Ronald Martinez

Investment Rationale

The structural demand for more oil and gas supply provides strong tailwinds for Halliburton’s (NYSE:HAL) business, and it is well-positioned to deliver improved profitability and increased returns for shareholders. Halliburton’s stock is outperforming the benchmark index, S&P 500 Index on a YTD, 1-year, and 3-year basis. Like other oil and gas companies, Halliburton stock is up on a YTD basis, even when the S&P 500 Index is down. Halliburton’s strategic goals, fundamental strength, and reasonable valuation indicate a good upside potential and makes it a suitable candidate for investment purpose.

About the Company

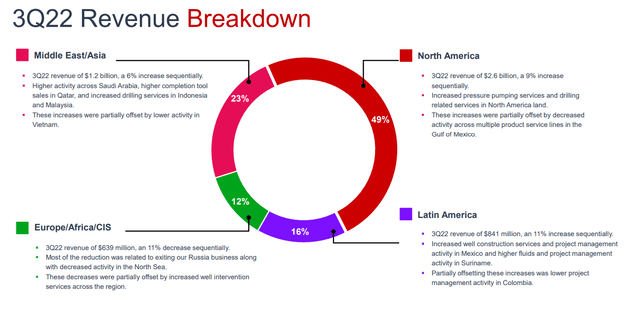

Halliburton Company is an oilfield services company offering a broad range “of equipment, maintenance, and engineering and construction services to the energy, industrial, and government sectors.” The company operates in more than 80 countries. It operates under two segments: Completion and Production, and Drilling and Evaluation. The following image briefs the revenue breakup of the company on a geographical basis:

Strong Financial Performance

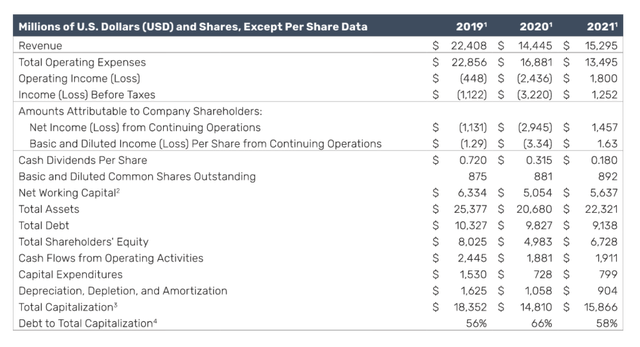

For the year 2021, the company delivered a profitable international growth with solid cash flow in North America. It has also deployed new digital and automation technology along with an increase in capital efficiency. The oil and gas sector faced the brunt of the pandemic, which also impacted Halliburton’s operations and margins in 2020. The company was able to reverse the operating and net losses in the transition year 2021 with the reopening of the economy and an oil and gas demand recovery accelerating across the globe. The following table gives an overview of the financial numbers reported by the company in 2019, 2020, and 2021.

In 2022, the company reported a strong performance. Overall, the performance demonstrated the company’s strong roots in the active North American Market.

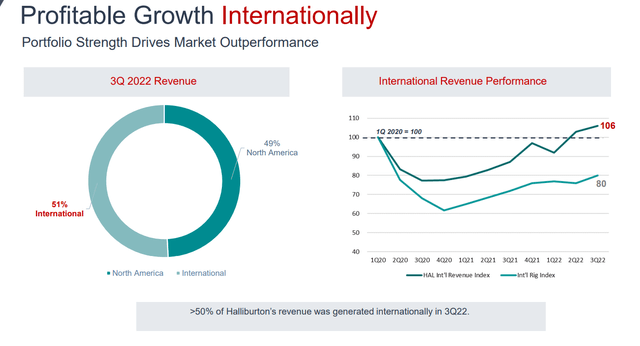

At the same time, its international operations continue to thrive. In Q32022, the company generated more than 50% of its revenue internationally. Comparing the performance of revenue in Q1 of 2020 with Q3 of 2022, the company has outperformed, showing the strength of its portfolio. The following graph highlights Halliburton’s international growth.

Internationally, Halliburton earned a revenue of $2.7 billion in the third quarter of 2022, which grew 3% compared to the second quarter of 2022.

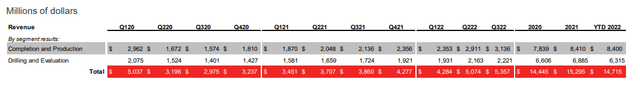

In Q3, the company completed the sale of its Russia operations. The results of both the divisions (Completion & Production and Drilling & Evaluation) were negatively impacted by the wind-down and sale of Russian operations. Despite the negative impact, both the segments reported higher revenues.

Even historically, the revenue numbers for both the segments have improved consistently since Q1FY20.

International revenue in the third quarter for the C&P and D&E divisions beat the international rig count growth and reflected the company’s competitiveness in all markets.

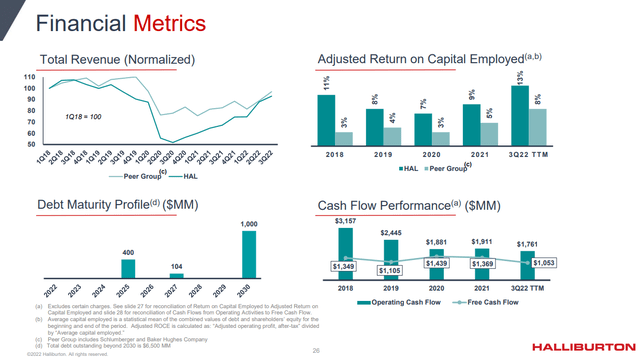

Over the last five years, Halliburton has consistently provided a higher adjusted return on capital employed as compared to its peers. The adjusted ROCE was 13% (‘TTM’) at the end of 3Q 2022.

The debt maturity profile of Halliburton indicates that till 2030, the company is not required to park funds for repayment of debt every year, except in 2025, 2027, and 2030.

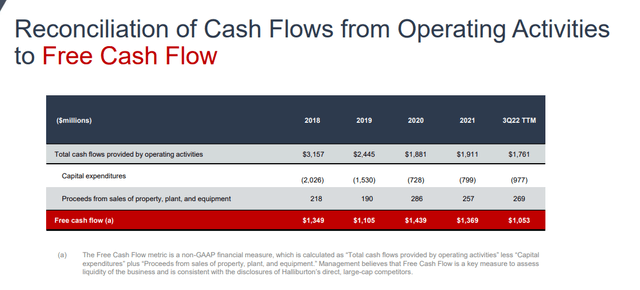

The company has been working efficiently towards the generation of free cash flows to derive value for its shareholders. It is reflected in the reported healthy total cash flow from operations and free cash flow numbers from 2018 to 3Q2022 as shown below:

Halliburton’s intelligent fracturing system, SmartFleet, is witnessing a favorable demand growth. Jeff Miller, Halliburton’s President and CEO, noted during the company’s third-quarter earnings call,

Additionally, our SmartFleet intelligent fracturing system continues to gain traction and we expect an almost eight-fold increase in stages completed this year. SmartFleet gives customers unparalleled access to data about where and how their fractures permeate, the potential for frac hits on adjacent wells and the real-time data necessary to improve completion designs.

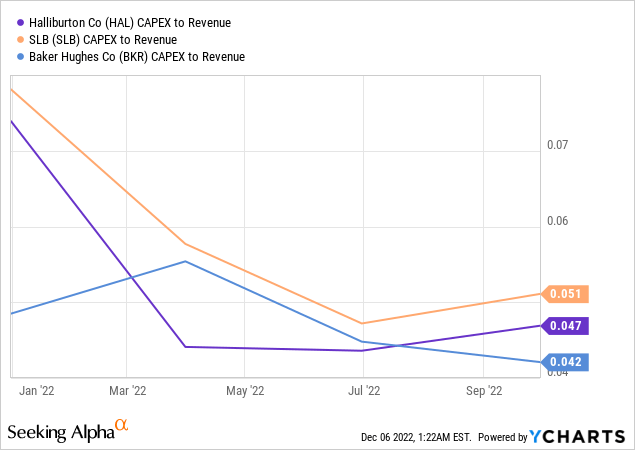

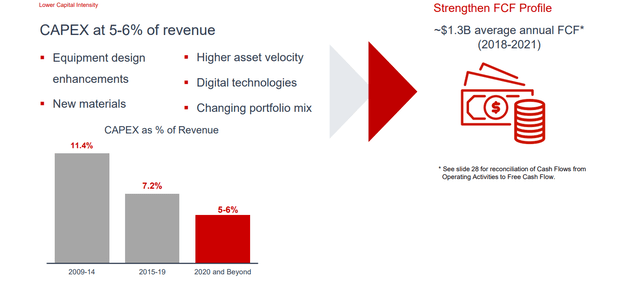

The capital expenditure for the third quarter was $251 million. The full year capital expenditure is expected to be in line with the company’s target of 5% to 6% of revenue.

Also, when compared to its peer companies, Halliburton’s Capex to Revenue Ratio appears to be decent, indicated by the following graph:

The company has also set key strategic priorities focusing on delivering industry-leading returns and strong free cash flow for shareholders.

Valuation

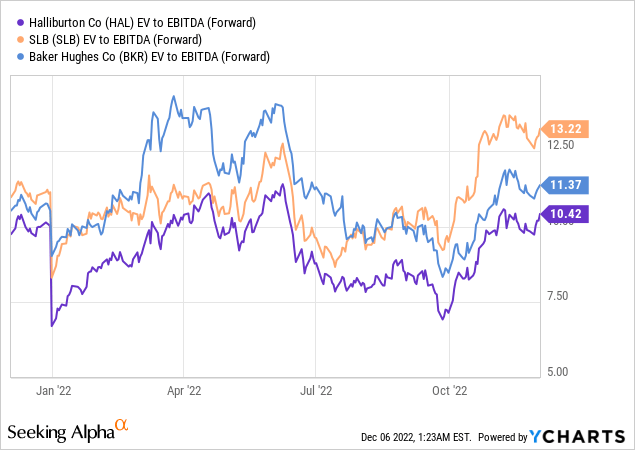

For an energy company, the EV to EBITDA ratio plays an important role as it takes into account the amount of debt the company has in the Enterprise Value (EV) calculation. The lower is the EV to EBITDA ratio, the more attractive the stock is for investors. The company stands in a good position as it trades at a comparatively lower forward EV to EBITDA than the multiples for Baker Hughes (BKR) and SLB (SLB), two of its top peer companies. The following graph compares the forward EV to EBITDA multiple of Halliburton with its peers.

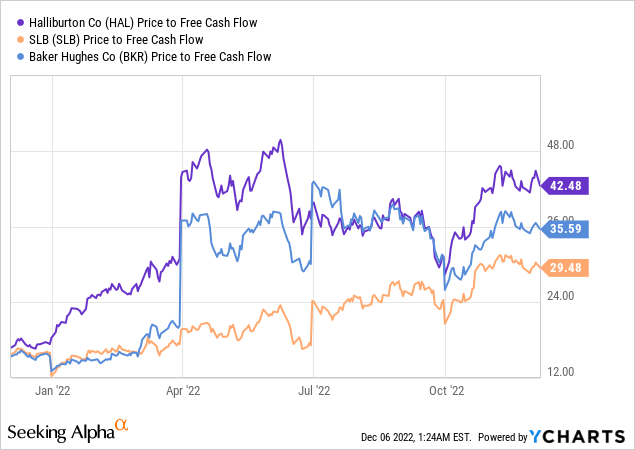

Halliburton’s stock, however, looks expensive based on the price-to-free cash flow ratio.

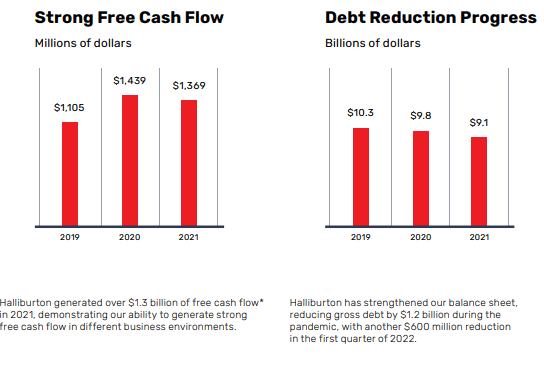

Though the free cash flow generated by the company was less than SLB, on an individual basis, the company generated over $1.3 billion of free cash flow in 2021 demonstrating its ability to generate strong FCF. The company also reduced its gross debt by $1.2 billion in two years.

Halliburton

Seeking Alpha’s proprietary quant ratings rate Halliburton as “strong buy.” The stock is rated high on revisions, momentum, and growth factors.

Conclusion

I think the supply for oil and gas will continue to struggle due to multiple years of underinvestment. The struggle traces to low inventory levels, production levels well below expectations, and temporary actions such as the lowest-ever Strategic Petroleum Reserve after releases. Against tight supply, demand for oil and gas is strong and is expected to continue to be strong. The volatility in broader markets can be clearly seen, but Halliburton can sense growing demand for equipment and services. Multiple years of increased investment in existing and new sources of production should solve the short supply.

The structural demand for more oil and gas supply provides strong tailwinds for Halliburton’s business, and it is well-positioned to deliver improved profitability and increased returns for shareholders. The company’s robust third quarter results and focus on executing strategic priorities indicate an optimistic outlook regarding the company deriving value for its shareholders. Hence, the stock of Halliburton Company can be a good alternative for long-term investment, in my view.

Be the first to comment