designer491/iStock via Getty Images

A Quick Take On Rent the Runway

Rent the Runway (NASDAQ:RENT) went public in October 2021, raising approximately $357 million in gross proceeds from an IPO that priced at $21.00 per share.

The firm operates a marketplace and subscription service for consumers to rent or buy designer clothing and related products.

Until we see the results of management’s cost-cutting actions show up positively in the company’s financial results and learn the effects of changing consumer behavior, I’m on Hold for RENT in the near term.

Rent the Runway Overview

Brooklyn, New York,-based Rent The Runway was founded to enable consumers to rent and purchase a wide selection of clothing and related items for every occasion.

Management is headed by co-founder, Chair and CEO Jennifer Y. Hyman, who has been with the firm since inception and was previously Director of Business Development at IMG, a talent management company.

The company’s primary offerings include:

-

Evening wear

-

Ready-to-wear

-

Workwear

-

Denim

-

Casual

-

Maternity

-

Outerwear

-

Blouses

-

Knitwear

-

Loungewear

-

Jewelry

-

Handbags

-

Activewear

-

Home Goods

-

Kidswear

The firm pursues an organic approach to acquiring customers, via word of mouth and social media.

Rent the Runway’s Market and Competition

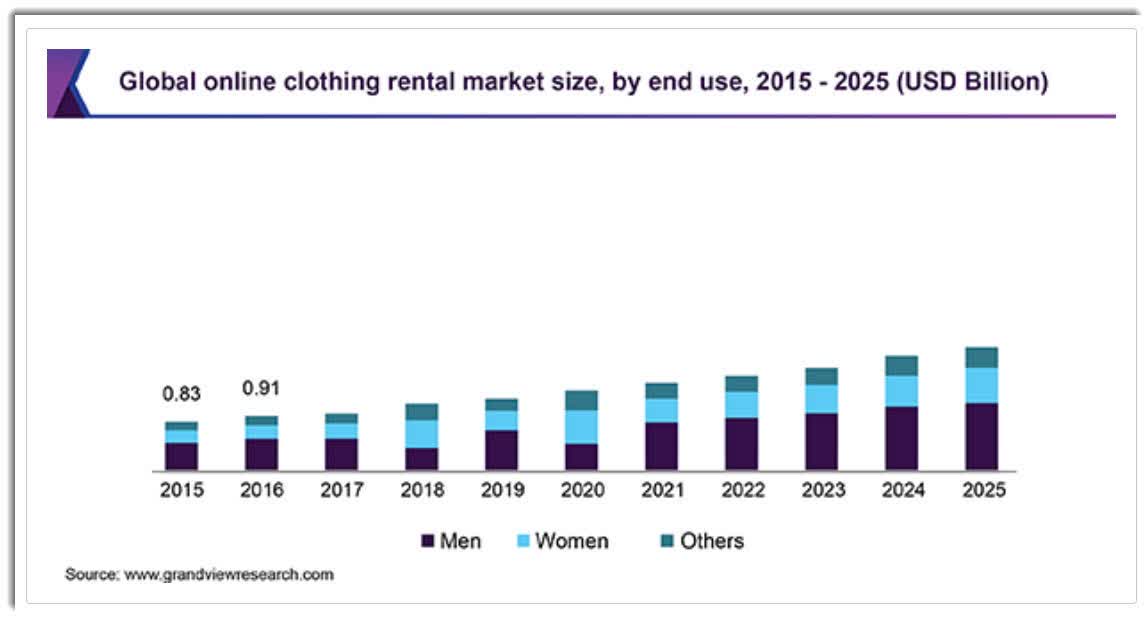

According to a 2019 market research report by Grand View Research, the global market for online clothing rental was an estimated $1.12 billion in 2018 and is forecast to reach $2.1 billion by 2025.

This represents a forecast CAGR of 9.4% from 2019 to 2025.

The main drivers for this expected growth are increasing popularity of online shopping experiences and a growing popularity of fashion influencers.

Also, below is a historical and projected future growth trajectory for the online clothing rental market:

Global Online Clothing Rental (Grand View Research)

Major competitive or other industry participants include:

-

The Clothing Rental

-

Flyrobe

-

Share Wardrobe

-

Secoo Holding

-

Gwynnie Bee

-

Le Tote

-

Swapdom

-

StyleLend

-

Dress Hire

-

Others

The company also sells clothing and offers subscription-based services for frequent use clients.

RENT’s Recent Financial Performance

-

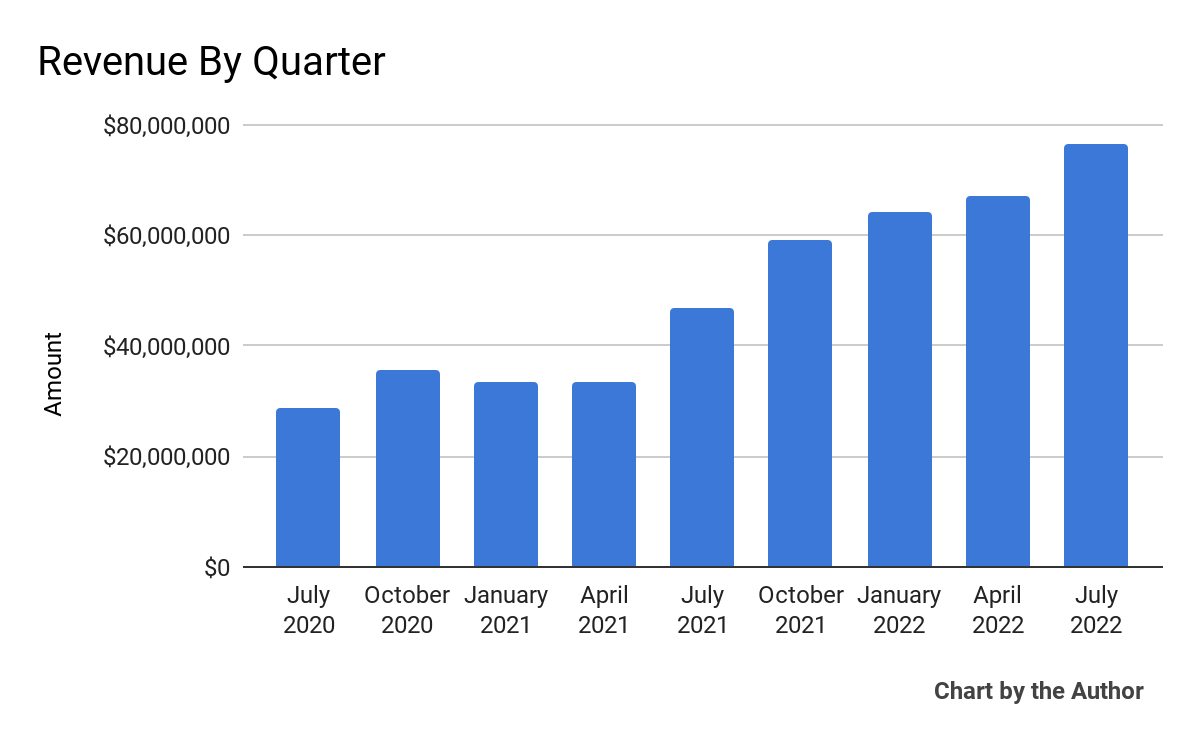

Total revenue by quarter has risen according to the following chart:

9 Quarter Total Revenue (Seeking Alpha)

-

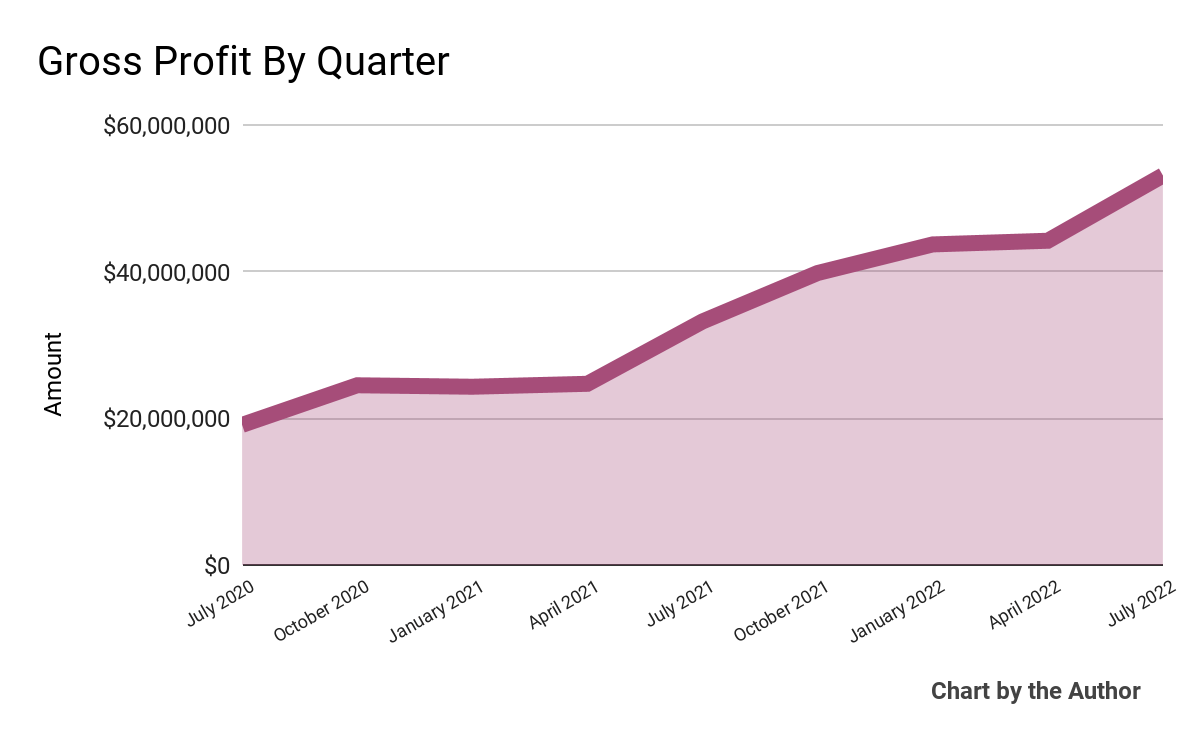

Gross profit by quarter has also risen substantially:

9 Quarter Gross Profit (Seeking Alpha)

-

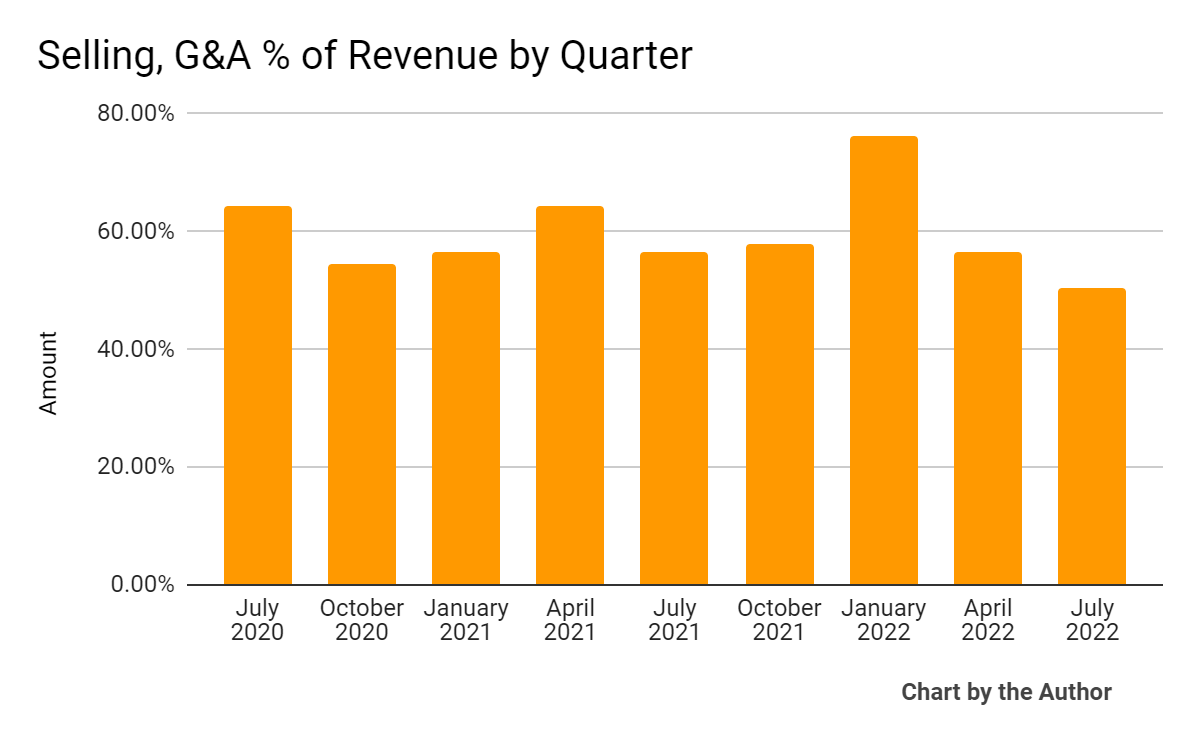

Selling, G&A expenses as a percentage of total revenue by quarter have trended lower in recent quarters:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

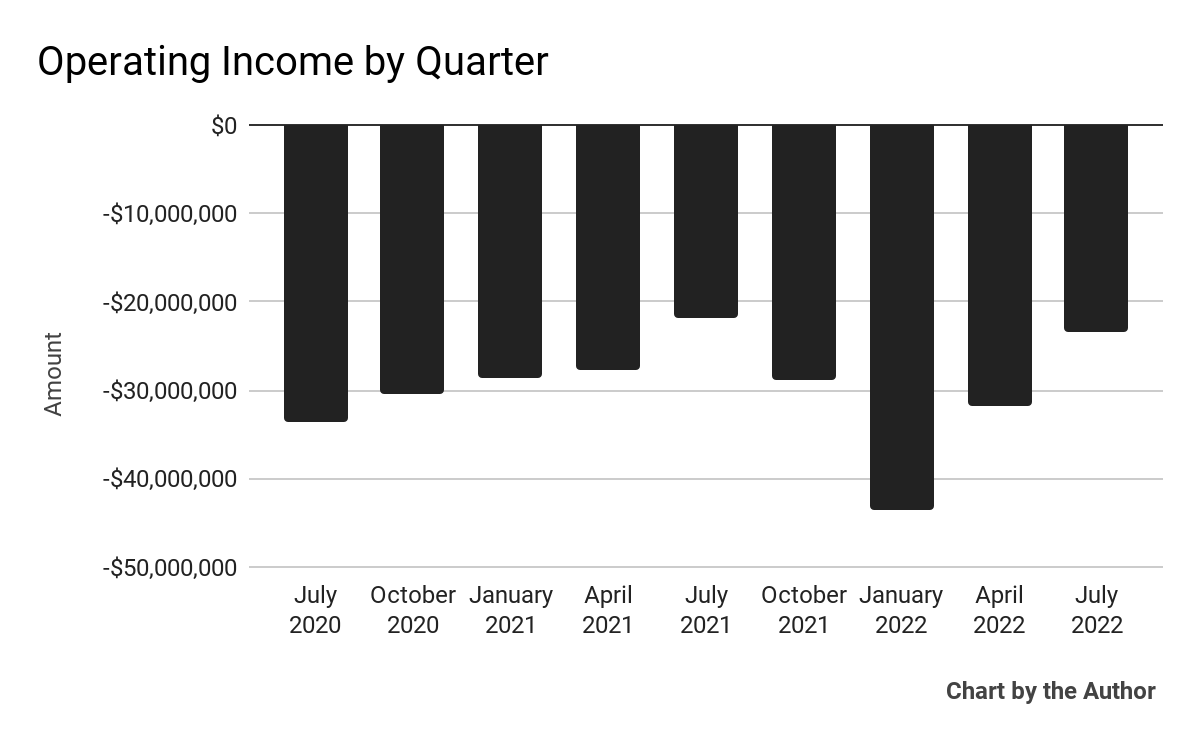

Operating income by quarter has remained heavily negative:

9 Quarter Operating Income (Seeking Alpha)

-

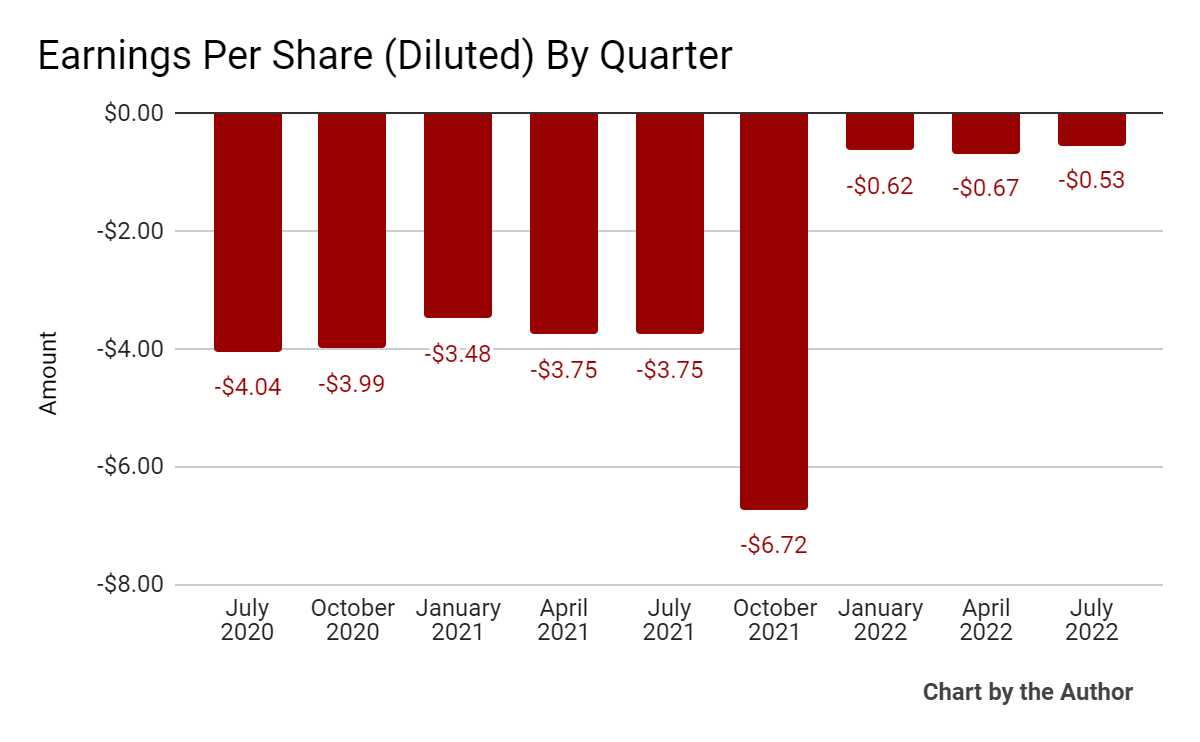

Earnings per share (Diluted) have also remained negative, as the chart shows below:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

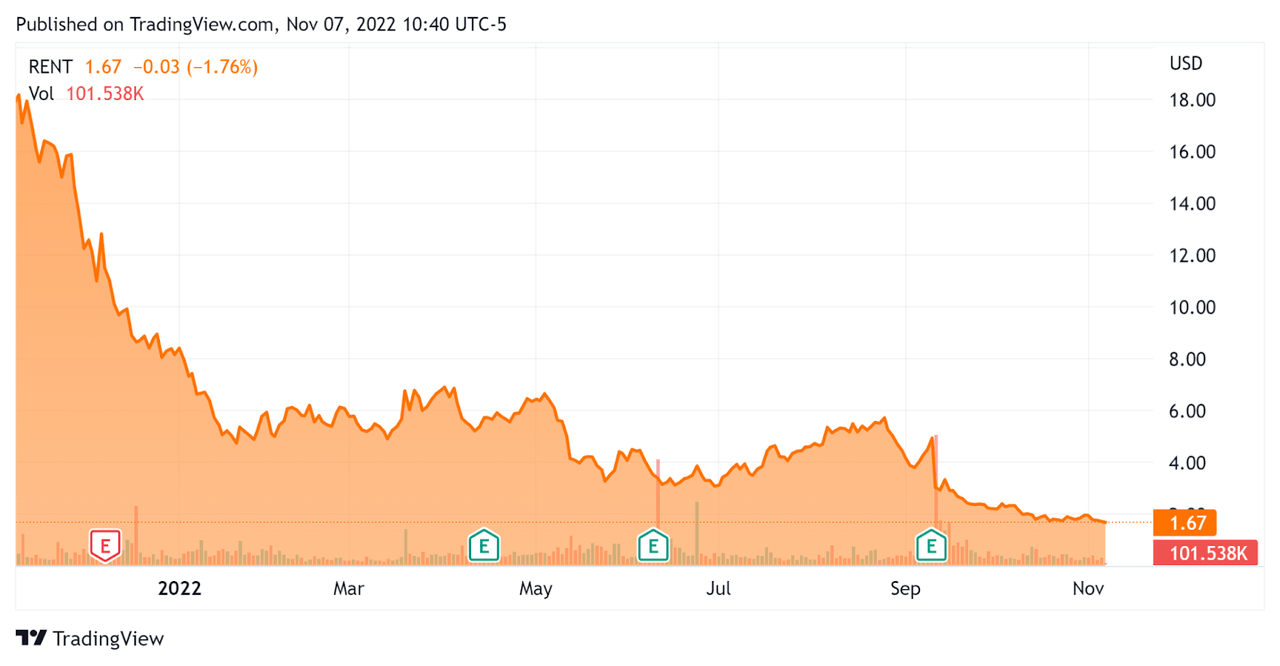

Since its IPO, RENT’s stock price has dropped 89.8% vs. the U.S. S&P 500 index’ drop of around 19.4%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For RENT

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

0.87 |

|

Revenue Growth Rate |

78.8% |

|

Net Income Margin |

-76.3% |

|

GAAP EBITDA % |

-24.7% |

|

Market Capitalization |

$110,000,000 |

|

Enterprise Value |

$233,300,000 |

|

Operating Cash Flow |

-$62,600,000 |

|

Earnings Per Share (Fully Diluted) |

-$8.54 |

(Source – Seeking Alpha)

Commentary On Rent the Runway

In its last earnings call (Source – Seeking Alpha), covering FQ2 2022’s results, management highlighted the growth in its subscription and reserve revenue.

Additionally, active subscribers grew 27% over the prior year, with engagement metrics described as “strong” and management seeing “some of the highest monthly subscription ARPUs (Average revenue Per User) in our history.”

The company counted 124,000 active subscribers at the end of the quarter, July 31, 2022.

However, starting in June, the firm detected an increase in subscriber pause rates and management is seeing changes in consumer behavior in 2022 vs. pre-pandemic behaviors.

The firm announced a restructuring plan to reduce operating costs and headcount by 24%, although it won’t begin to see the savings until FQ3 2022 and into fiscal 2023.

As to its financial results, total revenue rose 64% year-over-year to a record quarterly result.

Operating losses, while still unacceptably large, have lessened in the most recent quarters while earnings per share remain heavily negative.

For the balance sheet, the firm finished the quarter with $192.3 million in cash and equivalents and $269.8 million in long-term debt.

Over the trailing twelve months, free cash used was $112.5 million, of which capex accounted for $49.9 million of cash used.

Looking ahead, management believes it “can deliver 15% margin on adjusted EBITDA less product depreciation’ over the medium term.”

Regarding valuation, the market continues to severely penalize technology-oriented companies with significant operating losses.

The primary risk to the company’s outlook is a looming recession in 2023 which may reduce consumer discretionary spending and lower the firm’s revenue growth rate and intent to generate adjusted EBITDA.

A potential upside catalyst to the stock could include a “short and shallow” recession in the quarters ahead and continued strength in upscale consumers using its services.

However, until we see the results of management’s cost-cutting actions show up positively in the company’s financial results and learn the effects of changing consumer behavior, I’m on Hold for RENT in the near term.

Be the first to comment