kanawatvector

Gravitating to Visible Growth Amid Uncertainty

Market Overview

Worsening inflation and aggressive actions from the Federal Reserve to contain it sent equity markets spiraling in the second quarter. Investor optimism retreated in the face of persistent price pressures, global supply chain disruptions and rising recession risks, pushing the S&P 500 Index down 16.10% for the quarter, capping its worst start to the year (-19.96%) since 1970. Rising interest rates continued to weigh most heavily on growth stocks with the benchmark Russell 1000 Growth Index falling 20.92% for the quarter, underperforming the Russell 1000 Value Index by 871 basis points. Growth trails value by over 1,500 bps year-to-date.

Exhibit 1: Growth/Value Gap Continues to Widen

As of June 30, 2022. Source: FactSet.

Disruptions in global supply chains stemming from COVID-19 lockdowns in China, the Russian invasion of Ukraine and commodity shortages continued to propel inflation higher. A worse than expected 8.6% Consumer Price Index reading for May caused the Fed to raise rates 75 bps in June, the most aggressive hike since 1994, and project ambitious tightening through the rest of 2022. The 10-year Treasury yield climbed 67 bps to finish the quarter at 3.01%, near its highest level in four years.

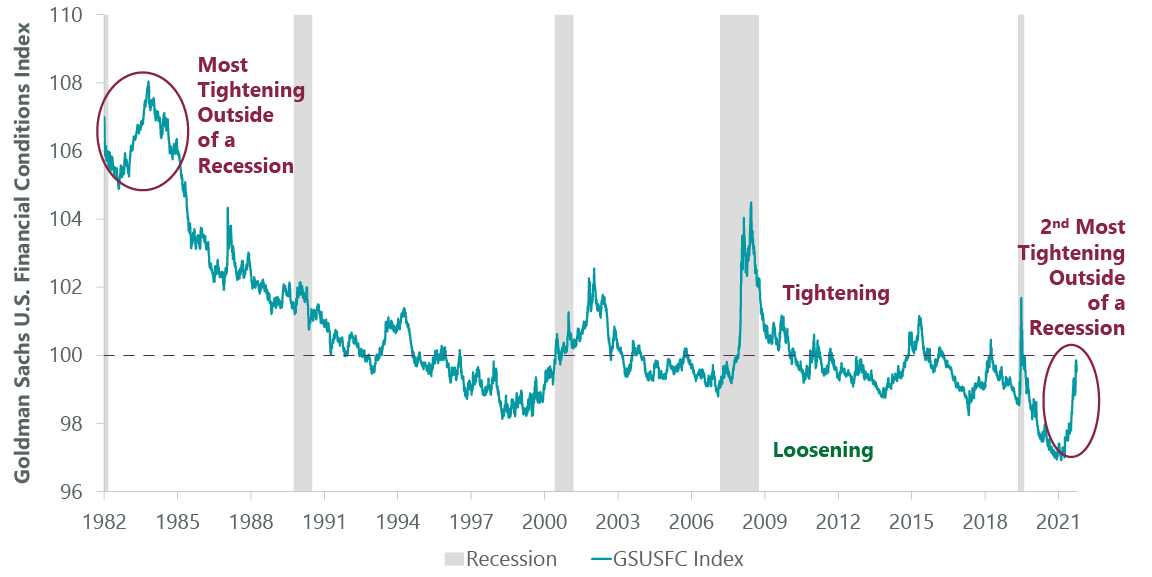

The U.S. economy contracted in the first quarter and the outlook for GDP growth has tempered as more liquidity leaves the financial system (Exhibit 2). While consumer demand has mostly held up, a shift in spending patterns from goods to services led to big first-quarter earnings misses and lowered outlooks for several retailers and social media platforms that are leading digital advertisers. We are, no doubt, in the type of low-growth environment where the ClearBridge Large Cap Growth Strategy should thrive. We manage the Strategy in a diversified, valuation-sensitive manner to participate in up markets but also provide a degree of protection during volatile periods.

Exhibit 2: Financial Conditions Are Rapidly Tightening

Data as of June 30, 2022. Source: Goldman Sachs and Bloomberg.

In the second quarter, however, the uncertainties unique to COVID-19 and the subsequent peak everything environment acted as headwinds to performance. The Strategy underperformed the benchmark, with weakness centered among several key COVID-19 beneficiaries that are seeing tough comparisons, rising input costs or both. The pandemic added a layer of complexity to managing businesses with companies challenged in discerning real trends in their operations from one-time COVID benefits.

Amazon.com (AMZN) was a primary detractor due to a disappointing outlook for profitability in its retail business. Following a surge of e-commerce demand in 2020 and 2021, the company has now overbuilt fulfillment infrastructure as e-commerce demand has moderated. While we believe current profitability levels are suboptimal, Amazon.com is working rapidly to rectify overcapacity issues and we believe the retail business has a robust long-term profitability outlook. We also believe Amazon is well-positioned to emerge stronger from this difficult operating environment of higher costs. There is a visible path to margin expansion driven by a positive mix shift as the more profitable businesses of third-party sellers, cloud, and advertising become the largest contributors.

Chipmaker Nvidia (NVDA) has also been pressured by multiple compression of higher growth companies and weakness in its gaming business. While Nvidia has grown into a top 10 position with its strong performance through late 2021, we have been consistently trimming the position to derisk against short-term volatility in its gaming business. The company is clearly exposed to the semiconductor cycle but also participates in the secular growth of cloud and AI adoption through its data center business. With these secular drivers intact and new products ramping up in the second half of the year, we are maintaining an overweight to the company.

Multiple compression has also hurt higher growth health care companies like DexCom (DXCM), despite its strong fundamentals. We continue to build out the position as we gain greater visibility on the catalysts of accelerating uptake in Type 2 diabetes patients and the launch of its G7 continuous glucose monitor in the U.S. and Europe. DexCom was hurt in the quarter by market speculation that it would acquire a diabetes pump provider, which would be outside of its core competency.

Portfolio Positioning

After seeding the portfolio with select growth companies in the second half of 2020 and 2021, we have redirected our focus over the last several quarters to risk management. Moves during the second quarter in pursuit of greater stability included reducing consumer discretionary exposure with the sales of Chinese e-commerce and payments provider Alibaba (BABA) and omnichannel retailer Ulta Beauty (ULTA).

Alibaba has been a detractor to performance over the past 24 months due to the Chinese government’s crackdown on Internet companies that began in late 2020, fears of share loss to competitors and a slowdown in the world’s second largest economy since mid-2021. We had been hopeful that macroeconomic trends in China were nearing a bottom, however this has been further delayed due to COVID-19 lockdowns re-emerging in large parts of the country. Despite Alibaba remaining attractively valued, we closed the position due to a lack of visibility on headwinds around macro, competition and regulation abating. We also exited our position in Ulta, as our thesis has largely played out in terms of a post-COVID 19 earnings recovery. Ulta has steadily gained share over the last several years and its partnership with Target (TGT) represents a new avenue to gain customer loyalty. That being said, we are wary about the resilience of the consumer and the impact of labor cost inflation, which could crimp Ulta’s margin expansion in coming quarters. As with recent activity, the sale further reduces our consumer discretionary exposure and helps manage portfolio risk through an ongoing period of volatility.

“Gaining further clarity on the extent of Fed tightening and the slope of the yield curve will give us greater confidence to be buyers of select growth companies.”

Within information technology (IT), where we maintain an underweight compared to the benchmark, we took profits in NXP Semiconductors (NXPI), a part of the pro-cyclical reflation basket built up in 2020. Despite strong current fundamentals, there is an ongoing risk of major supply increases in the semiconductor industry as capacity announcements are near records. We have been redeploying the proceeds into recent addition Intel.

Another sale during the quarter was BioMarin Pharmaceutical (BMRN), motivated by more attractive risk/reward opportunities elsewhere in the sector. We bought BioMarin in early 2018 after the launch of Vimizim (for Morquio syndrome) which made the company cash flow positive with a clear strategy for continued growth in orphan diseases. In late 2020, the FDA moved the goalpost from one to two years of data to approve BioMarin’s drug Valrox (Hemophilia A). However, the shares derated in late 2021 due to concerns around execution and commercial uptake as well as management issues. Given the opportunity cost of waiting for a takeout or an activist investor and thin remaining pipeline, we exited the position and redeployed the proceeds into higher growth areas in health care (i.e. diabetes, robotics, orthopedics). We continue to look for organic growers in the sector since health care should be less exposed to some of the inflationary pressures we see in other industries.

We added to our countercyclical health care exposure with the purchase of medical device maker Stryker (SYK). The company is a quality compounder in medical technology with higher growth from taking unit share in orthopedics. Stryker’s execution in its medical and surgical equipment businesses have also consistently generated premium growth and it is investing in new software for its robotic-arm assisted surgery, hip stem, and stroke care solutions. The company’s procedure-based business has been strong as it continues to take share in the growing end-markets of knee and hip surgeries, and hospital and ambulatory surgery center growth continues post-COVID.

Rounding out our risk-focused stance, we believe the addition of Sherwin-Williams (SHW), a manufacturer of paints and coatings for professional, industrial and retail customers, adds further resilience in the current inflationary environment. Paint is a relatively small part of total project input costs which can be passed through with price during inflation, and the company has a track record of successfully managing through periods of increased commodity costs. We are attracted to the company’s durability of growth by operating a strong franchise with both organic growth and consolidation amassing a strong portfolio of brands. We like Sherwin-Williams over competitors in the paint industry due to higher volumes, a domestically focused revenue base and strong relationships with the home builder and pro community. We believe the company will be able to keep pricing and expand margins as commodity pressures ease.

Outlook

The aggregate result of these transactions is a more concentrated portfolio with higher active share that best represents our highest conviction names. We constantly analyze our positions to determine which to hold and which to add to on weakness. Most of our recent additions have been in areas where we see the greatest earnings visibility and valuation support, while we have been staying put or cutting back on holdings in the most expensive areas of technology and the Internet. That said, we maintain a watch list of companies and some dry powder to respond to dynamic market conditions. Further clarity on the extent of Fed tightening and the slope of the yield curve will give us greater confidence to be buyers of select growth companies.

The downdraft this year in technology has been predominantly driven by multiple contraction, rather than earnings. We are hearing from our software companies about deal push outs and negative FX impacts but have yet to see downward revisions. Such data points are concerning because it means these companies now have less cushion to cover any negative surprises. We will be parsing second quarter results closely to help determine if demand destruction is starting to occur and if our estimates of earnings growth are still valid. The decade-long trend of digital transformation enabled by software and related technology companies is clearly secular but we could see a short-term softening as cyclical factors are considered.

The Strategy has historically generated solid relative results during market corrections and, despite recent performance struggles, we are committed to the formula that has compounded growth for our investors: a focus on stock selection for the long term. We remain dedicated to conducting robust fundamental analysis that leads us to attractive growth opportunities and managing a portfolio with a diversified set of drivers over a 3-to-5-year time horizon. We believe that a duration of growth mindset is a key differentiator that should play out as normalization of the market and economy continue.

Portfolio Highlights

The ClearBridge Large Cap Growth Strategy underperformed its benchmark during the second quarter. On an absolute basis, the Strategy posted losses across eight of the nine sectors in which it was invested (out of 11 sectors total). The lone contributor was the consumer staples sector while the primary detractors from performance were in the IT, consumer discretionary and communication services sectors.

Relative to the benchmark, overall stock selection detracted from performance but was partially offset by positive sector allocation effects. In particular, stock selection in the IT, communication services and health care sectors and an underweight to consumer staples hurt results. On the positive side, an overweight to health care as well as stock selection in the industrials, consumer staples and consumer discretionary sectors contributed to performance.

On an individual stock basis, the leading contributors were positions in Monster Beverage (MNST), UnitedHealth Group (UNH) and BioMarin Pharmaceutical (BMRN). The primary detractors were Amazon.com (AMZN), Nvidia (NVDA), Meta Platforms (META), Apple (AAPL) and Netflix (NFLX).

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment