Does your portfolio need to bounce back? cagkansayin

Brian Dress, CFA — Director of Research, Investment Advisor

As we went back and reviewed the action in the markets over the last week, we noticed that the major indexes all advanced between 1-2% for the week, but for some reason, it felt much better than that to us.

While we pondered the question of why that is, we reflected back on the first 8 months of 2022, which have been nothing if not volatile for investors. The relative calm of the last month has been refreshing and is borne out in the numbers: the “VIX,” the CBOE Volatility Index finally traded back below 20 this week, the barometer below which we can conclude that pessimism is waning among market participants and markets are beginning to firm. By no means can we state definitively that all risks are gone from the financial markets, but we are becoming more constructive, especially as we look through a long-term lens.

The exciting consequence of this improving sentiment is that we can stop spending so much time fretting about macroeconomic factors like inflation, geopolitics, and the Federal Reserve. As markets find their footing, we are back to what is our core competency, studying individual businesses on the microeconomic level, analyzing fundamental business trends, balance sheets, and management teams.

Whether you are a conservative or aggressive investor, whether in stocks or bonds, foreign or domestic, it is highly likely that your portfolio is showing losses for 2022. Against that backdrop and incorporating the many conversations we have with clients from our own practice, the overall sentiment is that investors are looking for a way to play some catch up for their portfolios. We appreciate this desire, but our observation is that even some of the most long-term oriented investors have gotten caught up in the short-term vicissitudes of the market in 2022. As investors look for a portfolio recovery we encourage them to shed the short-term mindset and think about stocks that will perform well in the next 3-5 years.

In this week’s letter, we continue our series of sharing stocks with you that are from our “bounce back” list, which numbers more than 20 names, at this point. These are stocks we think have the ability to outperform over the coming few years, through the twin growth engines of revenue and earnings acceleration, coupled with potential multiple expansion. As we have done our “bottom up” analysis on the 1,000 stocks we follow on a weekly basis through our database, one interesting pattern appears to be developing: opportunity seems to be bubbling up in the small and mid-cap growth area. We profile one such stock for you this week, Alteryx, Inc. (AYX).

The other topic we will cover for you is the wind down in the earnings season. This week was the chance for us to hear from many of the country’s most consequential retail operators, which gives us plenty of additional insight into the health of the consumer and the continued impact of inflation on company margins.

With that all being said, let’s get into it!

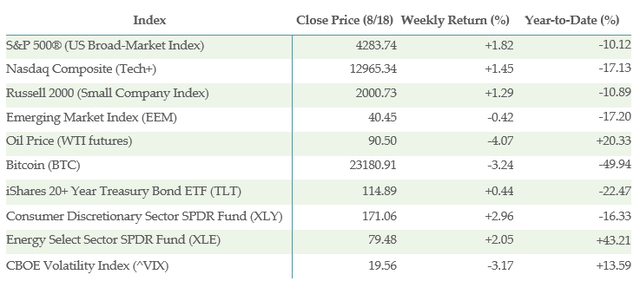

Below is the performance data of key indices, exchange-traded funds (“ETFs”) for the five trading days between 8/11/22 and 8/18/22:

What is/is not Working?

Even though markets were up modestly over the 5 trading days ended August 18, we were impressed by the fact that all 11 sectors of the S&P 500 were up for the week, led by consumer staples, utilities, and consumer discretionary. The “better-than-feared” earnings results coming from the retail sector were a major factor in this action, which we will address below.

Among the strongest sector/industry ETFs in our list this week were the SPDR S&P Semiconductor ETF (XSD), Utilities Select Sector SPDR Fund (XLU), Cambria Value and Momentum ETF (VAMO), and Invesco S&P 500 Low Volatility ETF (SPLV). There wasn’t much of a pattern to speak of there, as the positive movement in the market was somewhat broad-based.

The price of oil, as measured by the West Texas Intermediate (WTI) crude oil futures contract on the New York Mercantile Exchange, fell by more than 4% over the past week. Interestingly, however, many of the energy-related ETFs in our list were up significantly for the week, including United States Natural Gas Fund, LP (UNG), Tortoise Energy Infrastructure Corp (TYG), Alerian MLP ETF (AMLP), SPDR S&P Oil & Gas Exploration & Production ETF (XOP), and ClearBridge MLP and Midstream Fund Inc (CEM).

If you have followed us throughout 2022, you will know that we remain bullish on the energy sector, with the understanding that there is a long-term undersupply of fossil fuel energy relative to worldwide demand, which continues to grow. We have long noted that many oil companies should continue to deliver significant cash flows even if oil prices fall into the $70-80/barrel range, given that the cost of production for many firms is $40/barrel or lower. The fact that so many oil stocks performed well this week, despite the weakness in the commodity price itself, is further support to our thesis and we remain energy bulls. We also like the fact that energy investments tend to have reverse correlation to growth stocks, which helps us dampen portfolio volatility as we begin to add back some growth with markets finding their footing.

On the negative side of the ledger this week, we saw cryptoassets again dominating the list. Five of the seven worst performing ETFs on our list were crypto-related, including First Trust SkyBridge Crypto Industry and Digital Economy ETF (CRPT), Grayscale Ethereum Trust (ETH), and Grayscale Bitcoin Trust (OTC:GBTC). We remain skeptics of crypto and the market seems to agree.

Despite the fact that the broader market was strong this week, we did see some of the traditional “risk on” indicators finding weakness, including ARK Innovation ETF (ARKK), KraneShares CSI China Internet ETF (KWEB), and Renaissance IPO ETF (IPO). Some of these indicators had been extremely strong over the past month, so perhaps it should come as no surprise that they had a slight pullback over the last week. We will be monitoring these securities over the coming weeks to see if their pullback continues, as that could be a signal of impending overall market weakness. Stay tuned.

The Bounce Back List: Alteryx (AYX)

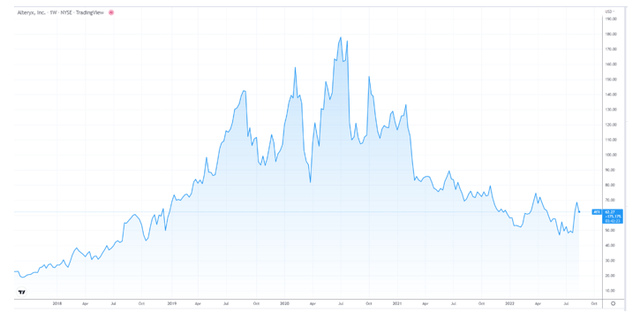

Alteryx is a company that operates in the data processing space, offering a cloud-based data processing and data analytics platform that helps data scientists enhance their productivity without building huge blocks of extensive code. This is a company that we have followed closely over the past five years and for which we profiled original founder/CEO Dean Stoecker, giving both he and the company a very high rating. Irrespective of the stock price, we were impressed by the company’s products, comprising one of the strongest data analytics platforms. Their product suite positions Alteryx well in an era where data processing is imperative for most companies.

Between 2018 and mid-2020, this stock was one of the market’s best performers, rising more than 600%, as investors enthusiastically bid up many stocks in the cloud Software-as-a-Service (“SAAS”) space. However, in mid-2020, the company’s growth trajectory collapsed. Before 2020, Alteryx was growing its revenues between 60-80% annually, whereas the company delivered sale growth rates of 18.5% in 2020 and 8.2% in 2021. This sort of collapse in growth is traditionally the death knell for stocks like AYX and this case was no exception. Between mid-2020 and mid-2022, the company’s stock fell roughly 70%. You can see this journey in the 5-year chart of the stock below:

Alteryx has spent the last two years taking dramatic measures to reestablish a growth trajectory for the business. In October 2020, founder Stoecker stepped down from the CEO role and Mark Anderson took the helm, who is best known for his time as President of Palo Alto Networks (PANW).

On August 2, we received the 2nd quarter earnings report from Alteryx. Results were much better than expected, with revenues for the quarter coming in at $180.6 million, more than a 50% increase year-over-year. The company also announced 3rd quarter guidance for revenue of $191-194 million, significantly higher than the consensus expectation of $173 million. Full year guidance is expected now to be in the range of $770-780 million, which would imply a 44-45% yearly growth rate. In short, from what we learned from company management, this company is back on a strong growth trajectory, as customers continue to invest in digital transformation and data analytics.

Alteryx is exactly the type of stock we are looking for to comprise our “bounce back” list. We are seeking companies with accelerating fundamentals, which are in evidence here. We are also looking for companies with reasonable valuations, which could expand as other investors warm to the fundamental story. At the current market cap of just over $4 billion, the stock trades as 5.5x price to sales. This is low, given the new growth trajectory in the 30-50% range and the company’s gross margin figure of 86%. Alteryx is one stock we follow that we think could be a strong performer over the coming 3-5 years and fits all the criteria we are looking for in a “bounce back” candidate.

Earnings: It’s Retail Week!

Markets got off to a great start on Monday, after a better-than-feared earnings report from one of the world’s largest retailers, Walmart (WMT). On July 25, Walmart management pre-announced 2nd quarter earnings, lowering the profit outlook not only for the most recent quarter, but also for the full fiscal year. Inflation has had a major impact on retailers like Walmart, reducing consumer demand for goods and also impacting profit margins due to much higher cost of goods sold.

On Monday of this week, Walmart announced its official earnings report. Non-GAAP Earnings Per Share (EPS) came in at $1.77, well in excess of the $1.60 expected by analysts. Revenue for the quarter was $152.6 billion, which implied an 8.2% annual growth rate and beating consensus by more than $2 billion. The company expects roughly 5% earnings growth for the rest of the year.

We also received earnings reports this week from Home Depot (HD), as well as other retailers like Target (TGT), Lowe’s (LOW), and TJ Maxx (TJX). We saw a significant rally in HD shares, as the company delivered a beat on both sales and profits over analyst expectations, along with comparative store sales growth of 5.8%. TJ Maxx delivered decent results in their apparel division with slight annual growth, but shared with investors that there was significant softness in the home goods side of the business. Both of HD and TJX had nice rallies this week post-earnings, powered by the fact that they were able to cope with inflationary pressures and deliver earnings in excess of what was expected (or feared).

Target (TGT) shares had rallied in sympathy with WMT after the Monday earnings, but that trend reversed sharply on Wednesday of this week after the earnings report came out. Comparative store sales growth came in at just 2.6% for the quarter, after 8.9% for the same period last year. The company missed expectations on both the sales and profit lines, as inflation and the need for the company to discount a mismatched inventory weighed on the company’s results.

Retail was a mixed picture this week. However, overall we are impressed by the general price action in retail stocks across the board, which has been one of the weakest sectors in the market this year. In our view, seeing general strength in retail is a good signal that broader market sentiment is improving.

Takeaways from this Week

Despite the fact that there remains some uncertainty, we are excited that macroeconomic pressures are beginning to wane, empowering investors to start looking for companies that can outperform in a long-term context over the next 3-5 years.

We have continued to build our “bounce back” list of stocks, which now numbers more than 20. We are looking for businesses with accelerating fundamentals, along with low enough multiples that could potentially expand in the coming months and years. As we take a deeper look at Alteryx, we are becoming more confident that this company fits the bill.

This week we heard from many of the largest companies in this economy’s weakest sector, retail. Investors were expecting disastrous results from this sector and when they came in lukewarm, many of these stocks experienced a relief rally. We consider this yet another data point to support our view that things are improving in the market.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment