zhangxiaomin/iStock via Getty Images

Thesis

Daqo New Energy Corp.’s (NYSE:DQ) Q2 release demonstrated the company’s growth cadence as one of the leading polysilicon players in China remains intact. However, investors are urged to consider the possibility of continued normalization in selling prices moving forward as more supply comes online. Furthermore, management also alluded that it sees further moderation through 2024, even though it’s still expected to be at reasonable levels.

We observed that DQ had recovered remarkably from its March capitulation lows, as the perfect storm of headwinds from delisting risks, worsening macros, and COVID lockdowns buffeted Chinese stocks. However, we remain concerned over a potential growth normalization moving forward, which could markedly impact its underlying metrics.

Also, DQ is nearing critical resistance levels that saw robust selling pressure previously. Therefore, we urge investors to be cautious at the current levels and wait patiently for a deeper pullback first.

As such, we rate DQ as a Hold for now.

DQ’s Solid Growth, But Look Ahead For Growth Normalization

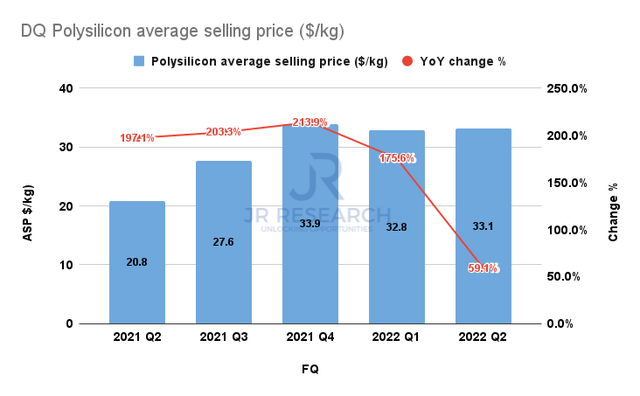

DQ polysilicon ASPs (Company filings)

As seen above, Daqo’s polysilicon average selling prices (ASPs) have gone through the roof over the past year. Given China’s thirst for transition to renewable energy, Daqo has been a key beneficiary as a leading player in the polysilicon supply chain. Furthermore, it has also benefited from the semiconductor upcycle as the fabs buildup continues to demand critical supplies from Daqo, as the industry struggles to meet the demand/supply imbalance, further escalating polysilicon prices.

However, we also noted that the growth rate has slowed down from 2021, as Daqo’s ASPs increased by 59.1% in FQ2, down from Q1’s 176% increase. The company also alluded to further normalization through 2024 as supply catches up. CEO Longgen Zhang accentuated:

So we consider [in H1′] 2023, [the] price will continue to keep about RMB 250 per kg. For the second half of next year, the price maybe will go down. I think maybe it will be RMB 180 to 200. Then beyond next year, really, we cannot project the price will go to which direction. Considering that, if the module price go down, then the market demand will be higher. I think that will stimulate the demand of polysilicon. So I think at a certain time, it’s some balance there. So we think the price maybe will slightly go down is [in] Q4 2023. Then really back to maybe normal around 120 in 2024. So basically, we’re not thinking polysilicon will drop to below RMB 120 per kg. That’s what we believe. (Daqo FQ2’22 earnings call)

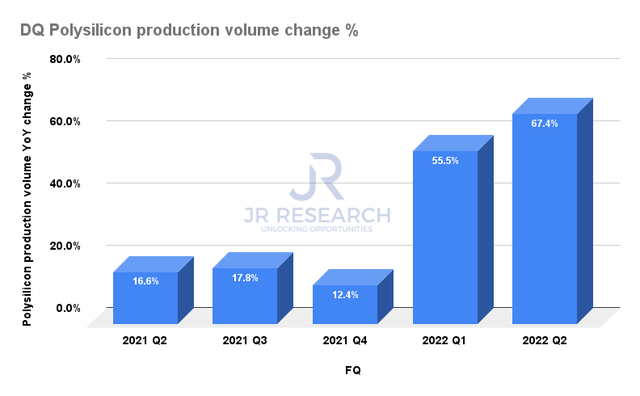

Daqo polysilicon production volume change % (Company filings)

Still, Daqo is well-primed to capitalize on the current high prices, as its production has kept up remarkably well, as Daqo posted production volume growth of 67.4% YoY in Q2. Also, the company’s upcoming facilities in Inner Mongolia could add another 100K MT, coupled with lower costs. Hence, even with potentially lower ASPs through 2024, the company has been working hard to improve its operating efficiencies and margins profile.

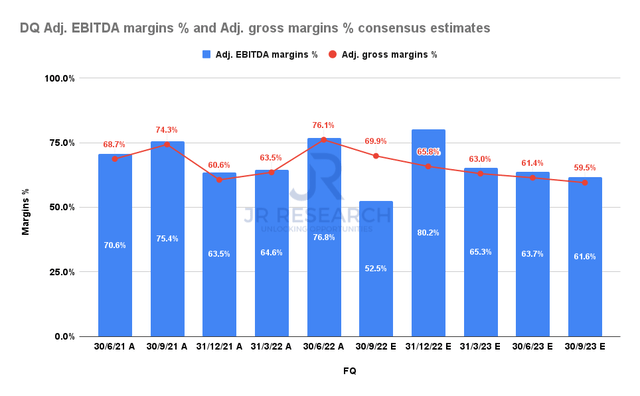

Daqo adjusted EBITDA margins % and adjusted gross margins % consensus estimates (S&P Cap IQ)

However, the consensus estimates (bullish) suggest that Daqo’s margins profile could continue to deteriorate through FY23. Therefore, we posit that investors should expect further normalization in its polysilicon ASPs growth, which could impact Daqo’s margins moving forward.

As a result, we are concerned that the recent recovery in DQ’s buying momentum could be affected by the underlying impact on its profitability through FY23. Therefore, investors are urged to pay close attention to the company’s ability to sustain its margins moving ahead.

Is DQ Stock A Buy, Sell, Or Hold?

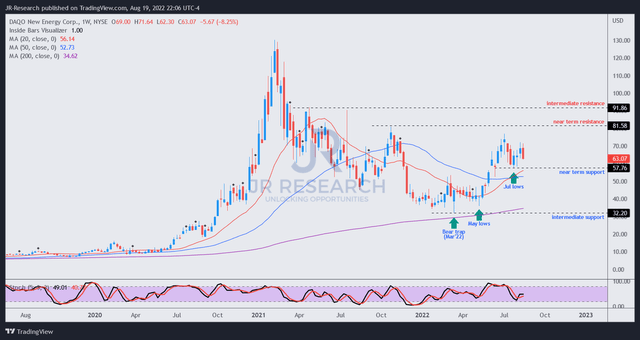

DQ price chart (weekly) (TradingView)

We postulate that DQ has likely staged its long-term bottom in March, in line with the capitulation lows seen in Chinese stocks.

However, investors should note that DQ has recovered remarkably from its March and May lows. Further buying upside was also rejected recently at its early July highs, pretty close to its near-term resistance zone.

Therefore, we consider Daqo’s price action pretty well-balanced now, with no clear buy triggers, and neither are we bearish on its momentum. However, we remain concerned with its ability to sustain its buying momentum at the current levels, given the potential normalization of its growth and profitability profile moving forward.

Therefore, we rate DQ as a Hold for now.

Be the first to comment