Jamie Squire

In a recent report, I marked shares of Delta Air Lines (NYSE:DAL) a strong sell, and that’s something that did attract some comment from readers. Admittedly, the timing was unfortunate for that call as shares dropped less than the broader market drop, but it was not completely inaccurate as I argued that airlines don’t make for sound long-term investments as the airline industry quite often finds a reason to sell off and that showed to be the case this time as well. While airlines are aligning for very strong earnings, airline shares have started to underperform the broader market.

Especially for a company such as Delta Air Lines that’s extremely unfortunate, because if I feel there’s one airline with a strong execution it’s Delta Air Lines as I discuss in this report.

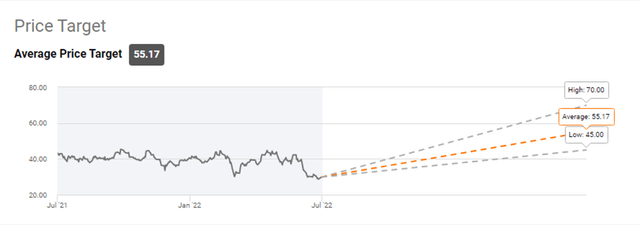

Wall Street is Bullish on DAL

Delta Air Lines price target (Delta Air Lines)

I’m not saying analysts or investors should be a Wall Street weathervane, but Wall Street analysts have a $55.17 price target for shares of Delta Air Lines implying an 87% upside. Even the lowest price target points at significant upside of at least 50%.

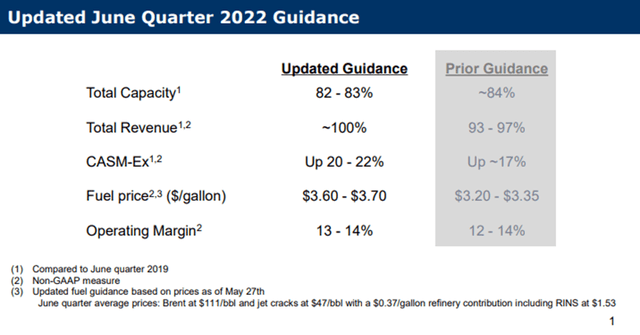

Delta Air Lines June Investor Update (Delta Air Lines)

Delta’s June investor update also provides some reason to be somewhat upbeat. Capacity guidance came down by 1 percentage point while revenue was expected to be comparable to the same quarter in 2019 helped by stronger than expected unit revenues. CASM-Ex costs are 20 to 22 percent higher than 2019 levels, suggesting there are significant unit cost savings to be realized as fleet utilization improves further.

Nevertheless, helped by strong unit revenues operating margins of 13% to 14% are expected. That is below the 17% margin from Q2 2019 but still quite good considering the elevated unit costs and higher fuel prices.

Delta Air Lines Shares Near 52-Week Low

Despite the upbeat expectations for the second quarter, shares of Delta Air Lines are trading near a 52-week low, and that is not completely unexpected. Delta Air Lines preemptively slashed 100 flights per day this summer season to improve the reliability in its schedule and that did not seem to be enough as cancellations and delays carried on forcing Delta Air Lines CEO Ed Bastian to apologize.

Not all of these issues are because of staffing issues as widely suffered by airlines, but also because of staffing issues at air traffic control centers which have tripled. However, combined with increasing oil prices and 1,200 Delta staff members picketing at seven airports that increases fears of not being able to benefit from the current pent-up demand being released to the market. Instead, Delta offered passengers up to $10,000 to give up seats on overbooked flights. Staff members are seeking higher pay and to be less overworked as the airline operates more flights than its workforce can handle.

So, there’s potential pressure on top and bottom line due to the demands from pilots and further pressure originates from high oil prices and recession fears. Recession fears likely are providing the biggest downward pressure on share prices as it raises concern on continued strength in ticket revenue which currently is absorbing part of the increased oil prices.

The Delta Air Lines Double Hedge

There are three things that prevent airline stocks from flying high at this point. Those three elements are staffing, oil prices and recession fears. Staffing is not something that Delta can deal with immediately. The airline can bring its operations in line with the size of its workforce which means reducing flights and also reducing revenue on constant unit revenues. A recession also is not something that Delta Air Lines can control, but on high oil prices, I believe Delta Air Lines has an extremely underappreciated strategy.

High oil prices are bad for airline business, not just because high oil prices increase costs but maybe even more so because high oil prices often are precursor of a recession, which results in a weaker pricing environment. Currently, we’re looking at whether that strong uptick in unit revenue and demand will outlive the elevated jet fuel price levels, but in a normal environment with high oil prices as an indicator of an upcoming recession, we will see oil prices and unit revenues decline both as demand for both lose momentum in a recession, but Delta Air Lines has the more appreciable mix to deal with oil prices.

The company has its own oil refinery which in the second quarter already improved it fuel price by $0.37 per gallon. It’s not to say that this is the most risk-free fuel price hedge, but it certainly is a creative one that’s paying off for Delta Air Lines at this point and allows Delta to be creative in an environment where demand for oil-related products might shift. Overall, I don’t believe the refinery is on the longer term going to be extremely profitable or extremely lossmaking, but it’s a tool for Delta to reduce the impact of oil price volatility on its cost balances.

Where Delta Air Lines is executing impressively is its fleet strategy, which if you do it well can be a major contributor to fuel cost savings. During the pandemic, Delta Air Lines removed the Boeing 737-700 from its fleet and replaced it with the fuel-efficient Airbus A220, which should burn around 20% less fuel and similar replacements took place for the MD-88s and MD-90s, which were replaced by the Airbus A220, Airbus A321 and Boeing 737-900ER.

Delta Air Lines Airbus A350 (Delta Air Lines)

In the wide-body fleet, Delta replaced the Boeing 777 fleet with the Airbus A350-900 providing fuel savings that should be around 20% per seat while the airline previously also took delivery of a significant number of Airbus A330neo jets. Introduction of fuel-efficient jets doesn’t make an airline an exception, but the way Delta Air Lines does it is bold. Delta Air Lines was the first US main carrier to order and operate the Airbus A220, back when the program was still under Bombardier’s wings and that’s benefiting the airline now in terms of having obtained attractive pricing for the jets and fuel savings.

The airline also adopted Airbus A321ceo aircraft from Airbus at attractive prices as well as the fuel-efficient which Delta Air Lines has recently started to take deliveries.

Similarly, while many airlines had been eyeballing the Boeing 787 to provide a next leg of fuel consumption benefits, Delta Air Lines looked for a more price-conscious approach and ordered the Airbus A330neo instead and opted for the Airbus A350 while competition in North America has been hesitant to introduce the jet and actually still operates the less efficient Boeing 777.

So, we’re seeing an extremely cost-conscious approach where Delta Air Lines weighs the overall economic life cycle costs of aircraft but also invests in fuel efficiency providing a fuel cost hedge. It’s an impressive strategy that grants Delta growth, replacement and fuel hedging at the most attractive prices.

Conclusion

For the second quarter, Delta Air Lines is expected to report $13.6 billion in revenues and earnings per share of $1.66. It seems that despite pressures, Delta Air Lines will be having a strong quarter and I feel like the current pricing levels offers a compelling entry point as the company should be able to present strong Q2 results and has an incredibly strong strategic focus for the longer term. I don’t feel like that the current price of around $30 per share which is just 60% higher than what Delta traded at during the pandemic reflects the long-term success the company should be able to book even when the economy cools off. It simply can’t get much worse than having 90% of the global fleet grounded like we saw during the pandemic.

Certainly, if you think that a recession is near, which it very much looks like, and believe it will be hitting airlines hard then airline investment is not your cup of tea in the same way it’s not my cup of tea for years now, but we shouldn’t forget that the Delta strategy has often made it a preferred investment in the airline space and the current price point is pricing Delta as if we are on the verge of another collapse similar in scale to what we saw during the pandemic and that is simply not the case. Delta is not there yet and there are pressures, but it also has made significant changes to its fleet that should render it more cost-efficient going forward.

Be the first to comment