xavierarnau/E+ via Getty Images

Published on the Value Lab 13/4/22

Logistics is probably one of the most interesting businesses in the world right now, which is why we are wondering about logistic real estate. This leads us to Prologis (NYSE:PLD), a company that has a global presence of logistic real estate, primarily in America and in Europe. Just like the rest of the logistics supply chain which has lots of pent-up demand, Prologis is attractive, but its all-time highs betray its ‘flavour of the moment’ status. Rates are going up, velocity of goods could decline, and their properties could lose some of the surge that they got in sentiment from the supply chain crises. While a microcosm worth studying, we give it a pass for now.

Look At PLD

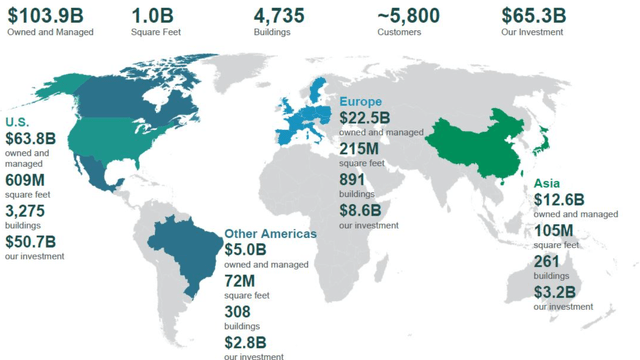

Prologis owns and operates logistic real estate all over the world.

PLD Geographic Spread (10-K 2021)

With supply chain issues being a global phenomenon, and with the invasion of Ukraine now a strategic concern, Prologis is a bit in the spotlight. Their business situation is excellent. Their leases are about 5 years long on average, and their FFO grew 14% YoY for the FY, with an increase in lease terms of 33% on leases that rolled over in the period creating a valuable base going forward. Tenants are less sensitive to real estate costs compared to fuel and labor costs, so the pricing power is quite meaningful for Prologis in negotiating its leases.

Moreover, the supply chain issues that have been driving performance for Prologis has only really cropped up towards the middle of 2021. This has caused fundamental shifts in demand for logistic real estate. Strategic considerations means that estimates land at a 5% increase in inventory levels relative to sales for the average company, which presumably means that the demand for warehousing space has grown by 5% at least assuming sales growth, a meaningful punctuated change. Moreover, this average is likely being driven by more working capitally intense businesses which could lie above it. Speaking with people in the industry, homebuilders are warehousing massive amounts of appliances and steel for modern condos, paying even 50% premiums and happy with the materials collecting dust for half a year, just to be able to have the inventory to deliver homes instead of the unfinished home inventory continuing to burgeon.

Logistics continues to be a major bottleneck. From our research in AB Volvo (OTCPK:VOLAF), flatbed trucks are struggling to be built due to semiconductor supply issues which persist, and the extent of the flatbed shortfall means that companies like Interfor (OTCPK:IFSPF) are also curtailing production because there is nowhere for their lumber to go. With coming rate hikes likely to be insufficient to deal with inflation as it is primarily supply side, and with shortages likely to continue unless rates rise substantially more, logistic considerations will continue to be a driver of value for Prologis.

The Issues

The problem is if rates continue to rise as monetary authorities take a more pronounced stance on inflation. Cap rates should start to rise and the value of these assets should begin to fall both as property markets do but also as the Prologis value proposition unravels with lower velocity of goods.

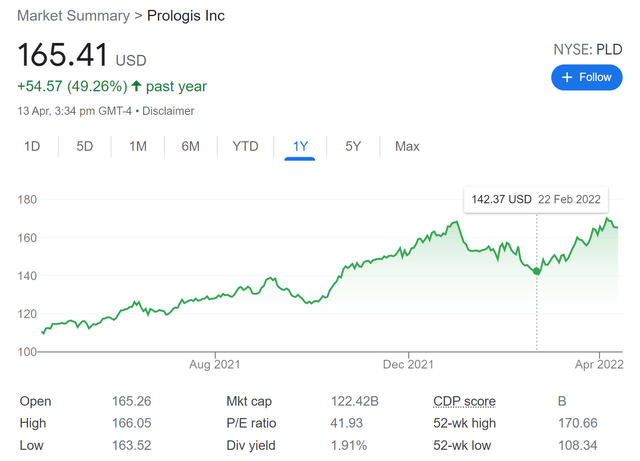

PLD Stock Price (Google Finance)

The price is already at almost all-time highs. I think that the monetary authorities are no longer willing to risk inflation being transitory, although core inflation being below expectations does seem to indicate that ongoing efforts to expand physical capacity is perhaps beginning to affect inflation trends. The rally of the markets may be coming to an end at this point, so any business trading at all-time highs and doesn’t have the margin of safety of being pre-emptively beat up by markets worries me.

Final Remarks

Secular trends still support the business, where the inflation and supply chain related ones may be more transient. The pandemic has certainly been a catalyst for growth in ecommerce, which has lowered the cost of purchase of goods thus increasing the velocity of goods trade, in addition to velocity increasing as a consequence of greater share over services as a consequence of the pandemic. The surge in goods demand might be at risk at this point with interest rate hikes needing to slow down the economy to bear any effect. Secular trends related to digitalization assure some value, but we’d still err on turning away from stocks trading at all-time highs.

Be the first to comment