Wasan Tita

By Anu Ganti

2022 has been a tumultuous year characterized by reversals, with the S&P 500® down 20% in the first six months of the year and rebounding by 9% in July. In this uncertain environment, seeking defensive exposures via sectors could mitigate portfolio risk, but a nuanced perspective may be required to understand which sectors offer the best defense.

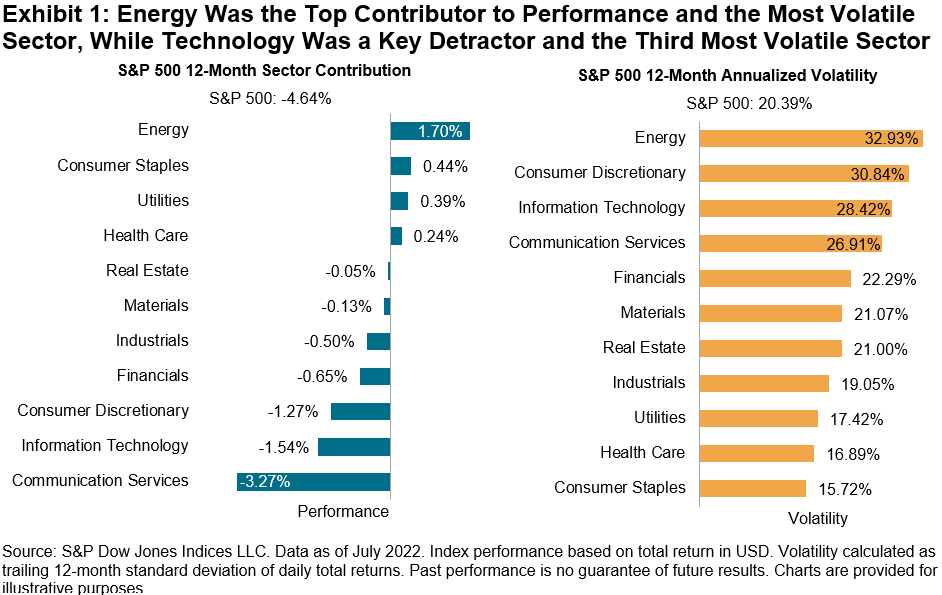

As Exhibit 1 illustrates, over the past 12 months, Energy was not only the most volatile sector, but was also the most positive contributor to the S&P 500’s performance. Meanwhile, Information Technology, the largest of the S&P 500 sectors by weight, was a key detractor to the S&P 500’s performance and the third most volatile sector.

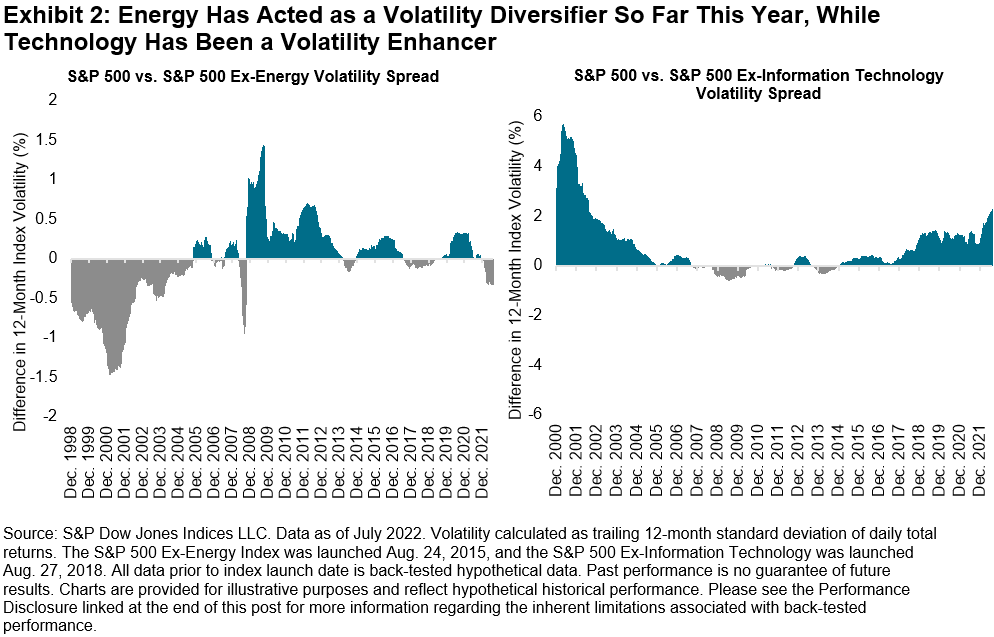

The impact of the Energy and IT sectors is particularly interesting to analyze due to the sectors’ different diversification properties. In Exhibit 2, we calculate the spread in trailing 12-month volatility between the S&P 500 versus S&P 500 Ex-Energy and the S&P 500 Ex-Information Technology, respectively. When this spread is positive, the inclusion of the sector increases volatility in the benchmark; when negative, the sector acts as a diversifier. Note the negative spread for Energy and positive spread for IT, over the most recent 12-month observation.

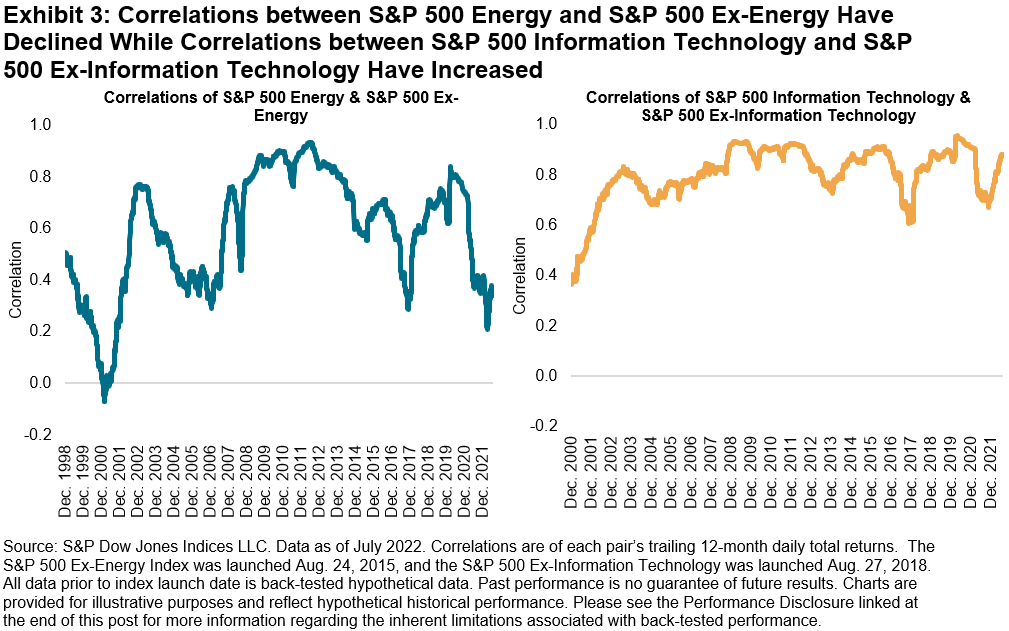

Digging deeper, Exhibit 3 plots the trailing 12-month correlations of the Energy and Information Technology sectors, respectively, with the S&P 500 excluding that sector. Consistent with the results of Exhibit 2, the correlation between S&P 500 Energy and S&P 500 Ex-Energy has declined in recent years. In contrast, the correlation between S&P 500 Information Technology and S&P 500 Ex-Information Technology, which has historically been positive, has increased recently. In other words, Energy’s performance has increasingly been divergent from the rest of the markets, while IT’s performance has increasingly mirrored the remainder of the market.

While we can conclude that Energy has recently been acting as a defensive sector by mitigating market volatility and Information Technology as a cyclical play via risk enhancement, this hasn’t always been the case. For example, in 2008, during the depths of the financial crisis, these two sectors acted very differently, as adding Energy significantly increased market volatility, while adding IT decreased overall market volatility. In contrast, following the burst of the tech bubble in 2001, IT added substantially to market risk. Understanding that sectors’ defensive characteristics change over time is key to alleviating risk via sector allocation.

Disclosure: Copyright © 2022 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. This material is reproduced with the prior written consent of S&P DJI. For more information on S&P DJI please visit www.spdji.com. For full terms of use and disclosures please visit Terms of Use.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment