mfto/iStock via Getty Images

My monthly series 10 Dividend Growth Stocks presents ten picks from Dividend Radar for further analysis and possible investment. To highlight different aspects of dividend growth [DG] investing, I use different screens stocks every month. For example, income investors favor higher yields and growth-oriented investors favor higher DG rates.

This month, I screened for discounted, high-yielding stocks. I used a threshold of 3% for yield and screened three different valuation conditions. Each stock is discounted based on my fair value [FV] estimate, trades below my risk-adjusted Buy Below price, and has a forward yield that tops the stock’s 5-year average yield.

I usually rank candidates using scores obtained from DVK Quality Snapshots. Before writing this article, I changed how quality scores are calculated. I’ll discuss the change and why I made it below.

Screening and Ranking

For this month’s article, I used the following screens:

- Stocks in Dividend Radar

- Investment Grade stocks (DVK Quality Scores: 15-25)

- Stocks yielding at least 3%.

- Stocks trading below my FV estimate

- Stocks trading below my risk-adjusted Buy Below prices (see below)

- Stocks whose forward dividend yield exceeds the 5-year average dividend yield

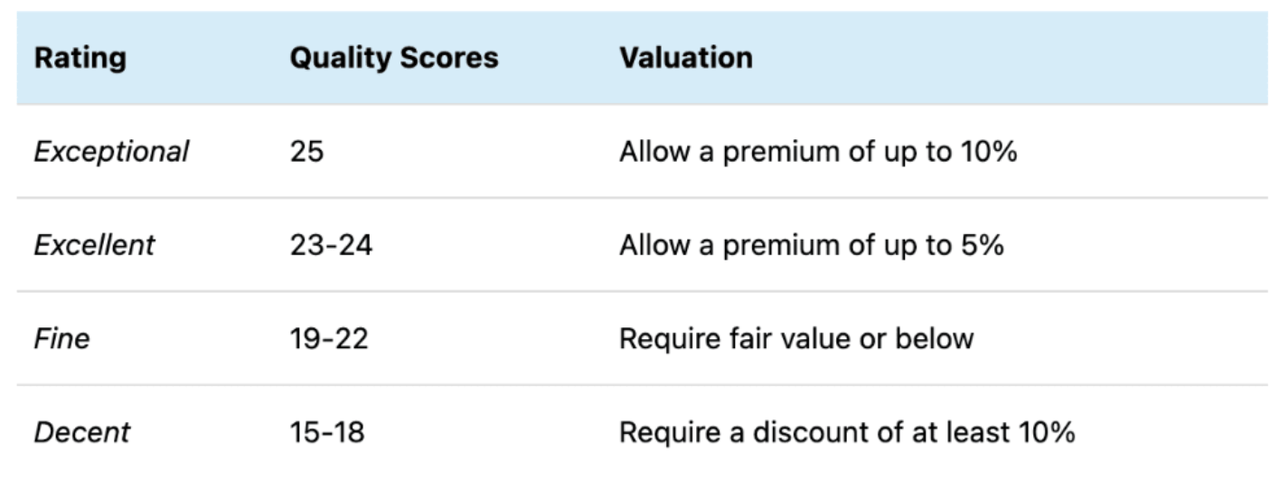

My risk-adjusted Buy Below prices allow premium valuations for the highest-quality stocks but require discounted valuations for lower-quality stocks:

To estimate fair value [FV], I reference fair value estimates and price targets from several sources, including Portfolio Insight, Morningstar, and Finbox. Additionally, I estimate fair value using the five-year average dividend yield of each stock. With up to 11 estimates and targets available, I ignore the outliers (the lowest and highest values) and use the average of the median and mean of the remaining values as my FV estimate.

The latest Dividend Radar (dated April 8, 2022) contains 749 stocks. There are 237 stocks with forward dividend yields of 3% or higher, but only 22 pass my three valuation screens.

I ranked these candidates by sorting their DVK Quality Scores in descending order and breaking ties using the following metrics, in turn:

- Simply Safe Dividends‘ Dividend Safety Scores

- S&P Credit Ratings

- Forward Dividend Yield

Before presenting the ten top-ranked candidates, let me explain a small change I’ve made to how quality scores are calculated in DVK Quality Snapshots.

A Scoring Change in DVK Quality Snapshots

I’ve been using David Van Knapp‘s Quality Snapshots system since August 2019. The system is elegant and effective and provides a quick way to assess the quality of DG stocks. David and I have talked about ways to improve Quality Snapshots and we’ve made minor adjustments occasionally.

One problem we haven’t solved is the outsized impact that Value Line [VL] has on quality scores. VL contributes two quality factors to the scoring system: the VL Safety Rank worth 5 points and the VL Financial Strength worth 5 points. Without VL coverage, a stock misses out on 10 out of 25 points!

To address this shortcoming, I’m changing how I calculate quality scores when VL doesn’t cover a stock. In such cases, I’m multiplying the stock’s quality score by 23÷15 (and ignoring the decimal digits in the result).

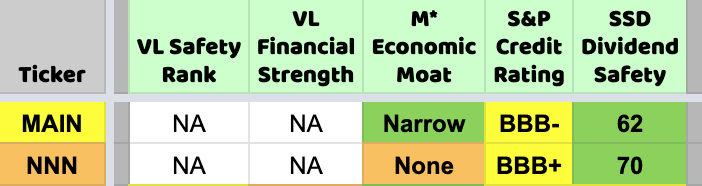

To see how this works, let’s consider two stocks I hold in my DivGro portfolio, Main Street Capital (MAIN) and National Retail Properties (NNN), neither of which are covered by VL:

Created by the author from a personal spreadsheet.

MAIN scores only 11 points:

- Narrow scores 4

- BBB- scores 3

- 62 scores 4

After the scoring change, MAIN scores 11×23÷15 = 16.867 or 16 points when ignoring the decimal digits in the result.

NNN scores only 9 points:

- None scores 2

- BBB+ scores 3

- 70 scores 4

After the scoring change, NNN scores 9×23÷15 = 13.8 or 13 points when ignoring the decimal digits in the result.

The effect of the scoring change is that stocks not covered by VL are no longer penalized excessively. Still, I’m penalizing them a little bit by limiting their maximum score to 23 points.

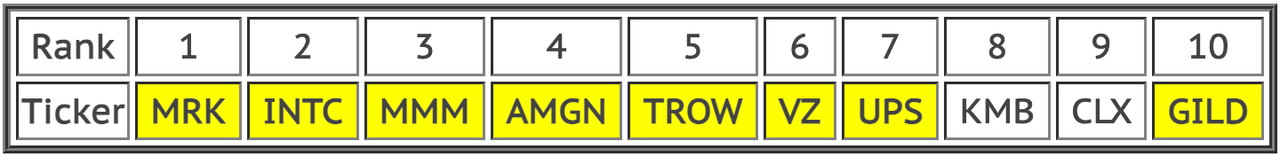

Top 10 Dividend Growth Stocks for April

Here are this month’s ten top-ranked DG stocks in rank order:

| Top 10 Dividend Growth Stocks for April 2022 |

Created by the author. |

|

Click here to review the February Edition of 10 Dividend Growth Stocks. |

I own all of the highlighted stocks in my DivGro portfolio.

The following company descriptions are my summary of company descriptions sourced from Finviz.

1. Merck (MRK)

Founded in 1891 and headquartered in Kenilworth, New Jersey, MRK is a global health care company that offers health solutions through prescription medicines, vaccines, biologic therapies, and animal health products. MRK markets its products to drug wholesalers and retailers, hospitals, government entities and agencies, physicians, physician distributors, veterinarians, distributors, animal producers, and managed health care providers.

2. Intel (INTC)

INTC designs, manufactures, and sells computer, networking, and communications platforms worldwide. The company operates through Client Computing Group, Data Center Group, Internet of Things Group, Non-Volatile Memory Solutions Group, Intel Security Group, Programmable Solutions Group, and All Other segments. INTC was founded in 1968 and is based in Santa Clara, California.

3. 3M (MMM)

MMM is a diversified technology company with worldwide operations. The company has leading positions in consumer and office; display and graphics; electronics and telecommunications; health care; industrial; safety, security, and protection services; transportation; and other businesses. MMM was founded in 1902 and is headquartered in St. Paul, Minnesota.

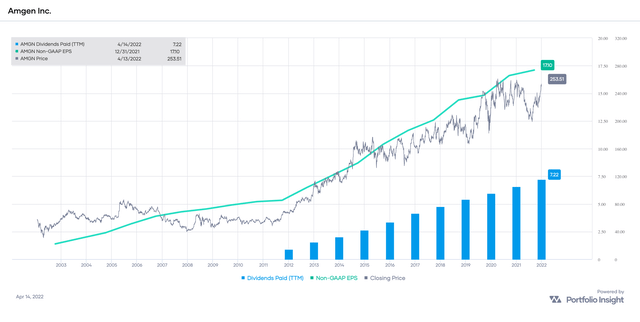

4. Amgen (AMGN)

Based in Thousand Oaks, California, AMGN is a biotechnology company. The company discovers, develops, manufactures, and delivers human therapeutics worldwide. It offers products for the treatment of serious illnesses in the areas of oncology/hematology, cardiovascular disease, inflammation, bone health, nephrology, and neuroscience. AMGN was founded in 1980.

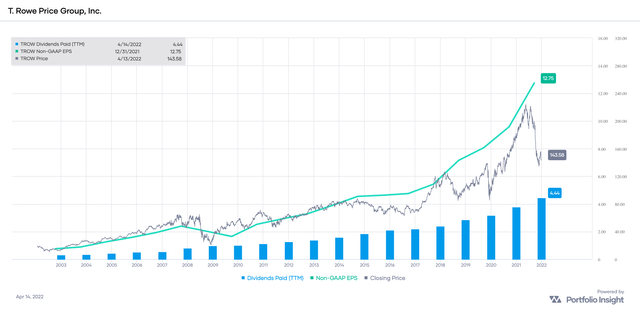

5. T. Rowe Price (TROW)

Founded in 1937, TROW is a financial services holding company that provides global investment management services to individual and institutional investors in the sponsored T. Rowe Price mutual funds and other investment portfolios, as well as through variable annuity life insurance plans. TROW is based in Baltimore, Maryland.

6. Verizon Communications (VZ)

VZ provides communications, information, and entertainment products and services to consumers, businesses, and governmental agencies worldwide. Formerly known as Bell Atlantic Corporation, the company changed its name to Verizon Communications Inc in June 2000. VZ was founded in 1983 and is based in New York, New York.

7. United Parcel Service (UPS)

UPS is a global leader in logistics, offering a broad range of solutions including the transportation of packages and freight; the facilitation of international trade, and the deployment of advanced technology to more efficiently manage the world of business. Headquartered in Atlanta, UPS serves more than 220 countries and territories worldwide.

8. Kimberly-Clark (KMB)

Using advanced technologies in natural and synthetic fibers, non-wovens, and absorbency, KMB manufactures a range of personal care, consumer tissue, and professional products. Brands include Huggies, Kleenex, Scott, and Cottonelle. The company sells its products directly to retail outlets and through e-commerce. KMB was founded in 1872 and is headquartered in Dallas, Texas.

9. Clorox (CLX)

CLX manufactures and markets consumer and professional products worldwide. Brand names include Clorox bleach and cleaning products, Pine-Sol cleaners, Liquid-Plumr clog removers, and Kingsford charcoal. The company sells its products through mass retail outlets, e-commerce channels, distributors, and medical supply providers. CLX was founded in 1913 and is headquartered in Oakland, California.

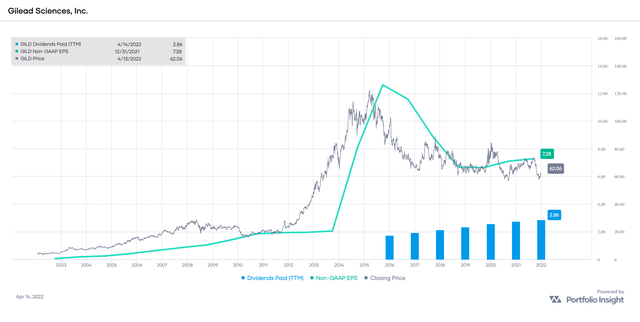

10. Gilead Sciences (GILD)

GILD is a research-based biopharmaceutical company that discovers, develops, and commercializes innovative medicines. The company’s primary areas of focus include human immunodeficiency virus, liver diseases such as chronic hepatitis B and C virus infections, oncology and inflammation, and serious cardiovascular and respiratory conditions. GILD was founded in 1987 and is headquartered in Foster City, California.

Please note that the top ten DG stocks are candidates for further analysis, not recommendations.

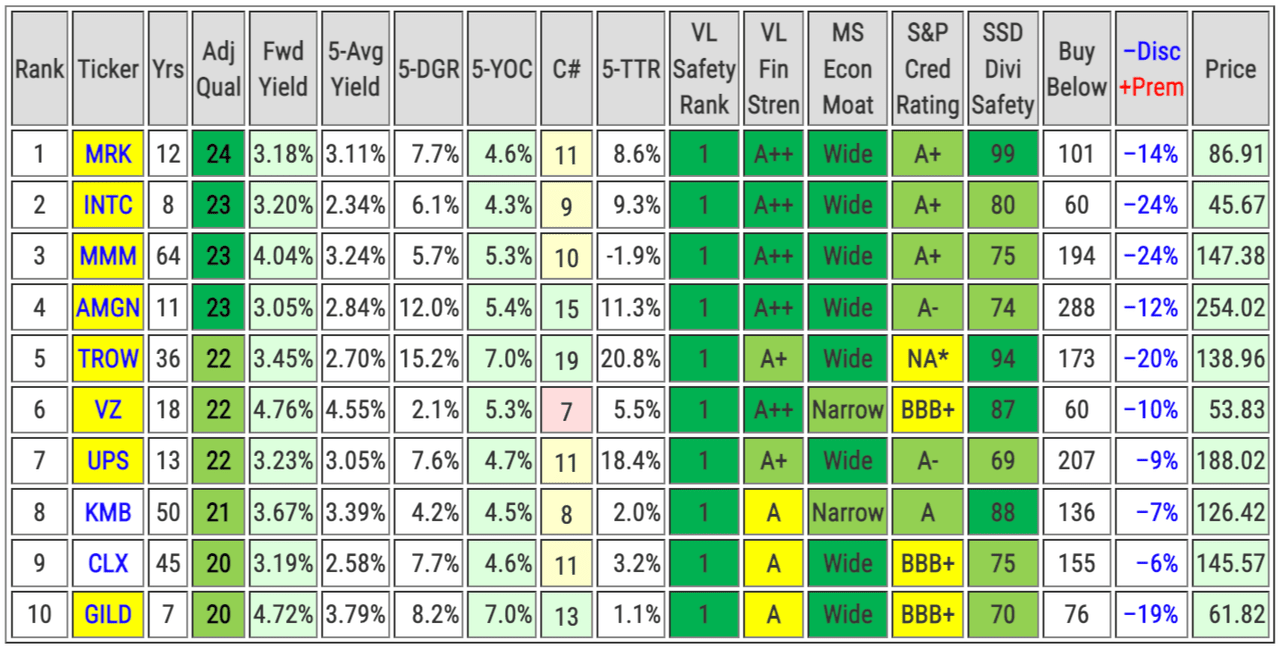

Key Metrics and Fair Value Estimates

Below, I present key metrics of interest to dividend growth investors, along with quality indicators and fair value estimates:

-

Yrs: years of consecutive dividend increases

-

Adj Qual: DVK Quality Snapshots adjusted quality score

-

Fwd Yield: forward dividend yield for a recent share Price

-

5-Avg Yield: 5-year average dividend yield

-

5-DGR: 5-year compound annual growth rate of the dividend

-

5-YOC: the projected yield on cost after five years of investment

-

C#: Chowder Number, a popular metric for screening dividend growth stocks

-

5-TTR: 5-year compound trailing total returns

-

VL Safety Rank: Value Line’s Safety Rank

-

VL Fin Stren: Value Line’s Financial Strength ratings

-

MS Econ Moat: Morningstar’s Economic Moat

-

S&P Cred Rating: S&P Global’s Credit Ratings

-

SSD Divi Safety: Simply Safe Dividends’ Dividend Safety Scores

-

Buy Below: my risk-adjusted buy below price

-

-Disc +Prem: discount or premium of the recent share Price to my Buy Below price

-

Price: recent share price

|

Color-coding

|

Created by the author from a personal spreadsheet.

| Rank | Company (Ticker) | Sector | Supersector |

| 1 | Merck (MRK) | Health Care | Defensive |

| 2 | Intel (INTC) | Information Technology | Sensitive |

| 3 | 3M (MMM) | Industrials | Sensitive |

| 4 | Amgen (AMGN) | Health Care | Defensive |

| 5 | T. Rowe Price (TROW) | Financials | Cyclical |

| 6 | Verizon Communications (VZ) | Communication Services | Sensitive |

| 7 | United Parcel Service (UPS) | Industrials | Sensitive |

| 8 | Kimberly-Clark (KMB) | Consumer Staples | Defensive |

| 9 | Clorox (CLX) | Consumer Staples | Defensive |

| 10 | Gilead Sciences (GILD) | Health Care | Defensive |

Commentary

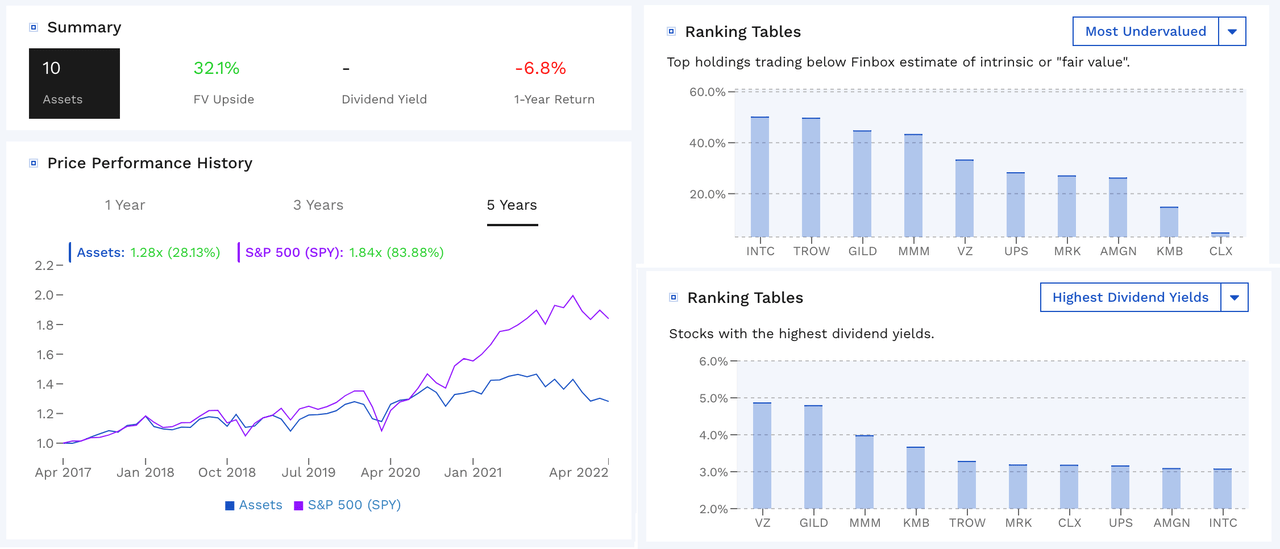

Here’s a comparative analysis of an equal-weighted portfolio of this month’s top ten DG stocks, courtesy of Finbox.com:

Finbox.com

From a price-performance perspective, the portfolio would have underperformed the S&P 500 (as represented by the SPDR S&P 500 Trust ETF (SPY)) over the last five years, returning 28% versus SPY’s 84%. All the stocks have fair value upsides according to Finbox.com.

VZ (4.76%) and GILD (4.72%) offer the highest forward yields, while TROW (15.2%) and AMGN (12.0%) have the highest 5-year DGRs.

TROW (19), AMGN (15), and GILD (13) have the highest C#’s, and TROW (20.8%) and UPS (18.4%) have the highest 5-year TTRs.

Only three of the stocks pass all five of my stock selection criteria for adding new positions to my DivGro portfolio:

- Stock Quality: Quality scores ≥ 19 (Exceptional, Excellent, or Fine ratings)

- Stock Valuation: Price ≤ Buy Below price (trades below my risk-adjusted Buy Below price)

- Growth Outlook: Green C#s (likely to deliver annualized returns of 8%)

- Income Outlook: 5-year YoC ≥ 4.00% (likely to have high YoCs after 5 years of ownership)

- Dividend Safety: Dividend Safety Scores > 60 (dividends deemed Very Safe or Safe)

In rank order, these stocks are AMGN, TROW, and GILD.

AMGN is a Dividend Contender with a dividend increase streak of ten consecutive years.

AMGN’s earnings and dividend growth histories are impressive, though, at 41% its earnings payout ratio is “edging high for biotechs” (according to Simply Safe Dividends).

Based on my preferred portfolio target weights, my AMGN position is slightly overweight by about 29 shares, which means I won’t be adding shares to my AMGN position in the near future.

TROW is a Dividend Champion with a dividend increase streak of 36 consecutive years.

The stock’s earnings and dividend growth histories are quite impressive, so it’s exciting to see an opportunity here with the recent stock price decline.

According to Simply Safe Dividends, TROW’s payout ratio is “edging high for asset managers”, though the stock’s dividend is considered Very Safe with its Dividend Safety Score of 94.

My TROW position is slightly underweight by about 30 shares, so I’m looking to add some shares. The timing seems good, as TROW has dropped a lot but seems to be finding a base now.

GILD is a Dividend Challenger with a dividend increase streak of 7 consecutive years.

GILD changed from a growth stock to a DG stock in 2016, and the impact of that change on GILD’s stock price certainly is informative! Perhaps it will take a while for DG investors to build trust in the company’s ability to continue paying and raising its dividends. The company is growing its dividend at a reasonable rate (5-year DGR is 8.2%), so I’m willing to be patient with GILD in my portfolio.

According to Simply Safe Dividends, TROW’s payout ratio is “edging high for biotechs”, but the dividend is deemed Safe with a Dividend Safety Score of 70.

My GILD position is slightly underweight by about 17 shares, so I’m looking to add some shares.

Concluding Remarks

In this article, I ranked 22 discounted Dividend Radar stocks yielding at least 3%.

I own all but two of the stocks in this month’s top 10. I’m considering adding shares to TROW and GILD, as both are a bit underweight in my portfolio. I also like AMGN, but my position is somewhat overweight.

Based on your investment style, you may want to focus on the following stocks first:

- For income investors: VZ, GILD, and MMM

- For value investors: INTC, MMM, and TROW

- For dividend growth-oriented investors: AMGN and TROW

- For very safe dividends: MRK and TROW

As always, I encourage readers to do their due diligence before buying any stocks I cover

Thanks for reading and take care, everybody!

Be the first to comment