Irina Kashaeva

Written by Nick Ackerman. This article was originally published to members of Cash Builder Opportunities on December 4th, 2022.

Dividend growth stocks aren’t always the most exciting investments out there. They often aren’t grabbing the headlines; they aren’t the stocks running up hundreds of percentages in a year. In fact, they are often some of the least exciting stocks. And that is precisely their strongest selling point. With such a vast world of dividend growth stocks available out there, it is important to screen through to see if there are any worthwhile investments to explore.

They are stocks that provide growing wealth over time to income investors. Dividend growers are often larger (not always), more financially stable companies that can pay out reliable cash flows to investors. Some are slower growers than others. Some are going to be cyclical that require a strong economy. Some are going to be secular, which doesn’t generally rely on a more robust economy.

Dividend growth can promote share price appreciation. Of course, that is if these companies are growing their earnings to support such dividend growth in the first place. Trust me. There are yield-traps out there – I’ve owned a few that I’m not particularly proud of.

I like to think of investing in dividend stocks as a perpetual loan of sorts. Essentially, every dividend is a repayment of your original capital. Eventually, holding long enough, you have the position “paid off.” It is all return back into your pocket from that point forward.

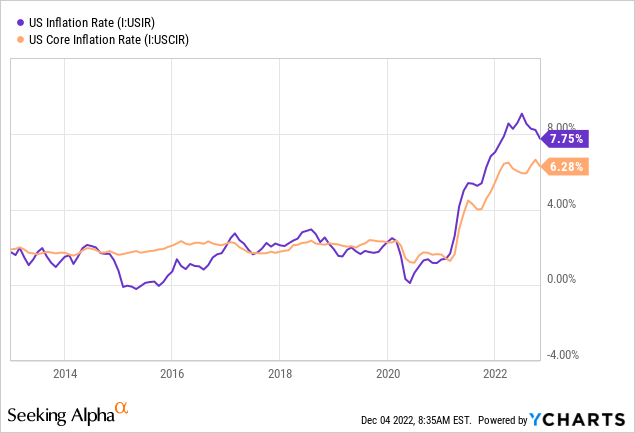

Inflation has been coming down but is still at very elevated levels. Dividend growth stocks can help combat the negative impacts of purchasing power erosion.

Ycharts

In Powell’s latest speech, he noted they were mostly staying the course. However, the pace of interest rate increases should be slower, and that could happen as soon as December. That puts a 50 basis point hike as the most likely next step for the December meeting of the Fed.

All of this being said is important to understand my approach to dividend stocks and why screening dividend stocks can be important for income investors. These are September’s 5 dividend growth stocks that might be worthwhile for a deeper exploration. As with any initial screening, this is just an initial dive – more due diligence would be necessary before pulling the trigger.

The Parameters For Screening

I’ll be using some handy features that Seeking Alpha provides right here on their website for this screen. In particular, I will be screening utilizing their quant grades in dividend safety, dividend growth and dividend consistency.

Dividend Safety is relatively self-explanatory. These will be stocks that SA quants show reasonable safety compared to the rest of their various sectors. The grade considers many different factors but earnings payout ratios, debt and free cash flow are amongst these. This category will be stocks with A+ to B- ratings.

For the dividend growth category, we have factors such as the CAGR of various periods relative to other stocks in the same sector. Additionally, the quants also look at earnings, revenue and EBITDA growth. As we will see, this doesn’t mean that every stock with a higher grade has the growth we are looking for. This just factors in that the dividend has grown or earnings are growing to support dividend growth possibly. For these, the grades will also be A+ through B- grades.

Finally, for dividend consistency, we want stocks that will be paying reliable dividends for us for a very long time. In particular, hopefully, they are raising yearly, though that isn’t an explicit requirement. We will also include stocks with a general uptrend in dividend payments, which means there could have been periods where they paused increases for a year or two.

After looking at those factors alone, we are left with 540 stocks at this time—from November’s 538 listings. I’ll link the screen here, though it is a dynamic list that constantly updates regularly. When viewing this article, there could be more or less when going to the link.

From there, I wanted to narrow down the list a lot more. I then sorted the list by forward dividend yield, highest to lowest. Since these will be safer dividend stocks in the first place, screening for those among the higher payers shouldn’t hurt.

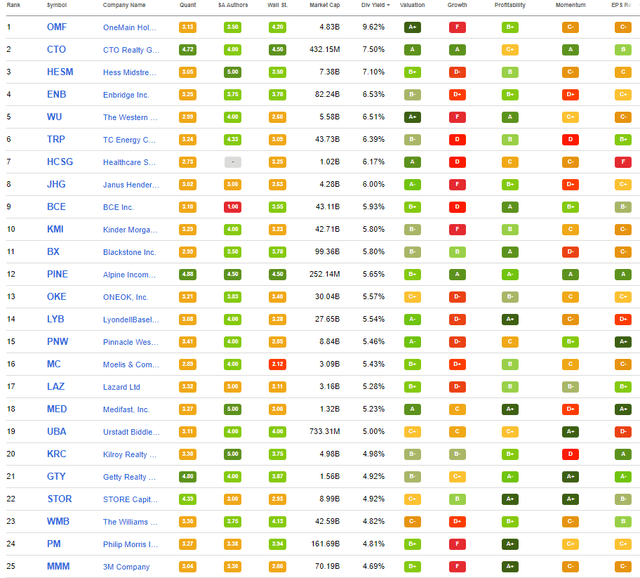

I will share the top 25 that showed up as of 12/04/2022.

Seeking Alpha Screening Top 25 (Seeking Alpha)

When going through this list every month, I want to get a good variety from the list. Therefore, I won’t touch on the same stock unless at least a quarter has gone by.

Last month we covered OneMain Holdings (OMF) and Enbridge (ENB). In October, we took a look at Hess Midstream (HESM).

That leaves us with CTO Realty Growth (CTO), The Western Union (WU), TC Energy (TRP), Healthcare Services Group (HCSG) and Janus Henderson Group (JHG) for this month.

CTO Realty Growth 7.50% Yield

CTO last showed up for us in September 2022. That was the last and first time as well. However, we have had a quick look at CTO before because of another name that makes this list. That is Alpine Income Property Trust (PINE), which spun-off from CTO Growth but is managed by them. They also own a sizeable position in that REIT, too.

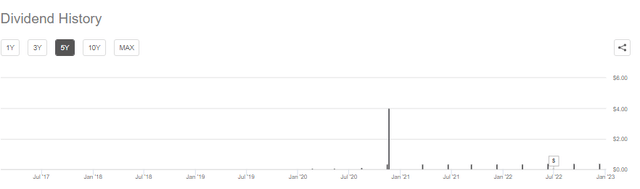

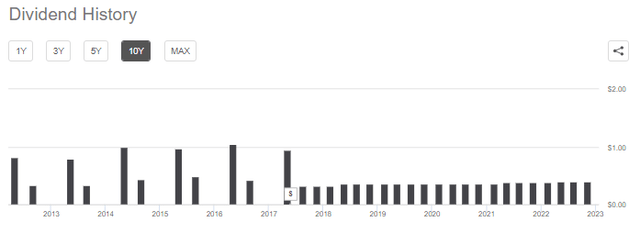

The dividend history from looking at a chart is hard to visualize their growth over the years.

CTO Dividend History (Seeking Alpha)

However, they have been growing their regular dividend for 9 years. They also had a split of 3-for-1 earlier in 2022. Although not really necessary as it was only around $60. That abnormally large special they paid out was when they converted to a REIT.

Shares of CTO had slid more recently, pushing the yield to the current level after a secondary offering of shares. This is normal business for REITs as they generally pay out a lot of their earnings, so to grow, they raise capital through debt and shares. Before this, shares were pretty much flat for the year. This secondary pushed it down, and that could be presenting an attractive opportunity for investors looking to pick up a position in CTO.

They last reported FFO of $0.47 and are estimated to continue to grow this. That means their current $0.38 should be covered and continue to grow from here.

The Western Union 6.51% Yield

WU occasionally shows up on this list; the last time was in September 2022. They’ve been growing their dividend for 14 years and 7 years consecutively.

WU Dividend History (Seeking Alpha)

However, those consecutive annual increases might be coming to an end. They’ve paid 7 dividends in a row now without a raise. If they don’t raise in this next announcement, that will end the consecutive increase streak. They’ve gone through other periods of maintaining the same dividend to investors, so this isn’t the first.

It isn’t a fact that dividends don’t grow every single year at a regular time for me. What keeps me hesitant about WU is that the business is getting hit with a lot of competition. They offer their own app and are seemingly competitive on fees. (I don’t have experience transferring money internationally, so I can’t say from personal experience.) It’s simply that they are drowned out by many others in the same space now.

Years ago, they were basically the only gig in town to transfer money internationally. With this stiff competition, they are still generating massive profits, but those profits are dwindling. Over the next two years, analysts expect EPS to decline. Declining profits don’t bode well for dividend potential in the future.

WU Estimated EPS (Seeking Alpha)

In this sort of position, we’ve seen the natural reaction from investors. They sell the shares off relentlessly. Shares are currently near decade lows.

Ycharts

Perhaps a silver lining is that, based on the historical P/E fair value estimate, is that WU is incredibly cheap. It would range from $16.62 to $20.86 for the fair value estimate. Investors could see some significant upside if they can turn the decaying earnings around. Either that or the fair value range on earnings will catch the stock’s price. That’s quite the uphill battle to turn this ship around, though, and it may never happen.

WU Estimated Fair Value (Portfolio Insight)

TC Energy 6.39% Yield

TC Energy showed up on our list previously in August 2022. TRP is an energy play from our friends in the north (assuming one is reading this from the U.S.) They’ve been delivering dividend growth for years and are expected to continue. TRP pays in CAD, so the conversion to USD makes some dividend charts appear unusual – as if the dividend is variable every quarter.

They expect 3 to 5% increases in the future. That’s a slowdown from the previous increase, but they never cut through 2015 to 2020. Those years were tough for most of the energy space. We saw a lot of bankruptcy, and other energy-related companies cut their dividends.

TRP Dividend History (Investor Presentation)

Helping them through those years was their focus on natural gas rather than oil. They are anticipating growth going forward, which should continue to help support the growing dividends they pay.

TRP Comparable EBITDA CAGR (Investor Presentation)

For those looking to add to their energy exposure, TRP seems like a name worth digging into further.

Healthcare Services Group 6.17% Yield

HCSG is one of the new names to make the list this month. They operate in the healthcare industry but are a bit unusual in that they provide “services” to the healthcare industry. They don’t operate the facilities themselves. Instead, they manage the “housekeeping, laundry, dining and nutritional services.”

The share price came crashing down earlier this year after what appeared to be an ugly quarter of missing both top and bottom-line expectations. The latest quarter they announced in October didn’t seem any better as they reported EPS of $0.00, and revenue showed a slight decline.

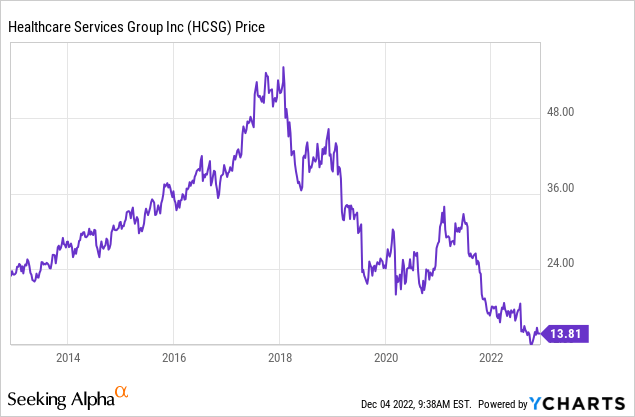

The share price seems to be on a never-ending downturn since 2018. While they might have been a mid-cap stock at one point, with around a $1 billion market cap, they are now a small-cap.

Ycharts

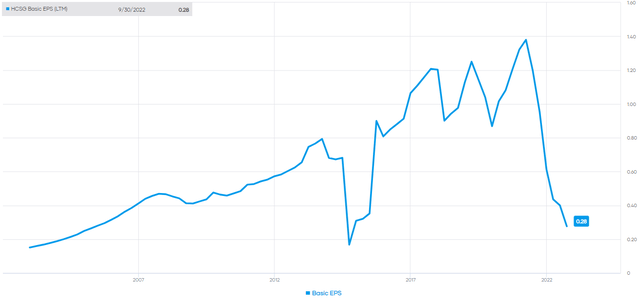

The latest quarters don’t seem to be the only problem either. This has been a significant trend of lower EPS. Unsurprisingly, it was about when the share price started to trend lower.

HCSG Earnings History (Portfolio Insight)

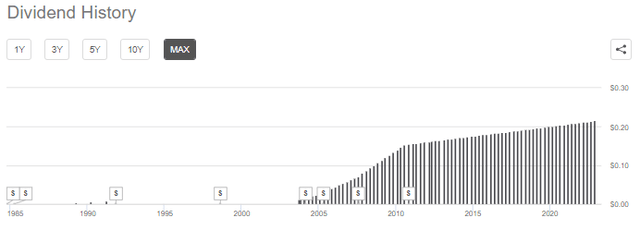

Despite this, they’ve continued to raise their dividend every quarter for years now. The last increase was 0.6%, which made it the 77th consecutive increase since 2003.

HCSG Dividend History (Seeking Alpha)

That’s impressive, but there are clearly some issues. The future of the dividend should be a concern if that’s the only reason you hold this one. This would seem more of a higher-risk speculative play at this point. One would also likely have to be quite patient, as a turnaround could take years. At least for now, one would be paid generously while awaiting a turnaround.

Janus Henderson Group 6.00% Yield

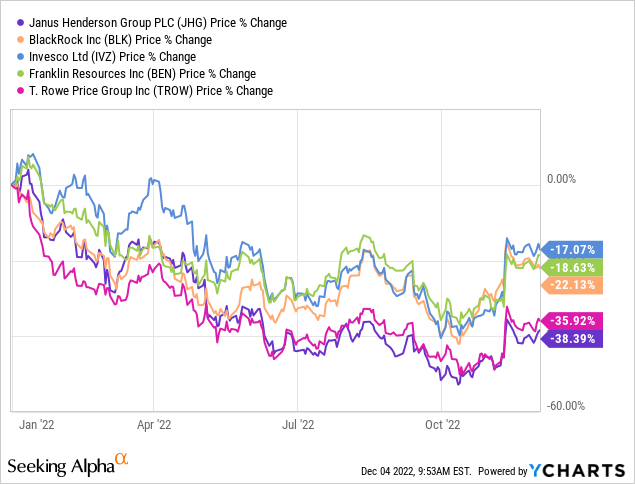

JHG is another new name showing up on this list. They are an asset management company, so they’ve been getting hit along with the rest of the market. As declines are coming in both fixed-income and equities, the fees generated on these assets naturally decline. Although JHG seems to be taking it harder than some of its asset management peers in terms of their share price declines YTD.

Ycharts

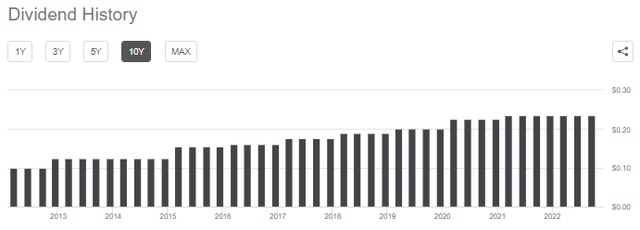

JHG doesn’t grow its dividend aggressively, and they froze it during 2019 and 2020. Since then, they’ve been back to raising. Before 2017, they paid their dividend semi-annually.

JHG Dividend History (Seeking Alpha)

Their latest earnings showed a beat on EPS and revenue. Albeit, revenue declined ~25% year-over-year. Again, the result of reduced asset prices broadly generating fewer management fees. However, they’ve also had to deal with outflows. The latest quarter showed $5.8 billion left their funds. That put them at $274.6 billion in total AUM.

They weren’t alone; T. Rowe Price (TROW) had long-term net outflows of $24.6 billion in the latest quarter. Invesco (IVZ) also saw outflows of $7.7 billion, and Franklin Resources (BEN) saw long-term net outflows of $20.4 billion. However, BEN also made acquisitions that brought in $64.9 billion.

In the last quarter, BlackRock (BLK) was the only asset management of this group that I’m using to see long-term net inflows of $65 billion. That’s not huge when they manage around $8.5 trillion, but it is a positive relative to the rest of the group. Helping them are their popular ETFs and their significant size; they have a ton of reach.

JHG seems to be an interesting name that could be worth exploring further. As an asset management firm, they are being hurt by the overall market environment. When things rebound, they should stand to benefit going forward. It might take some time for that to play out.

Be the first to comment