imaginima

In the past five days, Sitio Royalties (NYSE:STR) stock price increased by more than 10% as oil prices bounced back due to the OPEC plus announcement of a significant production cut to support crude oil prices. The company will benefit from the market condition as oil and natural gas prices will remain high. However, the company will benefit more significantly from its recent acquisitions due to the increasing production in the Permian Basin. The stock is a buy.

2Q 2022 highlights

In its 2Q 2022 financial results, STR reported total revenues of $88 million, compared with 2Q 2021 total revenues of $20 million, driven by increased production and higher prices. STR reported average daily production of 12,402 boe/d, compared with the 2Q 2021 average daily production of 5,337 boe/d. The company’s 2Q 2022 crude oil production, natural gas production, and NGLs production increased by 156%, 101%, and 129% YoY, respectively. STR’s average realized price increased from $40.39 per boe in 2Q 2021 to $76.65 per boe in 2Q 2022, up 90%. The company’s crude oil, natural gas, and NGLs prices increased by 75%, 139%, and 63% YoY, respectively. SRT’s net income increased from $5 million in the second quarter of 2022 to $72 million in 2Q 2022.

STR’s total current assets increased from $49 million on 31 December 2021 to $94 million on 30 June 2022. Its total current liabilities increased from $5 million on 31 December 2021 to $259 million on 30 June 2022. In the second quarter of 2022, STR completed an all-stock merger with Falcon Minerals Corporation for over 34,000 net royalty acres and cash acquisition of $357 million for an additional 22,000 NRAs. Also, the company signed an agreement to acquire 12,200 NARs from Momentum Minerals, which closed in July of 2022. Furthermore, the company declared a dividend of 71 cents per share of Class A Common Stock for the second quarter of 2022.

Recent acquisitions & market outlook

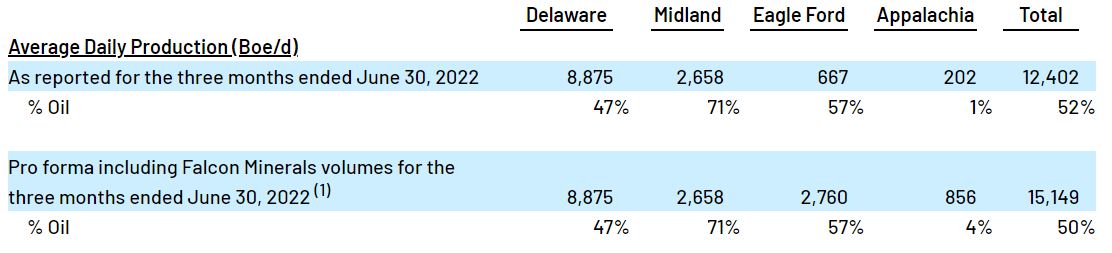

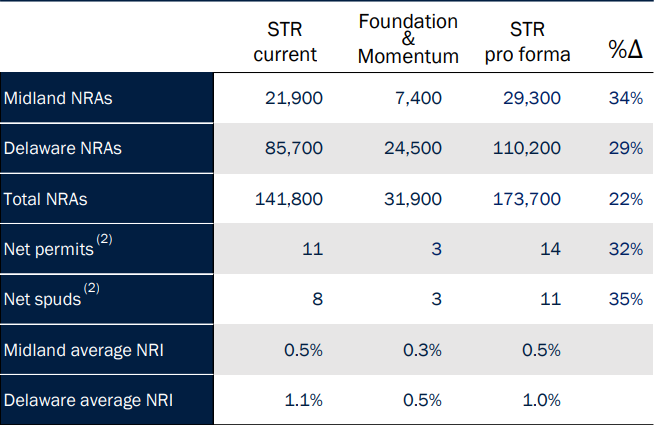

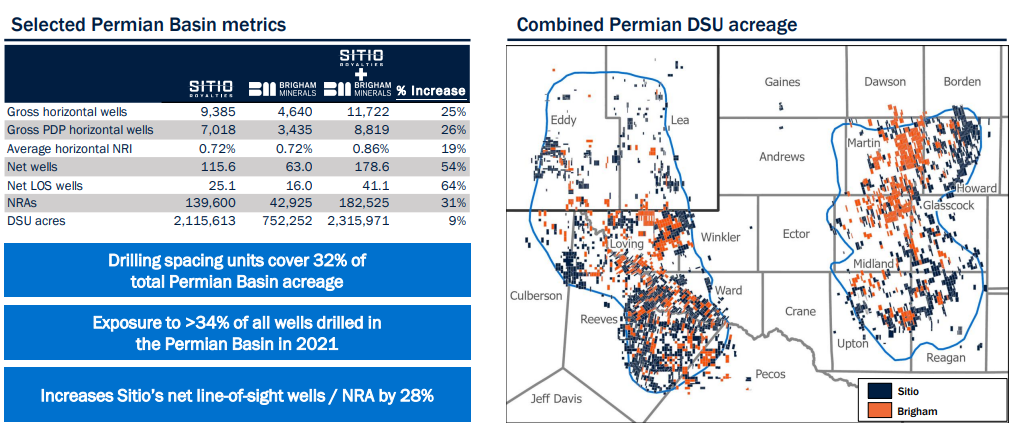

Figure 1 shows that, in 2Q 2022, STR’s average daily production in the Delaware and Midland Basins (Permian Basin) was 11,533 boe/d. The company’s production in the Permian Basin accounts for more than 76% of the company’s production (including Falcon minerals volumes). Also, after the Falcon merger, STR’s operations in Eagle Ford and Appalachia increased significantly. It is worth noting that the mentioned numbers do not include pro forma adjustments for Foundation Acquisition and Momentum Acquisition. With the acquisition of Foundation and Momentum, STR’s NRAs in the Midland Basin and Delaware Basin increased by 34% and 29%, respectively (see Figure 2). Furthermore, due to the merger of Sitio and Brigham, the company’s operations in the Permian Basin will increase further. According to Figure 3, as a result of the merger, Sitio’s Permian footprint will increase by 31% to 18,2525 NARs.

Figure 1 – STR’s production in 2Q 2022

2Q 2022 operational and financial results

Figure 2 – Sitio continues its large-scale consolidation strategy with the acquisition of Permian assets from Foundation and Momentum

Sitio Royalties acquisition announcement

Figure 3 – Sitio’s Permian Basin metrics as a result of the merger with Brigham

Sitio and Brigham merger announcement

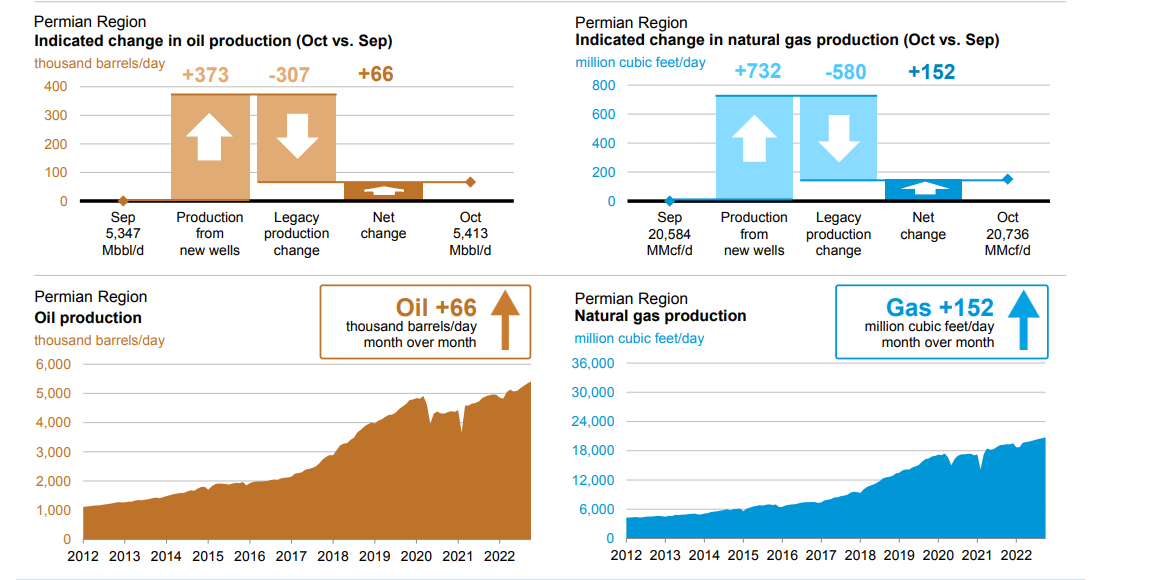

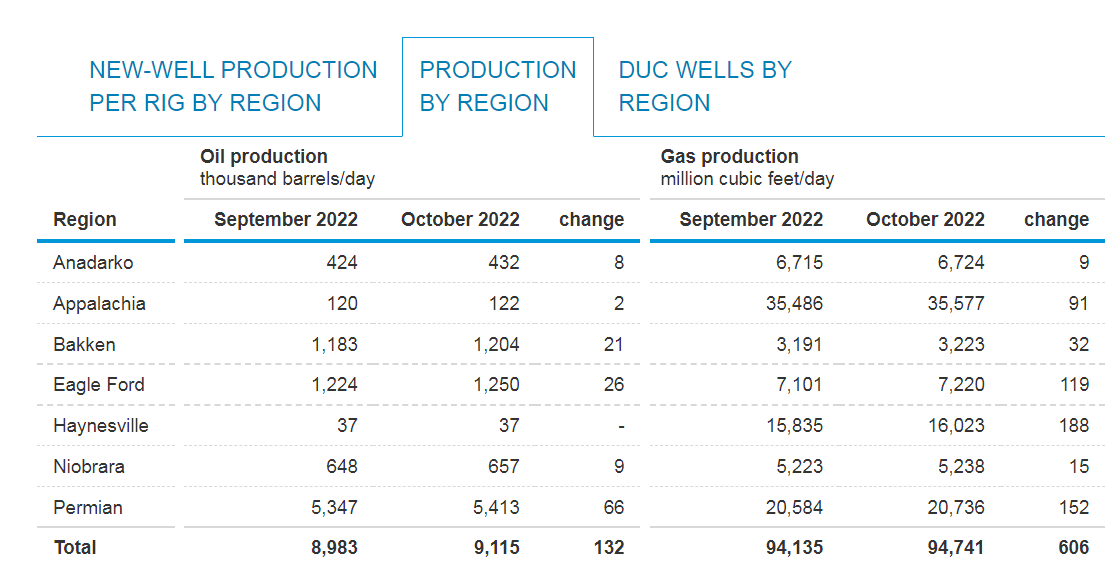

The Permian Basin is the driver for U.S. production growth of crude oil, natural gas, and NGLs. Figure 4 shows that, in October 2022, oil and natural gas production in the Permian Basin is expected to increase by 66 thousand barrels per day and 152 million cubic feet per day, respectively (month over month).

Moreover, Figure 5 shows that, in October 2022, oil production and natural gas production in Appalachia are expected to increase by 2 thousand barrels per day and 9 million cubic feet per day, respectively. Also, oil production and natural gas production in Eagle Ford is expected to increase by 26 thousand barrels per day and 32 million cubic feet per day, respectively. Due to STR’s recent acquisitions, the company will benefit significantly from the increasing production in the Permian Basin, Appalachia, and Eagle Ford.

Due to the recent announcement of the OPEC+ oil production cut and Russia’s announcement about not selling oil to countries that try to impose a price cap on Russian crude, oil prices bounced back (see Figure 6). OPEC+ agreed to cut production by 2 million barrels per day from November. Thus STR will continue benefiting from high oil and natural gas prices.

Figure 4 – Oil and natural gas production in the Permian Basin

EIA

Figure 5 – Oil and gas production by region

EIA

Figure 6 – WTI crude oil price

tradingeconomics.com

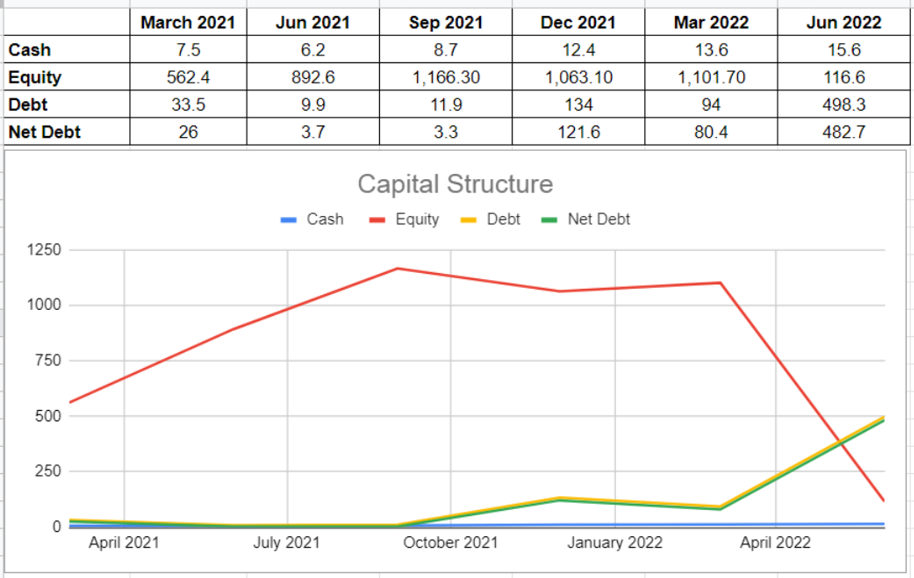

Performance outlook

The company’s capital structure shows that STR’s net debt increased severely to $482.7 million compared with its amount of $80.4 million in the first quarter of 2022, which is not surprising because of the recent acquisitions. During 1H 2022, STR’s total equity was $1218.3 million, which is 16% lower than 1H 2021. STR’s cash generation grew by over 14% to $15.6 million at the end of the second quarter of 2022. In detail, the company’s cash generation in 1H 2022 is $29.2 million, which is more than 100% higher than its amount of $13.7 million in 1H 2021. Meanwhile, the company’s debt sat at $498.3 million, which is far above its previous level of $121.6 million at the end of 2021 (see Figure 7).

Figure 7 – STR’s capital structure

Author (based on SA data)

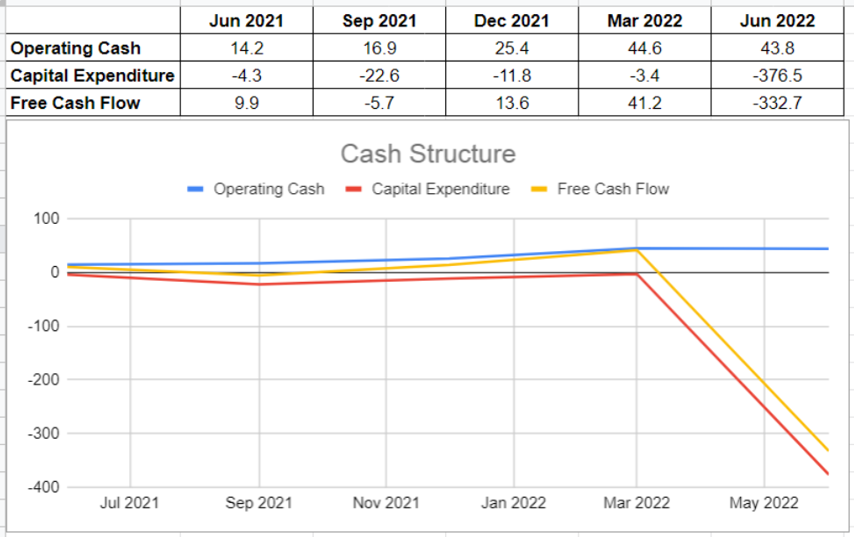

As can be seen from STR’s cash flow performance, the company’s operating cash flow of $43.8 million during the second quarter of 2022 increased amazingly by over 200% year-over-year versus its level of $14.2 million at the same time in 2021. However, due to the ample amount of capital expenditure, which is far higher than its $4.3 million in 2Q2021, the company’s free cash flow dropped deeply in the recent quarter (see Figure 8).

Figure 8 – STR’s cash structure

Author (based on SA data)

Summary

In conclusion, according to Sitio Royalties Corp.’s analysis of financial statements, we observed that the company could improve its cash generation year-over-year compared with the same time in 2021. Additionally, it will benefit from the recent acquisitions due to the increasing production in the Permian Basin. Therefore, I realized that Sitio Royalties is a good scope to cater benefits for its investors in the future. The stock is a Buy.

Be the first to comment