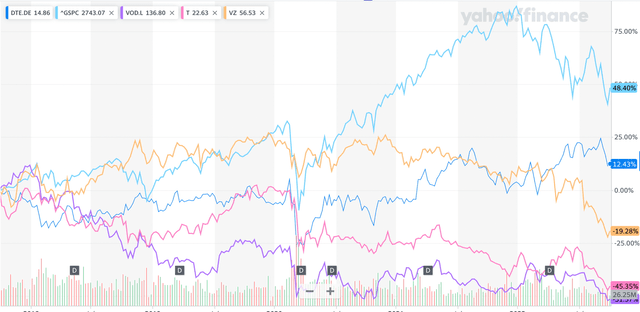

Deutsche Telekom 5 year performance vs peers (Yahoo Finance)

If we look at the 5-year performance, knowing how well Deutsche Telekom did so far this year, it is a bit disappointing. The stock only managed to return 12.43%. This is an underperformance compared to the S&P500 which returned 48.4% over the last 5 years. We do have to note that Deutsche Telekom is the only one of its peers to show positive returns. Deutsche Telekom is not a stock to outperform the global benchmarks. It is a stock that pays a solid dividend and where your money is as safe as possible against global downturns, recessions, or high inflation. Still, I believe 12% returns are too little for a company growing its EBITDA by over 10% CAGR over the last 5 years. Of course, this does mean valuation has come down over the years.

Valuation and Financials

Deutsche Telekom has a market cap of approximately $90 billion and a forward P/E of 10.88. For comparison, Vodafone had a forward P/E of 11.72, AT&T had a forward P/E of 6.35 and the P/E ratio for Verizon is 7.47. This makes Deutsche Telekom the 2nd highest valued of the 4. It is important to note that both Verizon and AT&T are seeing a loss of market share combined with negative revenue growth.

The company had a total of $5.28 billion in cash on the balance sheet and $157 billion in total debt. This seems like a lot of debt, and it is. But the company has this well under control and receives a BBB financial rating from S&P Global.

Deutsche Telekom receives a strong buy rating from Seeking Alpha Quant rating. This is supported by great profitability for which the company receives an A+. For valuation, the company receives a C+ rating, mostly supported by its cheap forward P/E which is a 20% discount to the industry average.

This is all shows us that Deutsche Telekom has a strong balance sheet with its debt under control. According to Seeking Alpha, the company is 20% undervalued on a P/E basis.

An important part of an investment in Deutsche Telekom is the dividends. The company pays a 3.48% forward dividend yield. This yield receives a Seeking Alpha Quant rating of B- and is 10% higher than the industry average. Although the company does only receive a D for dividend safety and D+ for dividend growth. The dividend growth rate over the last 3 years has been a mere 0.58%. This is almost 0 and so, not very good. The company has been paying a dividend since 2004, so for 18 years straight. It did not grow its dividend every year and even cut it in 2010 and 2018. The dividend cuts are not great, and this is the reason for the lower rating the company receives for safety. The company does still pay a decent yield and the dividend payout ratio is 47% which seems safe enough to me.

This is what management says about the dividend policy:

“Our dividend policy is to pay out 40 to 60 percent of the adjusted net income per share. The dividend for 2021 was € 0.64. We guarantee a minimum dividend of € 0.60 per share.”

Threats

Honestly, I do not see many threats to the business of Deutsche Telekom. The services the company offers are critical to society and so people and businesses are forced to use its products and services. The company does not have a lot of competitors in Europe and is by far the biggest in market share, which gives it a lot of pricing power. The barriers of the industry are too high for newcomers to enter, so this is no threat. An economic slowdown and a recession are possible over the coming quarters. This will have an impact on consumer spending, only the hit for Deutsche Telekom, if such a thing would happen, would be very small. This is mainly because of the point I started with: the company is irreplaceable and critical in today’s society. I honestly see no problems for Deutsche Telekom. It is important to note that the company may not give you an outperformance vs the S&P 500. The company is a slow, but steady, growing giant.

Reasons to invest

The ending of the previous quarter is also immediately the first reason to invest in this company. The company is a slow, but steady, growing giant. The company has reported over 18 consecutive quarters of growth, which is incredibly steady and shows this is a solid company that is very predictable. Growth might slow down in the near term, but long-term growth will remain intact. The services and products the company offers are crucial in today’s society and the company is irreplaceable. This makes the company one of the most reliable investments you can invest in. The company does not have any real threats and is solidifying its position in the industry by buying a bigger share of T-Mobile US. This company will be the main growth factor over the coming years, because of the great potential it still has. It is currently destroying its competitors in the US and gaining market share quickly. Deutsche Telekom is also still seeing very strong growth in Germany, its main market. The moat and strength of the business are incredibly strong, recession resistant, and inflation-proof.

Where the company may not grow very quickly, the reliability under any circumstances and the good dividend yield do make it a very nice income investment. Yes, dividend growth is not great, this is a big downside for dividend investors. It is just not for everyone, I guess. The current dividend payout is safe, and management has this well under control. The company is not a big fan of buying back its shares over the last few years. This is mainly because management prioritizes buying more shares of T-Mobile US with their free cash flow, over returning this to shareholders. I think this is a sign of management having their priorities in order: business growth before shareholder returns. I cannot agree more with management on this front.

This company is one of my biggest personal investments and one of my highest conviction stocks. Besides the dividend growth investors, I do not see any reason for anyone to not own this stock. Even high growth portfolios need a solid and reliable strength, and this is the one. Valuation is not the cheapest, but still cheap enough to rate the stock a Strong Buy. The recent dip creates an excellent buying opportunity.

Be the first to comment