Nuthawut Somsuk

Thesis

The BNY Mellon Alcentra Global Credit Income 2024 Target Term Fund (NYSE:DCF) is a closed end fund that falls in the “term” category, having a defined maturity date in December 2024. As per the fund’s literature:

The fund’s investment objectives are to seek high current income and to return at least $9.835 per Common Share to holders of record of Common Shares on or about December 1, 2024 (subject to certain extensions). The fund will normally invest primarily in credit instruments and other investments with similar economic characteristics. Such credit instruments include: first lien secured, floating-rate loans, as well as investments in participations and assignments of such loans; second lien, senior unsecured, mezzanine and other collateralized and uncollateralized subordinated loans; corporate debt obligations other than loans; and structured products, including collateralized bond, loan and other debt obligations, structured notes and credit-linked notes.

Source: Annual Report

To note that the current fund advisor Alcentra is being divested to Franklin Templeton with a Q4 2022 target completion date:

BNY Mellon has announced that it intends to sell all of its indirect equity interest in Alcentra (the “Transaction”) to Franklin Resources, Inc., a global investment management organization operating as Franklin Templeton (“Franklin Templeton”). The Transaction is expected to be completed in the fourth quarter of 2022 (the “Closing Date”), subject to customary closing conditions, including regulatory approvals.

As described in the fund literature, a “Target Term Fund” is a type of vehicle that aims to liquidate all underlying collateral on a set date and return the cash to shareholders. In this instance the term is December 2024. The issue with certain term funds, which we find here as well, is the basis between the collateral maturity dates and the December 2024 term. Specifically, we can see that the underlying collateral has maturity dates which exceed 2024 heftily. What does that mean you might ask. It means that the investor in DCF is taking mark-to-market risk in terms of the underlying credits. Rather than only taking credit risk (i.e. probability of defaults for the instruments) the investor is also hoping that yields and credit spreads will decrease to a level where the underlying collateral, when liquidated, will yield par. There is a 26% gap to be filled from the current price level of $7.73 to the target of $9.8/share. Unless risk free yields and credit spreads cooperate, this gap will not be filled. In other words, just because the fund aims to liquidate in December 2024 does not mean the underlying securities in the fund will have an aggregate net asset value of $9.8/share, specifically because the underlying securities have much longer maturity dates and their price will be set by prevailing yields at the time.

There are other types of term funds, such as the iShares iBonds Dec 2022 Corporate ETF (NYSEARCA:IBDN) where there is a maturity match between the underlying collateral and the term of the fund. This means that all collateral is set to mature by the term of the fund, thus an investor only takes credit risk (i.e. the ability of the underlying companies to survive without defaulting) with no market risk underwritten. We like the IBDN structure better because it eliminates a big risk factor.

DCF is currently trading with a -4.5% discount to NAV but do not expect this to be filled until maturity date. The fund has a high leverage – stated of 32%, but also embedded via subordinated CLO tranches and a very high expense ratio. Its performance is mediocre and it is lagging other more established CEF structures in the high yield space and there is no reason for the investor community to assign the manager a higher valuation here. The CEF has very poor analytics (low Sharpe ratio, high standard deviation) and has not done much since inception in terms of generating a total return for investors. We are not big fans of DCF and do not see a reason to allocate cash here. There are much better alternatives in the high yield CEF space that expose solid risk/reward analytics and impeccable track records. Conversely, if you are an owner of shares already then holding until the December 2024 stated term date is probably the best choice as of now.

Analytics

AUM: $0.116 billion.

Sharpe Ratio: 0.1 (3Y).

St Deviation: 18.2 (3Y).

Yield: 7.7%.

Expense Ratio: 2.42%.

Premium/Discount to NAV: -4.5%.

Z-Stat: -0.8.

Leverage Ratio: 32%.

Risk Factor: U.S. High Yield Credit

Holdings

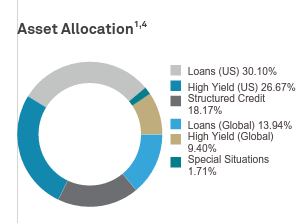

The fund contains a blend of high yield bonds, leveraged loans and CLOs:

allocation (fund fact sheet)

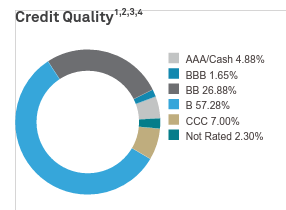

The fund is overweight “B” credits, meaning it tends to be overweight riskier collateral:

Credit Quality (fund fact sheet)

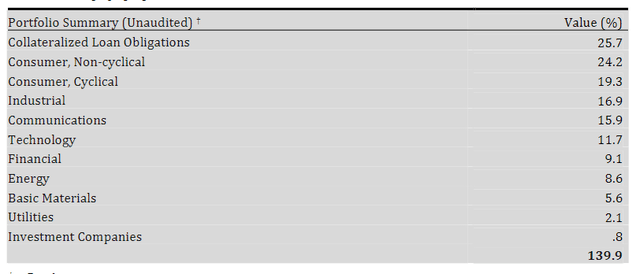

From its annual report, we can see that the vehicle has a very high allocation to subordinate tranches of CLOs:

portfolio summary (annual report)

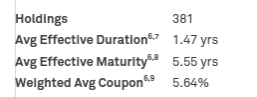

The fund however does have a very short duration profile:

Duration (fund fact sheet)

Due to its term structure the fund tends to invest in shorter duration assets, thus resulting in an average effective duration of 1.47 years.

Performance

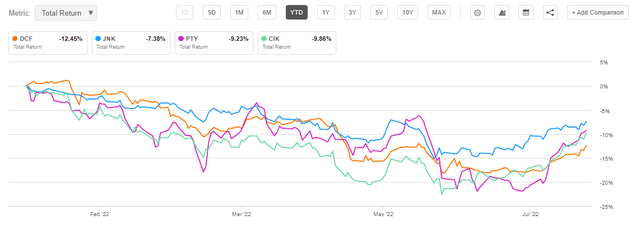

The fund is down more than -12% on a year to date basis:

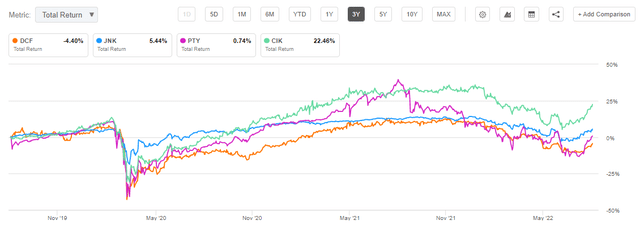

We can see that in comparison with the unleveraged ETF (JNK) and some of its peers in the CEF space such as (PTY) and (CIK), the vehicle underperforms. The same can be seen on a 3-year lookback period:

3-Y total return (Seeking Alpha)

Shockingly DCF actually has a negative total return on a 3-year lookback period. In fact, the fund has not done much since its inception in 2017, having a small positive net total return since inception:

Total Returns (fund fact sheet)

In a nutshell its past performance is poor.

Premium / Discount

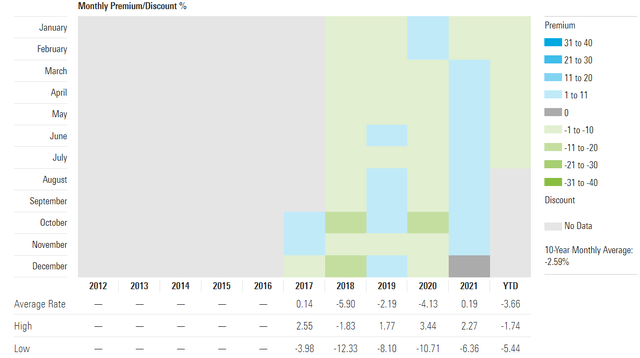

Outside of 2021 the CEF has traded at a discount to net asset value:

Premium / Discount to NAV (Morningstar)

The only time the vehicle traded at a premium was during the zero rates environment seen in 2021. We feel the fund’s performance does not justify any premium to NAV and expect the vehicle to continue to trade at discounts to net asset value. The fund manager (which is changing anyways) has not proven itself so the investor community should have no need to pay above underlying assets fair value here.

Conclusion

DCF is a CEF that invests in the high yield space. The vehicle has a stated maturity date of December 2024 when it would liquidate the collateral and return the cash to shareholders. The fund does not maturity match its collateral with the stated term date, thus resulting in a basis and exposing investors to significant mark to market risk. The fund has a high leverage ratio of 32% and invests in the riskiest part of the high yield market. The vehicle has failed to produce robust returns since inception, having an average annual total return slightly above 0% since being created. With poor risk/reward analytics and a collateral mismatch versus its stated tenor date there is little to like about DCF. New money should look at the established high yield CEFs in the space in order to invest, while holders already in the fund might be best suited to wait for the fund term date to monetize the discount to NAV.

Be the first to comment