viper-zero

Delta Air Lines (NYSE:DAL) has provided a strategic update updating its guidance for Q4 2022 and introducing a guidance for 2023 and even 2024. I have not been a shareholder of airline stocks for many years. Back in 2017 is the last time I owned shares of Delta Air Lines, but I found that airlines were trading in a too choppy fashion gaining and losing on month-to-month capacity and oil price news, but I do believe the current positive momentum does provide significant upside for Delta Air Lines stock, which I will explain in this report.

Delta Air Lines Stock: A Strong Buy In My Book

Delta Air Lines

In October 2022, I marked shares of Delta Air Lines a strong buy based on significant recovery runway ahead for corporate travel, continued demand strength and reduction in unit costs while also off-peak fuel prices are in line of expectation going forward. Did this call work out? If you look at Delta’s stock gaining 10% since publishing that report you would say it did. Reality is that as a strong buy, it did not deliver. A cocktail of slight softening in travel trends and anxiety over a recession hit airline stock harder than other sectors.

However, since July when I marked shares a buy the outperformance that I generally look for with a Buy or Strong Buy name was definitely visible: Delta Air Lines shares gained nearly 15% compared to 5% for the broader market.

Back then I noted the following:

Delta Air Lines is currently priced as if another crisis is going to hit the airline industry harder than before, providing a compelling opportunity for a speculative position.

So, that call most definitely paid off and, just like the Strong Buy call more recently, that was driven by expectations for not only this year but also next year, which makes it highly interesting to view Delta’s strategic update.

Ending The Year On A Strong Note

Delta Air Lines

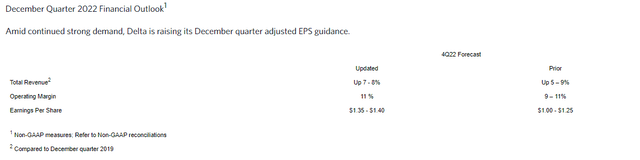

If we view the updated forecast for the fourth quarter, we see that total revenues are expected to be up 7% to 8%, so at the high range of Delta’s previous guidance. It confirms that while there have been concerns about softening in travel trends and some concerns about a recession, demand for air travel remains healthy. What’s likely also incorporated in the expected earnings per share which exceed the range significantly in the 12% to 35% range measured from the extremes or 22% from the midpoint are lower fuel costs. Delta did not provide any guidance for fuel costs but more recently during the Southwest Airlines (LUV) Investor Day, which I covered for Seeking Alpha, we did see fuel prices per gallon being guided down. So, it’s almost certain that this is also the case for Delta Air Lines.

Delta Air Lines

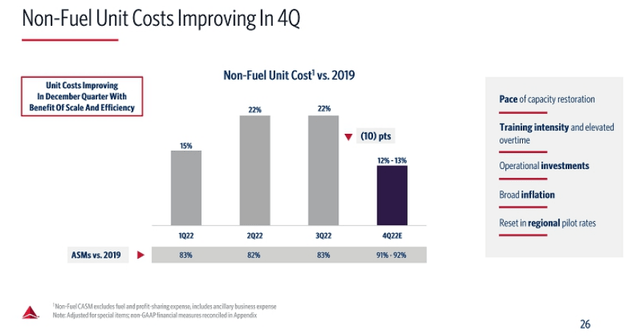

What we’re also seeing is that non-fuel costs are trending down sequentially in the fourth quarter. Delta had not guided a certain capacity for the fourth quarter, but we’re now seeing that sequentially the capacity compared to 2019 is increasing by 8-9 percent points and we see that immediately reflected in non-fuel unit costs. So, what we’re seeing here is that overall supported by demand, Delta Air Lines is scaling up the business which directly benefits them on cost side as the business amortizes the costs over more seats.

Looking Beyond 2022 Into 2023 and 2024

Delta Air Lines

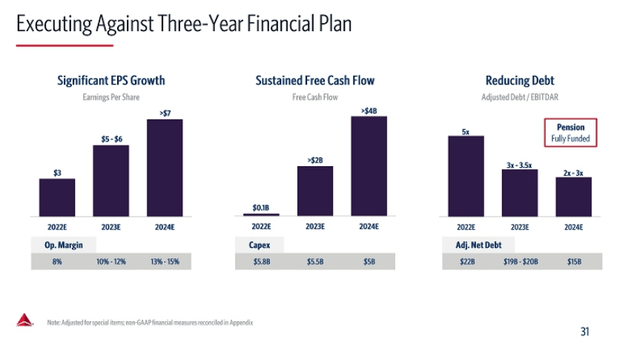

Where it becomes even more interesting is for 2023 and 2024. Without looking at the numbers, what we should keep in mind is that Delta Air Lines previously already expressed its aspiration to grow earnings per share to $7 with a free cash flow of $4 billion. The company now has formalized that in guidance and that does say something on how confident they are into the strength of the momentum being maintained next year and actually also into 2024. What we’re even seeing is that the guidance is now to exceed a $7 per share and also exceed a free cash flow of $4 billion.

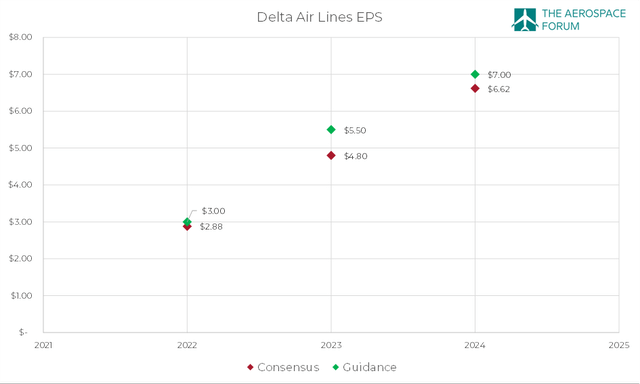

The Aerospace Forum

Looking at the guidance from Delta Air Lines, we see that it’s significantly higher than what analysts are expecting. So, once again Delta’s confidence in its strategy is reflected. So, what’s supporting this EPS outlook?

On top line, for 2022 a 15% to 20% increase in revenues is expected after which revenues should grow in line with GDP. Higher revenues are supported by upgauging which has been a strategy that Delta Air Lines already had envisioned before. Orders for the Airbus A321 platform and more recently for the Boeing 737 MAX 10 are testimony to that strategy. What also is incorporated into the expectations and was also part of the longer-term strategy is improving the premium revenues. Furthermore, as was already expected international long-haul operations will be increased in the coming years. In 2023, long haul will be 30% of the capacity mix compared to 31% in 2019.

Delta Air Lines

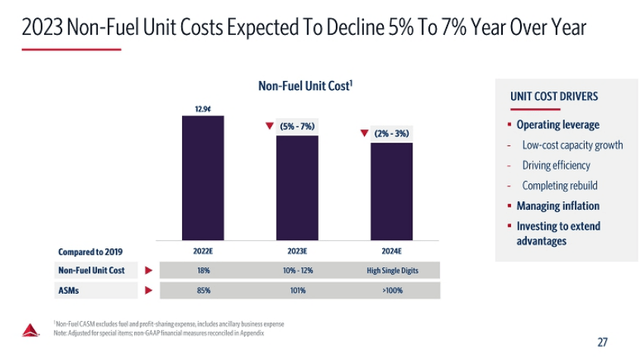

Those increases in seats per departure and system capacity also will drive down non-fuel unit costs, which is expected to come down 5% to 7% year-over-year for 2023 and another 2% to 3% in 2024. By 2024, the unit costs are expected to remain at elevated levels compared to 2019. Obviously, we would like to see some normalization in the unit costs. However, we also should keep in mind that we had 16% inflation from 2019 to 2022. If we forecast inflation to be elevated a 3% in subsequent years, we would get to 23% cost inflation. So, having a high single digit non-fuel unit cost is actually good given that new labor agreements with current high level inflation in mind are brought into effect and it shows how well the company can scale to bring its unit costs down even despite high inflation levels.

Key Risks and Opportunities For Delta Air Lines Stock

Delta Air Lines

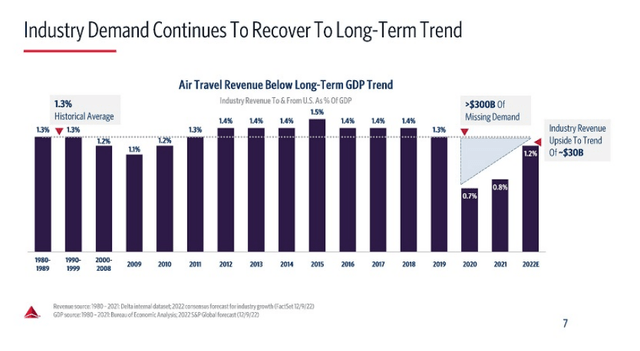

It goes without mentioning that airline investment is not without risk. No investment is, but it holds particularly true for airlines so we also should highlight the risks next to the opportunities. However, overall in the way Delta has guided and what we expect for the economy as a whole the risks also provide opportunity. In its strategic update, Delta Air Lines highlighted that historically 1.3% of GDP. For 2022 that means that there is a value shortfall of $30 billion and over $300 billion. So, that provides an opportunity going forward if that short fall translated into further demand strength. It also means that if GDP declines that the travel trend would weaken and right now the base case seems to be that there will be a mild recession in 2023 so there’s also a risk there.

In its forecasts, Delta Air Lines assumed fuel gallon prices of $3.00 to $3.20. If fuel prices are higher, then obviously there’s a big downward risk to the earnings forecasts. If fuel prices are lower, which could very well be the case given that Southwest Airlines assumed gallon prices of $2.85-$2.95 for 2023, this provides an additional tailwind to Delta Air Lines. So, Delta Air Lines might have been somewhat conservative in its assumptions for fuel costs which provides an opportunity.

What drives Delta Air Lines’ opportunity is the recovery in international travel and corporate travel next year and beyond. However, that goes hand-in-hand with the strategy that the airline has been pursuing for years which includes operating a cost efficient fleet, deriving revenues from maintenance activities for which Delta Air Lines has negotiated the rights when purchasing jets, upgauging to drive down unit costs and providing a more premium-heavy cabin segmentation.

Delta Air Lines Remains A Buy

As I mentioned earlier, Delta Air Lines was an airline that I was invested in 5 years ago. Back then the stock traded at the $56 level and hat $4.97 in earnings per share. So, Delta traded at roughly 11.3x its EPS. By the end of 2019, the stock was trading at the $59 level. It shows why I’m not a big fan of airline investment, because over a period of two years the stock seemingly went nowhere. For this year, based on the 2017 11.3x EPS multiple or the 8x 2019 multiple shares of Delta Air Lines seem to be overvalued or fairly valued. However, looking into 2023 and 2024, we see 25% to 80% upside for 2023 and 60% to 130% upside for 2024, even if we discount the earnings as we would do in a free cash flow method. There would still be 35% to 95% upside. Admittedly, these ranges are quite wide and that is caused by the big difference in the earnings multiple, but it shows that there is significant value to be unlocked.

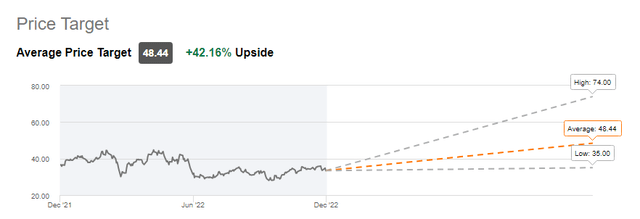

Seeking Alpha

The average target for Delta Air Lines provides over 40% upside, so I’m not the only one who sees significant value for the airline.

Conclusion: Delta Air Lines Confirms Its Buy Opportunity

Looking at what Delta Air Lines has guided for and how they plan to get there, I cannot say anything else than that the company is performing well on its recovery track as well as executing its longer-term plans. The way the company manages the business should position them well for the future. There’s some uncertainty in that future, but I do believe that based on the strength of the business and demand, there’s significant upside for Delta Air Lines stock.

Be the first to comment