ollo/iStock Unreleased via Getty Images

Introduction

On October 8th I wrote my initial thesis on Deutsche Telekom (OTCQX:DTEGY), and I rated the stock a strong buy. In that article, I concluded the following:

The company is a slow, but steady, growing giant. The company has reported over 18 consecutive quarters of growth, which is incredibly steady and shows this is a solid company that is very predictable. Growth might slow down in the near term, but long-term growth will remain intact. The services and products the company offers are crucial in today’s society and the company is irreplaceable. This makes the company one of the most reliable investments you can invest in. The company does not have any real threats and is solidifying its position in the industry by buying a bigger share of T-Mobile US. This company will be the main growth factor over the coming years, because of the great potential it still has. It is currently destroying its competitors in the US and gaining market share quickly. Deutsche Telekom is also still seeing very strong growth in Germany, its main market. The moat and strength of the business are incredibly strong, recession resistant, and inflation-proof.

Where the company may not grow very quickly, the reliability under any circumstances and the good dividend yield do make it a very nice income investment. Yes, dividend growth is not great, this is a big downside for dividend investors. It is just not for everyone, I guess. The current dividend payout is safe, and management has this well under control. The company is not a big fan of buying back its shares over the last few years. This is mainly because management prioritizes buying more shares of T-Mobile US with their free cash flow, over returning this to shareholders. I think this is a sign of management having their priorities in order: business growth before shareholder returns. I cannot agree more with management on this front.

For a deep dive into Deutsche Telekom, I highly recommend reading that article. Now within this second coverage of Deutsche Telekom, I want to reflect on the recent quarterly results presented by the company last week. Since my previous article, we have had two CPI reports from the US and the inflation trend seems to be turning downward. This is a strong push for the markets as we saw last week when the Nasdaq won over 7% in a single day.

Deutsche Telekom has been increasing, but it had a bit of a lesser week last week. The stock is up by over 11% at the time of writing since my initial coverage.

Where the CPI reports are turning more positive for the economy and the markets, I think the global economic outlook did not change for the good over the last month and I have become a bit more negative about the economy as I believe we will be entering a recession in 2023. I hope the markets have already bottomed last week, but I do not think so.

Now, let’s see how Deutsche Telekom did over the latest quarter, despite all economic headwinds, and whether these results change my long-term thesis on Deutsche Telekom.

Quarterly results

It was a good news quarter. Revenue increased by 8.8% to €29 billion and net profit increased by 80% to €2.4 billion. Growth across the board continued and the business remained strong. Over the first nine months of the year, Deutsche Telekom saw strong growth as well, as core EBITDA increased by 5.9%. Free cash flow was up by 13.9% during the first nine months and EPS increased by 47.4%.

Deutsche Telekom increased its outlook for the third time this year and now expects EBITDA to come in above €37 billion from around €37 billion before. EPS is expected to be €1.50 from €1.25 for FY22. On top of this Deutsche Telekom also announced a 10% dividend increase. The forward dividend yield stands at a very solid 3.39%.

If we look at the different regions we can see the US was the main driving force behind the growth so far this year as T-Mobile US (TMUS) saw EBITDA growth of 7% and free cash flow of €5.3 billion. T-Mobile US grew its user base by a strong 4.6 million, showing real strength within that company, of which Deutsche Telekom now owns close to 50%.

For Deutsche Telekom, ex-US growth was not as strong, but an increase anyways. EBITDA grew 4.3% organically and free cash flow was €4.1 billion.

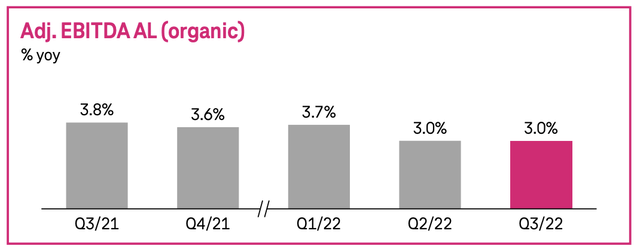

All in all Deutsche Telekom is having a strong year of growth across the board and seems to be quite resilient against all of the economic turmoil going on. This resulted in the third increase in the FY22 outlook as Deutsche Telekom has now increased the outlook every quarter. T-Mobile US remains to be the fastest-growing mobile provider in the US and new customer additions over the first nine months of the year were more than Verizon and AT&T combined. At the same time, growth in Germany continues despite the already leading position of Deutsche Telekom. We did witness a slight slowdown in growth over the last year for EBITDA in Germany.

Germany segment EBITDA growth (Deutsche Telekom)

At the same time, Deutsche Telekom did speed up its growth for broadband and home internet additions again in the latest quarter. Remarkably as well, or maybe not at all, is that data usage saw a strong increase of 35% YoY. This might be as expected as the long-term trend is up because we are being more and more reliant on our internet for all services. Yet, at the same time, a potential recession and less consumer spending are being witnessed across all industries but apparently, people are willing to spend more on their internet compared to last year. This could also be an increase as people need more internet since they go out of the house more often after the covid pandemic lockdowns.

Organic revenue for Europe increased slightly for the 19th consecutive quarter, yet some weakness is visible as revenue dropped by 1.1%.

I am very happy with this quarter for Deutsche Telekom as growth remains strong. We should be aware of some weaknesses in the companies’ financials as we are starting to see some impact of a difficult economy. Of course, the increase in the outlook and strong free cash flow make it a very solid quarter.

Balance sheet and valuation

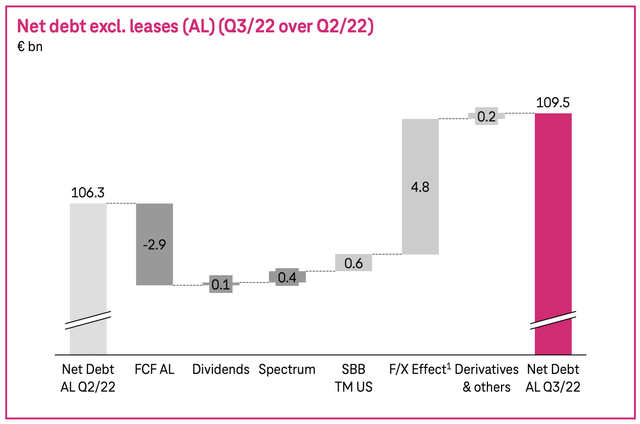

Net debt for Deutsche Telekom is up compared to the previous quarter mainly due to FX effects.

Balance sheet (Deutsche Telekom)

Of course, I would be happier if Deutsche Telekom would be able to lower its net debt position, but this is not something to worry about for Deutsche Telekom as the company has very reliable cash flows and no issues with paying down its debt. Deutsche Telekom receives a BBB+ rating from Fitch and BBB from S&P global. The company receives an A+ rating from Seeking Alpha Quant for its profitability. Dividends are also well covered by free cash flow and the payout ratio stands at a safe 47%.

Deutsche Telekom is currently valued at a forward P/E of 11.35, 22% below the sector average and below its historical valuation. P/E is slightly higher than a month ago when it was 10.88. The company is still cheaply valued by all metrics and receives a B rating from Seeking Alpha Quant.

Risks

As for the risks, not much has changed since last month and my view of the company remains the same.

Honestly, I do not see many threats to the business of Deutsche Telekom. The services the company offers are critical to society and so people and businesses are forced to use its products and services. The company does not have a lot of competitors in Europe and is by far the biggest in market share, which gives it a lot of pricing power. The barriers of the industry are too high for newcomers to enter, so this is no threat. An economic slowdown and a recession are possible over the coming quarters. This will have an impact on consumer spending, only the hit for Deutsche Telekom, if such a thing would happen, would be very small. This is mainly because of the point I started with: the company is irreplaceable and critical in today’s society. I honestly see no problems for Deutsche Telekom. It is important to note that the company may not give you an outperformance vs the S&P 500. The company is a slow, but steady, growing giant.

The single thing that did change is that I think that Deutsche Telekom might be impacted more severely by an economic downturn expected in 2023. Growth may stall for Deutsche Telekom in 2023, although I do not expect the company to lose a lot as I project revenue to be flat. Analysts are expecting solid low single-digit growth for Deutsche Telekom in 2023 and 2024. I think it is important to keep an eye on financials over the next few quarters.

Conclusion

My Long-term view of Deutsche Telekom remains unchanged. Deutsche Telekom is a slow-growing giant, with few long-term risks. Within the current economic climate and the risks of a recession getting bigger, it is no bad choice to invest in solid companies with strong cash flows. The need for internet services will only increase, and people and businesses will remain to be dependent on internet services. Deutsche Telekom is perfectly placed to benefit. The almost 50% stake in T-Mobile US will remain to be a growth driver as the fastest-growing provider in the US. T-Mobile is increasing its subscriber numbers at a rapid pace and is by far the most innovative provider in the US. Deutsche Telekom plans to keep increasing its stake in T-Mobile over the next few years, to gain a majority stake.

Growth may not be the most impressive, but growth is risk-free and the solid dividend yield will support shareholder returns. Deutsche Telekom remains to be undervalued and therefore I do not change my rating for Deutsche Telekom and rate it a Strong Buy.

Be the first to comment