z1b

“Even with the S&P 500 poised for its worst year since 2008, the buy-the-dip mentality that drove U.S. stocks to its repeated records in recent years lives on.”

This quote is from Jim Masturzo, chief investment officer of multi-asset strategies at Research Affiliates. Mr. Masturzo continues: “For the last decade, the U.S. market was ripping every year. Why would people invest anywhere else?”

In the last ten years or so, I have argued that the Federal Reserve, and the federal government, pursued a policy that I called “credit inflation.” Basically, credit inflation occurred when the Federal Reserve and the federal government emphasized a policy that aimed to achieve a 2.0 percent rate of inflation and a low level of unemployment.

This policy was based upon something called the Phillips Curve, a statistical relationship that indicated that the unemployment rate in the economy could be lowered when a slightly higher rate of inflation was maintained.

So, monetary and fiscal policies were aimed at maintaining the rate of inflation somewhere around or above 2.0 percent.

But, with the government supporting rising inflation, the world changed.

It changed even further when Ben Bernanke, chairman of the Board of Governors of the Federal Reserve System, committed monetary policy to achieving rising stock prices so as to create “a wealth effect” that would cause consumer spending to rise and thereby further stimulate the growth of the economy.

This was the foundation of monetary policy in the 2010s.

And, it worked…but not quite as Bernanke thought it might.

Formerly, when the government stimulated the economy, the effort was to generate lower interest rates so that businesses would invest more in real capital goods and so that people would buy more houses.

But, given steadily rising prices…asset prices like stock prices and housing prices…the stimulus money went into the financial circuit of the economy rather than the real circuit.

The incentive was to obtain steadier profits, but from directing stimulus funds into asset markets rather than into markets that produced real capital investment.

In the corporate world, financial engineering became the methodology. The corporations raised money to buy back their own stock and to pay higher dividends. And, the corporations got higher stock prices.

Furthermore, more and more “businesses” got into the field of buying real estate to take advantage of the rising prices of real estate. Again, the business effort was tailored on financial engineering, rather than on building.

However, in the decade of the 2010s, real economic growth slowed down as stimulus money went into the purchase of assets that would rise in price, rather than into productive outflows. The growth of labor productivity dropped toward zero during the decade.

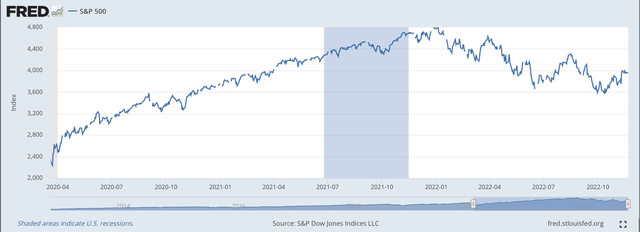

The following chart shows that the Fed did a pretty good job.

S&P 500 Stock Index (Federal Reserve)

Why not “buy-on-the-dip”?

Buying on the dip meant sticking with lower prices only for a short period of time.

It was obvious that stock prices were going to “come back.”

Many times, the Federal Reserve looked like it might “cut back” on its support over the market.

And, the market dropped for a little bit.

But, every time the Federal Reserve always came back.

Buy the dip worked.

And so, investors looked to the Fed, and it played out very well for them.

The Twenties

Then Federal Reserve policy changed in the 2020s.

Whereas before the Covid-19 pandemic hit, the Fed could follow a policy based upon the Phillips Curve.

After the pandemic hit, the Federal Reserve responded in a different way.

In order to show that the Fed truly meant to support the stock market, the Fed took the idea of quantitative easing to an extreme.

The Fed committed to buying $120.0 billion in securities purchased outright to its portfolio each and every month.

The S&P 500 Stock Index (Federal Reserve)

The stock market progress from March 2020, therefore, was quite steady. The Fed didn’t want, during a time period when there was a great fear that the economy might collapse, a “break” in stock prices. The Fed wanted to avoid a downward drop at all costs.

Thus, the stock market didn’t have any real reason to back off during the rest of 2020 and through most of 2021.

Toward the end of 2021, talk increased about the need for the Federal Reserve to switch its monetary policy and begin to tighten up.

The tightening didn’t begin until March 2022. However, as can be seen in the chart, investors began to work with the new information and try and deal with the possibility that the stock market might drop.

January 3, 2022, the S&P Index reached its historical peak.

The trend has been downward ever since.

But, investors remember how the buy-the-dip strategy worked for them.

And, so the investment community looked for every possible excuse it could find to buy the dip.

The search for information always connected with “what will cause the Federal Reserve to pivot from its tight monetary policy?”

Investors were looking all over the place for data that they thought would cause the Federal Reserve to change its stance.

This is what worked during the previous decade. It surely would work in this decade, too.

Morningstar Direct data reports that money has continued to flow into U.S. equity mutual and exchange-traded funds.

This year, the flow of funds into these funds has totaled more than $86 billion in funds, which is, so far, only “the second-highest sum since 2013, following last year’s inflows of $156 billion.”

So, lots of money is still flowing into the stock market. Robert Shiller’s CAPE ratio is 28.4. This is higher than the ratio has been for more than 90 percent of the time since 1881.

And, dividend yields “haven’t been lower relative to foreign markets in at least two decades.”

In other words, there is still lots of confidence in the being invested in the current stock market.

There is lots of confidence that the Federal Reserve is going to “pivot” its policy direction sometime soon.

So, the time is still right to watch what the Federal Reserve is doing and buy-the-dip when some type of information appears that might cause the Federal Reserve to pivot.

And, investors keep doing this because they know that the Fed will “have to pivot” sometime, and because they know that “buying the dip” has been a very profitable strategy over the past decade…and more.

Be the first to comment