YorVen

Article Thesis

Dow Inc. (NYSE:DOW) is a leading chemicals company that trades at a very inexpensive valuation. Massive cash flows can be used for deleveraging and shareholder returns, and on top of that, Dow Inc. could benefit a lot from the weakness of European peers that are hurting from ultra-high natural gas prices on the continent. Dow Inc. is not immune to a potential recession, but could still be a solid long-term pick at current prices.

Company Overview

Dow Inc. is a chemicals company that provides products such as packaging materials like ethylene, polyethylene, and propylene, industrial intermediates like propylene oxides, and so-called performance materials, which include a range of paints, coatings, etc.

Dow Inc. operates in an industry with a wide range of players, but as one of the biggest competitors in the chemicals industry, it enjoys some scale advantages. These scale advantages, such as a lower cost of capital, lower relative operating expenses, improved purchasing conditions, etc. are accelerated further by Dow’s favorable geographical positioning. Oil prices are more or less the same all around the world, as oil and related products are easily shipped across the ocean. That is not true for natural gas, which is only shippable on the ocean via liquefaction. That is very expensive and requires costly infrastructure that is not available at an unlimited scale. As a result, natural gas prices around the globe are very different. That matters for Dow and its peers since natural gas is an important input cost for the chemicals industry. Natural gas is both used as a resource that gets processed, and it is also used as an energy source since many technical processes in the industry are highly energy intensive.

Natural gas prices are very high in Europe right now, mainly due to supply disruptions caused by the Russia-Ukraine war. In Asia, where natural gas is oftentimes supplied in the liquefied form, prices are pretty high as well. In the US/North America, however, natural gas prices are very low on a comparable basis, although even in the US prices have risen over the last year. For comparison, natural gas prices in the Netherlands (‘TTF’) in Europe currently are slightly north of $50 per million BTU, whereas natural gas in the US (Henry Hub) costs around $7 per million BTU. In other words, natural gas in Europe costs around 7x as much as in the US. That naturally results in an incredible cost advantage for chemicals companies with US-based operations, whereas companies with most of their production being located in Europe suffer from ultra-high natural gas prices. Of course, companies do not necessarily buy all of their gas on the spot market, thus not all European chemical companies will pay $50+ per million BTU for all of the gas they buy. Still, it is pretty clear that the much higher natural gas cost in Europe provides for a major cost disadvantage.

Companies with large European activities, such as BASF (OTCQX:BASFY) will be at a disadvantage. BASF owns the world’s largest integrated chemicals complex in Ludwigshafen, Germany. With natural gas supplies potentially being cut for industrial customers later this year, BASF could see some of its production assets get forced offline. Other European chemical companies, such as Bayer (OTCPK:BAYRY), Covestro (OTCPK:COVTY), Umicore (OTCPK:UMICY), or Linde (LIN) are also exposed. It should be noted that major chemical companies usually have production facilities on more than one continent, thus these companies will not necessarily feel the natural gas impact on all of their assets. BASF, for example, owns production assets in China and the US, which means that its exposure to the European gas market isn’t 100%. But still, despite some geographical diversification, BASF and other European competitors are highly exposed to this macro issue, which should be to Dow’s benefit as it has access to large amounts of inexpensive natural gas and since Dow doesn’t have to worry about supply disruptions.

Compelling EPS Growth Potential

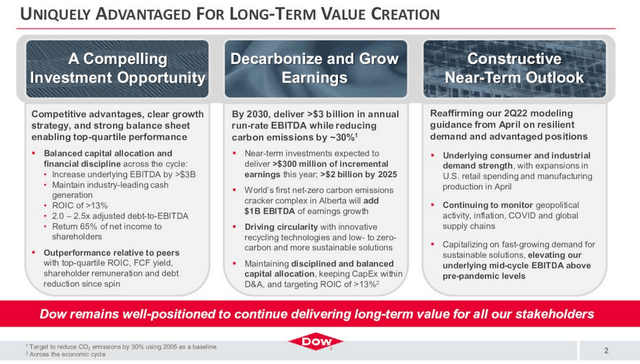

The company believes that it is well-positioned to drive a lot of shareholder value over the coming years, as it showcases in the following slide from a recent investor presentation:

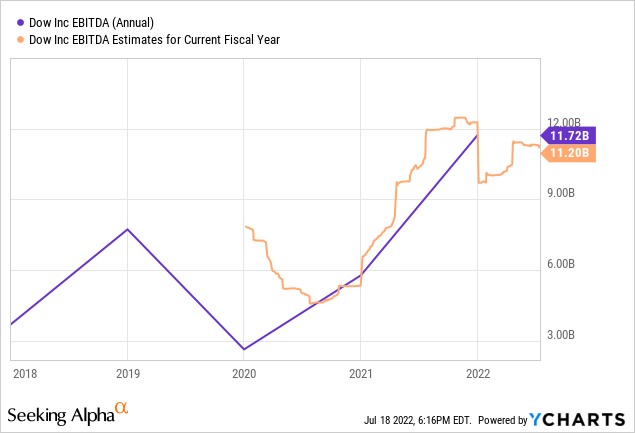

The company believes that it will drive EBITDA growth of at least $3 billion through 2030, which would represent an increase of around 25% relative to where EBITDA was in 2021 and is forecasted to be in 2022:

Those will be two above-average years compared to the past, however. When we look at the average over the last couple of years, EBITDA was lower. But current estimates for 2023 also see EBITDA at a $10+ billion level, thus Dow’s growth investments in recent years and a favorable pricing environment seem to have lifted profitability to a new “baseline” level. $3 billion in additional EBITDA, or around 25%, over the coming eight years doesn’t seem like a lot, but earnings per share growth will likely be way higher. There are several reasons for that.

First, Dow can use some of its cash flow to pay down debt, which will reduce its interest expense. Even if EBITDA were to remain flat in such a scenario, net profit would climb. More importantly, Dow also has the capacity to repurchase a large portion of its shares over the coming years.

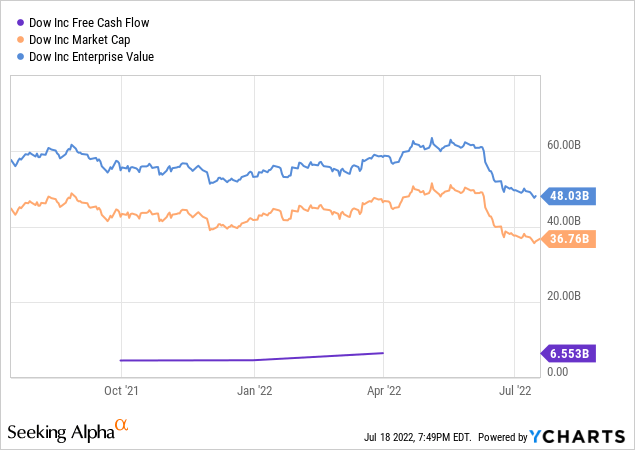

Over the last year, Dow generated free cash flows of $6.6 billion, equal to 18% of its market capitalization and 14% of its enterprise value. Dow needs around one-third of that free cash flow to pay for its dividend, which leaves around $4.4 billion worth of free cash for debt reduction and buybacks. Note that capital expenditures, both for maintenance and growth projects, are already accounted for in that free cash flow number, so this is what is left over for other purposes. If Dow were to spend $2.2 billion of its free cash flow on buybacks, or half of the post-dividend free cash flow, then the company could buy back 6% of its shares per year. Between a 3% EBITDA growth rate, some debt reduction that leads to lower interest expenses, and a 6% annual buyback pace, Dow could grow its earnings per share by 10% or so per year. Note that, in this scenario, with $2.2 billion of free cash left over after dividends and buybacks, Dow could reduce its net debt by $11 billion over the next five years, which would almost reduce its net debt to zero. It is unlikely that Dow will pay down this much debt, we believe. Instead, more buybacks or some M&A seem likely, with a lesser extent on debt reduction. More buybacks or some accretive deals would logically lead to more pronounced earnings per share growth, but even 10% annual EPS growth would be quite strong in the long run.

An Attractive Valuation

Dow has seen its shares drop by more than 30% from recent highs, which has made its already inexpensive stock even more undervalued.

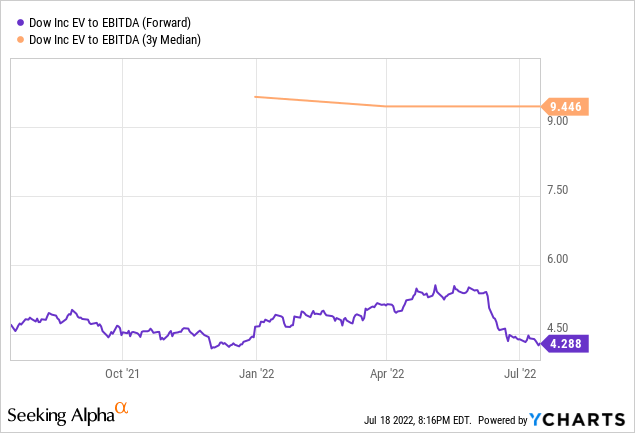

Today, Dow trades at a 4.3x EBITDA multiple. That is well below the 3-year median EBITDA multiple of 9.4. In fact, Dow’s enterprise value has an upside potential of 120% toward its long-term valuation norm. We do not believe that this will materialize in the near term, but it is, of course, great to buy shares when they are historically cheap. In the long run, upside potential via multiple expansion (on top of what would happen anyway due to earnings per share growth) is likely. At the same time, the pretty low valuation means that downside risk is limited.

If Dow were to just pay its dividend, which yields around 6%, while growing its earnings per share by ~10% a year in the long run, then that alone could result in double-digit annual returns rather easily. When we account for the potential tailwinds from multiple expansion thanks to Dow’s low valuation, the return potential is even better.

Takeaway

Dow Inc. looks like an attractive longer-term pick right now. It has scale advantages and geographical advantages thanks to benefiting from comparatively very cheap natural gas in North America.

Management is shareholder friendly and is aligned with shareholders, currently owning 0.8 million shares worth $40 million. Insiders have also been buying over the last year, adding 15% to their shareholdings, which may indicate that Dow is attractively priced. That also is suggested by the current discount compared to the historic valuation (EV/EBITDA) and by the company’s high free cash flow yield.

With a dividend yield of around 6%, not too many things have to go right for Dow to be a solid investment over the next couple of years, which is why we like the stock at current levels.

Be the first to comment