CalypsoArt

After the bell on Monday, we received third quarter results from small electric vehicle maker Arcimoto (NASDAQ:FUV). I’ve warned investors in the past to avoid this name or even short it, as major losses and cash burn have led to tremendous dilution. The latest quarterly report showed many of the same negative trends continuing, but I’m also afraid today that the announcement of a reverse split could send shares much lower still.

When looking at the Q3 financials, the picture is extremely ugly. Total revenues came in at a little more than $2 million, while the few analysts that follow this name were looking for between $3 million and $5.4 million. This was 35% topline growth over the prior year period, but that’s not saying much at these levels. In early 2020, analysts thought this name could do over $33 million in revenues for Q3 2022, but between covid and supply chain constraints, sales have come in at a small fraction of that.

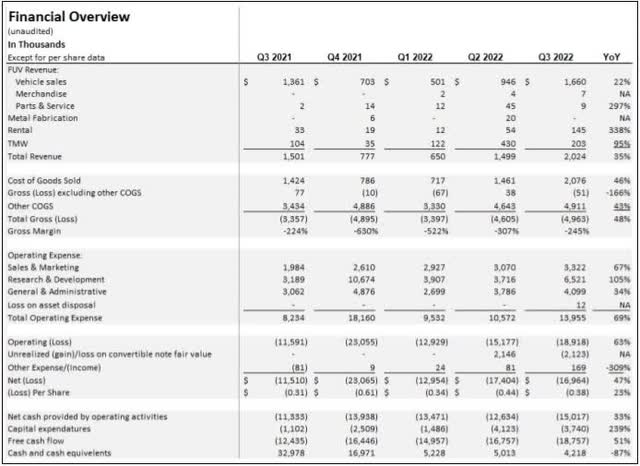

The bad Q3 sales figure follows in the footsteps of a terrible Q2 report, where the company also missed street estimates. However, the main problem here is that at such low sales numbers, the company is nowhere near profitability. The gross loss in Q3 was nearly $5 million, implying a gross margin of negative 245% for the period. Throw in the rest of the company’s expense base, and the net loss was nearly $17 million, up 47% over the prior year period. The graphic below shows the company’s financial overview over the past year.

Q3 Key Results (Quarterly company filing)

These massive losses aren’t good for any company but especially one that doesn’t have a large cash balance. Arcimoto cannot continue to burn $17 million or so every three months and expect to stay in business forever. While management has previously announced some restructuring efforts, it remains to be seen how much they will improve the overall financial picture in the coming quarters. The company’s vehicles are a niche product, and it’s hard to appeal to the mass market when consumers are dealing with high inflation and experts are warning of the potential for a recession and rise in unemployment during 2023.

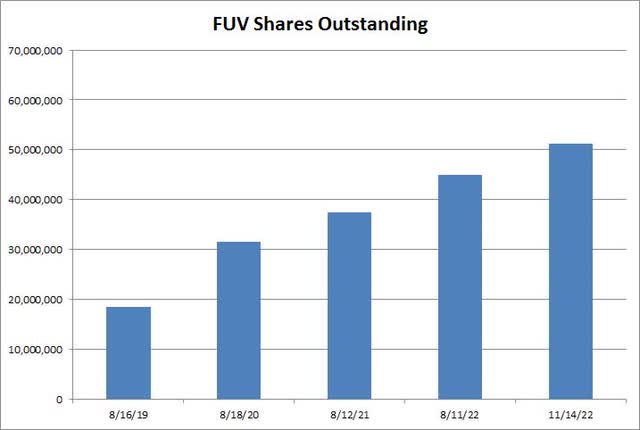

I warned investors back in January that massive dilution would be coming, and that is something we have seen quarter after quarter since. At that time, the outstanding share count was already over 37 million, which itself was more than double where it was in August 2019. The company has used an at-the-market equity offering program to raise some money, along with other negotiated deals with third parties to raise funds through convertible debt and equity sales. Unfortunately, it’s hard to bring in a lot of dough when you trade at just 60 cents right now, which has resulted in another surge in the share count over the past three months, as seen below.

Arcimoto Shares Outstanding (Company filings)

When stock prices get this low, the company risks being de-listed or having investors completely shy away from a name trading below a dollar. One way to get back in the game is to enact a reverse stock split, and that’s exactly what was announced on Monday afternoon. The board approved a reverse split at a ratio of one-for-20, which will become effective on November 29, 2022 after the close of trading. The reverse split will reduce the number of shares of common stock issued and outstanding from approximately 51.2 million to approximately 2.6 million.

At the same time, the company announced that the number of authorized shares has been increased from 100 million to 200 million. This figure will not be impacted by the reverse split. Thus, expect a lot of share sales to occur after the reverse split, which will likely take the share count up dramatically moving forward. As a reminder, even if Arcimoto reduces its Q3 2022 cash burn by a third moving forward, it would still burn nearly $50 million over the next twelve-month period.

Arcimoto shares were trading at 58 cents in Monday’s after-hours session. That would imply a post reverse split price of $11.60, but we’ve seen many names in the past fall once those reverse splits approach and then go into effect. If the company were to average stock sales at even $7 per to raise the above-estimated money, that’s another 7 million shares of dilution coming, which would take the share count almost up to 10 million. If shares drop even more, the dilution could be several times over, further sending the stock lower.

In the end, Arcimoto announced another terrible set of Q3 results, so investors should continue being bearish here. Revenues widely missed street estimates that have been dramatically reduced in recent years, and net losses and cash burn remain quite large. With the company having to raise money basically every quarter now to stay alive, dilution has piled up significantly already, and more will likely come after the reverse split later this month. This name has already gone from the low $30s to barely over 50 cents, so it wouldn’t surprise me to see the stock drop back down to the low- to mid-single digits again after the reverse split occurs.

Be the first to comment