ozgurdonmaz/E+ via Getty Images

Dentsply Sirona Corp (NASDAQ:XRAY) is the world’s largest manufacturer of professional dental products. If you’ve ever had a routine tooth cleaning or more complex oral surgery, there’s a good chance the tools and consumables used came from XRAY.

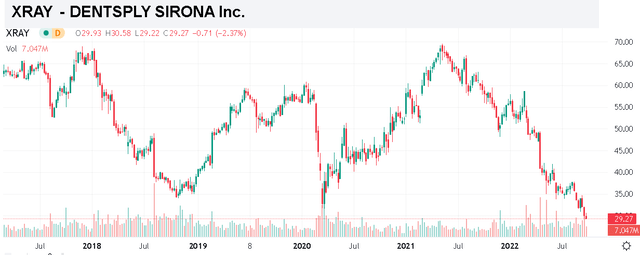

While the company has generated steady growth over the past decade, the challenge this year has been an ongoing regulatory firestorm since falling out of compliance by not releasing its Q1 audited financial statements. The issue involves an internal investigation on whether marketing incentives offered to distributors were adequately disclosed in Q3 and Q4 2021 results. Indeed, the stock has lost nearly half its value in 2022 amid the imbroglio.

With the string of increasingly negative headlines, the expectation here is for more volatility with XRAY high risk and left only for speculation. Still, there is a case to be made that the selloff in shares has already priced in much of the uncertainties. To the upside, there is the possibility that the issue gets resolved quickly with no material financial impacts in a bullish scenario for the stock. On the downside, the company remains exposed to broader market trends including concerns about slowing economic conditions. We’ll recap the recent developments and offer our take on where XRAY is headed next.

XRAY Accounting Probe

In March, Dentsply Sirona reported its preliminary results for Q1 while also notifying the SEC of a delay to its official 10-Q filing. By May, the company became technically delinquent with NASDAQ while requesting an extension for the final Q1 report.

The management team including the CEO has already been replaced to release the full Q1 and Q2 financial statements as soon as possible. The latest update in August is simply that the company is working to finalize the reports along with a broader review of internal controls and procedures. Notably, the new CFO started in the role on September 26th with an understanding that his signoff will be critical for the process to move forward.

There are many unknowns here but it’s important to recognize that Dentsply Sirona is not currently under any criminal investigation, although some pending shareholder lawsuits have been reported. At the end of the day, the story could just be some simple adjustments to previous financial results with the entire situation based simply on an abundance of caution. There is no indication of a more sinister “Enron” type of fraud.

That being said, this isn’t the first time Dentsply has been the subject of an apparent accounting scandal. Back in 2020, the company received a $1 million fine by the SEC for failing to make required disclosures going back to 2016 regarding a distribution partnership and the impact on reported inventories. It’s clear the company has some governance weaknesses that the new management will need to address.

XRAY Key Metrics

XRAY last provided preliminary Q2 data in early August with an expectation that net sales reached $1.01 billion, which represents a 6% decline from $1.07 in the period last year. Adjusted EPS “at or above $0.60” compared to $0.71 in Q2 2021. Again, the final results and 10Q financial statement are pending the results of the investigation.

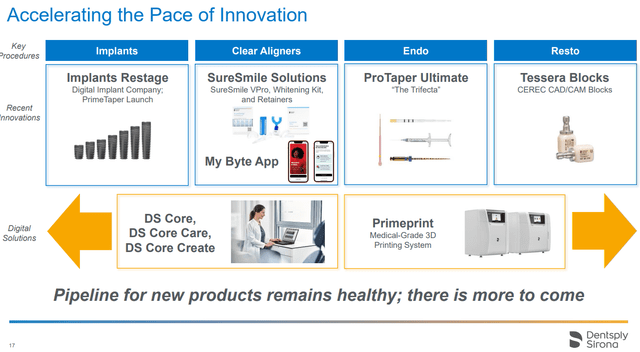

Management noted that FX changes hit the top line while organic growth was still positive based on solid trends in the Europe region. There was also momentum in tech solutions including dental computer-assisted design programs and manufacturing tools programs (CAD/CAM) used in dental restorations and the construction of implants like crowns and dentures. The trends reflect a shift in the company towards more digital and value-added product segments. On the other hand, the Covid lockdowns in China contributed to macro headwinds.

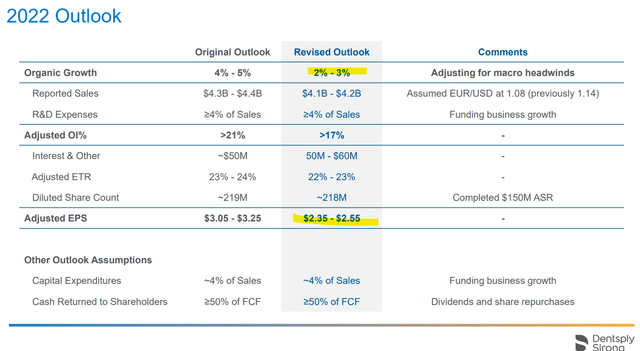

As it relates to financial guidance, targets issued back in Q1 were reiterated. Dentsply expects full-year organic growth between 2-3%, which was previously revised lower from a stronger 4-5% based on what are seen as more challenging global economic conditions. The EPS guidance between $2.35 and $2.55, at the midpoint, represents a decline of 15% versus 2021 with some margin pressure.

In terms of the balance sheet, the last reported figure from Q1 noted $347 million in cash against $1.9 billion in long-term debt. Considering approximately $920 million in EBITDA over the trailing twelve months, the net debt to EBITDA leverage ratio under 2x is stable. The company has also been active with share repurchases along with its regular quarterly dividend of $0.125 per share which currently yields 1.7%.

XRAY Stock Price Forecast

The trading action in XRAY has been terrible with both the internal probe headlines and broader market weakness. An outlook for slowing global growth in an environment of high inflation and rising interest rates haven’t helped with sentiment.

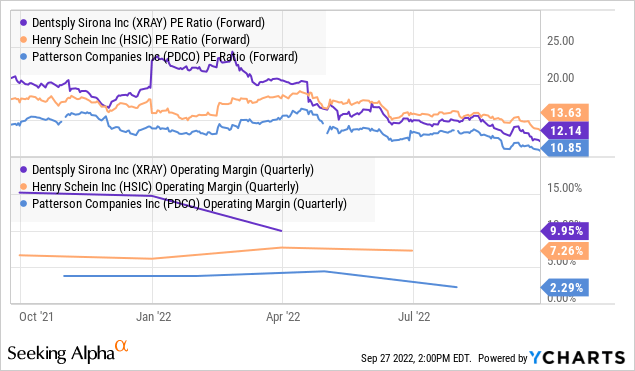

The biggest challenge we see for the stock comes down to valuation. Shares of XRAY trading at a 12x forward P/E on the current 2022 consensus EPS in line with management EPS guidance is just average compared to its peer group of competitors Patterson Companies Inc (PDCO) and Henry Schein Inc (HSIC) with an 11x and 14x forward P/E multiple, each respectively.

To be clear, Patterson and Henry Schein have key differences to Dentsply, but are major players in dental industry supplies facing similar market dynamics. By this measure, even following the deep selloff in the stock this year, XRAY doesn’t necessarily stand out as deeply undervalued. The dynamic can also be seen in other metrics like the EV to EBITDA multiple near 10X. Historically, XRAY’s ability to generate higher operating margins has driven the premium, which now gets harder to justify amid corporate dysfunction.

We rate XRAY as a hold representing a neutral near-term view of the stock. For investors stuck in the position from last year, our message here is that it’s probably too late to sell. We don’t see any near-term catalyst that would mark the start of a sustained rally and recognize the downside risks in earnings estimates.

The first step to any turnaround would be a conclusion to the probe and a return of listing compliance. A headline of the full Q1 and Q2 reports being released with a return to business as usual could spark a rally in the stock, although any chance of shares returning to peak in 2021 seem remote. The other side would be further setbacks including missing the next compliance deadlines or a more extensive investigation involving the SEC that would open the door for another leg lower in shares.

Be the first to comment