Debbie Ann Powell/iStock Editorial via Getty Images

Shares of Delta Air Lines (NYSE:DAL) slipped after the company provided its second quarter results and provided guidance for the third quarter. Results came in below the consensus estimate and that is not a full surprise as I pointed out earlier that Delta Air Lines but also other airlines are facing a tough environment for staffing and cost control and that is what hit the airline in the second quarter despite strong demand for air travel.

Delta Air Lines Produces a Miss

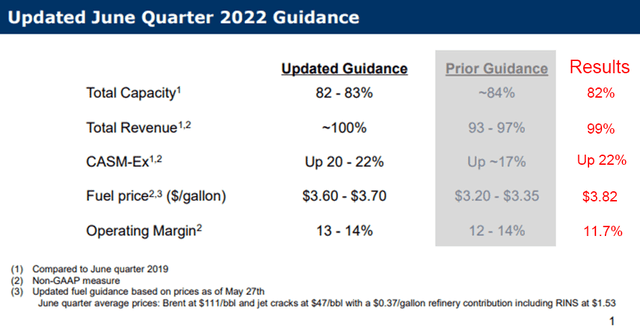

Delta Air Lines Q2 2022 guidance and results (The Aerospace Forum and Delta Air Lines)

Delta Air Lines produced an EPS miss of $0.28 as the consensus estimate was that the company would produce earnings per share of $1.72 but only ended up generating earnings per share of $1.44. As we see, revenue almost fully recovered to 2019 levels as was expected. Delta Air Lines reported revenues of $12.31 billion whereas $12.33 billion was expected and its previous guidance suggested $12.4 billion to $12.5 billion in sales. The miss can be attributed to the capacity being at the lower end of the guided range due to operational reliability issues and Delta’s effort to improve that reliability. The result was that costs per available seat mile excluding fuel (CASM-Ex) were up 22% being the higher end of the range.

The margins ended up below what Delta had guided for. In June, Delta still improved the lower end of its guidance by 1 percentage point, but with an 11% GAAP margin and 11.7% non-GAAP margin Delta missed its updates as well as its initial guidance. It is not really difficult to know where most of that margin compression comes from. If fuel prices would have been at the midpoint of the guided range margins would have been around 12.9% or put differently the margin pressure was between 0.8 and 1.5 percentage point. The remainder of the cost growth was driven by additional investment required to improve operational reliability.

We can make a long store about it, but the fact is that Delta Air Lines missed the numbers from its previous guidance due to operational issues that reduced revenues and required additional investments and higher than expected fuel prices. This has been an ongoing concern for airlines and is not just applicable to Delta Air Lines. Was it all that bad for Delta Air Lines? No, actually not. The company earlier guided for $1.5 billion in free cash flow and despite additional investments to improve operational reliability the airline reported free cash flow of $1.6 billion beating its own guide. Additionally, the momentum for corporate travel is improving. Delta was one of the airlines skeptical about a return of corporate level, but reality is largely proving them wrong now with corporate volume back at 65% and corporate sales back at 80% of previous levels. Surveys indicate that 84% will be recovered measured by volume in the second half of the year pointing to a strong recovery that still has to materialize and 90% in 2023.

Guidance: Not Ambitious

So, things really are not that bad at all I would say. I believe what spooked the market is the fuel prices outstripping the strong demand environment which gives some doubt on future profitability in case fare pricing softens or fuel prices do not fall enough. I don’t think that should have been a reason to set shares of Delta Air Lines lower. In a report covering another airline, I already warned for this and that was a month ago so you could really see this coming miles out. I believe investors were just delusional about the market realities.

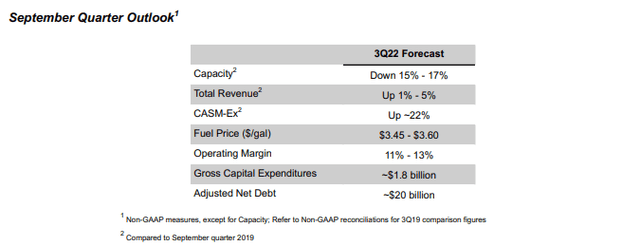

Delta Air Lines Q3 2022 guidance (Delta Air Lines)

In the outlook for the quarter ending September, we see that in terms of capacity recovery Delta Air Lines is not expecting much in capacity restoration, but is expecting lower fuel prices and revenues to be up compared to the same quarter in 2019. I would say that the guidance is not ambitious and there really is nothing bad with that I would say. Surely, investors do like all sorts of rosy outlooks but what are those worth if you can’t achieve those? That is a thing that Delta found out in the second quarter and early July so they are really being more realistic in their forecasting and execution to build in more operational reliability than they did before.

So, the pace of the recovery has slowed but I believe that the ambition has shifted more towards the longer term and that is a realistic assessment I would say. Delta Air Lines has learned not to overpromise and underdeliver and I think it is important to understand that the miss is not so much the result of sustained lack of resources on capacity side. Higher fuel prices, for which I believe Delta has an appreciable strategy, eroded margins and when it comes to staffing they are 95% recovered on 82% capacity. The reality on staffing is that the employees are there, but they are not contributing to the full extent yet as they are flowing through different phases of the process either becoming more proficient or being in training. None of that really deteriorates the long term prospect for Delta Air Lines.

Delta Air Lines in my few has a cost conscious approach towards its fleet procurement and also tries to hedge fuel prices using its refinery while it also tries to diversify its revenue stream with sources other than just passenger and cargo transport with significant prospects for maintenance, repair and overhaul and its partnership with AMEX.

Conclusion

Looking at Delta Air Lines’ results, I would say that while the miss is disappointing, it is not completely unexpected. It seems that everyone including Delta Air Lines itself was expecting strong unit revenue and capacity improvement to outgrow the fuel bill, but this wasn’t the case because the fuel bill was higher than expected while the capacity ended up on the lower range.

The result was that investors discounted share prices of Delta Air Lines. However, I believe that the long-term objectives and strategy remain intact and therefore the strategy has not been discounted creating an opportunity to position for the longer term. The way I look at airlines is that they are less suitable for investment because airline shareholders always find a reason to dump their shares, but I would say that even with a recession, Delta Air Lines is positioned extremely well as an airline and the beaten down stock price is not reflective of its current performance or its future performance.

Be the first to comment