Justin Sullivan

Thesis

Global PC sales have fallen by approximately 15.3% year over year versus 2021, and investors have taken notice. One of the major PC hardware manufacturer and distributor, Dell (NYSE:DELL) is down almost 35% YTD, versus a loss of about 21% for the SPX.

But PC sales have always been cyclical and it is, in my opinion, only a question of time until the next wave of IT hardware spending/upgrades brings new value to Dell.

Reflecting on a one year forward EV/EBIT valuation of x6, which is a 60% discount to the sector, I am confident to claim that Dell is priced very cheaply.

Thoughts About The PC Industry

Before we start discussing an investment opportunity related to Dell, lets reflect on a few thoughts regarding the PC industry.

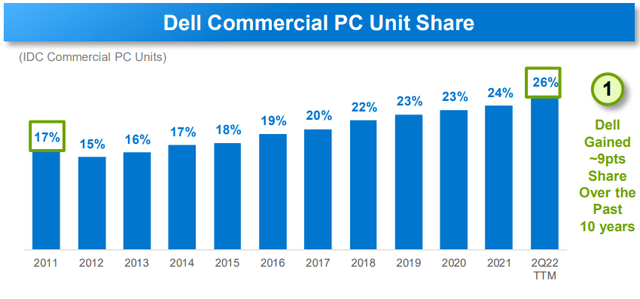

Before the financial crisis, the PC industry shipped about 325 million units. Following the market turmoil provoked the Lehman collapse, PC shipments crashed to 260 million. But by 2010, the market had rebounded to above 300 million shipments once again, and stayed at elevated levels though 2020, while Dell managed to continuously expand market share.

In 2021, PC sales surged to 348.8 million. But as of Q2 2022, PC sales are down some 15.3% year over year.

However, investors should consider that the 2020/2021 provides a very tough comparison, given the work-from-home related IT investments. Moreover, investors should consider that IT hardware spending has always been cyclical. But long-term, the industry has made higher lows and higher highs.

I do not know if 2022 is the bottom in the cycle. But at some point, a new wave of IT hardware spending and PC sales will inevitably follow. (In my opinion the next cycle could be correlated with VR/AR tech upgrades).

Dell’s Performance in 2022

Despite what has undoubtedly been a very challenging macro-economic environment, Dell has managed to deliver a strong performance YTD.

In Q2, Dell recorded revenues of $26.4 billion, which represents an increase of 9% year over year; and operating income of $1.3 billion, a 25% increase respectively. Chuck Whitten, Dell’s Co-COO commented: (emphasis added)

We delivered strong CSG and ISG growth and profitability – with revenue up 12% and 9% respectively – although we observed more cautious customer behavior as the quarter progressed …

… customers continue to prioritize advanced technology solutions to compete and succeed in the years ahead, and we are confident in our long-term opportunities.

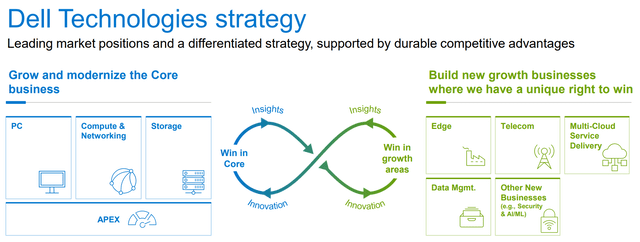

Investors should consider that Dell is not only a PC manufacturer and vendor. In fact, Dell has continuously innovated to become a integrated technology company, with exposure to data storage, management and security, as well as software.

Dell’s Infrastructure Solutions Group (ISG) managed to grow for the sixth consecutive quarter, and expand revenues 12% year over year to $9.5 billion. For reference, the ISG segment: (emphasis added)

… provides traditional and next-generation storage solutions; and rack, blade, tower, and hyperscale servers. This segment also offers networking products and services that help its business customers to transform and modernize their infrastructure, mobilize and enrich end-user experiences, and accelerate business applications and processes; attached software and peripherals; and support and deployment, configuration, and extended warranty services.

Steady Value Accumulation

Given the cyclical nature of the IT hardware industry, I argue investors should focus on Dell’s track record of long term revenue growth and value accumulation. Notably, during the past five years, Dell managed to expand revenues at a CAGR of about 12%, increasing sales from $62.2 billion in 2017 to $107 billion in 2022 (TTM reference).

According to Dell management, the business has ample room to grow — estimating that the company’s total addressable core market could be as high as $720 billion. With that in mind, management aims to grow the business’ revenues at a compounded annual growth between 3 – 4% and diluted EPS at about 6% through 2030.

Valuation

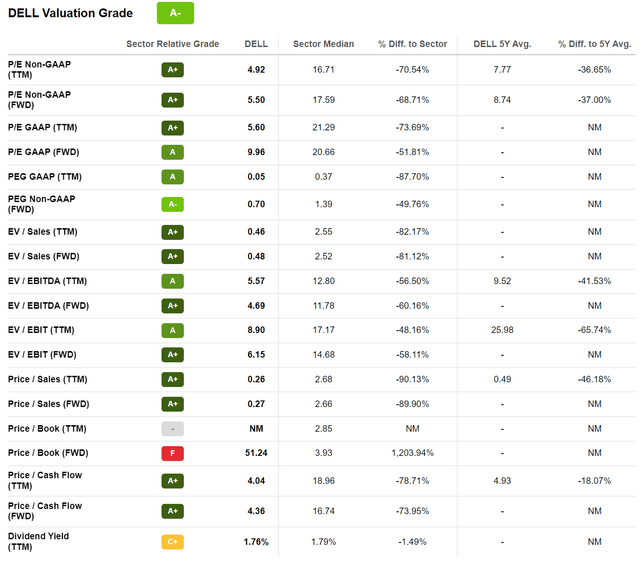

Investors should consider that Dell’s valuation is very cheap. The stock’s one year forward adjusted P/E is priced at x5.5, which reflects a 69% discount to the median P/E multiple of the information technology sector. Dell’s P/S is x0.26, a discount to the sector of 90% respectively.

Note that I am not picking multiples here. In fact, all valuation metrics for Dell — be it levered or unlevered — indicate that the company trades at a material discount.

(The exception: Dell’s x51 P/B ratio is a function of smart financial engineering, similar to what Apple is doing. Specifically, Dell leverages its bargaining power against suppliers to finance the company’s asset base and business operations).

Risks

In my opinion, the major risk associated with an investment in Dell is a continued and prolonged slowdown in IT hardware spending and PC sales. Such a scenario is not unlikely, given that the global economy is pressured by multiple simultaneous headwinds, including low economic growth, high inflation, rising interest rates, financial markets distress and geopolitical tensions.

Moreover, even if the slowdown for IT spending is less severe than feared, Dell stock might nevertheless fail to deliver near-term price appreciation, given that market sentiment could remain depressed well into 2023 (personal opinion).

Conclusion

Dell might be a less glamorous company than Apple (AAPL) or Microsoft (MSFT), but this doesn’t mean that there is less value in Dell stock. In fact, reflecting on a x6 EV/EBIT, there is lots of value in relation to the business’ valuation, including steady revenue growth and value accumulation. Moreover, investors might want to appreciate that the lion share of Dell’s value generation is directed to shareholders. In Q2 alone, Dell distributed $850 million to equity investors — $608M worth of stock repurchases and $242M in dividends. This equates to an annualized return of about 12%. Buy.

Be the first to comment