Sundry Photography

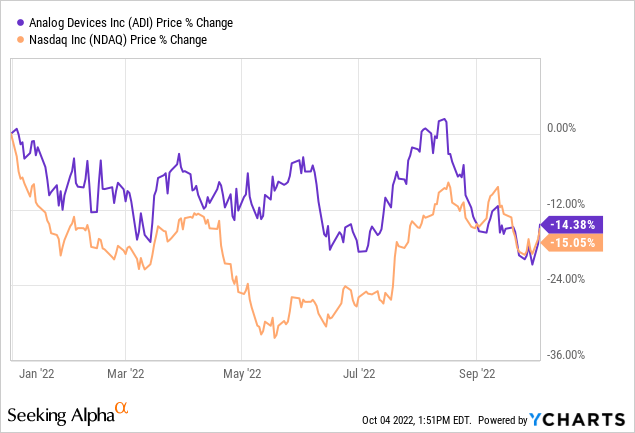

In this article, I take a closer look at Analog Devices, Inc. (NASDAQ:ADI). The share prices has dropped significantly year to date, although very much in line with the broader NASDAQ (NDAQ).

I own shares in the company, which represent a modest 0.6% of my total investment portfolio. Because of the share price decline, my cost base is now almost 10% higher than the current share price. Therefore, it makes sense to assess if buying additional shares of ADI right now is a good idea.

Recap: My investment strategy and goal

Let me first recap my personal investment strategy and goals, to help you better understand my approach and perspective. My goal is to reach financial independence years before my official retirement age of 67 (or perhaps even 70 or later by then). This independence is achieved when my annual dividend income equals or exceeds my annual cost of living. At that moment, I become completely independent from the income from my full-time job. Maybe I am still happily working in a full-time job and continue working, but maybe I decide to quit and find a different meaning for the remainder of my life. Achieving this goal of financial independence seems very realistic and my calculations show I can achieve it within the next 10-15 years.

All my investment decisions are made with this ultimate goal in mind. This means that whenever I have money to invest (my monthly addition to my investment account or re-investing dividend), I assess how it brings me closer to reaching this goal. This means that I look at the dividend that I expect the investment to generate immediately, but also 10 – 15 years into the future. This means that I always try to balance between a reasonable entry yield and expected dividend growth. I also only invest in undervalued or fairly valued high-quality companies and intend to hold them for decades. Safety of principal and foremost reliability of the dividend is extremely important to me.

This has helped me to minimize volatility. With markets being down 20-30% YTD, my overall portfolio is not even down 10%.

Please check out this article on a model portfolio to get more insights into my investment style and portfolio, including the update I wrote when the Ukraine crisis unfolded and the portfolio was seriously stress-tested.

Company profile

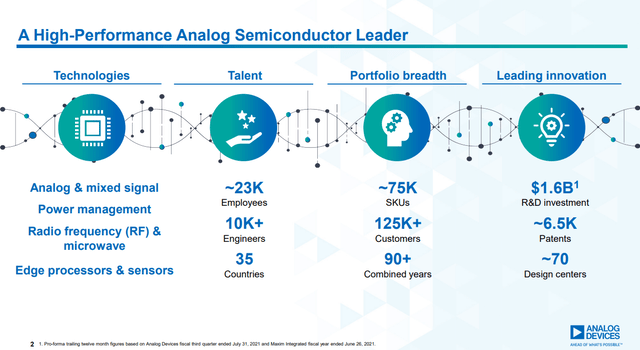

Let’s now turn back to ADI and first give you a short recap of the company. The following info-graphics from their Investors Presentation that was recently published gives a good overview of the breadth and depth of the company.

Key ADI company stats (ADI investors presentation Oct 2022)

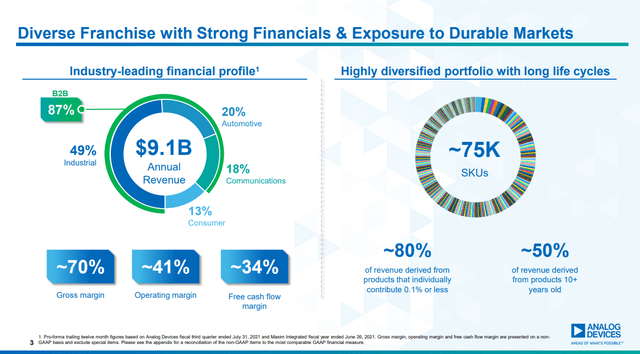

The following overview gives a break-down of their revenue per industry. As you can see, they are active in several industries and they also have a widely diversified product base.

Revenue and product base overview ADI (ADI Investors Presentation)

As you can see, ADI is a well-diversified semiconductor company operating across multiple industries and countries. It is impressive to see that they derive 50% of revenue from products 10+ years old. This gives them a very strong financial foundation and moat. Competitors are Texas Instruments (TXN), Intel (INTC), Micron (MU), Advanced Micro Devices (AMD), NXP Semiconductors N.V. (NXPI), and Infineon (OTCQX:IFNNY, OTCQX:IFNNF).

Reasons to like ADI

There are certainly more reasons to like ADI besides the diversification across multiple industries and wide product portfolio with 50% of revenue from products being 10+ years old.

High margins

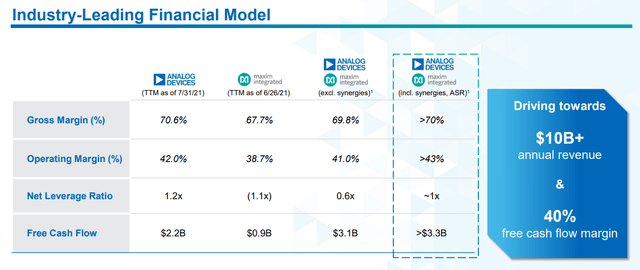

The margins of ADI are also very impressive, with operating margins of 40+%!

ADI Financials Model (ADI investors presentation (Oct 2022))

These high margins help them to generate a ton of free cash flow, which helps them to keep debt low and generously reward shareholders (more about that later on in this article). They aim to achieve 40% free cash flow margin, which is also very strong.

Successful M&A integrator

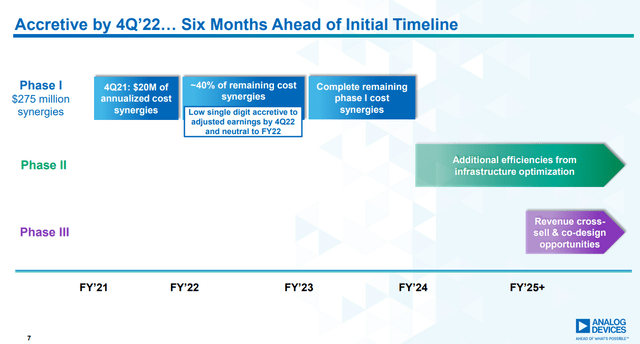

Many larger acquisitions done by companies turn out to be either neutral or simply disappointing, with only a limited number of acquisitions turning out to be really lucrative. ADI acquired Maxim Integrated Products Inc. in Q3 2021 for a stunning USD $21B. Maxim was roughly half the size of ADI and literally a big fish to digest. The company, however, seems to be doing so very well. As you can see below, the integration and synergies are already 6 months ahead of the initial timeline.

Timeline financial impact Maxime Integration for ADI (ADI investors presentation Oct 2022)

The acquisition is not only lucrative and ahead of schedule, but it also helps ADI to boost its market share in automotive and 5G chipmaking.

Dividend

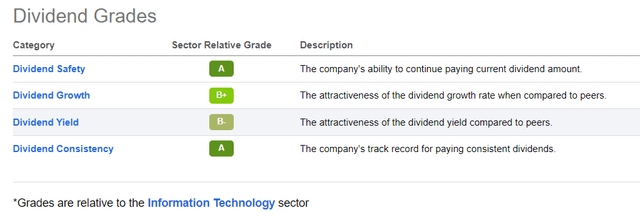

One of my personal reasons of being interested in ADI is their dividend. As you can see below, the company scores well on all four Seeking Alpha Dividend Grades.

Dividend Grades ADI (Seeking Alpha)

The dividend is relatively safe and consistent, and also the dividend growth and yield look good. These grades are driven by their low payout ratio of 34% and dividend growth streak of 18 years.

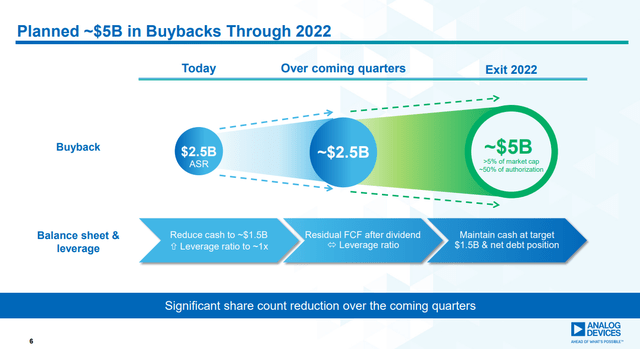

Strong share buybacks

The company is not just interesting for the dividend; ADI also has an attractive share buyback plan in place. For 2022, they plan to buy back around USD $5B in shares.

Planned share buybacks (ADI Investors presentation)

This is not just a high number in absolute numbers. Considering a market capitalization of USD $71B at the moment of writing, this would represent 7% (!) of all outstanding shares in just one year. In other words, only because of this buyback plan they are increasing earnings and dividend per share by 7%, even if they would have the same absolute numbers as before.

Reasons to less-like Analog Devices

As always there are also reasons to less-like a company, which for me are the following.

Relatively low entry dividend yield

The current dividend yield is 1.8% (backwards-looking) and 2.1% (forward-looking). This is not very high, but must be seen from the right perspective. As you can see below, the company has not been offering such a (relatively) high entry dividend yield since the end of 2020.

Historical dividend yield ADI (Seeking Alpha)

Also, if you look back a bit longer, you see that the current dividend yield is around the historical average yield of 2018 – 2020. This indicates the company is currently not expensive in terms of valuation.

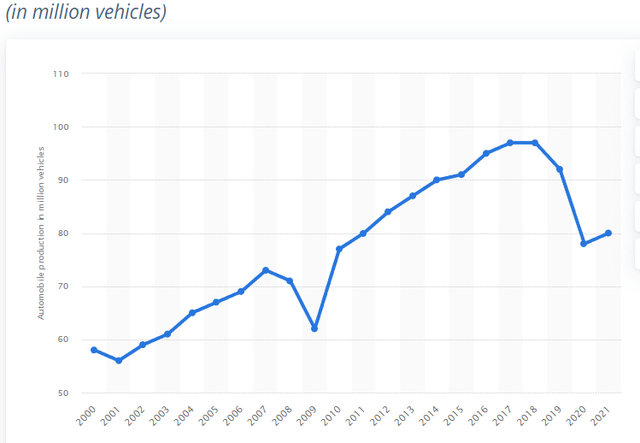

Exposure to automotive industry

Another reason to be a bit cautious about ADI is its exposure to the automotive industry, which represents around 20% of its total revenue. This sector is still struggling with the value chain and production issues from the COVID-19 lock-downs. You can see this well in the following chart from Statista:

Estimated global vehicle production 2000-2021 (Statista)

In 2021, global vehicle production is still 15-20% below previous years. Pressure on overall vehicle production, of course, also affects the appetite of vehicle manufacturers for supplier parts from companies like ADI. So far, ADI has managed well in this environment, but it can continue to put pressure on demand for their products, especially if COVID-19 flares up again (even regionally).

ADI Shares listed in USD

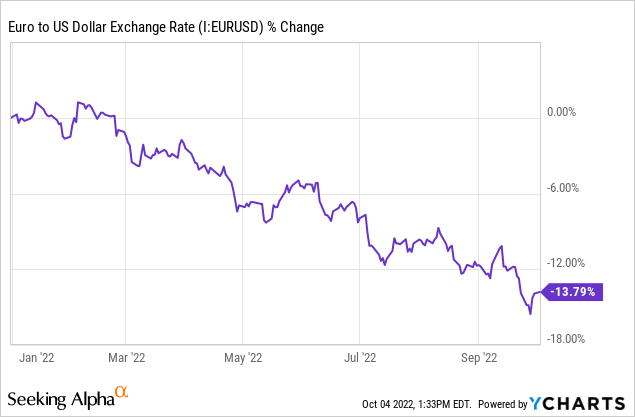

There is a final reason to less-like an investment in ADI. This might be only applicable for non-U.S. investors, for example, from Europe, like myself. The strengthening of the USD this year has made it much less attractive in general to invest in U.S.-listed companies in USD.

As you can see, this has effectively made any investment in USD from a European (euro) perspective 14% more expensive compared to the start of the year. FX rates can be volatile in the short term, but typically converge to a mean in the longer term. This means that if FX rates converge again, this might put significant pressure on your investment results if the USD is not your base currency.

I have been a heavy buyer of U.S.-listed shares for years, but because of this strengthening of the USD, I have been more focused on European companies to invest in. This is not a concern about ADI in specific, but I find it important to make non-U.S. investors aware of this aspect in general. I have always been actively managing the FX exposure in my portfolio, and I recommend other investors to do the same.

Valuation and Investment Thesis

As you have seen, ADI is a well-diversified and profitable company with a long (dividend) growth history. In my investment thesis, I distinguish between two things: dividends, and potential share price gains.

The dividend of 2.1% is safe and I expect the dividend to grow by 10% annually in the next years, which is also in line with the 5-year growth estimates on Seeking Alpha. Let’s see how that works out:

| Time | Dividend yield (YoC) | Dividend growth |

| Now | 2.1% | 10% |

| +5 years | 3.4% | 10% |

| +10 years | 5.4% | 10% |

| +15 years | 8.8% | 10% |

Source: author table

As you can see, the YoC in 15 years would be 8.8%. My overall portfolio, reflecting on average my “normal” investments, averages around 3.5% dividend yield and 6% CAGR dividend growth. In 15 years such an investment would grow to a YoC of 7.9%. This means that ADI is expected to perform (modestly) better, and for me, it would be attractive enough from a dividend perspective.

For potential share price gains, I look at P/E ratio. ADI has a P/E ratio of 16, averaging backwards and forward-looking P/E ratios. This implies an annual profitability growth ratio of not even 4%, using Benjamin Graham’s simple formula. This is very pessimistic, considering their historical growth numbers.

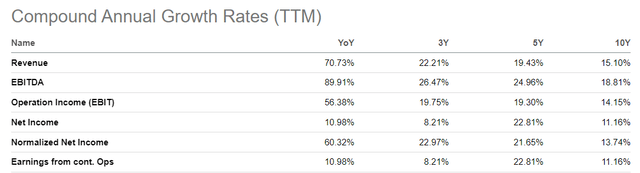

ADI annual growth rates (Seeking Alpha)

As you can see the company’s 5 and 10-year growth rates for various profitability metrics are all double-digit. Even if we would only assume a future profitability growth rate of 10% annually, this would justify a P/E ratio of 28.5. If this would happen, the share price could increase by almost 80%!

To summarize: an investment in ADI right now would yield 2.1% in dividends, which should grow to 8.8% in the next 15 years. In addition, there is a potential share price increase of 80%. In my perspective, this makes ADI a BUY.

Conclusion

Hopefully my analysis has triggered you to take a closer look at ADI yourself and consider it as an investment. It has the potential to bring you attractive growing dividend income and also significant share price increases if multiple expansion (which would be justified in my perspective) takes place.

I am now more cautious about investing in USD listed companies due to the 14% strengthening of the USD versus Euro in 2022. Nevertheless, I will continue to use those USD I receive from dividends to expand my ADI position.

Would you (dis)agree? Let me know in the comments!

Be the first to comment