AM-C

Thesis

Few companies have given investors so much headache as the Deutsche Bank (NYSE:DB). Ever since the great financial crisis, the company’s stock was pressured by non-existent profitability, a business strategy aimed at shrinking the bank and scandals. As a consequence, DB stock never reclaimed the valuation that it enjoyed 15 years ago. In fact, the stock still trades more than 90% lower from the all-time highs.

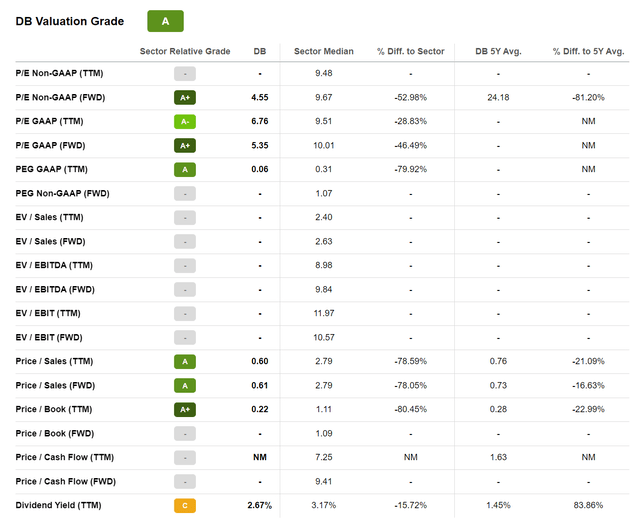

While I am not a fan of investing in companies with a history of such underperformance, I believe the stock is a clear bargain. For reference, Deutsche Bank stock trades at a one-year forward P/E of 5.35x and a Price to book of 0.22x.

I see about 120% upside as I value DB stock based on a residual earnings framework and analyst consensus EPS. My target price is $16.17/share.

About Germany’s Biggest Lender

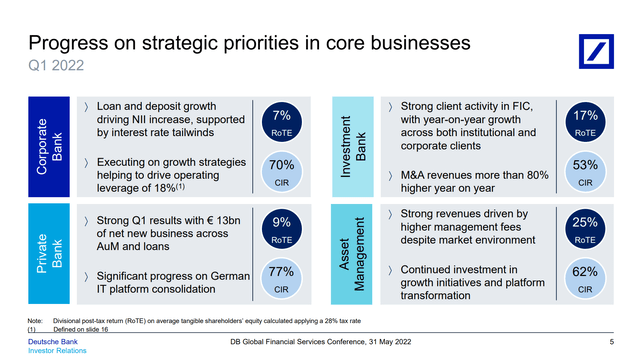

Deutsche Bank is Germany’s biggest lender with about €1.343 trillion of total assets and more than €24 billion annualized revenue as of Q1 2022. The bank operates four key business segments: the corporate bank, the investment bank, the private bank and the asset management arm known as DWS. The investment bank is the group’s most important segment accounting for about 45% of sales, followed by the private banking segment with about 30% of sales, followed by the corporate bank with about 17% of sales and asset management with about 8%. Please note below the company’s strategic RoTE and CIR targets for the respective segments.

Finally, Profitable Again

After a long history of negative profitability, that stretches back to the financial crisis, Deutsche Bank managed to deliver a profitable FY 2020 and 2021. In 2021, DB’s ROTE was about 3.8% and the company managed to generate earnings from continuous operation of about $2.95 billion.

I remain optimistic for Deutsche Bank’s 2022 outlook, as I believe the company can sustain profitability amidst market volatility and rising interest rates. While I do expect increased provisions for credit-losses, as a slowing economy in combination with higher interest rates will likely push some borrowers into bankruptcy, I believe rising interest rates are a clear positive for the bank. Moreover, I believe Deutsche Bank’s asset quality is less exposed to a downturn than most investors might think. The number one driver for credit-losses in a downturn is the amount of credit expansion during an economic upswing. And Deutsche Bank has consistently shrunk its balance sheet for many years.

Finally, investors should consider that Deutsche Bank is very strong in FICC trading. This segment, as indicated by Q2 2022 results of Citigroup (C), JPMorgan (JPM) and Goldman Sachs (GS), should support DB’s revenue and earnings strength in 2022. As market volatility is expected to stay elevated, Deutsche Bank’s trading desks could likely offset any slowdown in M&A and general investment banking.

Valuation Is Ridiculously Cheap

Deutsche Bank’s valuation is ridiculously cheap. Based on a $16.5 billion equity valuation (market capitalization) DB stock trades at a 0.22x price-to-book ratio, a 5.35x price-to-earnings ratio and a 0.6x price-to-sales valuation. Most notably, this is a more than 100% discount to US banks such as Morgan Stanley (MS), Goldman Sachs and J.P. Morgan. While these banks certainly deserve a considerable premium – given their enormous strength of brand, global recognition and leading position in most banking services – the premium is stretched too far, I argue. For reference, JPMorgan currently trades at a 1.3x price-to-book, an 8.3x price-to-earnings and a 2.7x price-to-sales. If we look at a general sector comparison as calculated by Seeking Alpha, we find a consistent discount between 50% – 80% for all multiples.

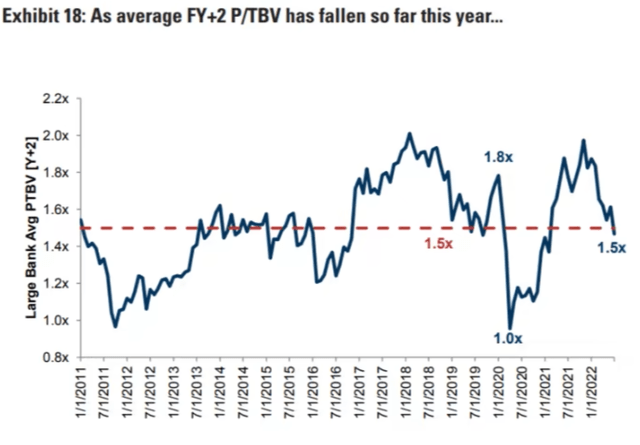

Please note how ultra-pessimistic an 0.22x P/BV is. For reference, according to research by Goldman Sachs, the cyclical low for bank stocks is usually around the 1x multiple. So, Deutsche Bank’s assets are priced at a 78% discount to the recession scenario.

Goldman Sachs Research; Financial Times Graph

Residual Earnings Valuation

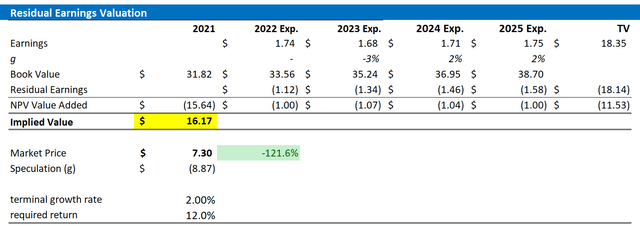

In my opinion, banks are prime candidates to be valued with a residual earnings valuation, given that the RE framework anchors on both the income statement and the balance sheet as well as accrual accounting. That said, I apply the following assumptions:

- To forecast EPS, I anchor on consensus analyst forecast as available on the Bloomberg Terminal ’till 2023. In my opinion, any estimate beyond 2023 is too speculative to include in a valuation framework – especially for banks.

- To estimate the cost of capital, I use the WACC framework. I model a three-year regression against the Dax 30 to find the stock’s beta. For the risk-free rate, I used the U.S. 10-year treasury yield as of July 20, 2022. My calculation indicates a fair required return of 12%.

- To derive DB’s tax rate, I extrapolate the 3-year average effective tax-rate from 2019, 2020 and 2021.

- For the terminal growth rate, I apply 2% percentage points, slightly below estimated nominal GDP growth in order to reflect a conservative valuation.

Based on the above assumptions, my calculation returns a base-case target price for DB of $16.17/share, implying material upside of more than 100%.

Analyst Consensus EPS; Author’s Calculation

I understand that investors might have different assumptions with regards to DB’s required return and terminal business growth. Thus, I also enclose a sensitivity table to test varying assumptions. For reference, red-cells imply an overvaluation as compared to the current market price, and green-cells imply an undervaluation.

Analyst Consensus EPS; Author’s Calculation

Risks

While I believe that investments in banks are less risky than the market implies, the tail-risk exposure is still elevated and if materialized this might depreciate DB’s share price significantly. For reference, the company has still not recovered the share price levels seen before the great financial crisis. In any case, Deutsche Bank’s 13.2% CET1 ratio should buffer the company for most market stress scenarios, even severe ones. In addition, investors should note that my bullish thesis for DB is connected to the implication that there are no structural differences between European and US banks. This, however, is not necessarily true since the respective regulatory exposure is somewhat different and US banks have a history of outperforming European peers. Nevertheless, a 100% relative valuation discrepancy is not justified, in my opinion.

Conclusion

I am bullish on DB stock, as I believe the bank is considerably undervalued as compared to fundamentals. Most notably, all metrics including P/B, P/E and EV/Sales point to a considerable discount as compared to industry peers – especially American banks. Based on a residual earnings valuation, anchored on analyst consensus EPS, I believe that DB should trade at approximately $16.17/share. That said, I see more than 100% upside. Buy.

Be the first to comment