David McNew

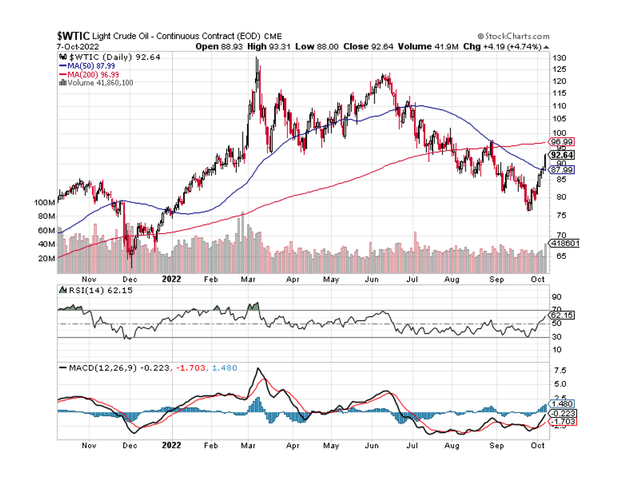

WTI crude oil prices are surging, benefiting oil companies such as Exxon Mobil Corporation (NYSE:XOM) (“ExxonMobil”).

The decision by OPEC to limit the crude oil supply by agreeing to production limits sent the price of WTI crude oil above $92 at the end of last week, implying that oil companies are dealing with a better short-term profit picture.

With that said, I believe the recent increase in crude oil market prices is temporary and the result of a growing fear premium, which has never been sustained for an extended period of time.

I believe ExxonMobil’s earnings peaked in the second quarter, and the OPEC decision isn’t a game-changer. Investors who chase the stock price above $100, in my opinion, are likely to be disappointed.

OPEC’s Output Decision Driving Price Upsurge

WTI crude oil prices are rising again, reflecting concerns about crude oil supply after OPEC signaled to the market its intention to cut output by 2 million barrels per day, despite the fact that the actual level of supply cut may be around 1 million barrels per day due to underproduction in countries such as Russia, Venezuela, and Iran.

In a major strategic shift, OPEC aligned itself with producers such as Russia (OPEC+) and announced a production cut, causing the price of WTI to rise to around $93 per barrel on Friday.

WTI crude oil also broke through the 50-day moving average, indicating a bullish short-term buy signal that may indicate that WTI prices will continue to rise.

Furthermore, if the WTI crude oil price breaks through $97, where the 200-day moving average is currently located, WTI crude oil could easily break through $100 per barrel again, potentially challenging its most recent high from June 2022, when the price briefly surged above $120 per barrel.

As bullish as the chart pattern appears, the current upswing is likely to be transitory, as the global economy faces a potentially toxic economic cocktail of high inflation (loss of purchasing power), high interest rates, and a softening labor market.

Since the United States’ economy entered an unofficial recession in the first six months of 2022, it is likely that slower economic growth will translate into slower, or even declining, demand for crude oil and refined products.

Because economic obstacles are likely to be greater than the market is willing to admit, I believe ExxonMobil’s profits peaked in the second quarter.

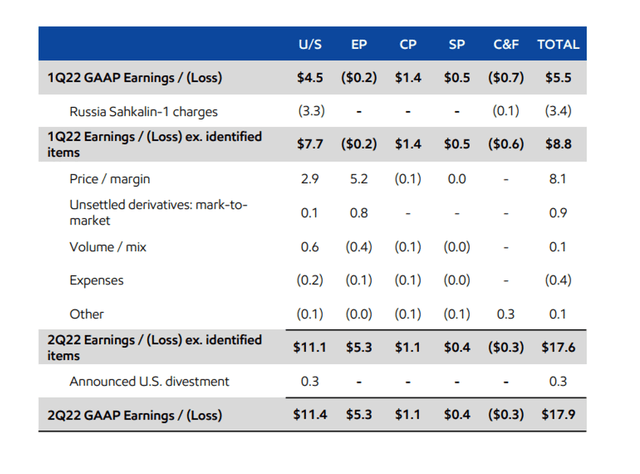

ExxonMobil’s net income was $17.9 billion in 2Q-22, up $13.2 billion from the same period the previous year. ExxonMobil’s profits increased as well, with the company earning $12.4 billion more than in 1Q-22.

During periods of “normal” prices, I believe ExxonMobil’s baseline level of profitability is around $5-6 billion per quarter. The current level of profitability is only possible during bull market runs and is not sustainable, whether OPEC cuts output or not.

Slowing Economic Growth Points To Falling WTI Crude Oil Prices

The U.S. economy created 263K jobs in September, which was less than the 315K jobs created the previous month. Slowing job growth indicates sluggish economic growth, which will eventually translate into less aggressive production and lower crude oil prices.

Why I Might Be Wrong About ExxonMobil

There are several warning signs flashing in the U.S. economy (with interest rates, inflation, GDP growth among them). The labor market is clearly softening, but it is not yet in a slump.

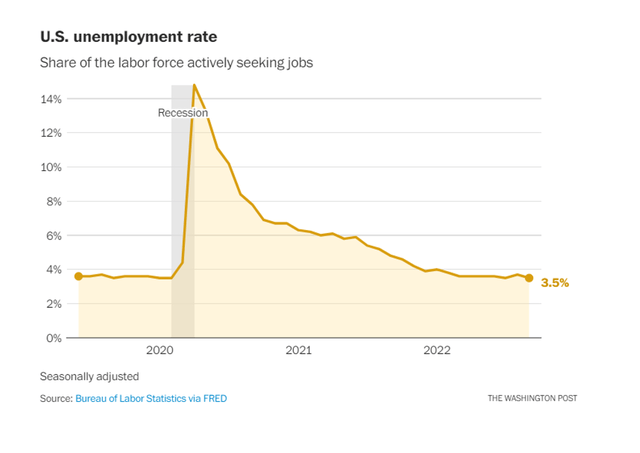

The unemployment rate in the United States was 3.5% in September, indicating full employment, and it even fell 0.2 percentage points from August.

If the central bank is successful in controlling inflation without causing the economy to enter a recession, higher WTI crude oil prices may be sustained for a longer period of time, improving ExxonMobil’s profit outlook.

A sharp increase in unemployment figures, on the other hand, would most likely indicate the opposite: worsening economic headwinds, higher unemployment, and lower crude oil prices.

U.S. Unemployment Rate (The Washington Post)

XOM Stock Trades At A Likely Inflated P/E Ratio

ExxonMobil’s P/E ratio is untrustworthy, which is probably my biggest concern right now. According to Finviz.com, ExxonMobil has a forward P/E ratio of 9.3x, but only because earnings projections for 2023 are extremely optimistic.

The average consensus for ExxonMobil earnings is $10.91, which may not be a realistic estimate if WTI crude oil prices drop by 50%, which I believe is more likely than not given the slowing U.S. economy.

My Conclusion

Investors should avoid chasing ExxonMobil’s stock price here solely because of the OPEC agreement.

WTI crude price increases in response to short-term output cuts are rarely sustained, and the overall economic trajectory points to a cooling of the U.S. economy.

Inflation, interest rates, and slowing economic growth are key risk factors that are currently being overshadowed by OPEC’s decision to reduce output in order to keep prices stable. While this strategy may be successful in the short term, broader macroeconomic trends point in the opposite direction.

ExxonMobil’s upstream profits most likely peaked in the second quarter, when oil prices were significantly higher than $100 per barrel. Don’t chase.

Be the first to comment