Juanmonino

I don’t know about you, but when I think about footwear companies, I often think about the major players in the space. Having said that, some of the most interesting opportunities can be found by looking at the smaller firms. One such example is Designer Brands (NYSE:DBI). In recent years, financial performance for the company has been somewhat volatile. Some of this has been due to the COVID-19 pandemic, but the rest appears to not be related to it. In all though, the overall trajectory for the company has been positive. Add on top of that the fact that shares of the enterprise look affordable at this time, and I cannot think of a reason not to rate it a soft ‘buy’ at this time.

A shoe-centric business

According to the management team at Designer Brands, the company, initially founded as DSW Inc., is one of the largest designers, producers, and retailers of footwear and accessories in North America. The brands the company sells are vast, ranging from regular contracted brand name and designer products to exclusive offerings. Under the exclusive category, the company has brands such as Vince Camuto, Lucky, JLO Jennifer Lopez, and Jessica Simpson. The company gets these products from an estimated 440 unrelated third-party merchandise vendors. In addition, it’s worth noting that what all the company does have its own products that it sells, an estimated 91.3% of its sales come from products from other providers.

Presently, the company has three different segments that it operates. And to best understand it, we should dig in a bit to each one. The first of these segments is referred to as U.S. Retail. This particular segment operates the DSW Designer Shoe Warehouse banner, which is offered in the US market. It does this through its direct-to-consumer US stores and its online website. During the company’s 2021 fiscal year, this segment made up 84.2% of the firm’s revenue but only 33.7% of its profits. Next in line, we have the Canada Retail segment. This is also known as The Shoe Company and, as you can probably guess, it generates its sales from operations in Canada. Last year, this statement accounted for 7.1% of the company’s revenue but for 32.7% of its profits. And finally, we have the Brand Portfolio segment. This unit is responsible for the design, development, and sourcing of in-season fashion footwear and accessories under the Camuto brand name. The entire purpose of this unit is to engage in the sale of wholesale merchandise to its retail segments and to other retail customers. It involves the company’s First Cost model, which involves the company earning Commission based income in exchange for serving retail customers as their design and buying agent. And finally, the segment also involves, to some degree, the selling of its branded products on one of its e-commerce sites. Last year, this segment accounted for just 8.7% of the company’s revenue but made up an astonishing 23.3% of its profits.

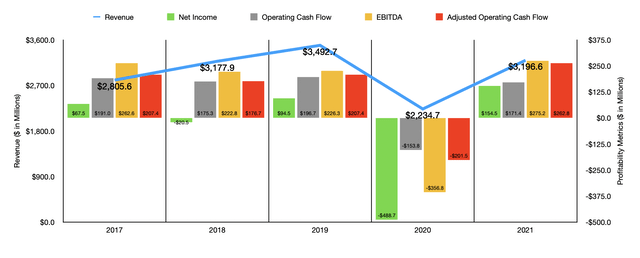

Over the past few years, the management team at Designer Brands has done a really good job growing the company. Revenue increased from $2.81 billion in 2017 to $3.49 billion in 2019. In 2020, because of the COVID-19 pandemic, revenue plummeted to $2.23 billion. But that decline was short-lived. I say this because, last year, sales came in at $3.20 billion. That increase relative to the 2020 fiscal year came even as the number of stores the company has in operation dropped from 663 to 648. It was driven, instead, by a 51.6% increase in comparable store sales. Leading the way was the U.S. Retail segment, with comparable store sales rising by 55%.

When it comes to profitability, the picture has been rather messy. Between 2017 and 2019, profits bounced around between negative $20.5 million and positive $94.5 million. The company generated a significant loss of $488.7 million in 2020 before rebounding and generating a profit of $154.5 million last year. Other profitability metrics have also been somewhat volatile. Operating cash flow, for instance, has bounced around in the past five years between $171.4 million and $186.7 million. The only year where this was the exception was in 2020 when cash outflow was $153.8 million. If we adjust for changes in working capital, we see a similar trend. But in that case, 2021 was the best year with cash inflow of $262.8 million. Meanwhile, EBITDA has also been rather volatile, ranging between $222.8 million and $275.2 million over the past five years, with the one down here being the negative $356.8 million incurred in 2020.

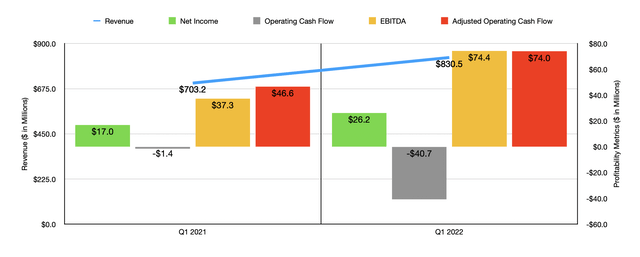

One really good thing for investors is that the 2022 fiscal year is now looking up. Revenue in the first quarter came in at $830.5 million. That represents an increase of 18.1% over the $703.2 million generated the same time one year earlier. The company really benefited here from a 15.3% rise in comparable store sales, with the Canada Retail segment posting a gain of 41.4% year over year. This is not to say everything was great. In fact, the number of stores the company has continued to decline, dropping from 661 to 650.

On the bottom line, the picture was generally positive in the first quarter. Net income of $26.2 million beat out the $17 million generated the same quarter last year. Operating cash flow did worsen, turning from negative $1.4 million to negative $40.7 million. But if we adjust for changes in working capital, it would have risen from $46.6 million to $74 million. We also saw a nice increase when it came to EBITDA. That metric ultimately grew from $37.3 million to $74.4 million.

For the 2022 fiscal year as a whole, management only said that comparable store sales should increase in the mid-single-digit rate. However, the company does have some big plans. Their current goal is to grow sales to $4 billion by 2026. Earlier this year, management revealed a plan to discuss these specifics. Part of that plan is to double sales of the brands that it owns, largely through its direct-to-consumer channels. This makes sense when you consider that brands the company owns should, in theory, generate greater margins. The company also wants to cater more toward the nearly 30 million customers that it has, many of whom are part of its loyalty program. Of course, none of this is slated to stop the company from rewarding investors in other ways. During that announcement, the company also reinstated its dividend to shareholders, coming out to $0.05 per share each quarter. And, it has also repurchased 1.7 million shares under its $500 million share repurchase program. Currently, $312.2 million is available under the plan.

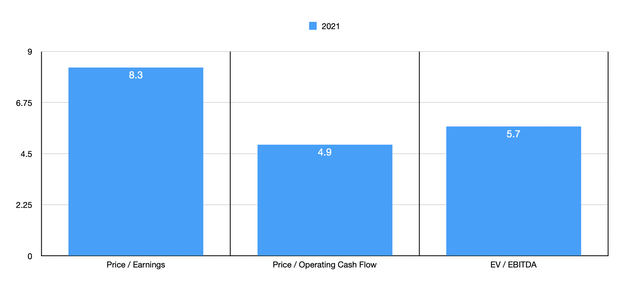

From a profitability perspective, the company also expects earnings per share to rise to between $2.75 and $2.85. This compares to the $1.90 to $2 per share the company is expected to generate in profits this year. That translates to roughly $150 million. This is awfully close to what the company generated last year. No guidance was given when it came to other profitability metrics, but given the proximity of projected earnings this year relative to last year, I have decided to assume that 2022’s results will closely mirror 2021 results. Doing this, we can see that the company is trading at a price-to-earnings multiple of 8.3. The price to adjusted operating cash flow multiple should be 4.9. And the EV to EBITDA multiple should be 5.7. To put this in perspective, I compared the company to five similar firms. On a price-to-earnings basis, these companies ranged between 5.7 and 8.4. Three of the five companies were cheaper than Designer Brands. Using the price to operating cash flow approach, the range was between 5.2 and 25.8. In this case, our prospect was the cheapest of the group. And using the EV to EBITDA approach, the range is between 4.2 and 25.8. In this case, two of the five firms are cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Designer Brands | 8.3 | 4.9 | 5.7 |

| MYT Netherlands Parent B.V. (MYTE) | N/A | 25.8 | 25.8 |

| Guess’ (GES) | 8.4 | 8.6 | 6.0 |

| Caleres (CAL) | 6.3 | 9.3 | 6.4 |

| Abercrombie & Fitch (ANF) | 5.7 | 5.2 | 4.2 |

| The Buckle (BKE) | 6.4 | 6.7 | 4.6 |

Takeaway

At this point in time, Designer Brands seems to be doing fairly well for itself. Yes, the company has a somewhat bumpy operating history, particularly from a profitability and cash flow perspective. Having said that, the overall trend has been positive and management has a favorable outlook regarding the future. While shares of the company aren’t as cheap as some others out there, they do look quite affordable at this time. So long as current strength continues, I could imagine the company generating quite a nice amount of upside for shareholders. And as such, I’ve decided to rate the business a soft ‘buy’ for now, reflecting my belief that it will likely outperform the market for the foreseeable future.

Be the first to comment