sankai

Thesis

Virtus Global Multi-Sector Income Fund (NYSE:VGI) is a fixed income CEF with a global mandate. The fund has a flexible, broad mandate:

The Fund seeks to achieve its investment objective by applying extensive credit research, to capitalize on opportunities across undervalued areas of the global bond markets.

As per its literature we can see VGI has the ability to take positions across the global fixed income spectrum. This entails taking credit, interest rate, FX and jurisdictional risk. Global fixed income funds with multiple risk factors are extremely tricky because fund managers rarely are able to generate alpha from such broad mandates. The fund is fairly straight forward in defining those risk aspects itself:

Credit & Interest: Debt instruments are subject to various risks, including credit and interest rate risk. The issuer of a debt security may fail to make interest and/or principal payments. Values of debt instruments may rise or fall in response to changes in interest rates, and this risk may be enhanced with longer-term maturities.

Foreign & Emerging Markets: Investing in foreign securities, especially in emerging markets, subjects the portfolio to additional risks such as increased volatility, currency fluctuations, less liquidity, and political, regulatory, economic, and market risk.

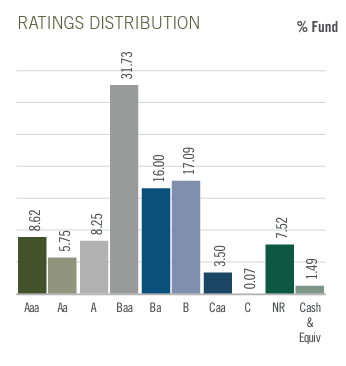

The fund is overweight investment grade credits across jurisdictions, but has a very broad allocation: from U.S. IG bonds to EM securities, RMBS bonds and treasuries. This co-mingling of risk factors does not have a happy ending – the fund has negative returns year to date and on a 3- and 5-year time-frames. The fund is on the small side (sub $100 million AUM), and has always traded at a sizable discount to net asset value.

Although it currently sports a massive 12% dividend yield, the distribution is not supported, with more than 57% of it coming from return of capital. We have seen this story play out over and over again – very broad mandate global bond funds fail to impress. They amass a plethora of risk factors, but fail to deliver on the one aspect which is the most important one – returns. There is not much to like about VGI, and nothing to single it out from the CEF universe. If you are already a holder then start thinking about divesting towards the end of 2023 (when you would have made up some of the money lost in the bond bloodbath this year). If you are a new investor, steer away from this name.

VGI Holdings

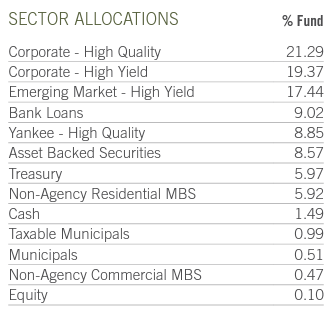

The fund currently holds a mix of bonds:

Sectors (Fund Fact Sheet)

Please note that “Yankee – High Quality” from the above table, references Yankee bonds. Yankee bonds are USD denominated debentures by foreign issuers. The bonds are traded in the U.S. markets.

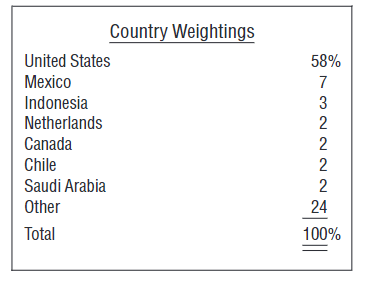

From its Semi-Annual report we can see the fund has only 58% of its holdings exposed to the U.S. jurisdiction:

Geographic Distribution (Fund Fact Sheet)

The fund is mostly investment grade:

Ratings (Fund Fact Sheet)

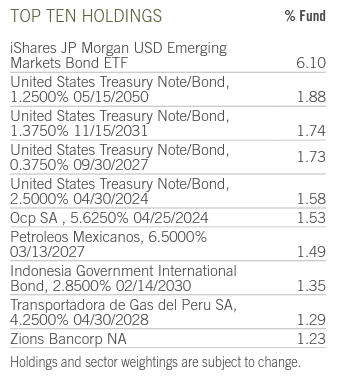

Its current top asset allocation contains a number of treasury securities, a diversified USD EM ETF, and a position in the Mexican Oil & Gas company Pemex:

Holdings (Fund Fact Sheet)

VGI Performance

The fund is down over -21% year to date:

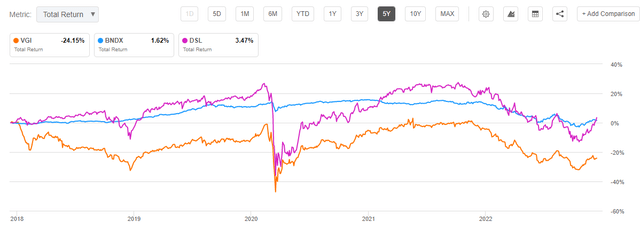

We are comparing the CEF here with the premier fund in the global bond CEF arena, namely DoubleLine Income Solutions Fund (DSL), and the unleveraged vehicle Vanguard Total International Bond ETF (BNDX). VGI is the worst performer of the cohort. On a 3-year time frame the story is similar:

While on a longer time frame VGI does not disappoint in coming in last, yet again:

If you look at the total return chart line in the above graph, you will notice it never really goes above the 0% line. That is pretty shocking.

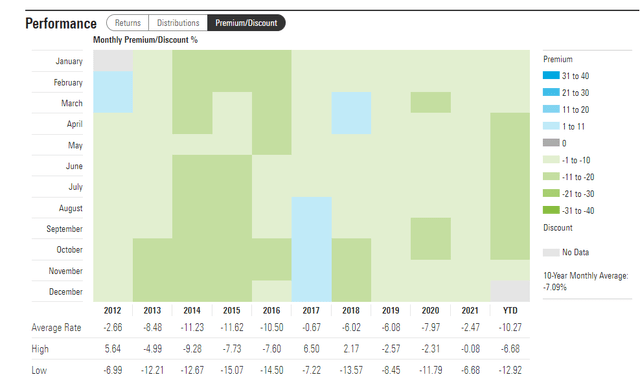

VGI Premium / Discount to NAV

The fund usually trades at a discount to net asset value:

Premium / Discount (Morningstar)

We can see that in the past decade the CEF has traded at an average -10% discount to net asset value. We are presuming this is due to its rather smaller size and underperformance through its life cycle.

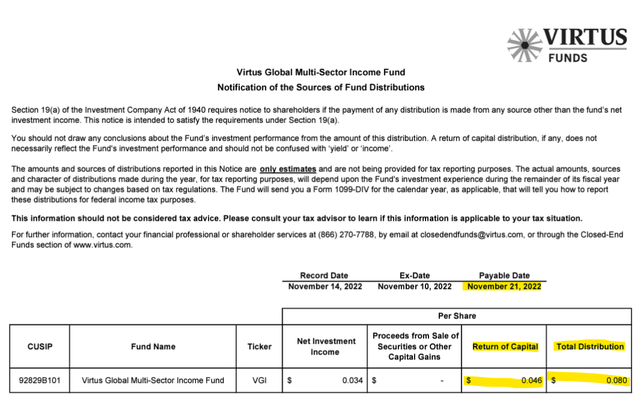

VGI Distributions

The fund does not currently cover its distribution:

We can see from the latest Section 19.a Notice that return of capital constituted over 57% of the distribution here. You are not getting a sizable yield here; you are just getting your money back.

Conclusion

Virtus Global Multi-Sector Income Fund is a fixed income CEF with a global mandate. The fund is overweight investment grade names across developed and emerging markets. Through its mandate, the vehicle runs multiple risks – from credit and interest rate, to FX and jurisdictional risks. The CEF has failed to produce a positive result on multiple time horizons (3- and 5-years), and is down over -20% year to date. The fund is trading with a substantial discount of -12% and has always averaged a pricing lower than its net asset value. The CEF is currently yielding over 12% on paper, but in reality more than 57% of the distribution is return of capital, or better put just your own money. Do not expect yields from the collateral pool in excess of 6% to 8% here in the long term. There is not much to like about VGI. If you are already a holder, then start thinking about divesting towards the end of 2023 (when you would have made up some of the money lost in the bond bloodbath this year). If you are a new investor, steer away from this name.

Be the first to comment