Alex Potemkin

Clipper Realty Inc. (NYSE:CLPR) is a pure play on New York City real estate through a portfolio of 66 properties across Manhattan and Brooklyn. Historically high rents have supported firming financials, although the stock has been under pressure amid the impact of higher interest rates and concerns of a broader economic slowdown. Indeed, Clipper just reported its latest quarterly result, highlighted by a record operating income even as the shares are down more than 20% year to date.

That being said, we view CLPR as well-positioned to rebound with an outlook for positive growth as its newest multi-family development begins leasing. The attraction of the company is its profile as a quality micro-cap REIT with exposure to some iconic and prime developments that continue to benefit from underlying growth tailwinds. We like CLPR’s 5% dividend yield, which is compelling in this segment of primarily-residential real estate

CLPR Q3 Earnings Recap

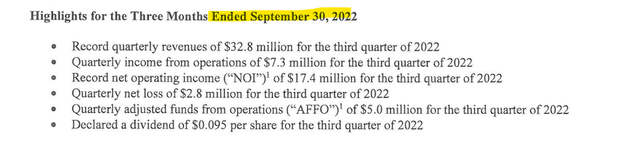

Clipper generated $32.8 million in Q3 revenue, up 7.2% year over year, and slightly ahead of market estimates. While an EPS at -$0.09 represented a net loss of $2.8 million in the quarter, the figure narrowed from the net loss of $3.4 million in the period last year.

More importantly, the net operating income of $17.4 million climbed by 9.4% year over year while the adjusted funds from operations (AFFO) at $5.0 million, or $0.12 per share, was up compared to $4.1 million and $0.10 in Q3 2021.

During the earnings call, management explains that the company continues to see strong demand for NYC and Brooklyn rental properties as occupancy levels, rents, new leases, and renewals are all above pre-pandemic levels. The highlights here include an 11.7% increase in residential revenue, which represents approximately 75% of the business. The driver here included higher average rental rates and an uptick in occupancy that reached 99.1% across all properties. The collection rate at 95.5% is also solid.

Reconciling the net loss, the company ended the quarter with approximately $1.2 billion in debt, resulting in $10.1 million as a quarterly interest expense. While the debt level has climbed over the last several years to finance its portfolio expansion, the construction of its newest property at 1010 Pacific Street is expected to be completed by year-end with leasing starting in Q1 2023.

On this point, we believe the near-term liquidity is stable considering an outlook for stronger cash flows going forward with ample coverage of the current dividend. As mentioned, CLPR yields 5.0% through a quarterly distribution of $0.095 per share, representing a payout of $17 million. This is at least covered by the annualized AFFO run rate now above $20 million.

Strength In NYC Real State

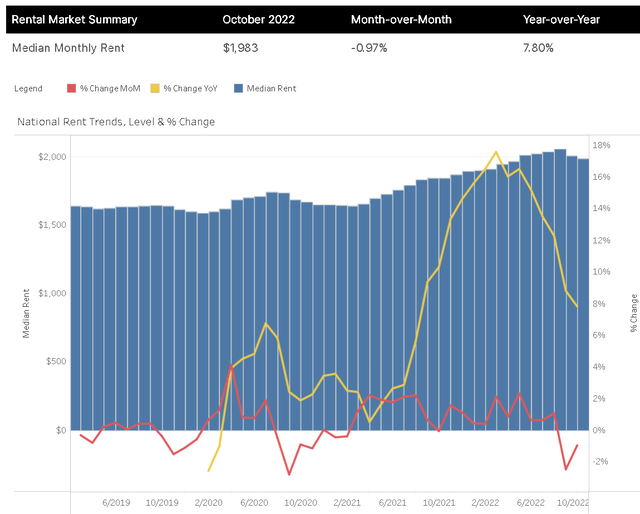

It’s been a difficult year for real estate and REIT investors in a shifting market environment compared to the momentum in 2021. Stubbornly high inflation coupled with climbing interest rates has pressured consumer spending budgets, translating directly into a slowdown in both real estate sales activity and rent increases.

Focusing just on the residential and multi-family side, a report from “rent.com“, shows that the year-over-year national average rent in the U.S. was up 7.8% in March, down from a peak closer to 17.6% back in Q1. The concern is the possibility of further declines going forward.

As it relates to Clipper Realty, the strong point is that its core market in New York City has been more resilient compared to other parts of the country. The same report notes that the New York City metro area has been one of the hotter markets, with rents still up 10% year over year. Part of this considers the strong labor market trends and structurally low inventory levels in the city.

The understanding is that as leases get renewed and the new properties rented, Clipper will capture a runway of growth over time, translating to an upside for its key financial metrics. This would be in addition to the topline boost from 1010 Pacific Street and the 953 Dean Street down the line.

The next part of the discussion considers what could be some improving macro conditions going forward. Favorably, inflation appears to be slowing and recent messaging from the Fed has opened the door to less aggressive rate hikes into 2023. By this measure, a “soft-landing” scenario for the economy averting fears of a deeper recession would allow for a rebound in real estate with a return of more positive momentum.

CLPR Stock Price Forecast

Putting it all together, we believe CLPR’s 5% dividend yield is sustainable and likely has room to narrow with an upside in the stock price into 2023. Stabilizing interest rates can support improved sentiment towards REITs with bulls back in control.

It’s encouraging to see that CLPR has rallied from its 52-week low of around $6.50, gaining some strength following the Q3 earnings report. The move above $7.50 is important as it suggests a break-out above the technical level that had been in play since 2021.

To the upside, we see room for shares to reclaim the $9.00 price level which was last reached in late August. This price target implies a dividend yield closer to 4.2% is closer to a fair value for the stock. The property portfolio quality including “trophy assets” in New York City warrants a premium as part of the bullish case for the stock.

With a market cap under $400 million, CLPR is a unique REIT that appears undervalued in our opinion. At the same time, its geographical concentration and high debt position represent risks that can keep shares volatile. Macro indicators like employment levels and the direction of interest rates will be monitoring points. Any setback in the timetable to begin leasing the Pacific Street property would also open the door for a leg lower in the stock.

Be the first to comment