JHVEPhoto

Despite completing a 10-for-1 stock split in June, Shopify (NYSE:SHOP)’s shares have failed to revalue higher. Additionally, the company warned of inflation and interest rate headwinds that are expected to weigh on consumer spending and e-Commerce sales. And although Shopify announced that it will lay off 10% of its workforce in light of growing revenue challenges in the e-Commerce market, Shopify has proven itself over time as an innovative company with great market instincts. For those reasons, I continue to stand behind Shopify and believe the e-Commerce company has a lot of potential in the long term!

Why Shopify is a long term buy: Growth in Merchant Solutions and annual cohort spending

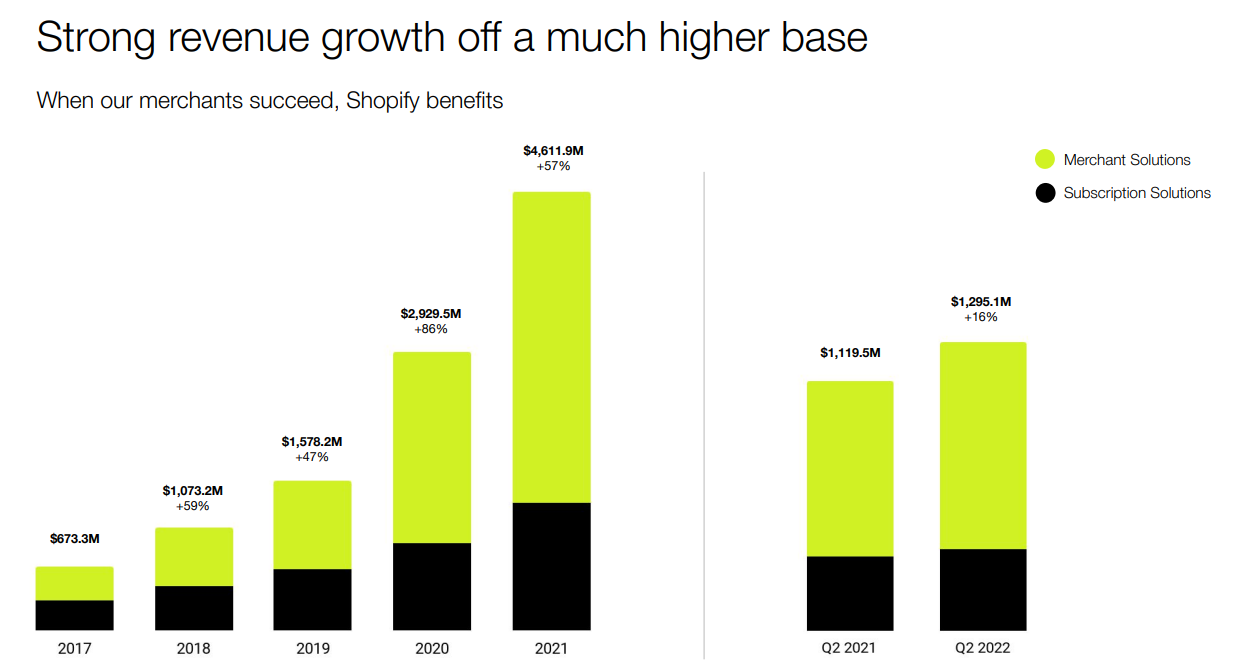

Shopify missed earnings and top line predictions for its second-quarter due to a slowdown in its core e-Commerce business. Shopify’s Q2’22 revenue line grew 16% year over year to $1.3B, which is down from 57% year over year growth in the year-earlier period. With tailwinds provided by the COVID-19 pandemic no longer present, Shopify’s top line growth rate has markedly decelerated, with a stronger USD making Shopify’s problems slightly worse.

Shopify’s Subscription Solutions grew 10% year over year to $366.4M, largely due to an increase in the number of merchants on the Shopify platform. The 10% growth rate in Subscription Solutions revenue showed a slowdown from the 70% growth rate achieved in Q2’21, but growth chiefly slowed because Shopify has made themes and apps available to merchants at no cost until they reach an annual revenue level of $1M. This change was not in effect in the year-earlier period.

Despite a rather expected slowdown in post-pandemic e-Commerce sales, Shopify is not going to stop growing. The e-Commerce business continues to have a lot of clout in the industry due to its large merchant base and accelerating product uptake in the Merchant Solution segment is promising.

The Merchant Solutions business is where the action is and where Shopify can make a difference going forward. Segment revenues grew 18% year over year to $928.6M due to growing customer adoption of merchant-focused add-on services like Shopify Payments, Shopify Shipping and Shopify Markets as well as growing gross merchandise volume/GMV. Shopify’s large merchant base gives Shopify considerable leverage in product up-selling which could be key to tapping into new revenue sources going forward.

Shopify: Growth Is Slowing

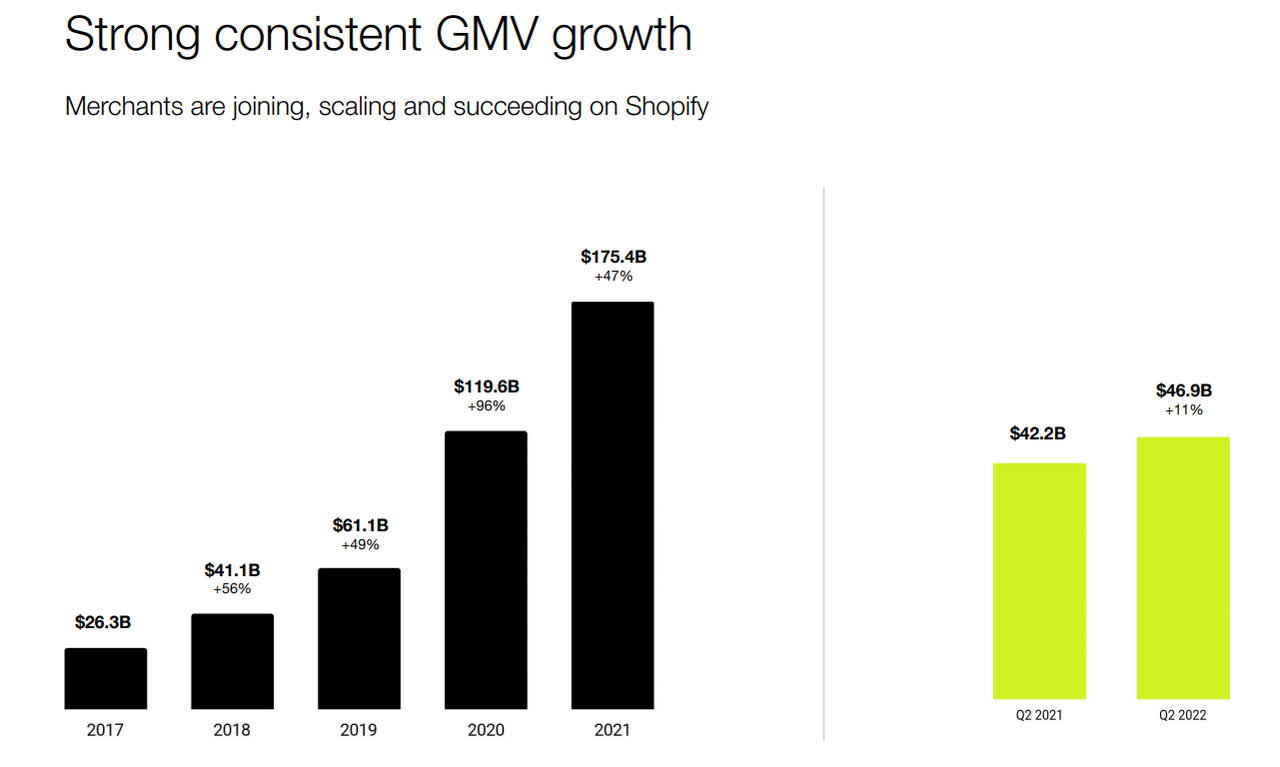

Gross merchandise volume is driven by the number of new merchants joining the Shopify platform as well as existing merchants that are adopting core merchant offerings such as Shopify Payments or Shopify Capital. These merchant-focused products are tools that help small businesses grow and lead to an increase in store conversions… which results in a higher volume of orders processed in the Shopify ecosystem. In Q2’22, Shopify reached an all time GMV high of $46.9B, showing 11% year over year growth.

Shopify: Q2’22 GMV

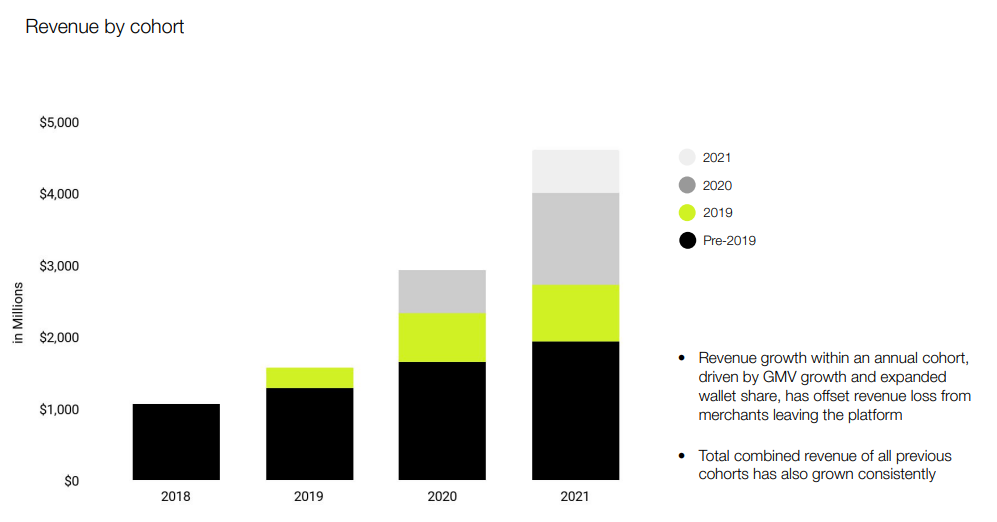

Shopify’s annual customer cohorts are driving internal revenue growth for the e-Commerce company, meaning merchants increase their spending on Shopify’s products and services as time goes on. This is chiefly due to the fact that Shopify has rolled out new products such as Shopify Payments, Shopify Capital or Shopify Markets which serve important needs for small businesses.

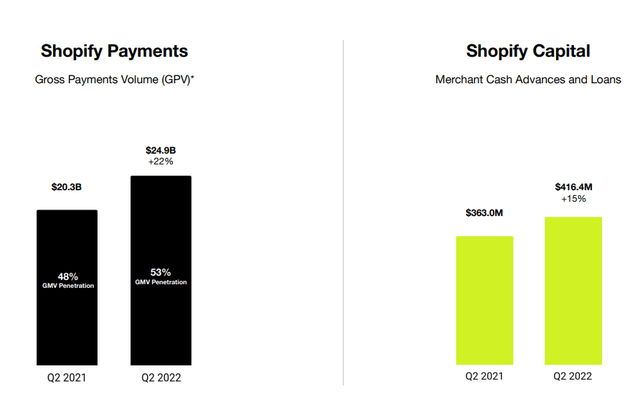

Shopify: Q2’22 Shopify Payments & Capital Growth

Shopify Payments provides payment processing solutions while Shopify Capital provides short term business funding for merchants — which are often struggling to finance their growing, yet unproven e-Commerce operations. Other promising products include Shopify Markets which aids merchants with cross-border management tools to make selling in different countries easier. Customer uptake for merchant-centric products is growing and it shows in growing annual product-spend of Shopify’s annual customer cohorts.

Shopify: Revenue By Cohort

Shopify retains a lot of potential for growth

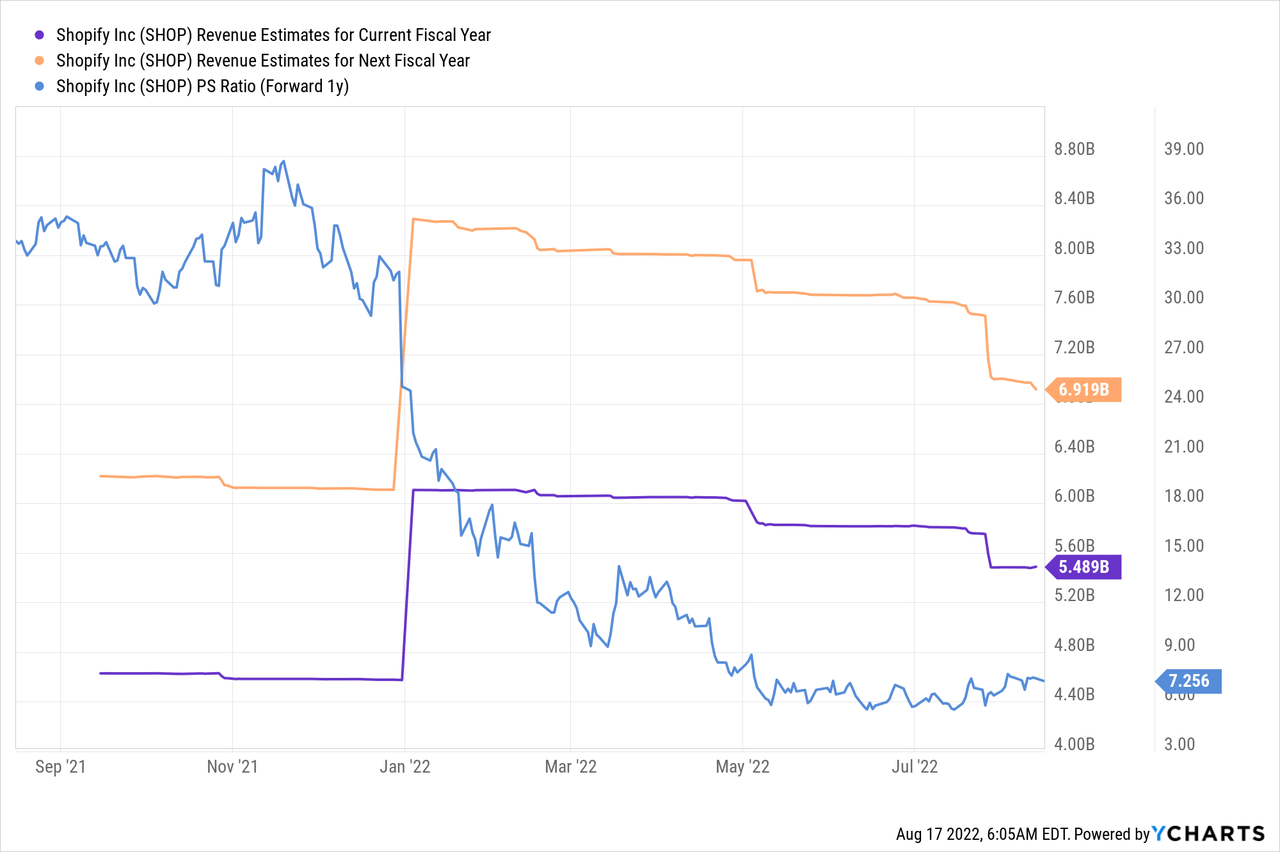

Revenue estimates for Shopify continued to fall after the presentation of the firm’s Q2’22 earnings card and the top line may experience continual revenue headwinds due to inflation and higher interest rates that are weighing on e-Commerce spending. But Shopify will likely continue to grow: the e-Commerce company is expected to grow revenues 19% in FY 2022 and 26% in FY 2023.

There is a pronounced risk that the company’s revenues will continue to consolidate for a longer period of time, especially if a recession were to capture the US economy. But over the long term, Shopify is an excellent bet on strong growth of the e-Commerce industry.

Based off of revenues of $6.9B (estimate for FY 2023), Shopify is trading at a 7.3X P-S ratio which is much lower than it used to be…

Risks with Shopify

Shopify is a leader in the e-Commerce sector: it dominates the merchant online store market and has proven to be a strong partner for merchants. However, slowing top line growth is a big commercial risk for Shopify, but even more so for the company’s stock. Shopify has been evaluated chiefly based off of its prospects for expansion in the e-Commerce market and top line growth, so a slowdown will affect how investors perceive the stock. A decline in GMV growth and revenues may lead to a lower valuation factor being applied to Shopify’s shares.

Final thoughts

Shopify is a very promising e-Commerce company because the industry will continue to grow and although Shopify’s growth is slowing, the company’s growing merchants base and improving customer monetization are two top reasons to buy Shopify.

Rising product adoption as well as continual growth in annual cohort spending could add to Shopify’s revenue growth in the future which would support the company’s potential for upside revaluation. While Shopify has failed to deliver a post-split rally, the stock is set for a longer term rebound!

Be the first to comment