onurdongel

DCP Midstream, LP (NYSE:DCP) is one of the largest and most well-known midstream partnerships in the United States. Unfortunately, it is also one of the most controversial ones as the company earned the ire of many investors following its distribution cut back in 2020. While this ire may not be entirely undeserved, the company has made some very smart decisions with the money that its distribution cut freed up. In fact, there is quite a lot to like here as DCP Midstream boasts a rock-solid balance sheet and some near-term growth potential. The company also posted very solid results for the second quarter, which has had a very positive effect on the unit price. Indeed, DCP Midstream’s common units are up 39.77% over the past year. While this is certainly a very impressive return relative to many other companies in the sector, it has also had the effect of suppressing the yield as DCP Midstream only yields 4.20% at the current price. There could still be an argument to be made in favor of buying the company’s common units however so let us investigate and see if DCP Midstream could deserve a place in your portfolio.

About DCP Midstream

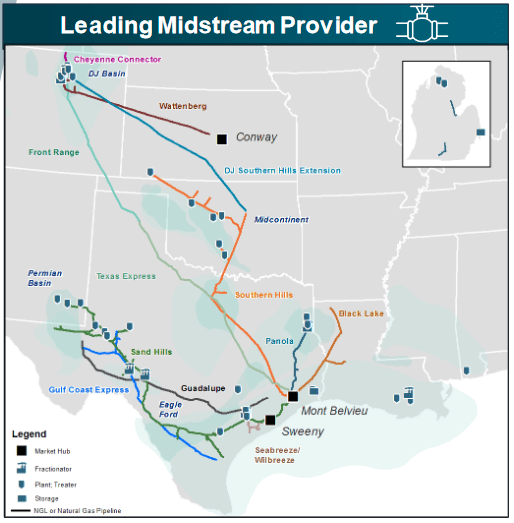

As stated in the introduction, DCP Midstream is one of the largest and most well-known midstream partnerships in the United States. The company boasts a substantial portfolio of assets stretching across much of the Southcentral part of the country:

DCP Midstream

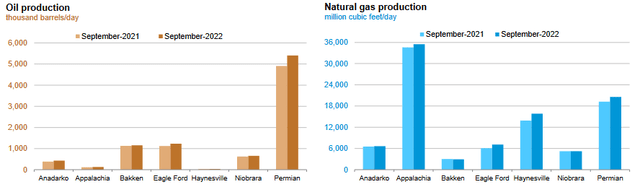

In total, DCP Midstream owns 55,000 miles of pipelines, 35 natural gas processing plants capable of handling approximately 5.4 billion cubic feet of natural gas per day, and twelve billion cubic feet of natural gas storage capacity. One thing that we notice here is that DCP Midstream’s assets are highly centered around the Permian Basin, so it is not nearly as diversified as some of its larger peers like Kinder Morgan (KMI) or Energy Transfer (ET). The single basin focus is not necessarily a bad thing, though. The Permian Basin is by far the most mineral-rich hydrocarbon basin in the United States and it has been the focal point of the American energy boom over the past decade. In fact, even today the Permian Basin is seeing strong production growth. As we can see here, the production of both crude oil and natural gas is up year-over-year:

U.S. Energy Information Administration

This has created some growth opportunities for DCP Midstream’s gathering and processing assets. This business unit operates a network of gathering pipelines, which grab resources from the wellhead where they are extracted from the ground and carry them to a processing plant or larger long-haul pipeline. As is the case with all midstream companies, DCP Midstream’s gathering pipelines earn their money based on the volume of resources that they handle. Thus, when volumes increase, DCP Midstream’s cash flows also increase. We certainly saw that reflected in the company’s second-quarter 2022 earnings results as the company reported record adjusted EBITDA and distributable cash flow.

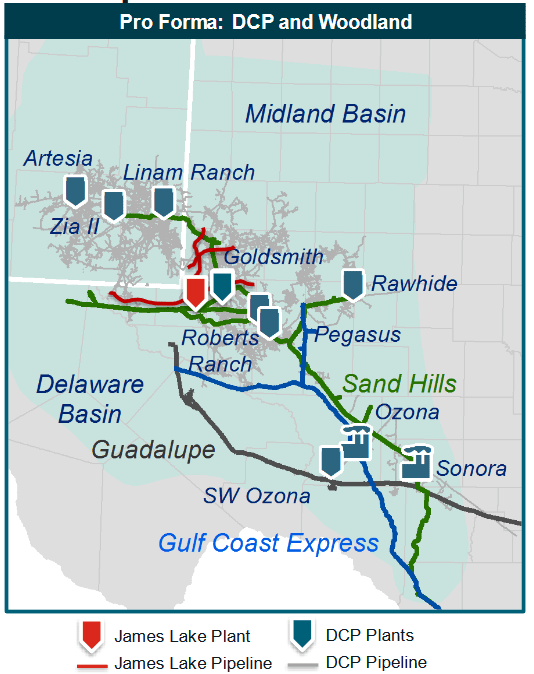

The increase in volumes is not the only thing driving DCP Midstream’s growth. Another method that the company is using to generate growth is acquisitions. The company is currently doing that as it is in the process of acquiring a gathering and processing system in the Permian Basin:

DCP Midstream

Woodland Midstream, which is the company that DCP Midstream is acquiring, owns and operates a 230-mile gathering pipeline system and a natural gas processing plant that is capable of handling 120 million cubic feet of natural gas per day. As we can clearly see, this system should supplement DCP Midstream’s existing operations in the Permian Basin. This acquisition will also expand DCP Midstream’s already substantial presence in the natural gas midstream space. This is something that is very nice to see given the incredibly strong fundamentals for natural gas that exist today, which we will discuss later in this article. The nice thing about this acquisition is that Woodland Midstream’s infrastructure is fully contracted and cash flow positive. Thus, we can be quite certain that this acquisition will be accretive to DCP Midstream’s own cash flows. In light of this, DCP Midstream appears to be getting a very good price for Woodland Midstream. DCP Midstream is paying $160 million for this company, so it should pay for itself in 5.5 years. This is a very impressive return for any sort of midstream growth spending and it is in fact better than the 6x EBITDA multiple that The Williams Companies (WMB) is getting from the projects that it is constructing itself. The company’s investors should thus be quite pleased once this transaction closes, which is expected to be sometime in the third quarter of 2022.

As mentioned in the introduction, DCP Midstream earned the ire of many investors when it cut its distribution in response to the uncertainty that was plaguing the energy industry. The company was forced to cancel or defer many of the growth projects that it was working on at the time and cut its distribution in order to free up cash to pay down debt. It has actually enjoyed great success at shoring up its balance sheet since that time, which we can see by looking at the company’s leverage ratio. The leverage ratio, which is also known as the net debt-to-adjusted EBITDA ratio, essentially tells us how long it would take the company to completely pay off its debt if it were to devote all of its pre-tax cash flow to that task. As of June 30, 2022, this ratio stood at 2.9x, which is one of the lowest ratios in the midstream industry. This is very nice to see as analysts usually consider anything under 5.0x to be reasonable. However, following the events of 2020, most midstream companies have been working to get their ratios down under 4.0x in order to improve their ability to weather crises and I will admit that I like to see this ratio under 4.0x for the same reason. As we can clearly see, DCP Midstream easily meets this more restrictive requirement. Thus, investors should appreciate this.

On August 18, 2022, another event occurred that could have a significant impact on our investment in DCP Midstream. In short, Phillips 66 (PSX), which already has a significant ownership stake in DCP Midstream, offered to purchase all of the outstanding common units of DCP Midstream for $34.75 per unit. As of the time of writing, DCP Midstream’s common units are trading for $38.13 per unit, so buying the units today may not make sense unless Phillips 66 increases its offer. However, the current offer appears to require Phillips 66 to purchase all of the units in the market as opposed to investors being forced to sell at the offering price. This is also a preliminary offer and there are many analysts expecting that Phillips 66 will increase its offer by 10%. As such, it is difficult to say whether or not investors should be willing to buy the common units at a price above $34.75 per unit but it definitely makes sense to buy at a lower price.

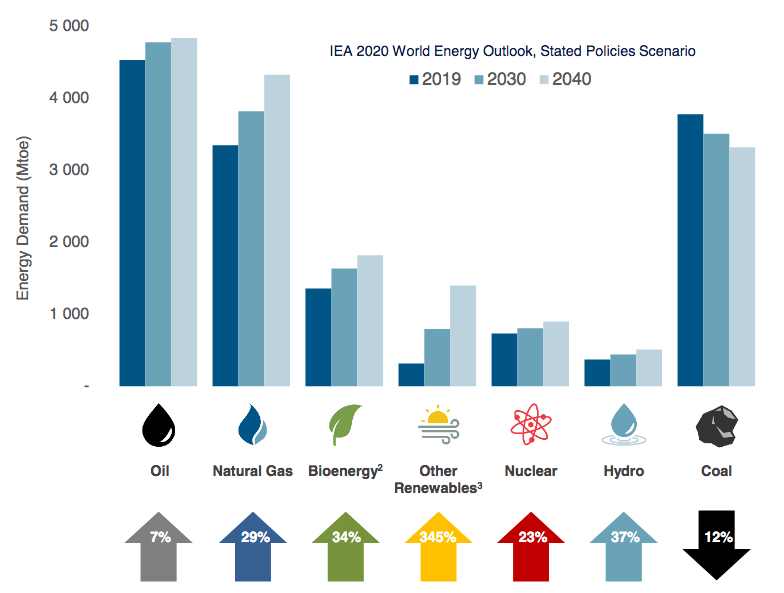

Fundamentals Of Natural Gas Midstream

As we discussed earlier in this article, DCP Midstream has been aggressively expanding its presence in the natural gas space. This is quite nice to see since the fundamentals of natural gas are quite positive. The fundamentals for crude oil are also strong, albeit not as strong as natural gas. This is something that may be surprising to many readers considering the demonization that traditional fossil fuels have been receiving from environmental activists, the media, and politicians. However, the International Energy Agency projects that the demand for natural gas will increase by 29% and the global demand for crude oil will increase by 7% over the next twenty years:

Pembina Pipeline/Data from IEA 2021 World Energy Outlook

Perhaps surprisingly, the demand for natural gas is being driven by concerns about climate change. As everyone reading this is no doubt well aware, these concerns have led governments all over the world to impose a variety of incentives and mandates that are intended to reduce the carbon emissions of their respective nations. The most common method that is being used to accomplish this is to encourage utilities to retire old coal-fired power plants and replace them with renewables. Unfortunately, renewables have one major problem and that is that they are unreliable. After all, wind power does not work if the air is still and solar power does not work if the sun is not shining. The common solution for this is to supplement the renewable generation with natural gas turbines because natural gas burns cleaner than any other fossil fuel and has the reliability to keep the grid functional when renewables cannot. This is why natural gas is often called a “transitional fuel,” since it provides a way to reduce carbon emissions and keep the grid functional until renewable technology advances sufficiently to perform this task.

The case for crude oil demand growth may be somewhat harder to understand. After all, we are seeing a strong push by the governments of most developed countries to reduce the consumption of crude oil within their borders. However, it is a very different story if we look at the various emerging markets around the world. These nations are expected to see tremendous economic growth over the projection period. This will naturally have the effect of lifting the citizens of these nations out of poverty and putting them securely into the middle class. These newly middle-class people will begin to desire a lifestyle that is closer to their counterparts in the developed nations than what they have now. This will result in a growing consumption of energy, including energy derived from crude oil. As the populations of these nations are higher than the populations of the developed nations, the growing demand for crude oil from the emerging world will more than offset the stagnant-to-declining demand in the developed nations.

DCP Midstream is positioned to benefit from this despite the company not actually producing any crude oil or natural gas itself. This is because the United States is one of the only nations in the world that can increase its production sufficiently to satisfy this demand growth due to the mineral wealth of regions like the Permian Basin. However, the producers in this area will need to get their resources to the market where they can be sold. This is exactly the business that DCP Midstream is in. Thus, we can see a scenario where the company’s volumes grow over time and since DCP Midstream’s cash flows are directly correlated with volumes, the company should see rising cash flows as this story plays out.

Distribution Analysis

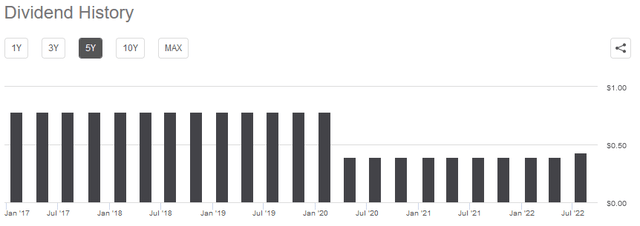

One of the biggest reasons why investors purchase the common units of midstream partnerships is because of the incredibly high yields that many of these companies possess. This is also why DCP Midstream earned the ire of many investors since it cut its distribution drastically back in 2020 in order to shore up its balance sheet and has still not returned it to the previous level:

The company currently yields 4.20%, which is much lower than many of its sector peers. However, it is still better than the 1.48% yield of the S&P 500 index (SPY). As is always the case, it is critical that we determine how well DCP Midstream can afford the distribution that it pays out. After all, we do not want to find ourselves the victims of another distribution cut that both reduces our incomes and almost certainly causes the stock price to decline.

The usual way that we analyze a company’s ability to pay its distribution is by looking at its distributable cash flow. This is a non-GAAP figure that theoretically tells us the amount of cash that was generated by the company’s ordinary operations and is available to be distributed to the limited partners. In the second quarter of 2022, DCP Midstream reported a distributable cash flow of $369 million, which represents a fairly substantial improvement over the $225 million that the company had in the year-ago quarter. This was enough to cover the company’s distribution 4.5 times over, which is a very impressive ratio for a master limited partnership. Analysts generally consider anything over 1.20x to be reasonable and sustainable. However, I am much more conservative and like to see this ratio above 1.30x in order to add a margin of safety to the distribution. As we can clearly see, DCP Midstream is substantially above that figure. We can therefore conclude that the company’s distribution is almost certainly quite safe.

Conclusion

In conclusion, DCP Midstream may not have the best reputation among investors right now but there are certainly some reasons to consider making an investment in it today. The biggest of these reasons is that the company boasts a very strong balance sheet and some real growth prospects. The yield is admittedly a bit low but it is incredibly well covered and the company does have room to increase it quite a bit if it wants to. The biggest wildcard here is the proposed acquisition by Phillips 66 as we do not know exactly what the price will be for that deal nor do we even know for sure that it will even go through. Thus, it might be worth taking a chance and investing in the company since Phillips 66 will almost certainly have to increase its offering price in order to get anyone buying today to agree to the deal. The current unit price is above the offer price though so there is a risk of taking a loss. Overall, it might be worth considering if you are willing to bet on either the deal falling through or Phillips 66 being forced to increase its offer.

Be the first to comment