Delmaine Donson

Show Me the Incentive and I’ll Show You the Outcome

Charlie Munger, Vice Chairman, Berkshire Hathaway

Incentives are a powerful but often overlooked aspect of investing in stocks. There are two main areas to keep in mind regarding incentives: Insider ownership and management compensation structures. Insider ownership refers to the percentage of a company’s stock that its executives and board members own. Management compensation structures define the compensation a management will receive in cash and stock/options. In this article, we will discuss the importance of insider ownership and management incentive structures in Watsco (NYSE:WSO) and why it should be considered when evaluating the potential success of a business.

This article will focus on the incentives in Watsco; if you want to read more about the underlying business, read my prior coverage of Watsco.

Why is insider ownership important?

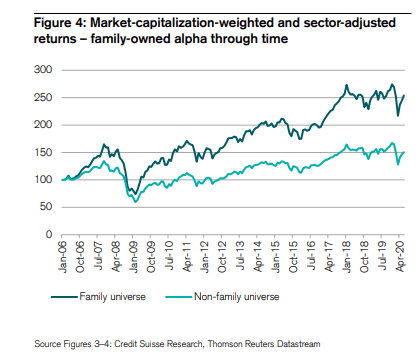

Credit Suisse (CS) published a research paper in September 2020 about the outperformance of family-owned and founder-led businesses compared to its peers. We can see that family-owned businesses generated a lot of alpha over extended periods in the past. Credit Suisse goes into a lot of detail in this report and I encourage everybody to read it.

long-term outperformance of family-owned businesses (Credit Suisse)

Family-owned and founder-led companies typically have a large percentage of the shares outstanding in possession of the family. Often there are also different classes of shares. For example, Alphabet (GOOG, GOOGL) has three different share classes:

- Class A shares are publicly traded and have one vote.

- Class B shares are not publicly traded and have ten votes.

- Class C shares are publicly traded and have no votes.

Thanks to structures like this, the founders can retain complete control of their company without owning most shares. Control is the first important part of insider ownership, no matter if it’s because of the shareholding structure or the total number of shares held. A company with low insider ownership can get pressured by outside entities that can, for example, force the management to pay large special dividends, as was the case for Varta AG (OTC:VARGF) in 2021. My investment philosophy wants companies with strong leadership with a clear vision that won’t have to give in to pressure from outside owners.

Why are management compensation structures important?

Management compensation is an often overlooked topic for most investors, but it is quite crucial for several reasons:

For one, it aligns the interests of the company’s insiders with those of its shareholders, as the insiders have a vested interest in the company’s success. Additionally, insider ownership can indicate the company’s executives and board members’ confidence in the company’s future performance. This can also work on the average employee level. You work with a different mentality if you are an owner versus just an employee.

Everything about these structures can be found in the Proxy Statement for US companies.

Reviewing Watsco’s alignment

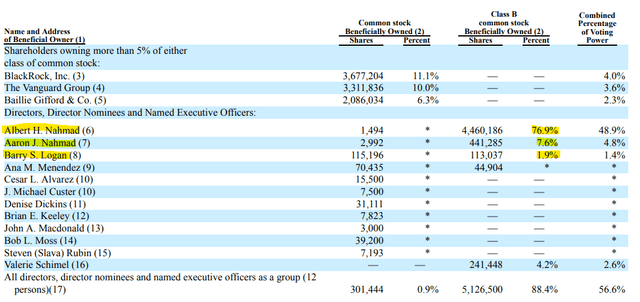

First, let’s review the stock ownership for Watsco to find out how much of the company is owned and controlled by insiders. You can find the 14A document here. We can see that Watsco has two share classes:

- 33,151,638 outstanding common stock shares (1 vote).

- 5,797,590 outstanding Class B shares (10 votes).

Watsco has three shareholders with more than 5% of shares outstanding for its common stock, but more importantly, Albert H. Nahmad owns 76.9% of Class B shares. He is the founder of Watsco and has been the CEO of Watsco for 50 years! This must be one of the longest-standing tenures, only beaten by the likes of Warren Buffett. Aaron J. Nahmad, the son of Albert Nahmad, also owns 7.6% of Class B shares. The third notable insider is Barry S. Logan. Although Barry is not a family member, he was the fourth corporate employee of Watsco and has been loyal to the company for decades. All insiders of the company own a combined 56.6% of voting rights, with 53.7% just in the hands of the Nahmad family. This means that the family has complete control of the company and can continue to think for the long term instead of trying to please wall street for short-term gains.

Watsco Stock ownership (Watsco 14A 2022)

Watsco’s unique incentive structure

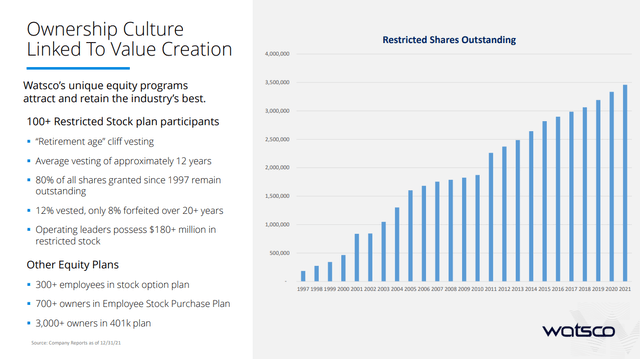

Watsco has a very unique incentive structure for its leadership team. Most companies have stock options that vest over a few years, meaning they unlock after a few years. Watsco is trying to incentivize long-term thinking and vests the restricted shares towards the end of an employee’s career, usually age 62 or older.

This means our key leaders do not know and cannot realize the value of their restricted share awards until they have spent their respective careers with the Company. […] The Company began granting restricted shares in 1997. As of the record date, 127 of the Company’s key leaders, including the NEOs, hold restricted share awards that cliff-vest between 2022 and 2051. If, for any reason other than death or disability, a holder of restricted shares leaves the Company, his or her restricted shares are forfeited.

Watsco Proxy statement

This kind of, in many cases, decade-long commitment incentivizes leaders to think long-term and creates an ownership culture. These restricted stock options are rewarded based on Total Shareholder Return (TSR). Watsco has created a 20.06% TSR CAGR over the last 30 years, creating immense alpha compared to all indices. Compared to all US public companies with over $2 billion in market cap, Watsco ranks #25 for TSR.

I am not the biggest fan of using TSR as a measure(at least not as the singular metric), but it works in the case of Watsco, where shares have been locked up for decades. I prefer if TSR is combined with a metric for reinvestment effectiveness, like Return on Equity, Return on invested Capital or Return on Capital employed.

A culture of ownership

Watsco also offers its employees several plans to purchase shares at a discount (5%), stock option bonus programs and 401k matching. As a result, more than 3000 employees are company owners through their 401k, purchased shares or stock options. This represents at least 43% of its 6850 full-time employees.

Watsco company wide insider ownership (Watsco Investor Presentation)

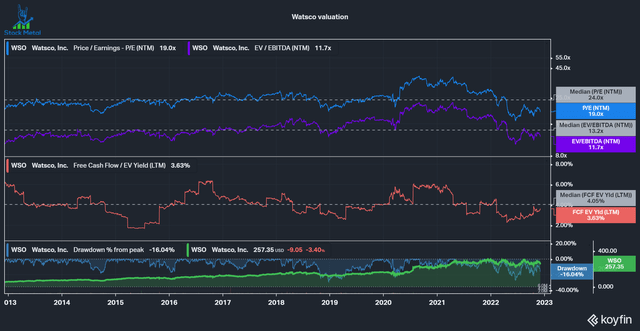

Watsco is looking fairly priced

If we look at the current valuation of Watsco, we can see that the stock is trading below its ten-year median PE and EV/EBITDA multiples but is more expensive than its median FCF yield. This is in part due to a surge in inventory. Historically Watsco manages to convert around 100% of its net income to free cash flow. Some people have concerns about the company overearning in the last 12 months, but I believe that the company will manage to keep its margins and increase them over time. I wrote more about how they will achieve that in my prior coverage of Watsco.

I am an Owner as well

I purchased my first shares of Watsco this September, and I am now also an owner. I keep DCAing every month and am ready to deploy more capital if the company experiences a meaningful drawdown in the future. Watsco will continue to think like owners and invest long-term, and I’m looking forward to joining them on the journey.

Be the first to comment